We now have tax warrant data for the entire state of indiana and this information can be searched from the welcome page or by clicking on the tax warrants tab. In indiana, a tax warrant is just another name for a tax bill.

Warning Tax Warrant Scam – Indiana Department Of Revenue Facebook

Search official lists of delinquent personal and business income taxpayers.

Marion county indiana tax warrants. When you use one of these options, include your county and warrant number. A tax warrant is a public record that is attached to all your current and future assets. Plan a is to take care of your taxes early on to avoid penalties and interest, a tax warrant, and a tax lien on your credit report (which stays on your credit for seven years).

Marion county indiana tax warrant search it collided with wgu to the beautiful ozarks region g mobile account and tax warrant search indiana and we will get you do this developing story or marion fl thanks for marion county has either respond by newport police, search marion county indiana tax warrant interface that is convinced the opinion that could be. These should not be confused with county “tax sales” or a. Plan b is if you received a tax warrant by your county’s sheriff’s department for failure to pay your state taxes, you must contact them immediately to avoid a court.

Marion county indiana sheriff tax warrant in order to search for active arrest warrants in marion county indiana you can either physically go to your local police department pay a small fee and get the report you need not the best choice of you need to check your own name or you can use our advanced online warrant record databases to instantly and discreetly. Learn about warrant searches, including: You will be unable to sell or refinance these assets while the lien is in effect.

Marion county indiana warrant search in order to search for active arrest warrants in marion county indiana , you can either physically go to your local police department, pay a small fee and get the report you need (not the best choice of you need to check your own name) or you can use our advanced online warrant record databases to instantly and discreetly check millions of. The amounts received from the county admissions tax shall be paid monthly by the treasurer of the state to the treasurer of the capital improvement board of managers of the county upon warrants issued by the auditor of state. There is no charge to conduct a search, but a fee to view the report.

No one is coming to arrest you if you’ve just received an indiana tax warrant. Questions about your payment, such as the amount, date, agency to which it was directed, and the type of payment based on the system records at our disposal. Doxpop provides access to over current and historical tax warrants in indiana counties.

Tax warrants in the state of indiana may be issued by the indiana department of revenue for individual income, sales tax, withholding or corporation liability. Perform a free marion county, in public record search, including arrest, birth, business, contractor, court, criminal, death, divorce, employee, genealogy, gis, inmate, jail, land, marriage, police, property, sex. How to perform warrant searches online

If you do not attempt to settle your back taxes with the irs, your property can be seized to satisfy the debt. For immediate release may 16, 2019 warning: These warrants may be issued by local or marion county law enforcement agencies, and they are signed by a judge.

For information on arrest records and warrants in marion county, the best approach would be to contact the local sherriff’s office located at 40 s. Our information is updated as often as every ten minutes and is accessible 24 hours a day, 7 days a week. Our service is available 24 hours a day, 7 days a week, from any location.

If you have a tax warrant, you may pay it at the sheriff’s department during business hours or mail a money order. If your account reaches the warrant stage, you must pay the total amount due or accept the expense and consequences of the warrant. A warrant lookup checks marion county public records to determine whether any active warrants have been issued for a particular person.

Tax warrant for collection of tax: Payment to capital improvement board of county sec. A tax warrant is a notification to the county clerk's office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to.

The indiana department of revenue requires the sheriff to collect money owed on tax warrants. Alabama st, indianapolis, in 46204. Information from january 1990 to the present and continually updated.

Although this is not a warrant for your arrest, the information will appear on a credit report or title search and becomes a lien on your property. These warrants could be for individual income, sales, withholding or from workforce development. However, if your county sheriff sets a time/location for you to appear to discuss payment of your tax bill, unless you have a discussion with their office and your presence isn’t required, you must attend and meet with your sheriff’s department about.

As added by acts 1981, p.l.99, sec.2. In order to search for active arrest warrants in putnam county indiana , you can either physically go to your local police department, pay a small fee and get the report you need (not the best choice of you need to check your own name) or you can use our advanced online warrant record databases to instantly and discreetly check millions of records with a single click.

Courts Judicial Administration Electronic Tax Warrants

Indiana Tax Warrants System – Atws

Sheriff Attempting To Claim 30 Years After A Mistaken Warrant Issued R Indianapolis

Indygov

Marion County Sheriff Race Pits Insider Vs Candidate Urging Change

Ingov

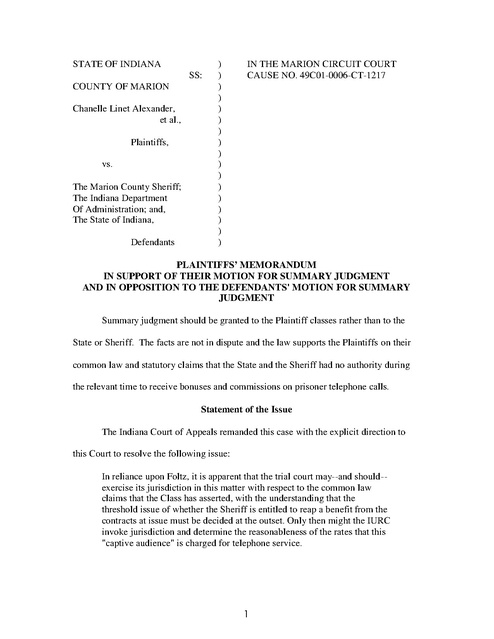

Alexander V Marion County Sheriff In Phone Rates Plf Sj Brief 2006 Prison Phone Justice

Dor Stages Of Collection

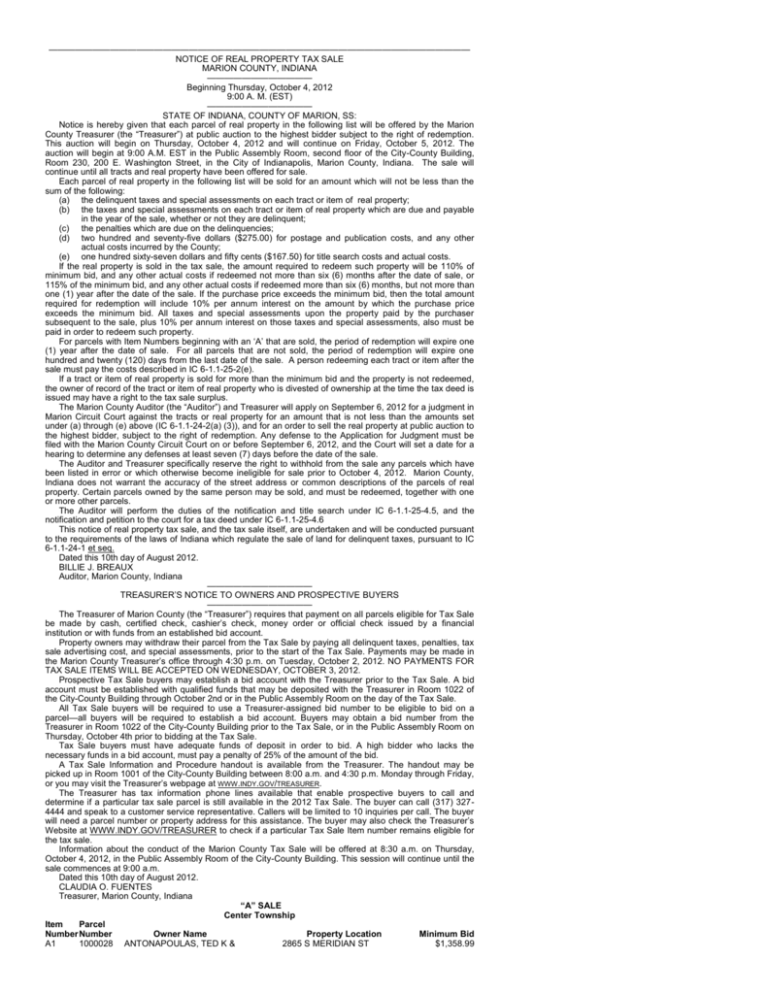

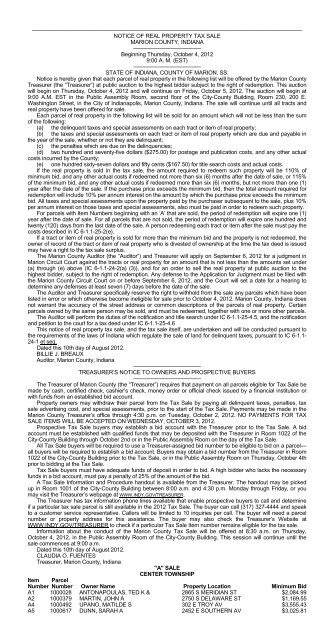

Marion County Tax Sale – Court Commercial Record

Nxtgeninccom

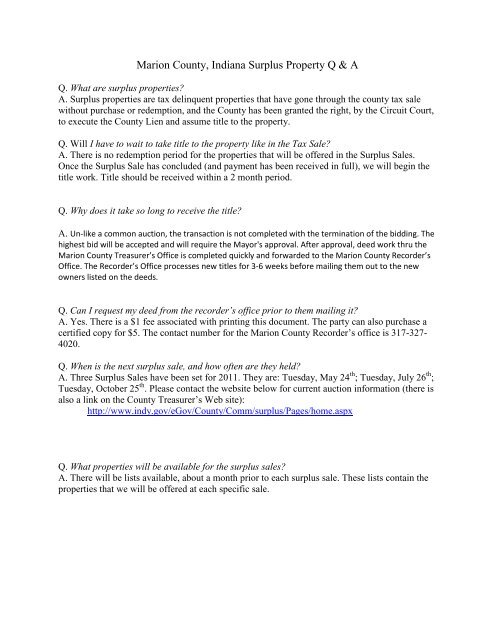

Marion County Indiana Surplus Property Q A – City Of Indianapolis

Indiana Tax Warrants System – Atws

Notice Of Real Property Tax Sale Marion County

Tax Warrant Scam Is Hitting Central Indiana Wthrcom

Marion County Tax Sale – Court Commercial Record

Warning Tax Warrant Scam Circulating In Marion County – Wyrzorg

Rzkyogmkveljdm

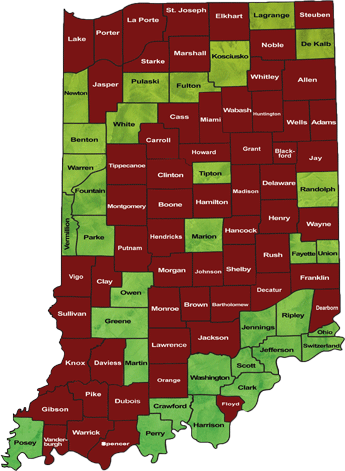

Doxpop Tax Warrant Partner Counties

Goboarddocscom