It may be a good idea to file a gift tax return even if it’s not required. Gifts of present interests (see below) within the annual exclusion amount (currently, $15,000 per donee), deductible charitable gifts, and.

Planning For Year-end Gifts With The Gift Tax Annual Exclusion – Sol Schwartz

But gifts that don’t meet these requirements are generally considered taxable —.

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Do you have to file a gift tax return for annual exclusion gifts. The donor is responsible for paying the gift tax, except in certain circumstances in which irs allows the gift recipient to pay the gift tax. Your gift transfer of money to the ilit: Filing a gift tax return generally, a federal gift tax return (form 709) is required if you make gifts to or for someone during the year (with certain exceptions, such as gifts to u.s.

The general rule is that any gift is a taxable gift. • by filling the gift tax return, the government is formally advised of the transfer and less likely. In 2020, if you made substantial gifts of wealth to family members you may have to file a gift tax return.

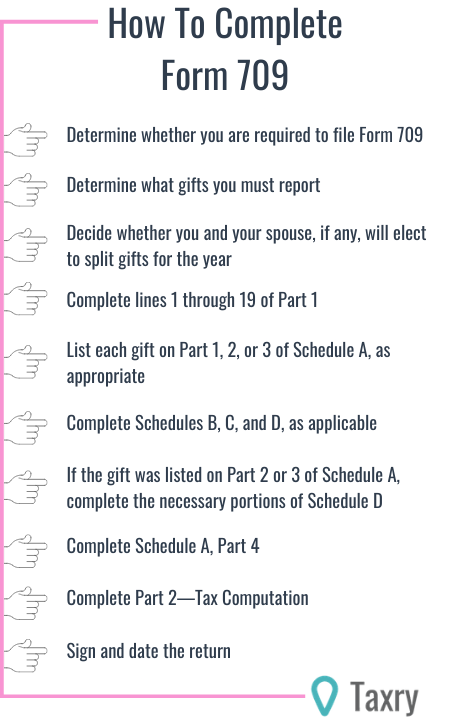

If you have no taxable gifts, you are not required to file the irs form 709 gift tax return. Generally, you must file a gift tax return for 2018 if, during the tax year, you made gifts: In 2021, the annual gift tax exemption is $15,000, meaning a person can give up $15,000 to as many people as they want without having to pay any taxes on the gifts.

Taxpayers don’t have to file a gift tax return as long as their total gifts are less than the annual gift tax exclusion amount per recipient. This technique allows one spouse to make gifts using both spouses’ annual exclusions, for a total gift of $30,000. The ilit trustee takes money you contribute to the trust, and uses it to pay the premiums to the life insurance company.

Filing a gift tax return generally, a federal gift tax return (form 709) is required if you make gifts to or for someone during the year (with certain exceptions, such as gifts to u.s. Tuition or medical expenses you pay for someone (the educational and medical exclusions). Annual exclusion amount must file a gift tax return.

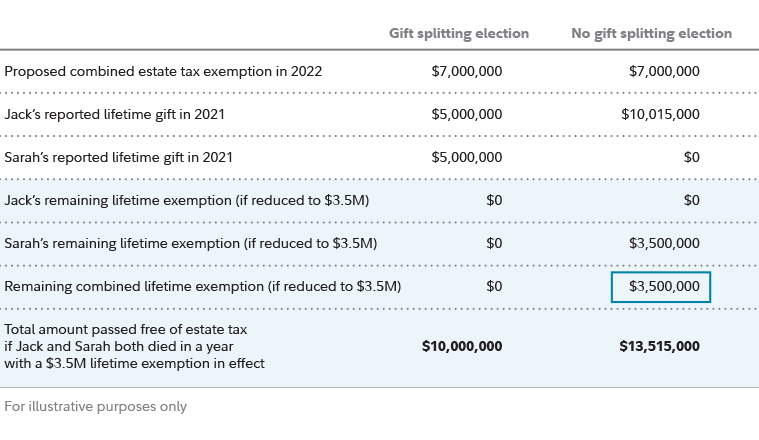

To qualify for gift splitting, the spouses must file federal gift tax returns signed by both spouses consenting to the split, even if a return would not otherwise be necessary were each to give $15,000 individually. Gifts that are not more than the annual exclusion for the calendar year. However, there are many exceptions to this rule.

If all your gifts for the year fall into these categories, no gift tax return is required. What is the benefit of filing gift tax return? Reduces the size of your estate, and reduces or eliminates estate taxes;

These transfers to the ilit trustee are covered by your annual gift tax exclusion. Citizen spouses) that exceed the annual gift tax exclusion ($15,000 per person for. In 2020, if you made substantial gifts of wealth to family members you may have to file a gift tax return.

Form 709 does not have to be filed for years subsequent to the election year. The annual gift tax exclusion is $15,000 per recipient in 2020 and 2021 ($30,000 for a married couple giving jointly). Except as described earlier, you do not have to file a gift tax return to report gifts to your spouse regardless of the amount of these gifts and regardless.

Generally, the following gifts are not taxable gifts. Citizen spouses) that exceed the annual gift tax exclusion ($15,000 per person for. It'll also limit the donor to $20,000 annual exclusion gifts in total.

A return also is required when a married couple makes a joint gift that qualifies for the annual exclusion. Finally, if either spouse makes a gift that exceeds the couple's combined annual gift tax exclusion ($30,000 in 2021), or if each spouse make gifts that exceed that spouse's individual annual gift tax exclusion ($15,000 in 2021), both spouses will need to file their own federal gift tax return and each spouse will need to provide their consent to split gifts on the other. Starting in 2022, currently proposed legislation would reduce the annual gift tax exclusion to $10,000 per year per donee (recipient).

To qualify, such unreportable gifts must have a “present interest,” generally meaning that the donee must have the unrestricted right to the immediate use, possession, or enjoyment of the gifted property. So if you’re looking to give some large gifts, it’s likely a good idea to do so before new limits go into effect. If all your gifts for the year fall into these categories, no gift tax return is required.

For example, a man could give. More specifically, if the combined fair market value of all gifts in a year to any one person is $14,000 or less, most gifts need not be reported on a federal gift tax return. Each spouse must file a gift tax return to.

The annual exclusion amount is $13,000 for 2009 and 2010.

Planning For Year-end Gifts With The Gift Tax Annual Exclusion Doeren Mayhew Cpas

Do You Need To File A Gift Tax Return – Miller Kaplan

Planning For Year-end Gifts With The Gift Tax Annual Exclusion – Somerset Cpas And Advisors

Do You Need To File A Gift Tax Return Nk Cpas

Estate Planning Strategies For Gift Splitting Fidelity

How To Utilize The Gift Tax Annual Exclusion – Buchbinder Tunick Co

Why You Should File Non-taxable Gifts With Your 2021 Taxes

Planning For Year-end Gifts With The Gift Tax Annual Exclusion – Mauldin Jenkins

Gift Tax Limit 2021 How Much Can You Gift – Smartasset

2021-2022 Gift Tax Rate What Is It Who Pays – Nerdwallet

The Gift Tax Made Simple – Turbotax Tax Tips Videos

Gift Tax Return Who Needs To File A Gift Tax Return Example

Do I Owe Taxes On The Gifts I Make Drobny Law Offices Inc

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation-skipping Transfer Tax Return

Planning For Year-end Gifts With The Gift Tax Annual Exclusion Timpe Cpas

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

2

How Does The Irs Know If You Give A Gift Taxry

2021-2022 Gift Tax Rate What Is It Who Pays – Nerdwallet