Effective november 1, 2021, the new prepaid gasoline sales tax rate is 16.6 cents per gallon. Specifically, the temporary gas tax floor will prevent the gas tax rate in 2021 from falling below the 2020 rate (36.1 cents per gallon), as it would have done automatically without legislative intervention due to the tax rate being indexed in part to energy inflation.

2

Michigan tax forms are sourced from the michigan income tax forms page, and are updated on a yearly basis.

Michigan gas tax increase 2021. As a result, the average residential heating customer's bill will go up on december 1. This group includes states that had allowed their gas taxes to stagnate for decades such as alabama, illinois, iowa, maryland,. 44.4 6.0 26.3 19.0 15.0 11.0 9.0.

The combined fuel tax increase totals 11.8 cpg in the second year and 16.8 cpg over two years. Before the official 2021 michigan income tax rates are released, provisional 2021 tax rates are based on michigan's 2020 income tax brackets. 41.98 cents per gallon (14.0% greater than national average) 2021 diesel tax:

The tax on regular fuel increased 7.3 cents per gallon and the tax on diesel fuel increased 11.3 cents per gallon, equalizing both taxes at 26.3 cents per gallon. Michigan gas tax rate actual vs. The current federal motor fuel tax rates are:

The size of the january 2022 fuel tax increase will depend on how much the consumer price index has risen between oct. If 2021 inflation is 5% or more, then the fuel tax will be increased to 27.7 cents per gallon. The current average of $3.33 per gallon for regular gas is up 13 cents from last week’s average of about $3.20 per gallon.

The increase is capped at 5%, even if actual inflation is higher. Compressed natural gas (cng) $0.184 per gallon †. The 2021 state personal income tax brackets are updated from the michigan and tax foundation data.

Prepaid diesel sales tax rate. The current state gas tax is 26.3 cents per gallon. 4,862,405 gallons (4,381,530 highway, 480,875 nonhighway)

Prepaid gasoline sales tax rate. $0.219 / gallon* *most jet fuel that is used in commercial transportation is.044/gallon Included in the gasoline, diesel/kerosene, and compressed natural gas rates is a 0.1 ¢ per gallon charge for the leaking underground storage tank trust fund (lust).

It is 15 cents higher than last month’s average of approximately $3.18 per gallon, according to aaa. The gas tax will again increase from 21.2 cpg to 26.2 cpg and the diesel fuel tax will increase from 20.2 cpg to 27 cpg on july 1, 2021. Gretchen whitmer proposed a large tax hike:

Effective november 1, 2021, the new prepaid diesel fuel sales tax rate is 17.2 cents per gallon. 51 rows the gas tax by state ranges from $0.0895 in alaska to $0.586 in pennsylvania. 43.18 cents per gallon (14.1% greater than national average) total gasoline use:

† these tax rates are based on. Gas prices in 2021 are up more than $1 per gallon compared to a year ago, according to the american automobile association (aaa), climbing from $1.79 in 2020 to $2.89 now. This rate will remain in effect through november 30, 2021.

The government is effectively subsidising the cost of. Announced tuesday that its purchased gas cost rates will increase. Michigan gas prices have soared to a 2021 high, as the average gallon of unleaded gas in the state registers at $3.33.

1951 rate adjusted for inflation (2019): Gas for boilers should face higher taxes to meet net zero pledge s, the government's climate advisers have said. Fortunately, many states recently have made significant progress in updating their gas tax rates.

City Of Taft To Vote On 1 Cent Sales Tax Increase Kget 17

Gas Price Faq Congressman Tim Walberg

As Drought Grips American West Irrigation Becomes Selling Point For Michigan – Circle Of Blue

2022 Tax Brackets 2022 Federal Income Tax Brackets Rates

Virginia Gas Tax Hike Deal Reached As State Lawmakers Come Down To The Wire Wtop News

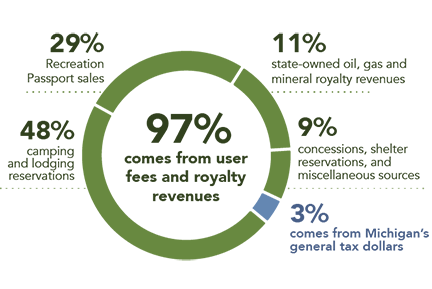

Dnr – Camping And Overnight Lodging Fee Adjustments

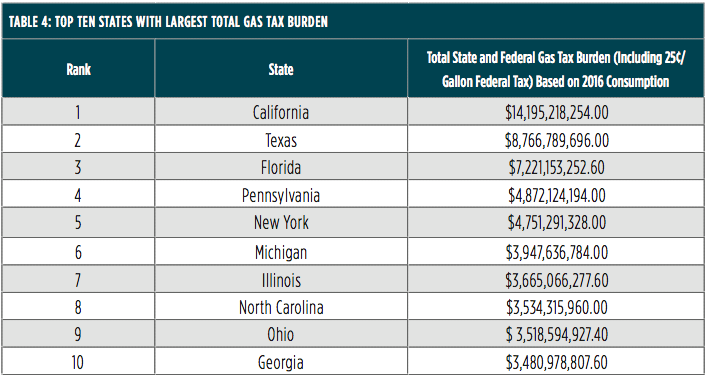

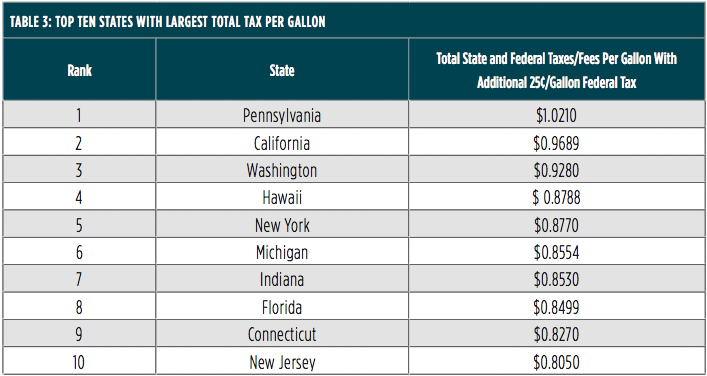

Every American Stands To Lose Under Unprecedented Gas Tax Increase

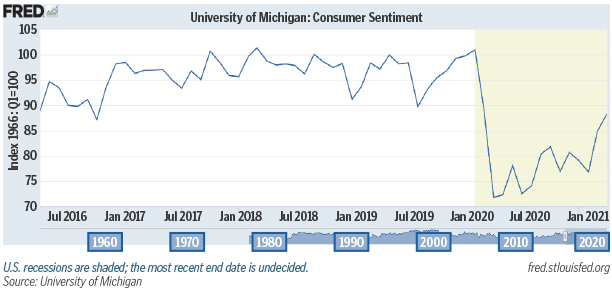

National Net Lease Group Q2 2021 Retail Report – Srs

How The Infrastructure Package Would Hurt The Middle Class

Ny Senate Republicans Urge Hochul To Suspend Gasoline Tax News Oleantimesheraldcom

Where Do Gas Taxes Go States Divert Fuel Taxes To Schools Police And Fish Barrier Removal – Reason Foundation

Gas Price Faq Congressman Tim Walberg

As Drought Grips American West Irrigation Becomes Selling Point For Michigan – Circle Of Blue

Every American Stands To Lose Under Unprecedented Gas Tax Increase

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Edmonton Mayoral Candidates Pledge Zero Tax Increase But Will It Work Cbc News

Metro Detroit Gets 28 Road Projects As Panel Oks 35 Billion Bond Plan

New Jersey To Raise Gas Tax Rate 93 Cents Per Gallon Starting Thursday October 1 – Abc7 New York

Every American Stands To Lose Under Unprecedented Gas Tax Increase