These tax rates are based upon the relationship of the beneficiary to the deceased, with no inheritance tax due from spouses and direct lineal descendants or ascendants (i.e. Below are the ranges of inheritance tax rates for each state in 2020 and 2021.

Iowans Heres Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About – Arnold Mote Wealth Management

The annual rate is based on the average monthly prime rate during the preceding twelve month period, october.

Iowa inheritance tax rates 2020. The exemption amount will rise to $5.1 million in 2020, $7.1 million in 2021, $9.1 million in 2022, and is scheduled to match the federal amount in 2023. • for deaths on or after january 1, 1988, the surviving spouse’s share is not. How do i avoid inheritance tax in iowa?

When payment in full has been received by the iowa department of revenue, an inheritance tax clearance will be issued. Maine, for example, levies no tax the first $5.8 million of an estate and taxes amounts above that at a rate of 8 percent to a maximum 12 percent. What is the federal inheritance tax rate for 2020?

The top estate tax rate is 12 percent and is capped at $15 million (exemption threshold: State inheritance tax rates in 2020 & 2021 The iowa tax rate is unchanged from last year, however, the.

The iowa trust and estate rates are the same as individual tax rates, with the rate ranging from.36 % to 8.98% for taxable income over $71,910. Inheritance tax is a tax on the share going to a beneficiary, and it is the beneficiary who is responsible for payment of the tax. Probate form (for use by iowa probate attorneys only) read more about probate form (for use by iowa probate attorneys only) print.

0.019126% daily iowa code section 421.7 specifies the procedures for calculating the department’s annual and monthly interest rates. Ad an inheritance tax expert will answer you now! Ad an inheritance tax expert will answer you now!

The department updates withholding formulas and tables each year because individual income tax brackets are indexed annually to adjust for inflation. However, it is the duty of the personal representative to see that the tax is collected and paid. Sf 576 , passed march 17, requires inheritance taxes be reduced 25% in 2021, reduced another 50% in 2022, and another 75% in 2023, and all amounts would be rounded to the nearest one.

A few counties do not collect that additional tax on a county. Taxpayer b pays $6,875 (i.e., $25,000 x 0.275) in estimated tax on september 30, 2020. Even if no tax is due, a return may still be required to be filed.

Iowa, kentucky, maryland, nebraska, new jersey, and pennsylvania. The iowa department of revenue is issuing updated income tax withholding formulas and tables for 2022. Iowa inheritance tax rate c (2020) up to $50,000.

Iowa, kentucky, nebraska, new jersey, and pennsylvania have only an inheritance tax — that is, a tax on what you receive as the beneficiary of an estate. Starting january 1, 2020, the interest rate for taxpayers with overdue payments will be: The base sales tax rate in iowa is 6%, but many counties collect an additional “local optional” tax of 1%, meaning the actual rate collected in most places is 7%.

Iowa has no estate tax, but does have an inheritance tax. Heirs who are not part of your direct family line, such as friends or nieces/nephews, may face iowa inheritance taxes. • if the net estate of the decedent, found on line 5 of ia 706,is less than $25,000, the tax is zero.

Note that historical rates and tax laws may differ.

Iowans Heres Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About – Arnold Mote Wealth Management

Iowans Heres Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About – Arnold Mote Wealth Management

Pin On Wtf

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Filing Taxes

Pin By Ryan Hart On Kavanaugh Art Gallery List Of Artists Art Gallery Shower Bath

06szevjlh7ielm

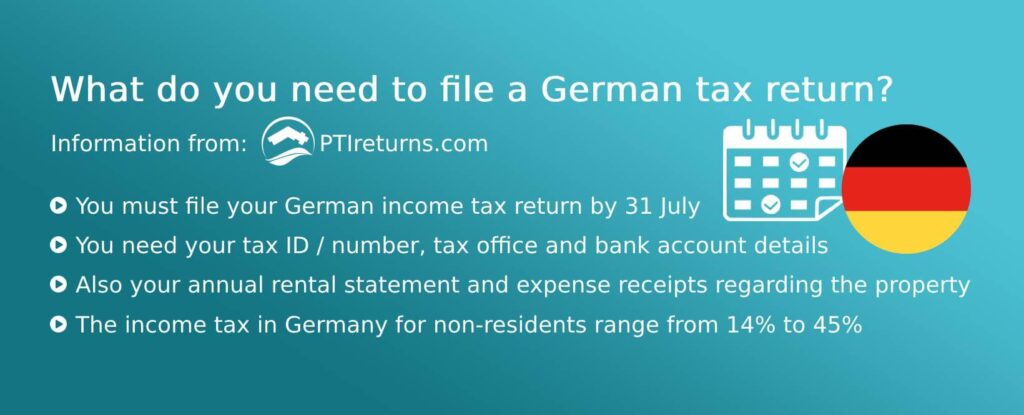

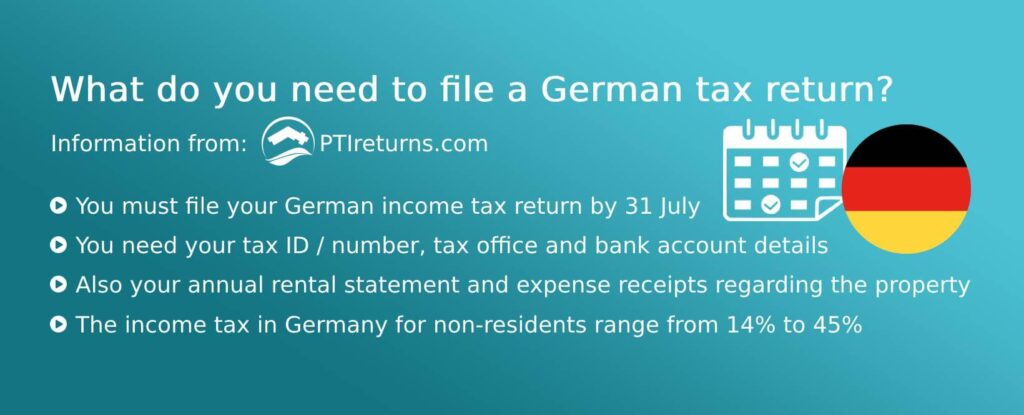

German Rental Income Tax How Much Property Tax Do I Have To Pay

As Of January 1 2021 The Corporate Income Tax Will Increase From 7 Percent To 799 Percentthis Will Replace T Tax Lawyer Long Term Care Insurance Income Tax

Iowans Heres Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About – Arnold Mote Wealth Management

10 Most Tax-friendly States For Retirees-kiplinger Retirement Locations Retirement Retirement Advice

Brookhampton Realty Real Estate Fun Real Estate Quotes Real Estate Humor

Contoh Soal Perhitungan Pph Pasal 4 Ayat 2 Bag 2

1yo1jrlqizxsem

Iowa Inheritance Tax Law Explained

Matterport 3d Showcase Home House Tours Dream House

Pengadilan Agama Padang Website Resmi Pengadilan Agama Padang

How To Avoid Inheritance Tax In Iowa

Social Securitys 2021 Hike Is Smallest In Years Investors Business Daily Mens Tailored Suits Suit Separates Bespoke Jacket

Protests Cause California To Shutdown It Is Reported That All California State Departments And Agencies Have Been Ask Tax Attorney Orange County Newport Beach