License there is a $12 license fee due with each application. If you are a new business an initial business license application must be submitted to the clerk’s office.

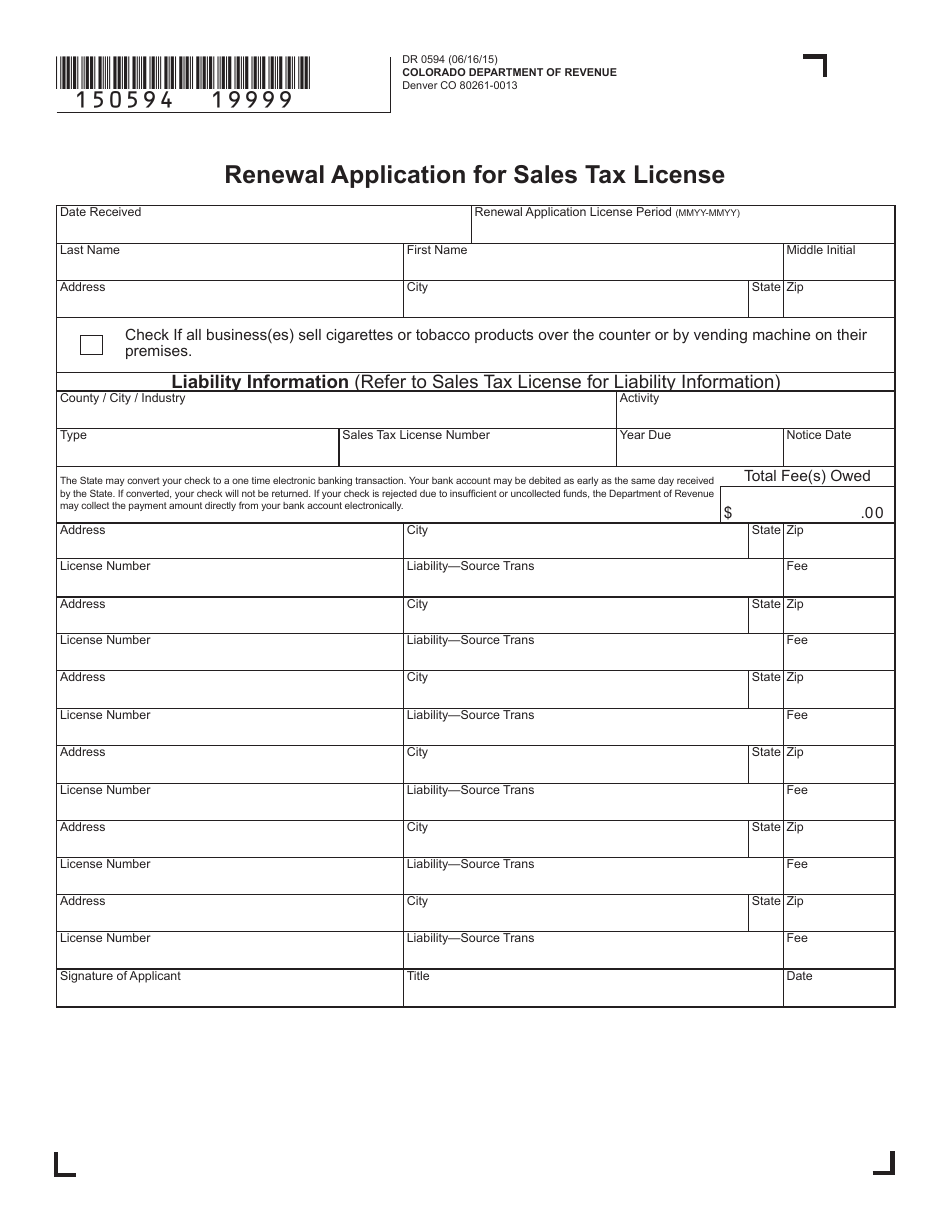

Form 0594 Download Printable Pdf Or Fill Online Renewal Application For Sales Tax License Colorado Templateroller

New tobacco ordinances are now in effect concerning flavored tobacco, sales tax, age requirements, and licensing fees.

Loveland co sales tax license renewal. The city of delta is a home rule city that collects and administers its own sales and use tax, which is currently 3%. For contractors who do not need a sales tax license, trade name registration and renewal is handled by the colorado secretary of state business center. Chillers bar and grill in downtown loveland closed suddenly after the city of loveland declined to renew its liquor license and barred it from selling alcohol on nov.

Contractor licenses that are expired are not subject to renewal and must be processed and approved as a new license. For business license fees please refer to ordinance 6.16 or click the appropriate form on this page. The license fee is $20 and covers a two year period ending on december 31 of each even numbered calendar year.

110 loveland, co 80537 phone: View the new tobacco ordinance fact sheet here. The annual sales and use tax license fee is $10.00 and must accompany a completed sales and use tax license application.

2021 business & tax license renewal fee $ 15.00 if you have already paid in full, we thank you and will send your 2021. Apply for sales/lodging tax license; Sales tax licenses may also be renewed through electronic funds transfer (eft).

All licenses are for a calendar year and. Renewal applications must be submitted 45 days prior to the license expiration. Complete your business license application online by using the munirevs system.

Contractor licenses are good for up to one year and expire one year after the date of issue. Please submit applications and permits for approval to clerk@hudsoncolorado.org. Must supply a copy of driver's license.

Retail sales & use tax licenses expire on december 31 of each even number year (2 year license) and have a $15.00 initial and $15.00 biennial renewal fee. Special event permit applications need to be submitted 30 days prior to the event. When renewing by eft, you do not need to send us the dr 0594 form because that can cause a.

For general business or retail sales tax. Sales & use tax license guidelines. Complete and mail or take the renewal application for sales tax license to any taxpayer service center.

Need a city of loveland’s sales tax license? The initial business license fee is $10.00. You must obtain a sales and use tax license in order to conduct business in the city of delta.

Business license renewal applications are due each calendar year on march 31st. Licensed contractors do not need a business license. Please contact support if you are having trouble accessing your account, applying for a license, filing tax forms, making payments, or if you want to close your account.

To receive an exemption certificate for construction contracts with tax exempt organizations use the contractor application for exemption certificate ( dr 0172 ). 500 east third street, suite. Even businesses that do not “sell” anything must obtain a city license.

Once your sales tax account is linked to your user profile, you will choose the 'renew' option from the menu, select the license you wish to renew (it may appear you are renewing for the current year but the effective & expiration date is your current years license), and follow the remaining screen prompts to renew for 2021. If your license is not current i.e. 20 business / sales tax license application.

200 peridot ave, first floor, loveland, co 80537 hours: A separate license is needed for each location in golden. They are valid until the business is discontinued, sold or revoked.

The city of sheridan has partnered with munirevs to provide an online business licensing and tax collection system this system allows businesses to access their accounts and submit tax returns and payments online. We are here to help you get started. Penalties are currently 10% of the tax owed per month that you are late, interest is.5833% of the tax owed per month that you are late.

Days for processing and approval. Manage my business/tax account (password required) online payment options! New licenses or transfer of ownership requires a minimum of 90 to 120 days.

Tobacco retail license application please submit your completed application and fee to the gypsum town clerk. Business licenses do not expire and have no renewal fee. 2018, the effective date will.

Business may not be conducted until a business / sales tax license has been issued. It shall be the duty of each licensee, on or before january 1 of each year, to obtain a renewal of the licensee’s license if the licensee continues to conduct business in the city or is liable to account for the tax provided for in the louisville sales/use tax code. The city sales and use tax rate is 2.75%.

500 east third street, ste. Your license renewal fee is: Municipal budgets & financial audit reports;

Sales Use Tax License City Of Golden Colorado

Lovgovorg

Cityoflovelandorg

Taxcoloradogov

Online Sales And Use Tax Return Filing And Payment City Of Longmont Colorado

Lovgovorg

Cityoflovelandorg

Golflovelandcom

Sales Tax License Grand County Co – Official Website

Colorado Business License

Lovelandwaterandpowerorg

How To Apply For A Colorado Sales Tax License Department Of Revenue – Taxation

Lovelandwaterandpowerorg

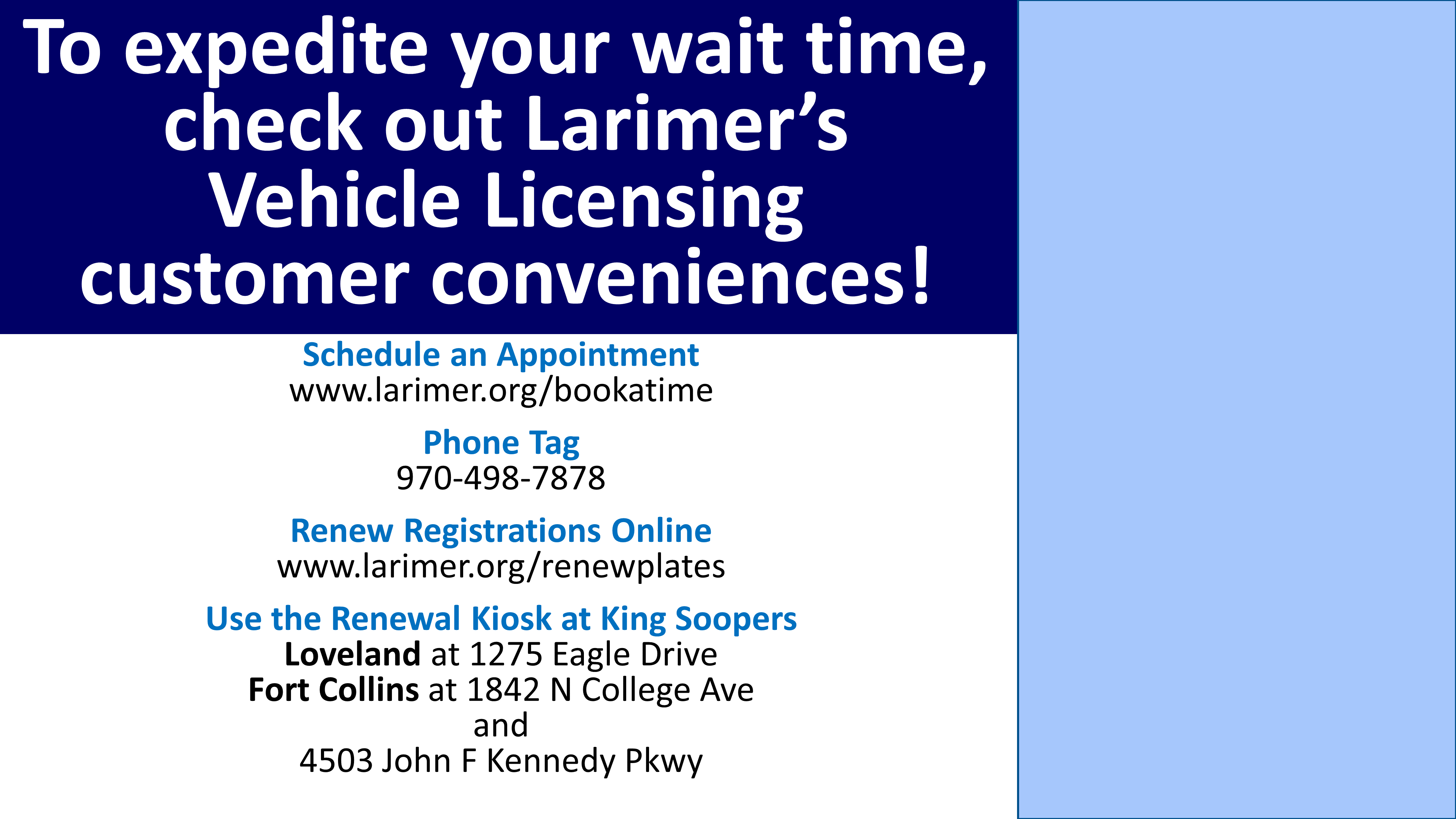

Vehicle Licensing Slideshow – Loveland Larimer County

Chillers Bar And Grill Closed After Liquor License Renewal Denied By City Loveland Reporter-herald

Fact Sheet On Proposed 1-cent Increase On Citys Sales Tax News Releases City Of Loveland

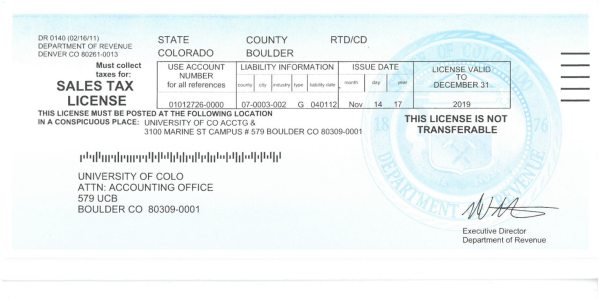

Sales Tax Campus Controllers Office University Of Colorado Boulder

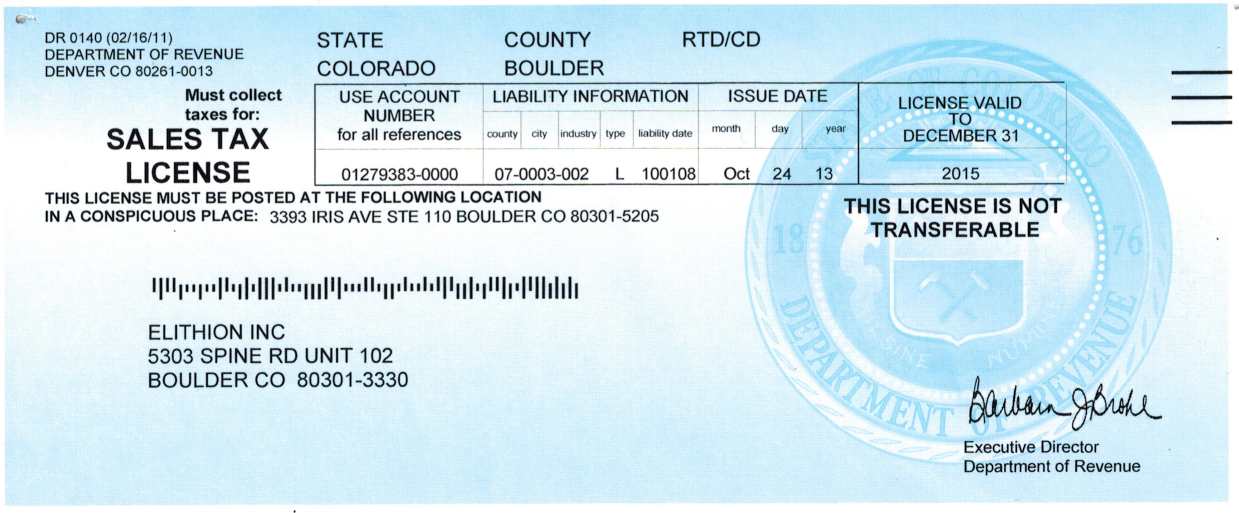

Company – Elithion

Cityoflovelandorg