There is the federal estate tax to worry about, potentially, but the federal estate tax threshhold is current fairly high. There is no federal inheritance tax.

Are You Making These Common Estate Planning Mistakes Estate Planning Checklist Estate Planning Estate Planning Infographic

Florida residents and their heirs will not owe any estate taxes or inheritance taxes to the state of florida.

Does georgia have estate or inheritance tax. No estate tax or inheritance tax Any deaths after july 1, 2014 fall under this code. Georgia does not have any inheritance tax or estate tax for 2012.

The estate tax is applied before the people inheriting the money receive it. No estate tax or inheritance tax. The exact federal rules depend on the year in which your parent died.

Eight states and the district of columbia are next with a top rate of 16 percent. The estate tax is different from the inheritance tax. $11.58 million as of 2020, increasing to $11.7 million for deaths that occur in 2021.

The top estate tax rate is 16 percent (exemption threshold: Some people include provisions for inheritance tax in their wills, to spare their beneficiaries that tax burden. Georgia inheritance tax and gift tax.

Washington doesn’t have an inheritance tax or state income tax, but it does have an estate tax. No estate tax or inheritance tax. Estate tax of 0.8 percent to 16 percent on estates above $1.6 million

Also called a “death tax,” the estate tax is the final round of taxes someone pays before their property is distributed to their heirs. Estate taxes are only mandated in a handful of states, and thankfully, there is no georgia inheritance tax. It all ensured that no estate tax returns were required by georgia.

Inheritance taxes, also known as estate taxes, are the taxes paid on the property left to the heirs of a deceased person. If the decedent died on or before december 31 st, 2004, his or her estate should have paid the taxes on the asset or assets before the distribution of the estate. New jersey finished phasing out its estate tax at the same time, and now only imposes an inheritance tax.

Hawaii and washington state have the highest estate tax top rates in the nation at 20 percent. This lack of inheritance tax, combined with the absence of florida income tax, makes florida attractive for wealthy individuals wanting to reduce. Since 2014, the state not only eliminated estate taxes but also ruled that residents do not need to file estate tax returns.

As of july 1, 2014, georgia does not have an estate tax, either. Does georgia have an inheritance tax? Only five states have inheritance taxes, and one (iowa) will eliminate its inheritance tax by 2025.

However, the federal estate tax is still applicable. Twelve states and the district of columbia collect a state estate tax as of 2021. Counties in georgia collect an average of 0.83% of a property's assesed fair market value as.

There is no inheritance tax in georgia. Estate and inheritance taxes are burdensome. The states with this powerful tax combination of no state estate tax and no income tax are:

The federal government also has an estate tax, but it does not collect an inheritance tax. Inheritance tax of up to 15 percent; Georgia does not have an estate tax or an inheritance tax on its inheritance laws.

Inheritance tax of up to 16 percent; According to the georgia department of revenue’s website, the state of georgia does not levy estate taxes. Estate tax is based on your legal state of residence, not where you die.

The top estate tax rate is 16 percent (exemption threshold: Massachusetts and oregon have the lowest threshold for estate taxes, as they impose taxes on all. No, georgia does not have an inheritance tax.

No estate tax or inheritance tax. Inheritance taxes are applied to a person’s heirs after they have already received money from someone who recently died. Inheritance tax is a state tax on the amount that your receive from an estate.

Moreover, georgia does not have any inheritance tax, either. Another state’s inheritance tax could still. Massachusetts and oregon have the lowest exemption levels at $1 million, and connecticut has the highest exemption level at $7.1 million.

In the tax cuts and jobs act of 2017, the federal government raised the estate tax exclusion from $5.49 million to $11.2 million per person, though this provision expires december 31, 2025. Georgia does not have estate or inheritance taxes. Any deaths after july 1, 2014 fall under this code.

Georgia does not have an estate tax or an inheritance tax on its inheritance laws. Alaska, florida, nevada, new hampshire, south dakota, tennessee, texas, and wyoming. Does georgia have an inheritance tax?

The good news is that georgia does not have an inheritance tax either. In 2010 and 2011, the estate tax exemption amount for a single testator is $5 million or $10 million for spouses. Estates and taxes in the state of georgia.

Estate tax of 10 percent to 16 percent on estates above $1 million; Even with this welcome benefit, there are some returns that must be filed on behalf of the decedent and their estate, such as: Georgia has no inheritance tax, but some people refer to estate tax as inheritance tax.

Estate tax of 3.06 percent to 16 percent for estates above $5.9 million; Often, however, the estate will pick up the tab. Georgia has no inheritance tax.

The tax is paid by the estate before any assets are distributed to heirs. If you inherited assets from a deceased loved one, you may wonder if you have to pay taxes on the property. No, florida does not have an inheritance tax (also called an “estate tax” or “death tax”).

Nevertheless, you may have to pay the estate tax levied by the federal government.

Are Your Clients Subject To Massive Estate Taxes Without Knowing It Everplans

Will It Will It Not New Direct Tax Law Dtc Proposals Income Tax Finance Quickbooks

Pin By Audrey Kernodle On College Teaching Writing Personal Identity Essay

Just What Is Probate Estate Planning Checklist Funeral Planning Checklist Funeral Planning

Just What Is Probate Estate Planning Checklist Funeral Planning Checklist Funeral Planning

Real Estate Bird Dogs Wanted Attention All Real Estate Bird Dogs My Company Is Willing To Pay You Top Bandit Signs Wholesale Real Estate Distressed Property

Rightsizing Helping Elders Move Downsizing Retirement Community Downsizing Moving

Are Your Clients Subject To Massive Estate Taxes Without Knowing It Everplans

Pdf Death Taxes In The United States A Brief History

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Will 2021 See Changes To The Federal Estate Tax – Brian Douglas Law

Farm Groups Win For Now Expanded Protection From Estate Tax 2021-09-22 Agri-pulse Communications Inc

What Is An Irrevocable Trust – Infographic Httpswwwassetprotectionpackagecomwhat-is-an-irrevocable-t Revocable Trust Types Of Trusts Setting Up A Trust

Mcleod County Minnesota Treasurers Office Tax Receipts From Etsy Tax Payment Estate Tax Inheritance Tax

Phenix City Alabama Divorce Lawyer Mark Jones Inheritance Tax Divorce Family Law Attorney

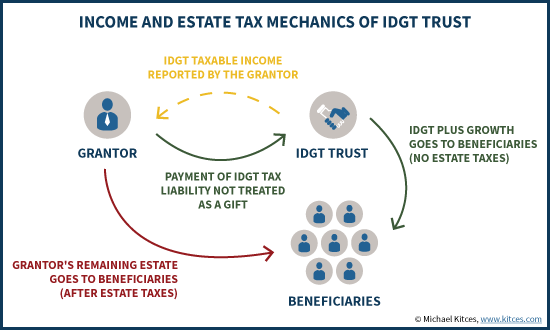

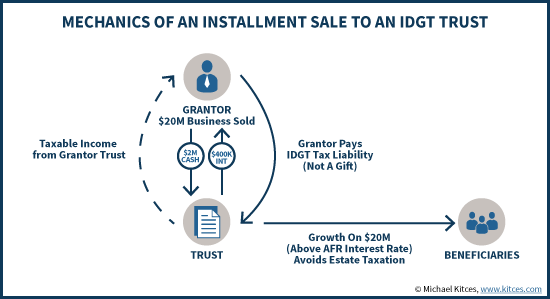

Installment Sale To An Idgt To Reduce Estate Taxes

Installment Sale To An Idgt To Reduce Estate Taxes

Wills And Trusts Kit For Dummies – Aaron Larson – 9780470283714 In 2021 Dummies Book Estate Planning Checklist Setting Up A Trust

What Is The Meaning Of Travel Insurance Our Deer Travel Insurance Travel Finance