While maine's tax policies with regard to retirement pay and social security aren't changing in 2018, social security benefit amounts are generally rising in 2018. Maine military retired pay income tax:

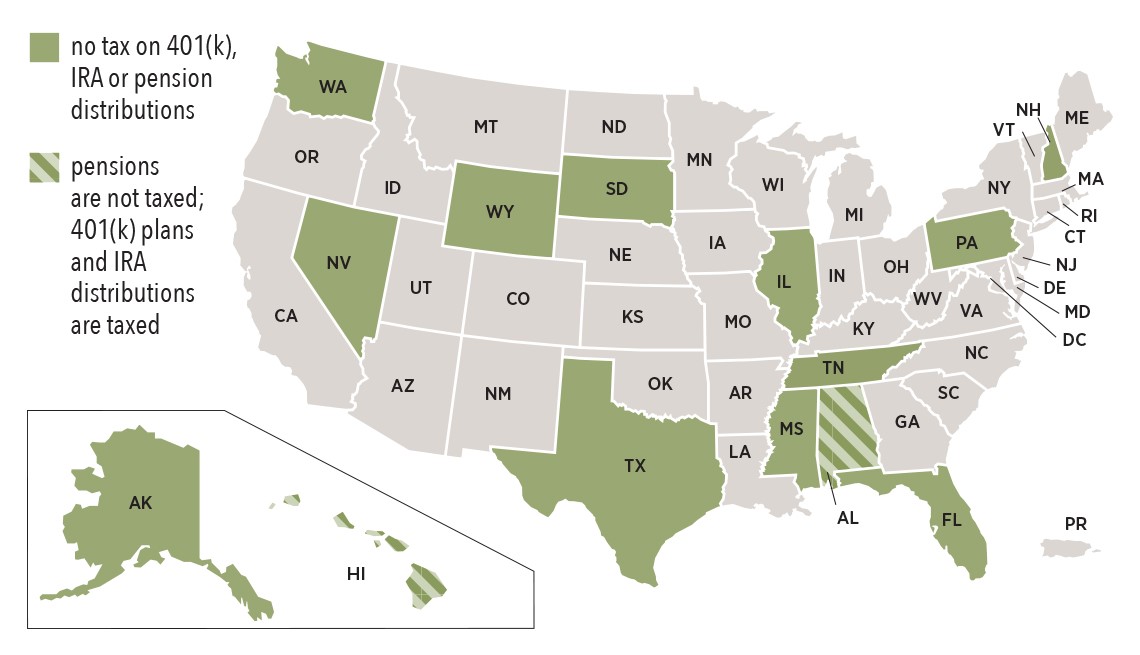

7 States That Do Not Tax Retirement Income

There may be a silver lining, though.

Does maine tax retirement pensions. The state does not tax social security income and it also provides a $10,000 deduction for retirement income. In 2018, teachers contributed 7.65 percent of their salary to the pension fund, while the state contributed 19.92 percent. $6,000 minus social security (ss)/railroad retirement (rr) benefits.

100% exemption for benefits earned before 1/1/98. $24,000 per person minus ss/rr benefits. In total, 27.57 percent of teacher.

Vast experience in helping expatriates worldwide plan and achieve their retirement goals. If you file state of maine taxes you might be eligible for a deduction of $10,000 as a single taxpayer or $20,000 as a married taxpayer. For people who receive social security benefits and another pension, this can mean less income eligible to be deducted under the maine pension deduction.

Maine doesn’t tax social security benefits, and retirees can deduct up to $10,000 of eligible pension income. Maine tax laws conform with federal laws except in. These amounts appear in box 9b.

Learn more about maine retired military pay income tax maine income tax on military disability retirement pay: For more information, please see this document and then contact your tax advisor or maine revenue services. Maine tax return begins with federal agi (review the discussion about differences with federal taxes.)

Over 65, taxable pension and annuity exclusion up to $30,600. In addition, you and your spouse may each deduct up to $10,000 of pension income that is included in federal adjusted gross income. Recipients of an employer pension are entitled to choose not to have income tax withheld from their payments, or to change their withholding election.

For tax year 2004, the exemption is $5,500 Deduct up to $6,000 of pension and annuity income; The state taxes income from retirement accounts and from pensions, such as from mainepers.

In the maine interview, proceed to the screen entitled retirement income and contributions and indicate that you had pension income. You will have to manually enter this subtraction after creating your maine return. In maine, teachers are a part of the maine public employee retirement system, which includes not only teachers but all state employees.

Maine tax law allows for a pension income deduction to all its pensioners on schedule 1. Pension income, whether from a public employee pension fund or from a private employer, is also taxable. Maine tax laws conform with federal laws except in.

Retiring in the pine tree state is not all bad: Maine doesn’t tax social security benefits, and retirees can deduct up to $10,000 of eligible pension income. Here are 12 reasons why maine is one of the best places to retire.

Ma pensions can be applied toward a retirement income tax credit, currently up to $200 oklahoma ma pensions qualify for the pension exemption: Maine public employees retirement system (mpers) distributions need your special attention. Am i eligible for the maine pension income deduction?

Maine does allow for a deduction of up to $10,000 per year of pension income. A bill passed by the maine legislature which would have provided a tax exemption for over 51,000 civil service retirees including teachers, Maine does not tax military retired pay.

Military disability retirement pay received as a pension, annuity or similar allowance for personal injury or sickness resulting from active service in the u.s. Reduced by social security received. Annual notice of right to elect or revoke federal tax withholding to all mainepers retirees:

Age 65 or older whose adjusted gross income is $25,000 or less for single filers, or $50,000 or less for married, filing jointly qualifies for the exemption; Armed forces should not be included. The next screen is pension income deduction (see screenshot for the screen from a test return).

1 the cost of living is reasonable Census suggests the state is becoming an increasingly popular retirement destination, with more than 6,000 people aged 55 or older moving to maine in 2013 alone. Is my military pension/retirement income taxable to maine?

Income from retirement savings accounts like an ira or 401 (k) is taxable. According to the maine department of revenue, military pension benefits, including survivor benefits, will be completely exempt from the state of maine’s income tax. For tax years beginning on or after january 1, 2016, the benefits received under a military retirement plan, including survivor benefits, are fully exempt from maine income tax.

In maine, teachers are a part of the maine public employee retirement system, which includes not only teachers but all state employees. Vast experience in helping expatriates worldwide plan and achieve their retirement goals. In that case, all your other retirement income will be taxed as part of your gross income.

Retiring in the pine tree state is not all bad:

Download Paycheck Stub Template 05 In 2021 Paycheck Prepaid Debit Cards Payroll Checks

37 States That Dont Tax Social Security Benefits The Motley Fool

Maine Retirement – Taxes And Economic Factors To Consider

37 States That Dont Tax Social Security Benefits The Motley Fool

Best States To Live In Retirement

Maine Retirement Tax Friendliness – Smartasset

Free Fico Scorecard From Discover Budget Saving Budgeting Money Bill Organization

Maine Retirement Tax Friendliness – Smartasset

12 States That Keep Retirement Dollars In Your Pocket Alhambra Investments

Where Are The Best And Worst States To Retire Bankratecom Clark Howard Retirement Life Map

The 10 Best States For Retirees When It Comes To Taxes Retirement Locations Retirement Retirement Advice

Personal Net Worth Statement Business Forms Template Etsy In 2021 Personal Financial Statement Net Worth Financial

Tax Friendly States For Retirees Best Places To Pay The Least

States That Dont Tax Military Retirement Pay Military Benefits

How To Pay Off A Tax Debt Capital Gains Tax Tax Accountant Tax Services

Future Of Super According To Bt Insight Social Media Super

The Aca Tax Return Preparer Directory Is An Online Directory For Overseas Taxpayers Search Results In Irs Listed

The Most Tax-friendly States For Retirees Vision Retirement

Wheres My State Refund Track Your Refund In Every State