Mississippi’s state income tax is fairly straightforward. This will result in an increase of.

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

The 2002 law established a system by which, in any year in which revenue growth exceeded a specified baseline, the individual income tax rate would be reduced by 0.05.

Mississippi state income tax rate 2020. All other income tax returns p. Are delaware statutory trusts right for you? The proposed legislation does so by gradually increasing the personal exemption until the income tax is ultimately eliminated.

Mississippi’s income tax currently has three marginal rates of 3 percent, 4 percent, and 5 percent. Mississippi code at lexis publishing The mississippi income tax has three tax brackets, with a maximum marginal income tax of 5.00% as of 2021.

Taxpayer access point (tap) online access to your tax account is available through tap. Residents of mississippi are also subject to federal income tax rates, and must generally file a federal income tax return by april 15, 2021. 4% on the next $5,000 of taxable income.

5% on all taxable income over $10,000. Read the mississippi income tax tables for married filing jointly filers published inside the. There are just three income tax brackets, and the tax rates range from 3% to 5%.

If filing a combined return (both spouses work), each spouse can calculate their tax liability separately and add the results. The graduated income tax rate is: The taxable wage base in 2020 is $14,000 for each employee.

The list below details the localities in mississippi with differing sales tax rates, click on the location to access a supporting sales tax calculator. There is no tax schedule for mississippi income taxes. These rates are the same for all filing statuses, as well as for businesses.

3% on the next $2,000 of taxable income. Tax year 2020 first $3,000 @ 0% and the next $2,000 @ 3% first $4,000 @ 0% and the next $1,000 @ 3% tax year 2022 first $5,000 @ 0% $2.50 per $1,000 of capital in excess of $100,000 tax year 2019 $2.25 per $1,000 of capital in excess of $100,000 tax year 2020 $2.00 per $1,000 of capital in excess of $100,000 tax year 2021 18 cents per gallon of regular gasoline and diesel

Mississippi has three marginal tax brackets, ranging from 3% (the lowest mississippi tax bracket) to 5% (the highest mississippi tax bracket). The mississippi sales tax rate is 7% as of 2021, with some cities and counties adding a local sales tax on top of the ms state sales tax. See the tap section for more information.

There is no percentage method available to determine mississippi withholding; Employees who earn more than $10,000 a year will hit the top bracket. • six states—alaska, illinois, iowa, minnesota, new jersey, and pennsylvania— levy top marginal corporate income tax rates of 9 percent or higher.

Beginning in 2022, the personal exemption would dramatically increase to $47,700 for individuals, $95,400 for Check the 2020 mississippi state tax rate and the rules to calculate state income tax. Effective july 1, 2021, the nsm fee will increase from 1.71 cents for each nsm cigarette to 1.81 cents for each nsm cigarette.

Mississippi governor tate reeves (r), in his budget proposal for fiscal year (fy) 2022, has announced his goal of phasing out the state’s income tax by 2030. 3% on the next $3,000 of taxable income. Mississippi state tax quick facts.

Mississippi has 3 state income tax rates: Rates range from 2.5 percent in north carolina to 12 percent in iowa. The mississippi tax freedom act aims to eliminate the individual income tax in a period as short as a decade.

4% on the next $5,000 of taxable income. 0% on the first $2,000 of taxable income. Find your pretax deductions, including 401k, flexible account contributions.

However, the department does provide a computer payroll flowchart. Exemptions to the mississippi sales tax will vary by state. How to calculate 2020 mississippi state income tax by using state income tax table.

2020 mississippi state sales tax rates. 5% on all taxable income over $10,000. Each marginal rate only applies to earnings within the applicable marginal tax bracket , which are the same in.

Mississippi Tax Rate Hr Block

Income Tax Rates For Ay 2020-21 Fy 2019-20

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

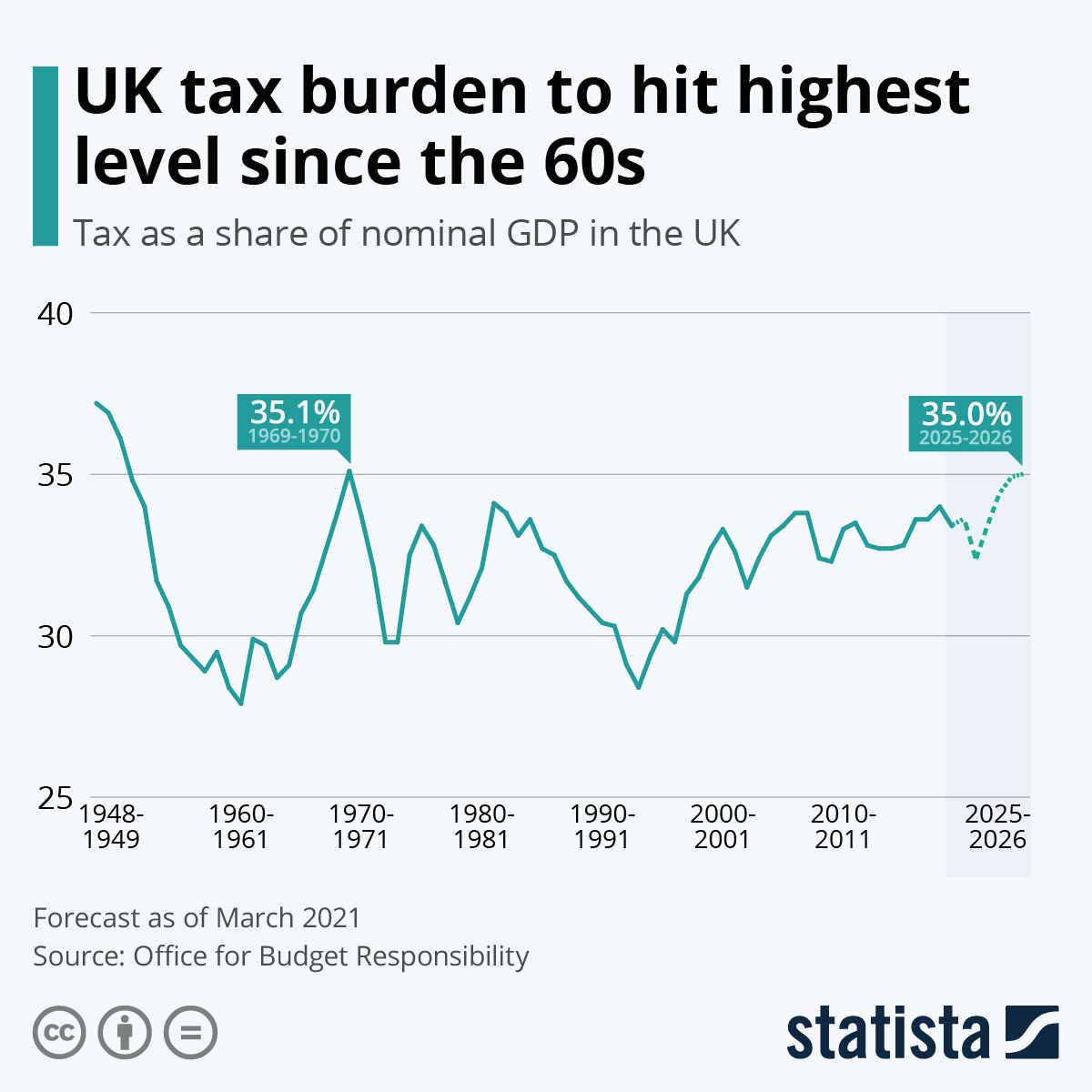

Chart Uk Tax Burden To Hit Highest Level Since The 60s Statista

States With Highest And Lowest Sales Tax Rates

25 Percent Corporate Income Tax Rate Details Analysis

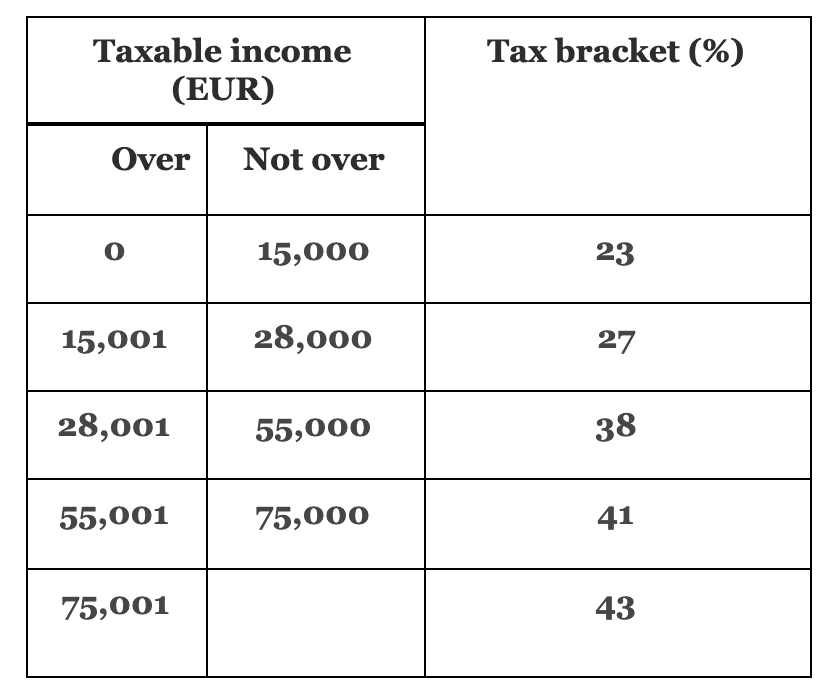

Individual Income Tax In Malaysia For Expatriates

The Dual Tax Burden Of S Corporations Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

Low-tax States Are Often High-tax For The Poor Itep

Income Tax Rates For Financial Year 2019-20 And 2020-21

Mississippi Tax Rate Hr Block

Colorado Income Tax Rate And Brackets 2019

Income Tax Rates In Nepal 20782079 Corporation Individual And Couple

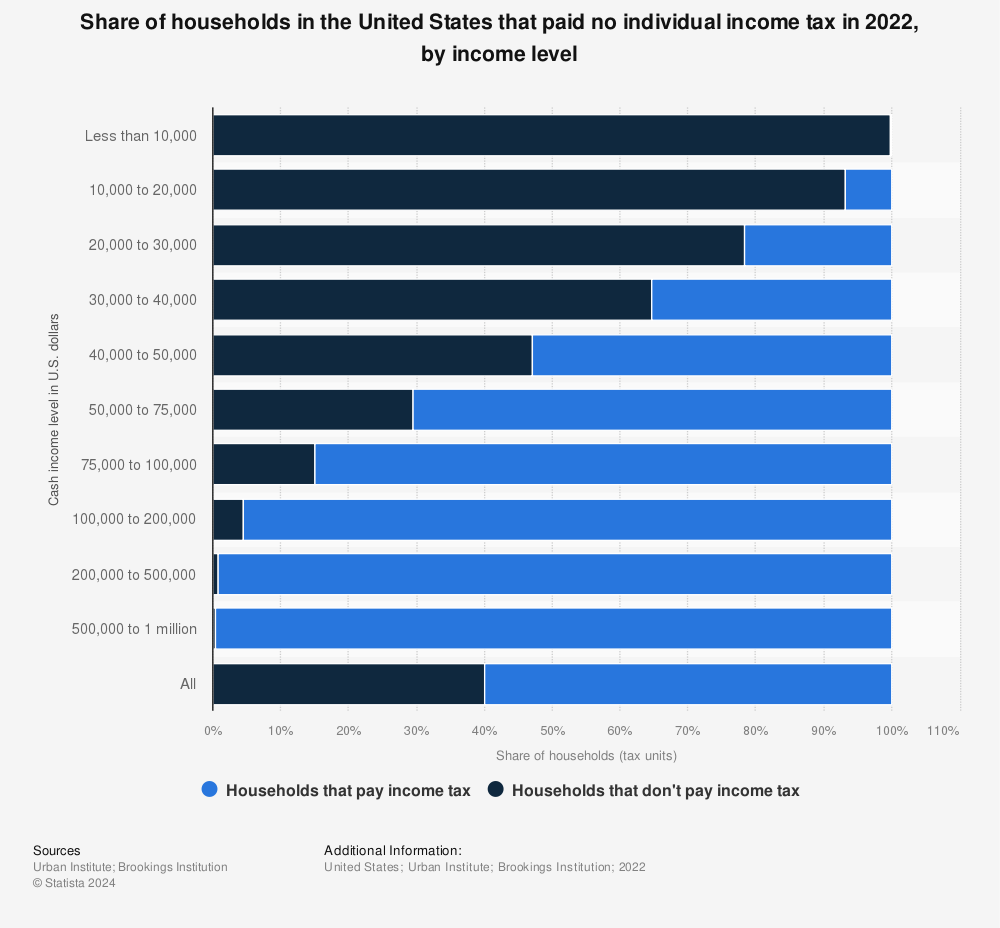

Percentages Of Us Households That Paid No Income Tax By Income Level 2019 Statista

List Of States By Income Tax Rate – See All 50 Of Them With Interactive Map

Salary Taxes Social Security

Bfnbn2regx2uzm

Income Tax Rate In Italy 2020 Guide For Foreigners – Accounting Bolla