These are contributions that you make before any taxes are withheld from your paycheck. It is not a substitute for the advice of an accountant or other tax professional.

How Much You Really Take Home From A 100k Salary In Every State Income Tax Salary Tax

To use our new jersey salary tax calculator, all you have to do is enter the necessary details and click on the calculate button.

How much tax is taken out of my paycheck new jersey. New jersey tax (before we factor in the resident credit) = $90,000 x 4% = $3,600. Total state tax (before the resident credit) = $4,800 + $3,600 = $8,400. New jersey state payroll taxes new jersey has a progressive income tax policy with rates that go all the way up to 11.8% for gross income over $5.

So if you elect to save 10% of your income in your company’s 401(k) plan, 10% of your pay will come out of each paycheck. If you have a household with two jobs and both pay about the same click this button and exit. Living in new york city adds more of a strain on your paycheck than living in the rest of the state, as the big apple imposes its own local income tax on top of the state one.

The amount withheld must be at least $10 per month in even dollar amounts (no cents). Switch to new jersey hourly calculator. Tax rate of 1.4% on the first $20,000 of taxable income.

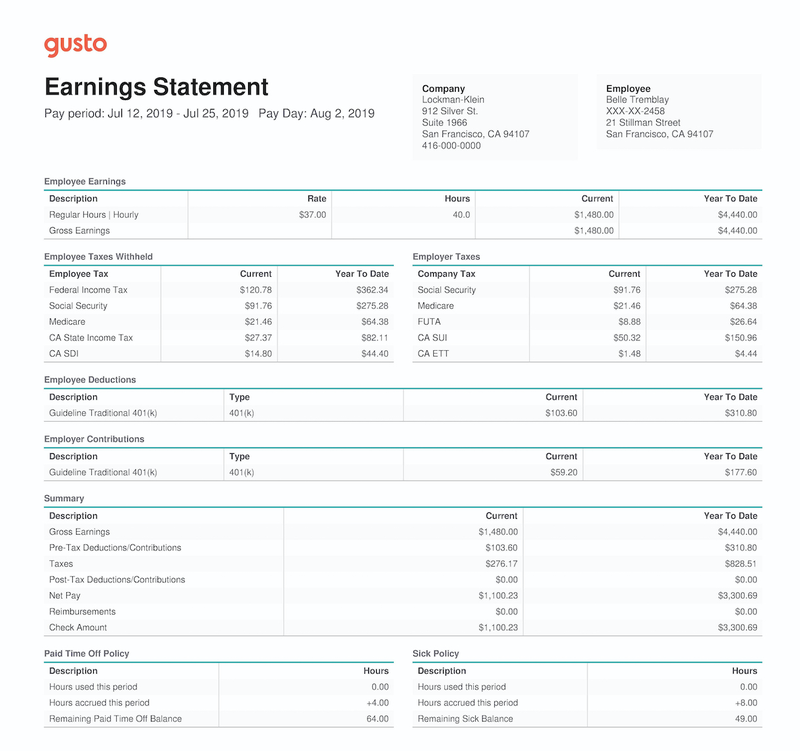

How your new jersey paycheck works. Ad 5 tax professionals are online. Federal income tax is usually the largest tax deduction from gross pay on a paycheck.

If your household has only one job then just click exit. The paycheck calculator may not account for every tax or fee that applies to you or your employer at any time. New jersey income tax rate ranges from 1.40% to 10.75% and there are also three types of payroll taxes.

New york state has a progressive income tax system with rates ranging from 4% to 8.82% depending on taxpayers’ income level and filing status. How to calculate taxes taken out of a paycheck Tax rate of 5.525% on.

New jersey requires employers to withhold state income and applicable local income taxes from employee paychecks in addition to employer paid state unemployment taxes.for new jersey's tax rates, please click here. Questions answered every 9 seconds. But that same income would cost you 4.5 percent in new york.

For example, if an employee earns $1,500 per week, the individual’s annual income would be 1,500 x 52 = $78,000. New jersey has a single, statewide sales tax rate. The more someone makes, the more their income will be taxed as a percentage.

After a few seconds, you will be provided with a full breakdown of the tax you are paying. What are my state payroll tax obligations? Exit and check step 2 box otherwise fill out this form.

Your average tax rate is 22.2% and your marginal tax rate is 36.1%. This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local w4 information.

Tax rates start at just 1.4 percent in new jersey, although this rate only applies to incomes under $10,000 as of 2020. To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. Switch to new jersey salary calculator.

That means that your net pay will be $42,787 per year, or $3,566 per month. This new jersey hourly paycheck calculator is perfect for those who are paid on an hourly basis. Ad 5 tax professionals are online.

Calculates federal, fica, medicare and withholding taxes for all 50 states. 1, 2018 that rate decreased from 6.875% to 6.625%. Tax rate of 1.75% on taxable income between $20,001 and $35,000.

The information provided by the paycheck calculator provides general information regarding the calculation of taxes on wages for new jersey residents only. Your employer will withhold 1.45% of your wages for medicare taxes each pay period and 6.2% in social security taxes. If you make $55,000 a year living in the region of new york, usa, you will be taxed $12,213.

New jersey bonus tax aggregate calculator change state this new jersey bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments, such as bonuses. This free, easy to use payroll calculator will calculate your take home pay. Nj income tax rates, you'll do somewhat better in new jersey than in new york.

Questions answered every 9 seconds. Tax rate of 3.5% on taxable income between $35,001 and $40,000. Only the highest earners are subject to this percentage.

Overview of new york taxes. In 2021, the federal income tax rate tops out at 37%. Check out our new page tax change to find out how.

You still need to pay federal income tax on top of this. New york tax = $80,000 x 6% = $4,800. Medicare and social security taxes together make up fica taxes.

Using our new jersey salary tax calculator. Your new jersey employer is responsible for withholding fica taxes and federal income taxes from your paychecks. Supports hourly & salary income and multiple pay frequencies.

However, now we have to figure out how much our nj resident.

2021 New Jersey Payroll Tax Rates – Abacus Payroll

New York Paycheck Calculator – Smartasset

Gross Wages What Is It And How Do You Calculate It The Blueprint

How Much Does An Employer Pay In Payroll Taxes Examples More

Heres How Much Money You Take Home From A 75000 Salary

Pin On Trending T-shirt Usa

Gross Pay And Net Pay Whats The Difference Paycheckcity

Paycheck Calculator – Take Home Pay Calculator

25 Great Pay Stub Paycheck Stub Templates Excel Templates Payroll Template Salary

Sample Pay Check And Fica Taxes Savings For Cpt Opt Studetns

Payroll Check Stub Pay Stub And Payroll Codes Human Resources Swarthmore College Payroll Checks Payroll Payroll Template

Need To Stop Wage Garnishment Are You Wondering What You Can Do To Avoid It Wage Garnishments Can Be Released By Follo Wage Garnishment Tax Lawyer Tax Debt

How Much Tax Is Deducted From A Paycheck In New Jersey

How Much Would I Have After Taxes In New York With A 120kyear Salary – Quora

Pin En Personal Financial Literacy For Ells

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

2020 New Jersey Payroll Tax Rates – Abacus Payroll

Paycheck Calculator – Take Home Pay Calculator

Tip Tax Calculator Primepay