The congressional tax breaks passed in. Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan contributions.

The Or 529 Plan – No More Tax Deduction For Savers Springwater Wealth Management

These changes create some opportunities for increased tax savings over the next several years.

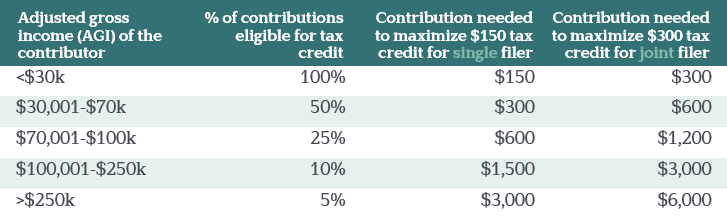

Oregon college savings plan tax deduction 2018. The credit replaces the current tax deduction on january 1, 2020. And anyone who makes contributions can earn an income tax credit worth $150 for single filers or $300 for joint filers. For all other qualified taxpayers, the oregon eic is now 9 percent of your federal eitc.

While the plan offers several tax benefits to all u.s. Follow the instructions for line 6 to make sure you claim the correct number of exemptions for your oregon return. • review the employee checklist.

Beginning january 1, 2020, contributions to the oregon college savings plan will no longer be eligible as a subtraction from oregon taxable income. There is also an oregon income tax benefit. All oregon taxpayers are eligible to receive a state income tax credit up to $300 for joint filers and up to $150 for single filers on contributions made to their oregon college savings plan account.

Contributions must be made to an oregon 529 plan in order to qualify. Here is where we are at with our oregon plan at the end of q1 2017. For a short window of time, oregon taxpayers can qualify for both a deduction and a credit over the next four years.

Citizens, tax payers from the beaver state get to take tax credits. Fellow oregonians may have received an email today from the oregon college savings plan about changes in the state tax benefit beginning in 2020. Oregon state income tax deduction is available for contributions up to $4,750/year (married filing jointly) and $2,375/year (all other filers) for 2018.

In addition, your child can use your savings in unison with financial aid and scholarships to. This federal deduction from adjusted gross income (agi) was suspended for tax years 2018 through 2025. Afterward, they can contribute up to $400,000.

The state tax subtraction for contributions to the oregon college savings plan or mfs oregon 529 plan increases in 2016 to $2,310 for a single taxpayer and $4,620 for couples filing jointly, the. With the oregon college savings plan, your account can grow with ease. Oregon's eic has increased to 12 percent of the federal earned income tax credit (eitc) if you have a qualifying dependent under age 3 at the end of the tax year.

Most states have a december 31 contribution deadline to qualify for a 529 plan tax deduction, but taxpayers in the states listed below have until april. Instead, oregon taxpayers will be eligible to receive a tax credit for any contributions made up to a maximum $150. State income tax deadlines are approaching, but families saving for college may still have time to reduce their 2018 taxable income.

All oregon taxpayers are eligible to receive a state income tax credit up to $300 for joint filers and up to $150 for single filers on contributions made to their oregon college savings plan account. Oregon college savings plan is a traditional 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified education expenses. Oregon college savings plan gives $25 to kindergartners (08/02/2019) oregon college savings plan launches savings match plan (09/18/2019) oregon tax deduction to.

Contributions and rollover contributions up to $2,330 (for 2017) for a single return and up to $4,660 for a joint return are deductible from oregon state income tax. Some provisions were extended retroactive to tax year 2018. In 2019, individual taxpayers were allowed to deduct up to $2,435 for contributions made to the oregon college savings plan, while those filing jointly could deduct $4,865.

In the past, contributions to the oregon 529 plan were deductible on your oregon state income tax return, up to certain limits. Explore the benefits, and see how saving for your kid’s future can help come tax season. Citizens to invest in their children's educational future by starting out with as little as $25.

Tax benefits that make a difference. The new tax credit would be in addition to any carried forward deductions. The oregon college savings plan allows u.s.

Taxes rachel diesel august 13, 2018. To stop payroll deduction contributions, please contact your employer. If you are a resident of oregon, contributions made to any account in the oregon college savings plan are eligible to receive a state income tax credit up to $300 for joint filers and up to $150 for single filers.

• fill out this form to set up payroll deduction contributions to your oregon college savings plan account, or to change existing payroll deduction contributions. Plus, you can get up to a $300 state income tax credit in oregon.

Saving For College The Oregon College Savings Plan – The H Group – Salem Oregon

Saving For College The Oregon College Savings Plan – The H Group – Salem Oregon

How Much Can You Contribute To A 529 Plan In 2021

Can I Use A 529 Plan For K12 Expenses – Edchoice

How Much Is Your States 529 Plan Tax Deduction Really Worth

Oregon College Savings Plan Examining The New Changes And Existing Opportunities Human Investing

Oregon College Savings Plan Examining The New Changes And Existing Opportunities Human Investing

529 Plan Advertisements And Marketing Collateral

529 Plan Advertisements And Marketing Collateral

Oregongov

The Or 529 Plan – No More Tax Deduction For Savers Springwater Wealth Management

15 Things About College Savings Oregon 529 Plan Focus

Tax Changes Ahead For Oregons 529 Plan Vista Capital Partners

529 Plan Deductions And Credits By State Julie Jason

If I Move From Oregon Can I Still Keep My Oregon College Savings Plan Account Oregon College Savings Plan

All Oregon College Savings Plan Portfolios

Oregon 529 College Savings Plans 2021 – 529 Planning

529 Plan Advertisements And Marketing Collateral

The Best 529 Plans Of 2021 Forbes Advisor