They have increased the lifetime capital gains exemption limit (lcge) “for dispositions in 2020 of qualified small business corporation shares, the lifetime capital gains exemption (lcge) limit has increased to $883,384.” In 2016, there was a lot of speculation prior to the budget that the liberals were going to raise the capital gains inclusion rate.

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

This has canada speculating, again, if a hike to the capital gains inclusion rate may occur in the next federal budget.

Capital gains tax canada changes. Lifetime capital gains exemption limit. Over the years, the taxation of capital gains has been normalized. Candidates and their political parties are proposing several changes to the current tax schemes.

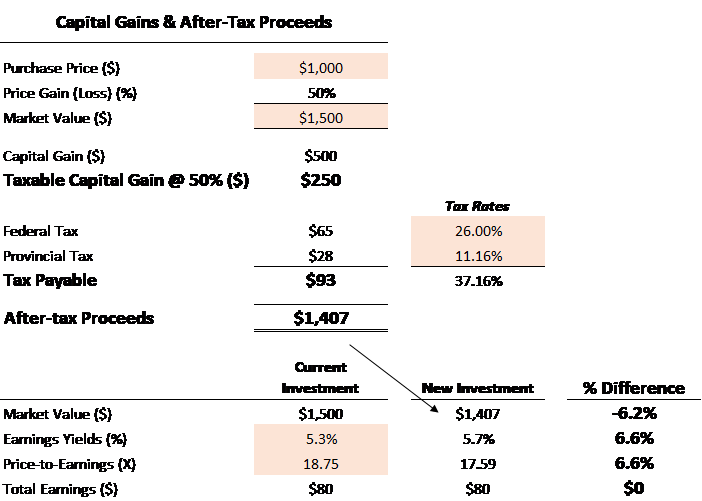

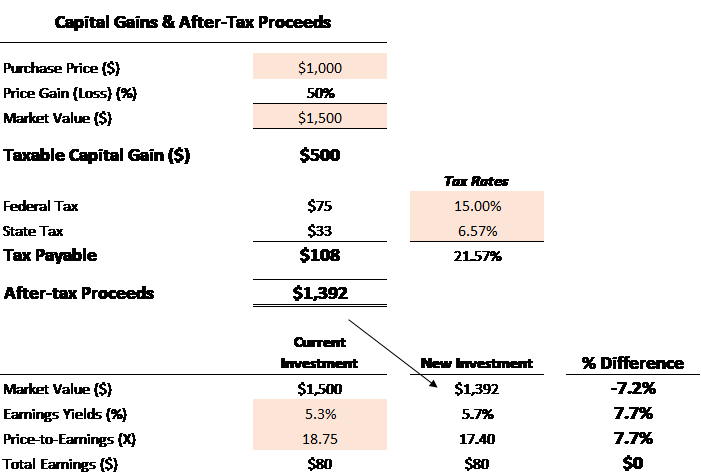

Wowa calculates your average capital gains tax rate by dividing your capital gains tax by your total capital gains. Changes to capital gains tax? Additionally, a section 1250 gain, the portion of a gain on a sale that.

The rate of capital gains in tax in canada has changed several times since it was introduced in 1972. The notion that capital gains should form a part of the tax base has largely been accepted, both in canada and globally. Specifically, finance has targeted strategies designed to multiply access to the lifetime capital gains exemption.

The federal government website says the following about capital gains changes in 2021. The department of finance canada has released their proposed changes aiming to close perceived income tax loopholes relating to the use of private corporations. For more information, see what is the capital gains deduction limit?

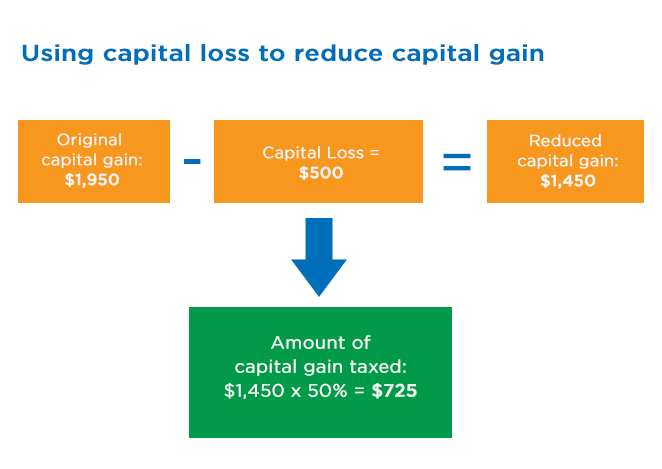

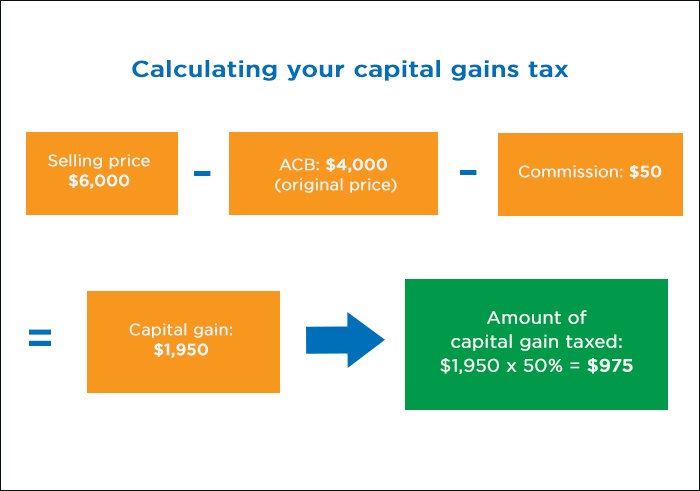

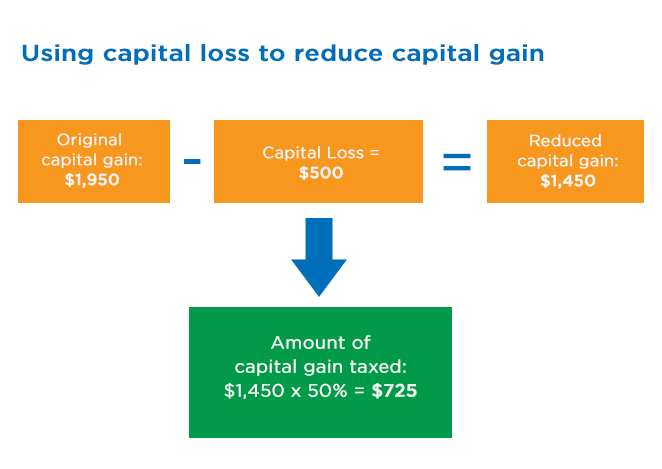

If a change to the capital gain inclusion rate is announced in the upcoming budget, it is not known whether it would be The capital gains inclusion rate is 50% in canada, which means that you have to include 50% of your capital gains as income on your tax return. When the tax was first introduced to canada, the inclusion rate was 50%.

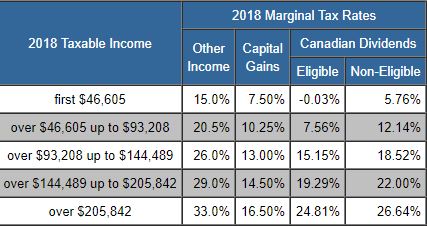

The rates do not stop there. Please select all that apply: Increasing the capital gain inclusion rate may be one tax change the canadian government could consider in order to boost tax revenues.

Currently, under canadian tax law, only 50% of capital gains are taxable, at your marginal rate. The federal government's 1971 decision to include capital gains in income was part of a sweeping change to the canadian income tax system. Report a problem or mistake on this page.

Although the concept of capital gains tax is not new to canadians, there have been several changes to the rate of taxation since its introduction in 1972. For example, if you bought a stock for $10 and sold it for $50, but paid broker fees of $5, you would have a capital gain of $35. To equalize the tax treatment of gains and other income, the inclusion rate for capital gains on shares of small businesses should rise to 90% from the current 50%, and the.

The current tax preference for capital gains costs upwards of $15 billion annually. If the government does propose to increase the capital gains inclusion rate when its 2020 budget is released, the speculation is that the rate would increase to either 66.67% or 75%. The same rules apply in the case of a change of use (i.e.

However, the cra recognizes that property owners may face difficulty paying capital gains tax when a sale has not occurred. This increased to 75% in 1990 and was then reduced back to 50% in 2000, where it has remained for the last 20 years. Prior to 1972, capital gains were not taxable in canada.

For tax purposes, the gain would only be half of $35. Instead, as an investor one would pay the income tax on part of the gain that they make. What is the capital gains tax rate in canada?

In canada, 50% of the value of any capital gains are taxable. Generally, capital gains are taxed on half of the gain. For dispositions in 2020 of qualified small business corporation shares, the lifetime capital gains exemption (lcge) limit has increased to $883,384.

The table below shows the effective personal tax rate on a capital gain for an alberta resident in the highest tax bracket in 2020 at the current capital gains inclusion rate and at the capital gains inclusion rates if one. The cra has increased indexation rates. The canada revenue agency (cra) imposes capital gains tax on investment gains realized through the sale of certain assets.

In order to provide relief to the exchequer, the canada revenue agency (cra) has made changes to a few tax breaks in 2022. There has been speculation from advisors and investors that capital gains taxes may be increased, given the sharp increase in relief spending by the government due to. Under the proposal, a new capital gain rate would apply to capital gains recognized after the date of the proposal.

The tax base includes profits or losses made by selling investments such as stocks, bonds, mutual funds, and listed securities. The new democratic party (ndp), in particular, pledges to. In this case, the cra allows owners to file an election to defer the payment of tax until a true sale takes place, provided you do not claim cca.

The below outlines the current tax treatment of capital gains in canada and the u.s., the appetite for change in each country, and a few questions to ask your financial planner about realizing capital gains before december 31, 2020. Should you sell the investments at a higher price than you paid (realized capital gain) — you'll need to add 50% of the capital gain to your income. Canada first introduced a capital gains tax in 1972.

In the income tax act, there is no special tax relating to gains you make from investments and real estate holdings. To address wealth inequality, and to improve functioning of our tax system, tax rates on capital gains income should be increased.

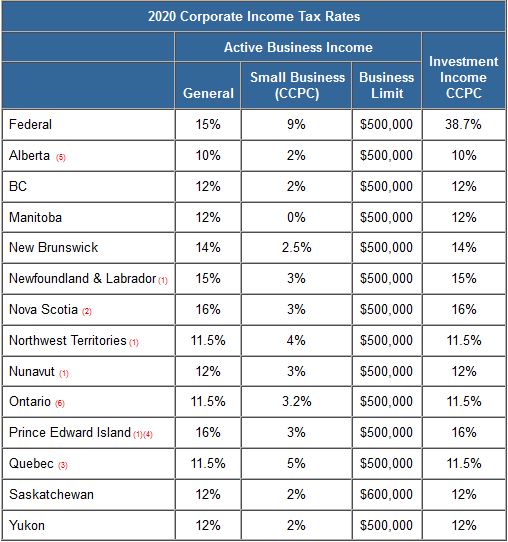

Taxtipsca – Business – 2020 Corporate Income Tax Rates

Understanding Taxes And Your Investments

How Do Capital Gains And Losses Affect Your Income Tax

Canada Capital Gains Tax Attribution Rules In Canada Versus The Us

The States With The Highest Capital Gains Tax Rates The Motley Fool

Possible Changes Coming To Tax On Capital Gains In Canada – Smythe Llp Chartered Professional Accountants

A 95-year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

Taxtipsca – Manitoba 2021 2022 Personal Income Tax Rates

How To Calculate Capital Gains Tax Hr Block

Capital Gains Tax Calculator For Relative Value Investing

Capital Gains Tax Capital Gain Integrity

How Do Taxes Affect Income Inequality Tax Policy Center

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

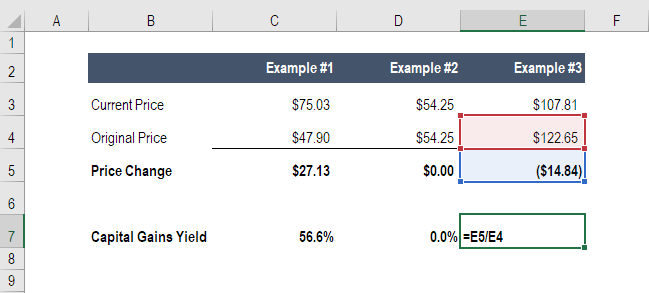

Capital Gains Yield Cgy – Formula Calculation Example And Guide

How Do Capital Gains And Losses Affect Your Income Tax

Possible Changes Coming To Tax On Capital Gains In Canada – Smythe Llp Chartered Professional Accountants

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Taxtipsca – Canada Federal 2017 2018 Income Tax Rates

Capital Gains Tax Calculator For Relative Value Investing