The increase would be substantially bigger from 20% to 45% therefore it would be good to know if this does take place, should assets be sold off before the end of this tax year. Capital gains tax will rise this year (2021) in the us and the uk.

Autumn Budget 2021 What Happened To Capital Gains Tax Crowe Uk

The chancellor could decide to reduce this allowance, with these changes being tapered over a number of years.

Will capital gains tax increase in 2021 uk. Ots proposals suggested bringing capital gains tax in line with income tax, currently charged at a basic rate of 20 percent, and rising to 40 percent for higher rate taxpayers. The capital gains tax annual exemption is £12,300 for the year 2021/2022. It will affect online businesses (especially ecommerce business owners), and because the changes aren’t exactly positive, it’s a really smart idea to learn more about them if.

Reduce the current capital gains. Since then, president biden has set out plans to nearly double capital gains tax for wealthy americans, with tax rates set to soar from 20% to 39.6% for those earning more than usd 1 million (mn) a year from investment income. Capital gains have skyrocketed in recent years.

For higher rate tax payers who have already used their cgt allowance, this would equate to a potential £40,000 cgt charge or could even see them go in to the additional rate tax band and suffer 45% tax on all or part of this payment. Will the capital gains tax rates increase in 2021? Once again, no change to cgt rates was announced which actually came as no surprise.

The chancellor has long been rumoured be considering bringing capital gains tax rates more in line with income tax. In a press conference, president biden said: Of the areas where it is looking to make increases, it has been widely reported that capital.

The ots made a recommendation to scale back the capital gains tax exemption to below £5,000, which would bring more taxpayers into the capital gains tax net, tax growth on wealth, and increase. If your assets are owned jointly with another person, you can use both of your allowances, which can effectively double the amount you can make before cgt is due. Understanding the implications and actions required.

This could mean a switch to 20 per cent rates for people on the basic rate, 40. Or, could the tax rate be retroactively applied to the 2021/22 tax year? “it’s time for corporate america and the wealthiest 1 percent… to pay their fair share.”.

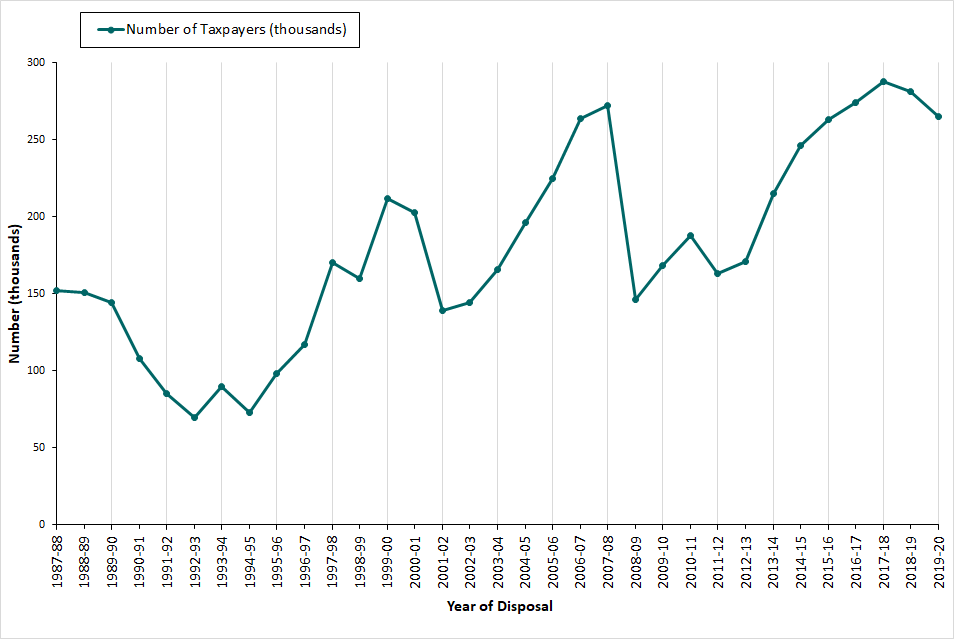

Asset sales have increased by around 2% to 11.5% of the tax revenue over the last 12 months, largely because of the nervousness that the chancellor would bring cgt more in line with income tax but again this did not materialise. No changes were announced to the rates of capital gains tax with the higher rate remaining at 20% and the basic rate at 10%. Chancellor rishi sunak’s budget did not ignore capital gains tax after all.

Under the proposed build back better act, the top marginal tax rates will jump from 20% to 39.6% that is. This is the amount of profit you can make from an asset this tax year before any tax is payable. For months now there has been speculation that capital gains tax rates will go up in the forthcoming budget.

Biden presented his american family plan on wednesday, proposing an increase in capital gains tax to 39.6 percent for households earnings more than $1m per year, up from 20 percent. Because the combined amount of £20,300 is less than £37,500 (the basic rate band for the 2020 to 2021 tax year), you pay capital gains tax at 10%. The annual exemption for 2021/2022 will remain at £12,300 and the chancellor announced that the annual exemption will remain at this amount for the tax years 2021/22 to 2025/26.

Capital Gains Tax Rishi Sunak Likely To Increase Cgt In Upcoming Budget 2021 Personal Finance Finance Expresscouk

Capital Gains Tax Commentary – Govuk

How To Avoid Or Cut Capital Gains Tax By Using Your Tax-free Allowance Getting An Isa And More Lovemoneycom

Guide To Capital Gains Tax – Times Money Mentor

Capital Gains Tax Commentary – Govuk

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunaks List Autumn Budget 2021 The Guardian

Capital Gains Taxes Are Going Up Tax Policy Center

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Will Capital Gains Tax Rates Increase In 2021 Implications For Business Owners – Bdo

New Recommendations For Capital Gains Tax Raid On Landlords

Democrats Are Among The Doubters Of Bidens Plan To Tax The Rich Financial Times

Capital Gains Tax Examples Low Incomes Tax Reform Group

2ttyp6dxwep62m

Capital Gains Tax Receipts Uk 2021 Statista

Exclusive Capital Gains Tax Rise Being Considered By Rishi Sunak

Capital Gains Tax Reporting And Record-keeping Low Incomes Tax Reform Group

The Proposed Changes To Cgt And Inheritance Tax For 20212022 – Bph

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Simmons Simmons Hmrc Tax Rates And Allowances For 202122