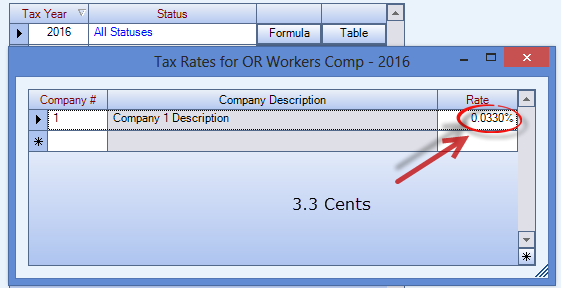

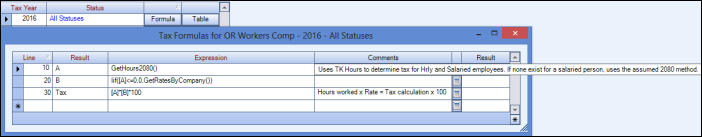

This tax rate is the same for all employers, and is. Wbf assessment for oregon is based on the number of hours that an employee works.

2

Oregon uses its own test to determine who is an employee for state unemployment insurance (sui) tax purposes.

Oregon wbf assessment employee. For 2020, our analysts recommend lowering the assessment from 2.4 cents per hour worked in 2019 to 2.2 cents per hour worked in 2020. When entering payroll checks, you must enter the number of hours worked, and the application calculates the wbf tax and displays it on the payroll checks as oregon wc. Qb incorrectly adds vacation hours and holiday hours to calculate this assessment.

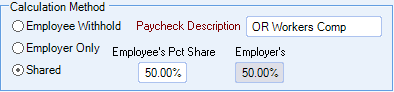

For 2019, our analysts recommend lowering the assessment from 2.8 cents per hour worked in 2018 to 2.4 cents per hour worked in 2019. Employers must pay at least half the amount (1.1 cents per hour) and deduct no more than half from workers’ wages. The wbf assessment is a payroll assessment that employers of oregon workers have paid since 1966.

Each pay period, the employee withholding amount is calculated by multiplying the deduction rate of $.011 times the actual number of. The law defines wages for sui purposes as all compensation for personal services, including salaries, commissions, bonuses and the cash value of all compensation paid in any medium other than cash. The wbf assessment is a payroll assessment that employers of oregon workers have paid since 1966.

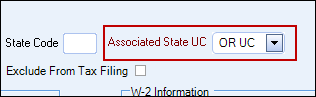

Detailed information about the workers' benefit fund assessment; In accounting cs, the employee's work location must be entered as oregon, but no special setup is required to calculate the wbf assessment. It is automatically added by payroll, but requires a manual entry of the worker's assessment rate for each employee and company rate.

Projected reporting, recordkeeping and other administrative activities required for compliance, including costs of professional services: The worker's/employee's portion is only 1/2 ( $.011/hr ) of the assessment rate. See test for employee status.

What is the benefit fund assessment (wbf), as opposed to the workers' compensation premium? In 2021, this assessment is 2.2 cents per hour worked. Each quarter, employers use forms oq and otc to report and pay the assessment through oregon’s combined payroll tax reporting system.

In oregon, employers are required to pay and report the workers benefit fund (wbf) payroll assessment. Employers pay at least half of this assessment and deduct no more than half of it from workers' wages. The assessment is paid directly to oregon’s employment and revenue departments through quarterly payroll tax reports, and the revenue is transferred to dcbs.

For information about calculating the assessment, visit oregon.gov/dcbs/pages/wbf.aspx, email. The assessment is paid directly to oregon’s employment and revenue departments through quarterly payroll tax reports, and the revenue is transferred to dcbs. More than 125,000 oregon employers are subject to the wbf assessment.

Oregon employment department (oed), and department of consumer and business services (dcbs) rules may be different from each other. The wbf is healthy, made so by a growing economy, which The 2021 wbf assessment rate is $.022/hr.

Employers and employees split the cost. State workers benefit fund (wbf) assessment. What is workers' benefit fund assessment?

Programs funded by workers´ benefit fund Employers pay at least half of this assessment. This is an oregon payroll assessment paid quarterly.

For information about calculating the assessment, visit oregon.gov/dcbs/pages/wbf.aspx, email. Each quarter, employers use forms oq and otc to report and pay the assessment through oregon’s combined payroll tax reporting system. (a) if actual hours worked are not tracked, an employer may either calculate the assessments using a flat rate, use contract information.

Oregon workers benefit fund the workers benefit fund (wbf) assessment — this is a payroll assessment calculated on the basis of hours worked by all paid workers, owners, and officers covered by workers compensation insurance in oregon, and by all workers subject to oregon's workers compensation laws (whether or not covered by workers compensation. All regular, overtime, and double time hours are subject to this tax. The only work around that i have found is to manually adjust the hours under the other payroll items section in the quantity column.

The wbf is healthy, made so by a growing economy, which At least 90 percent of employers are small businesses (50 or fewer employees). This article explains how to set up or change the or wbf in quickbooks desktop.

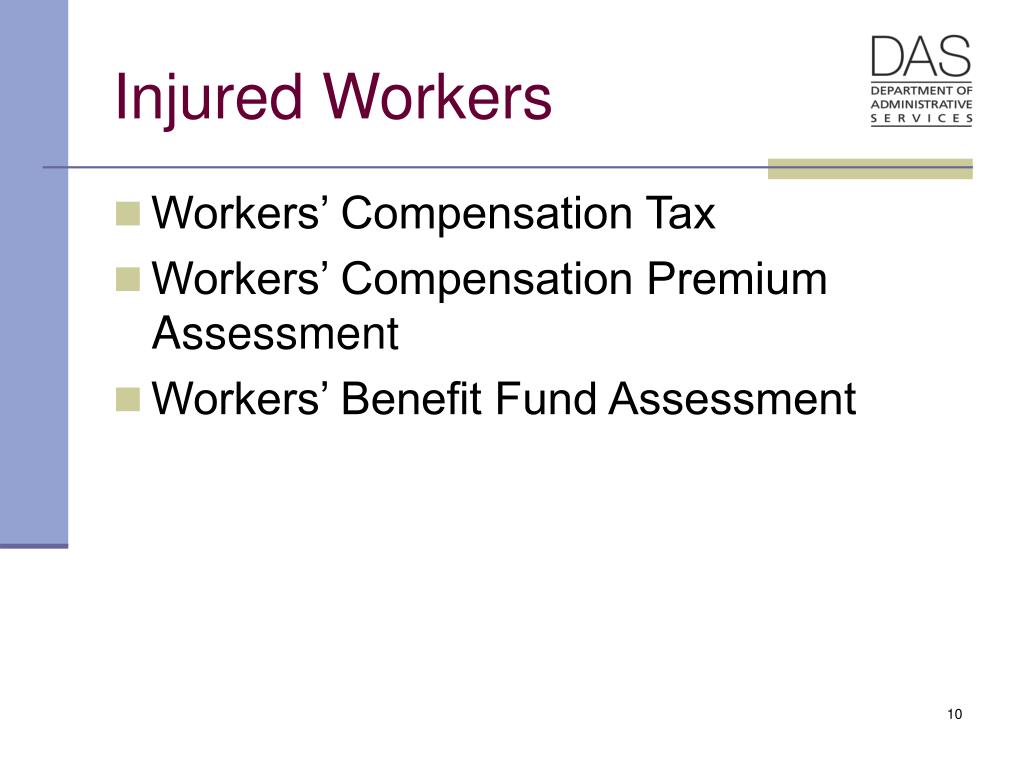

If you are an oregon employer and carry workers’ compensation insurance, you must pay a payroll tax called the workers’ benefit fund (wbf) assessment for each employee covered under workers’ comp. 2) you choose to provide workers’ compensation insurance coverage for yourself or any others that receive remuneration The purpose of the tax is to help fund programs in oregon to help injured workers and their families.

The oregon worker benefit fund (or wbf) is an hourly tracked other tax that is different from oregon workers compensation. Employers report and pay the wbf assessment directly to the state with other state payroll taxes. For purposes of the wbf assessment, you are required to report and pay the wbf assessment if 1) you have workers for whom you are required by oregon law to provide workers’ compensation insurance coverage;

The assessment is one part of the workers compensation insurance requirements. Employers must pay at least half the amount (1.1 cents per hour) and deduct no more than half from workers’ wages.

Oregon Workers Benefit Fund Wbf Assessment

2

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue – Pdf Free Download

Oregon Workers Benefit Fund Payroll Tax

Defining The Codes Needed For The Oregon Form Oq

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue – Pdf Free Download

2

2

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue – Pdf Free Download

Oregon Workers Benefit Fund Payroll Tax

Oregon Workers Benefit Fund Payroll Tax

Ppt – Ospa Payroll Calculation Powerpoint Presentation Free Download – Id1146425

2

Oregon Workers Benefit Fund Payroll Tax

Oregon Workers Benefit Fund Payroll Tax

How To Set Up Workers Compensation – Pdf Free Download

Ppt – Ospa Payroll Calculation Powerpoint Presentation Free Download – Id1146425

2

2