Ad create an online store. The nebraska state sales and use tax rate is 5.5% (.055).

Which Cities And States Have The Highest Sales Tax Rates – Taxjar

The total tax on gasoline and ethanol, before adding any federal taxes, is 33.20 cents per gallon.

Omaha nebraska sales tax rate 2020. [ 3 ] state sales tax is 5.50%. The nebraska sales tax rate is currently %. The current total local sales tax rate in omaha, ne is 7.000%.

This is the total of state, county and city sales tax rates. The minimum combined 2021 sales tax rate for omaha, nebraska is. Estimated combined tax rate 5.50%, estimated county tax rate 0.00%, estimated city tax rate 0.00%, estimated special tax rate 0.00% and vendor discount 0.025.

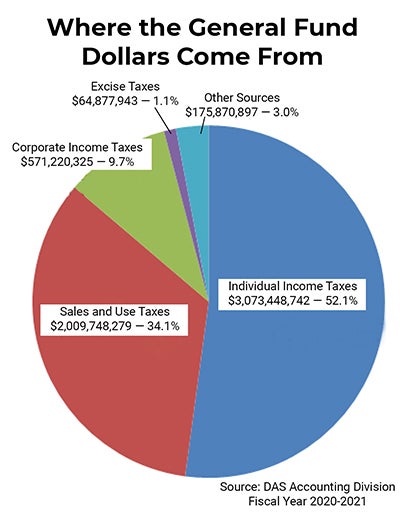

The omaha, nebraska sales tax is 7.00% , consisting of 5.50% nebraska state sales tax and 1.50% omaha local sales taxes.the local sales tax consists of a 1.50% city sales tax. The omaha sales tax is collected by the merchant on all qualifying sales made within omaha. Farmers and ranchers pay 29% and commerce and industry pay 17%.

2020 nebraska state sales tax rates the list below details the localities in nebraska with differing sales tax rates, click on the location to access a supporting sales tax calculator. For tax rates in other cities, see nebraska sales taxes by city and county. This is the total of state, county and city sales tax rates.

The omaha, nebraska, general sales tax rate is 5.5%. There is no applicable county tax or special tax. Select the nebraska city from the list of popular cities below to see its current sales tax rate.

The minimum combined 2021 sales tax rate for millard, nebraska is. Homeowners pay 47% of nebraska property taxes; Your brand can grow seamlessly with wix.

Utilize quick add to cart and more!. Utilize quick add to cart and more!. With local taxes, the total sales tax rate is between 5.500% and 8.000%.

The 68136, omaha, nebraska, general sales tax rate is 5.5%. 1, 2020, deshler will collect a new 1% sales and use tax, while unadilla will collect a new 1.5% lincoln to raise sales tax rate |. The county sales tax rate is %.

Depending on the zipcode, the sales tax rate of omaha may vary from 5.5% to 7% depending on the zipcode, the sales tax rate of omaha may vary from 5.5% to 7% Sales tax and use tax rate of zip code 68138 is located in omaha city, douglas county, nebraska state. The budget would keep the tax rate at just over 29.5 cents per $100 in valuation, although the rate won’t be set in stone until august, after final valuations are certified.

With local taxes, the total sales tax rate is between 5.500% and 8.000%. The tax on diesel is also 33.20 cents per gallon. Ad create an online store.

If property taxes, sales taxes and income taxes were equalized as sources of state and local revenue, property taxes would need to be reduced over $600 million. As of july 2020, the national average gas excise tax is 25.64 cents per gallon and the national average diesel excise tax is 26.25 cents per gallon. The millard sales tax rate is %.

Counties and cities in nebraska are allowed to charge an additional local sales tax on top of the state sales tax. The registration fees are assessed:. There are approximately 2,260 people living in the omaha area.

You can print a 7% sales tax table here. Your brand can grow seamlessly with wix. The county sales tax rate is %.

The omaha, arkansas sales tax rate of 7.75% applies in the zip code 72662. The 7% sales tax rate in omaha consists of 5.5% nebraska state sales tax and 1.5% omaha tax. The nebraska sales tax rate is currently %.

Nebraska has recent rate changes (thu jul 01 2021). The state capitol, omaha, has a. Remember that zip code boundaries don't always match up with political boundaries (like omaha or boone county ), so you shouldn't always rely on something as imprecise as zip codes to determine the sales tax rates at a given address.

Sales taxes are 29% of total tax collections, and income taxes are 26%. The nebraska tax rate is unchanged from last year, however, the income. Registration fee for commercial truck and truck tractors is based upon the gross vehicle weight of the vehicle.

Omaha, ne sales tax rate. The combined rate used in this calculator (5.5%) is the result of the nebraska state rate (5.5%). The nebraska state sales tax rate is 5.5%, and the average ne sales tax after local surtaxes is 6.8%.

The omaha sales tax rate is %. The december 2020 total local sales tax rate was also 7.000%. The state sales tax rate in nebraska is 5.500%.

Nebraska has recent rate changes (wed.

How To Start A Business In Nebraska – A How To Start An Llc Small Business Guide

Nebraskas Sales Tax

General Fund Receipts Nebraska Department Of Revenue

How High Are Cell Phone Taxes In Your State Tax Foundation

Nebraskas Sales Tax

Nebraskas Sales Tax

Taxes And Spending In Nebraska

Nebraska Sales Tax – Taxjar

Nebraskas Sales Tax

Cell Phone Taxes And Fees 2021 Tax Foundation

Lincoln To See New Sales Tax Revenue Starting October 1

North Carolina Tax Reform North Carolina Tax Competitiveness

Nebraska Sales Tax Rates By City County 2021

Sales Taxes In The United States – Wikiwand

General Fund Receipts Nebraska Department Of Revenue

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare

2020 Nebraska Property Tax Issues Agricultural Economics

Taxes And Spending In Nebraska

Tax Foundation Proposed Tax Rate Increases Undo Impact Of Property Tax Cuts