1, lengthens the time period investment funds must hold assets to five years. The taxation of carried interest is a subject of frequent debate at the federal level.

Hong Kong Profits Tax Exemption To Be Extended To Offshore Private Equity Funds 2015 Private Equity Equity Offshore

For a detailed discussion of wyden’s 2019 proposal, read an august 2019 report [pdf 231 kb] prepared by kpmg llp:

Carried interest tax proposal. Senior white house economic advisor jared bernstein pointed to tax lobbyists as the reason the “carried interest loophole” was not included in a group of tax hikes democrats intend. Federal income tax treatment of partnership interests issued in exchange for services, commonly known as carried interests,. Maryland proposes tax on carry, management fees.

The proposed changes would significantly affect fund managers and employees of private equity firms that use current carried interest rules for additional performance compensation at favorable tax rates. Maryland’s house and senate proposed legislation to apply a 17 percent additional state income tax to carried interest and management fees. But in reality, the tax, as proposed in the administration’s plan, would impact partnerships of all sizes, including those with individual partners earning less than the.

A new approach to taxing carried interest. Nonetheless, today’s proposal reflects some minor changes to wyden’s 2019 proposal—the most significant relating to the definition of invested capital (which is. The biden administration “fact sheet” misleadingly implies that a carried interest tax would only hit hedge funds, while other proponents of the tax hike portray carried interest as a perk for private equity.

Unlike previous proposals in other states, even funds located outside the state would be hit by the tax if they invest in maryland businesses. To ensure consistency with tax principles, The proposal would expand the type of gain/income from carried interests that are subject to the holding period rules applicable to carried interest.

On august 5, 2021 senate finance committee chairman ron wyden and senator sheldon whitehouse introduced proposed legislation (the “ending the carried interest loophole act,” or the “proposal”) that would substantially change the u.s. Would, if enacted, tax all or some of carried interest as ordinary income or treat the granting of carried interest as a subsidized loan. Furthermore, the proposal clarifies that 100% of eligible carried interest would also be excluded from the employment income for the calculation of the investment professional’s salaries tax.

The proposal, which is part of a $3.5 trillion tax and spending package that house leaders say could get a vote by oct. Now, states are jumping into the debate. Biden is unveiling a $1.8tn proposal that includes new spending on child care, education and paid leave, as well as extensions of some tax breaks.

The proposed ending the carried interest loophole act (s. The proposal includes a transitional rule that allows a partner with a carryforward excess business interest expense amount under the current rules to treat such amount as paid or accrued in the. 1639) would treat the grant of carried interest to a general partner as a loan from the limited partners made at a preferred interest rate.

The proposal includes a transitional rule that allows a partner with a carryforward excess business interest expense amount under the current rules to treat such amount as paid or accrued in the partner’s first tax year beginning after december 31, 2021. Under the proposal, gain from the sale of active business assets (section 1231 gain) and “qualified dividend income” (qdi) could be subject to stcg treatment if the holding period for carried interest is. Carried interest offers lower tax rate than for income biden administration had proposed eliminating the tax break house democrats’.

Based on the proposed rules, there are planning opportunities available such as structuring the investment company’s capital contributions. A new proposal to tax carried interest as ordinary income was just attached to a larger tax and spending bill that could be voted on by.

Pin On News

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

What Is The Tax Expenditure Budget Tax Policy Center

All Strange And Wonderful How To Plan Tax Haven Bernie

Carried Interest Tax Proposal Threatens Charitable Giving

Maldives In Imf Staff Country Reports Volume 2019 Issue 196 2019

Accounting Taxation Interest Rates Of Delay In Itreturns Submission It Returns Non-submission Failure To Income Tax Return Interest Rates Pay Advance

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

Auerbach Alan J 2017 Demystifying The Destination- Based Cash Flow Tax Nber Working Paper 23881 September Nat Economic Research Cash Flow Business Tax

Collaboration Tools Which Boost Stakeholder Engagement Engagement Strategies Stakeholder Management Business Management Degree

14 Budget Proposal Templates Word Excel Pdf Templates Proposal Templates Resume Template Free Sample Resume

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim – Bloomberg

Biden Tax Plan And 2020 Year-end Planning Opportunities

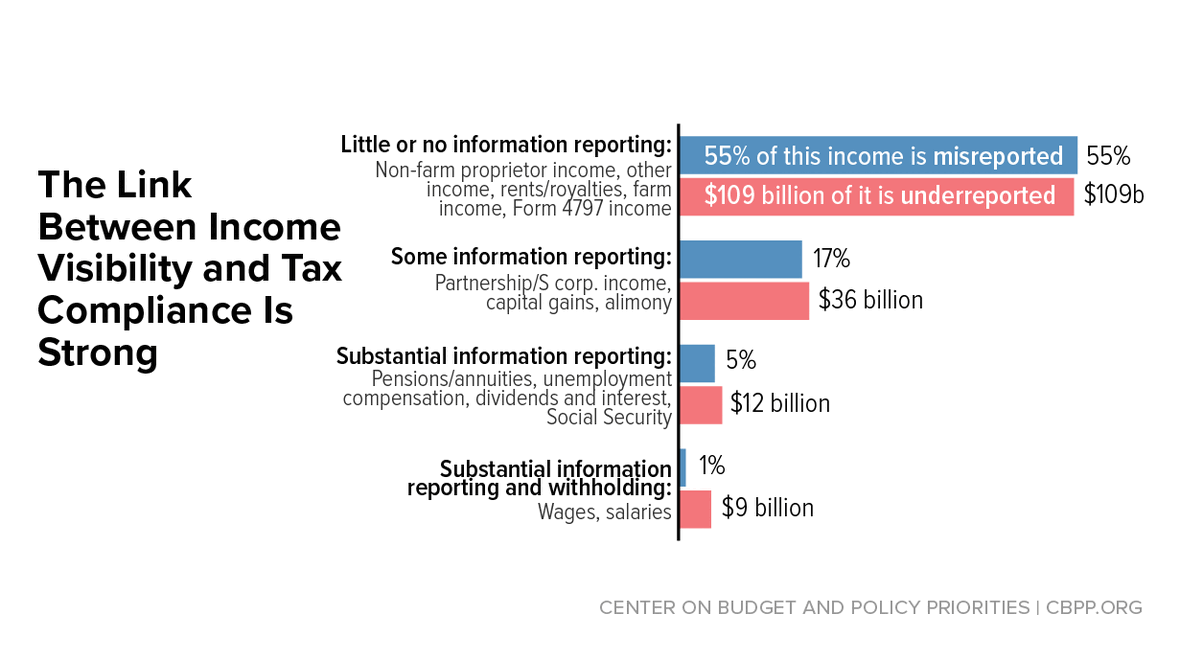

Build Back Better Requires Highest-income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

Biden Tax Plan And 2020 Year-end Planning Opportunities

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim – Bloomberg

Clintons Taxes On The Wealthy Explained Committee For A Responsible Federal Budget

Free Course Proposal Template In 2021 Business Plan Template Free Proposal Templates Free Proposal Template