No, you cannot defer capital gains tax by selling your existing property and then buying another property within 3 months of the sale. Ad a tax expert will answer you now!

How Do I Report Capital Gains In British Columbia

You can defer paying capital gains tax for your shares only when you got them from a spouse or parent due to death or divorce.

Defer capital gains tax canada. The canadian chamber of commerce recommends that the federal government: 2 nd year = 40%, 3 rd year = 20% , 4 th year after sale = 0% deferral. “create a tax and regulatory environment that promotes the building of new affordable housing by allowing investors to defer cca recapture and capital gains on the proceeds from the sale of rental property when the proceeds are reinvested in another rental property within a reasonable.

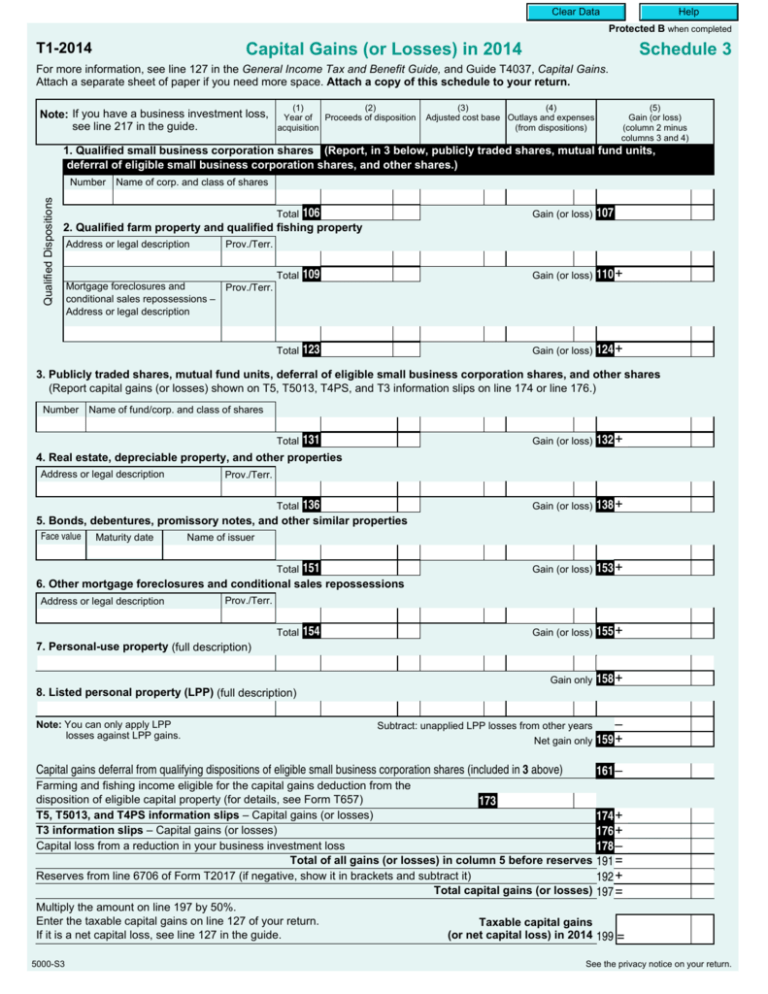

But you do pay income tax on capital gains. For dispositions in 2020, report the total capital gain on lines 13199 and 13200 of schedule 3 and the capital gains deferral on line 16100 of schedule 3. Capital gains deferral = b x (d ÷ e) where b = the total capital gain from the original sale e = the proceeds of disposition d = the lesser of e and the total cost of all replacement shares.

50% of the value of any capital gains are taxable in canada. (i) has been stolen, destroyed, or expropriated (often referred to as an “involuntary disposition”),or In this way, you only owe taxes on the received earnings.

Capital gains tax calculator & real estate 1031 exchange. Canada does not have capital gains tax deferral rules like the us does (1031 exchange). Deferred capital gains do not qualify for the capital gains deduction (line 25400).

Half the value of your capital gains is taxable, so you simply add 50%. Comments for deferal of capital gains tax in canada. Currently it’s 50% in canada, but has been as high as 75% historically.

Deferral election is taken, but cannot claim cca. This means that the canadian government applies tax to the profits gained by selling an asset for more than you paid; Tax basis increases from $0 to 10% of the invested capital gains, reducing future tax liability.

The cra can charge capital gains tax on anything you sell that makes a profit including stocks, bonds, real estate investments and other assets (most retirement accounts in canada, however, allow you to defer paying taxes on. Should you sell the investments at a higher price than you paid (realized capital gain) — you'll need to add 50% of the capital gain to your income. They tax 50% of your profits.

So this means you’ll pay tax on half of your capital gains. Deferal of capital gains tax in canada. In canada, taxpayers may defer and roll capital gains into replacement properties under either section 44 or 44.1 of the act.

Section 44 applies to a property that: This determines how much of your capital gains you’ll have to pay tax on. Technically speaking, there’s no such thing as a capital gains tax in canada.

My wife and i are selling a real estate property and will have capital gains. Get unlimited capital gain and loss questions answered Instead, as an investor one would pay the income tax on part of the gain that they make.

With the deferral election, any tax on the appreciation of $250,000 from year 1 to year 5 will be deferred until the true sale occurs in year 10. If an investor was to sell the investments at a higher price than what they paid (realized capital gain) — the investor will need to add 50% of the capital gain to their income. But another thing to consider is the inclusion rate.

Canada’s current capital gains tax rate is 50% of capital profits as set by the canada revenue agency. Comments for deferal of capital gains tax in canada. One of the cleanest ways to save yourself from capital gains tax in canada is to defer your earnings.

November 24, 2020 at 1:15 am. In canada, 50% of the value of any capital gains are taxable. For example, if you have a property worth $150000 and sell it for $200000, you can receive the amount yearly with over $50000 on profit.

Get unlimited capital gain and loss questions answered Ad a tax expert will answer you now! How to defer capital gains tax on real estate canada.

Capital Gains Tax Calculator For Relative Value Investing

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Tax Tips 2016 Investment Income Capital Gains And Losses – Tax – Canada

Capital Gains Tax Calculator For Relative Value Investing

How To Pay 0 Capital Gains Taxes With A Six-figure Income

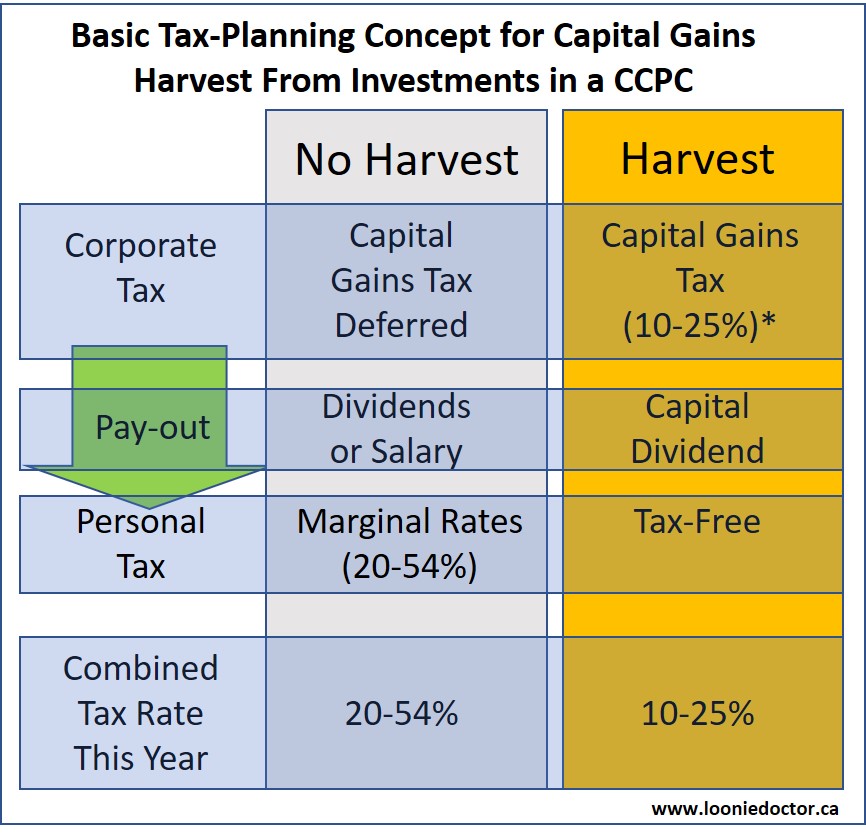

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Types Of 1031 Exchange Properties Commercial Property Commercial Exchange

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

Taxation Of Capital Gains In Developing Countries In Imf Staff Papers Volume 1968 Issue 002 1968

Taxation Of Capital Gains In Developing Countries In Imf Staff Papers Volume 1968 Issue 002 1968

Schedule 3 Capital Gains Losses

Long Term Capital Gain Tax – Ltcg Vs Stcg Calculation Exemption 2021

Make Tax-free Capital Gains On Australian Shares Whilst A Non-resident Expat – Expat Taxes Australia

1031 Exchange Property For Sale Investing Property Listing Economic Analysis

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Tax Tips 2016 Investment Income Capital Gains And Losses – Tax – Canada