A mobile home will be: The martin county assessor is responsible for appraising real estate and assessing a property tax on properties located in martin county, florida.

Florida Property Tax Hr Block

How to use this calculator.

How are property taxes calculated in martin county florida. The office of the property appraiser establishes the value of the property and the board of county commissioners, school board, city commissioners and other taxing authorities set the millage rates. Florida taxes mobile homes in three ways. Using this feature you can determine the cost for deeds, mortgages, and other standard documents that we accept.

The estimated tax range reflects an estimate of taxes based on the information provided by the input values. The maximum portability benefit that can be transferred is $500,000. At this time, a 3% interest charge is added to the gross tax amount.

¹ if you need to determine the fees for a document that does not require. The taxable value is your assessed value less any exemptions. The amount of the tax is based on the assessed value of the property that is set by the property.

A tax certificate, when purchased, becomes an enforceable first lien against the real estate. Ad valorem real estate taxes are based on the value of real property, and are paid in arrears. The taxable value is then multiplied by your local millage rate to determine your ad valorem taxes.

(total price/$100) x.70 = doc stamps cost Information on your property's tax assessment; Counties in florida collect an average of 0.97% of a property's assesed fair market value as property tax per year.

Martin county collects very high property taxes, and is among the top 25% of counties in the united states ranked by. The sale allows citizens to buy certificates by paying the owed tax debt. Actual property tax assessments depend on a number of variables.

Checking the martin county property tax due. The average florida homeowner pays $1,752 each year in real property taxes, although that amount varies between counties. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address.

Or • assessed and taxed as tangible personal property. In other words, you can calculate the transfer tax in the following way: You must provide the police report number when filling out the application form hsmv 83146 for a replacement plate.

When searching by address, enter street number and street name only. The martin county tax collector is a florida state constitutional office and as such is independent of county and local government. All unpaid tangible personal property taxes become delinquent april 1st.

Your property tax is calculated by first determining the taxable value. How property tax is calculated. (1) administer tax law for 36 taxes and fees, processing nearly $37.5 billion and more than 10 million tax filings annually;

Florida real property tax rates are implemented in millage rates, which is 1/10 of a percent. To get your exact property tax liabilities, contact the martin county tax assessor. In addition, the statutes require the county property appraiser to deduct for typical costs of sale (which include expenses such as commissions, title insurance, appraisals, inspection fees, etc.) when arriving at market value for tax purposes.

For assistance in calculating estimated taxes when such exemptions are applicable, please contact the martin county property appraiser's office for additional clarification. Florida’s average real property tax rate is 0.98%, which is slightly lower than the u.s. The tax year runs from january 1st to december 31st.

Beginning on or before june 1st, the law requires the tax collector to hold a tax certificate sale. At this time a 1.5% per month interest and $2.00 delinquent fee charge is added to the gross amount. The final millage rates are used to calculate the estimated property tax on the proposed property purchase.

Florida department of revenue, taxation of mobile homes in florida, page 1 taxation of mobile homes in florida. The median property tax in florida is $1,773.00 per year for a home worth the median value of $182,400.00. (2) enforce child support law on behalf of about 1,025,000 children with $1.26 billion collected in fy 06/07;

The median property tax (also known as real estate tax) in martin county is $2,315.00 per year, based on a median home value of $254,900.00 and a median effective property tax rate of 0.91% of property value. Florida is ranked number twenty three out of the fifty states, in order of the average amount of property taxes collected. • subject to an annual license tax;

If your license plate and/or decal has been lost or stolen you must contact your local law enforcement agency to report the loss or theft. All unpaid real property taxes become delinquent april 1st. You can contact the martin county assessor for:

This tax estimator assumes purchaser has 100% of the equitable title of the referenced property. Appealing your property tax appraisal; Please note that we can only estimate your property tax based on median property taxes in your area.

Shown below, we have provided the ability online to calculate the fees to record documents into the official record of florida counties. The tax collector represents the florida department of revenue in the collection and distribution of property taxes. In order to determine the tax bill, your local tax assessor’s office takes into account the property’s assessed value, the current assessment rate, as well as any tax exemptions or abatements for that property.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in martin county. • assessed and taxed as real property; (3) oversee property tax administration involving 10.9.

We will make reasonable efforts to accommodate all needs. (enter 555 main when trying to locate the property at. Real property records can be found using the parcel id, account number, subdivision, address, or owner last name.

How To Calculate Florida Sales Tax 12 Steps With Pictures

A Taxattorney Needs To Be More Punctual Because You Are Dealing With Taxes Taxes Come With A Deadline You Should Try To Be Available Tax Lawyer Tax Attorney

Palm-beach-county Property Tax Records – Palm-beach-county Property Taxes Fl

Calculate Your City Of Fernandina Beach Property Taxes – Fernandina Observer

How To Calculate Property Tax And How To Estimate Property Taxes

Montana Property Tax Calculator – Smartasset

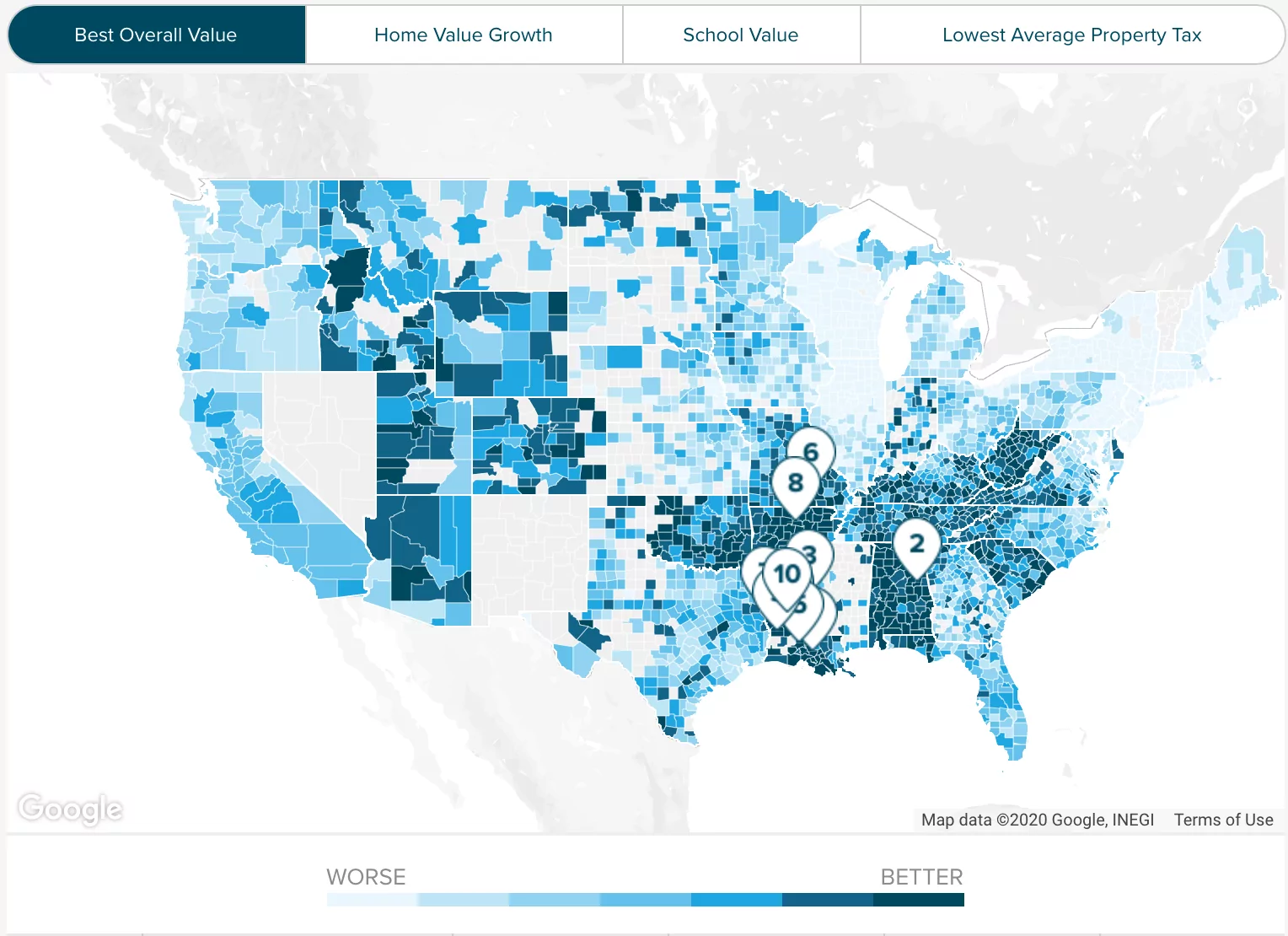

Florida Property Tax Records – Florida Property Taxes Fl

Anoka County Mn Property Tax Calculator – Smartasset

Florida Property Tax Records – Florida Property Taxes Fl

Duval-county Property Tax Records – Duval-county Property Taxes Fl

Florida Property Tax Records – Florida Property Taxes Fl

26 Tax Write Offs For Freelance Photographer Tax Deductions Tax Write Offs Business Expense Tracker Traveling By Yourself

Minnesota Sales Tax Calculator Reverse Sales Dremployee

Where Are The Lowest Property Taxes In Florida – Mansion Global

Get You Refund Florida Income Taxes Free Tax Calculator 2019

Louisiana Sales Tax – Small Business Guide Truic

Florida Dept Of Revenue – Property Tax – Data Portal

Florida Income Tax Calculator – Smartasset

Your Guide To Prorated Taxes In A Real Estate Transaction