Says i have to check back later as it’s not ready. Click retirement plan income in the federal quick q&a topics menu;

2020 Form Irs 8915-c Fill Online Printable Fillable Blank – Pdffiller

However, i understand the irs has not yet released this form.

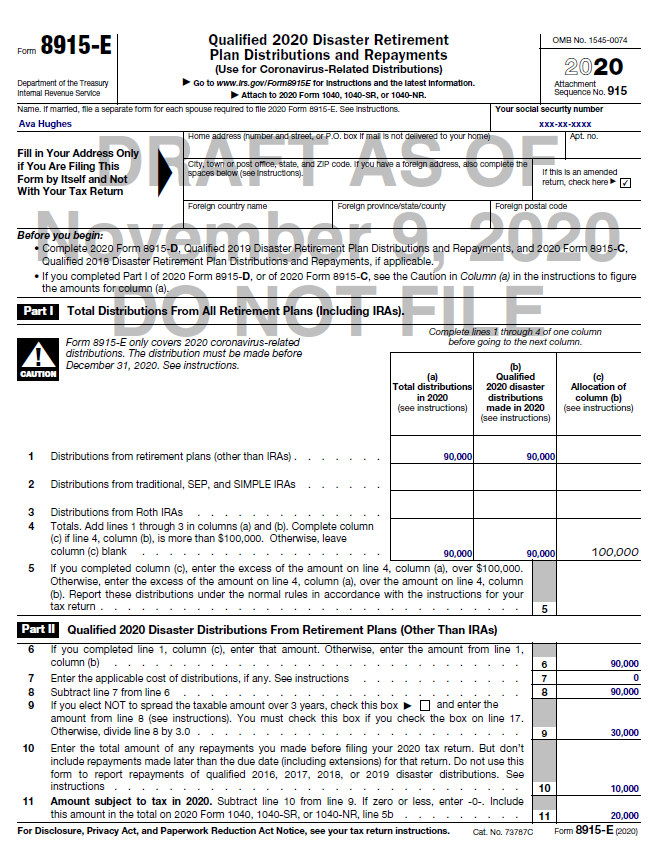

When will the 8915 e tax form be available. Most personal state programs available in january; Per the instructions, use form 8915 if you were adversely affected by a qualified 20yy disaster and you received a distribution. Recipients are allowed to repay amounts withdrawn and avoid taxation if reported and restored timely.

As of today 2/12/2021, irs just completed its final development of the 2020 version of this form. Please click on the following link and sign up for an email notification when it's fixed. This section allows a qualified individual to spread the taxation of amounts up to $100,000 and withdrawn between jan.

H&r block says they won't have the form available until 3/4/21. Once that's updated it should remove the penalty, right? Says 2/26/21 as go live eta but since they keep pushing it back i’ll believe it when i see it.

· 6m · edited 6m. By terry savage on february 15, 2021 | economy & taxes. Please, be aware that the irs currently won't start processing returns until february 12, 2021.

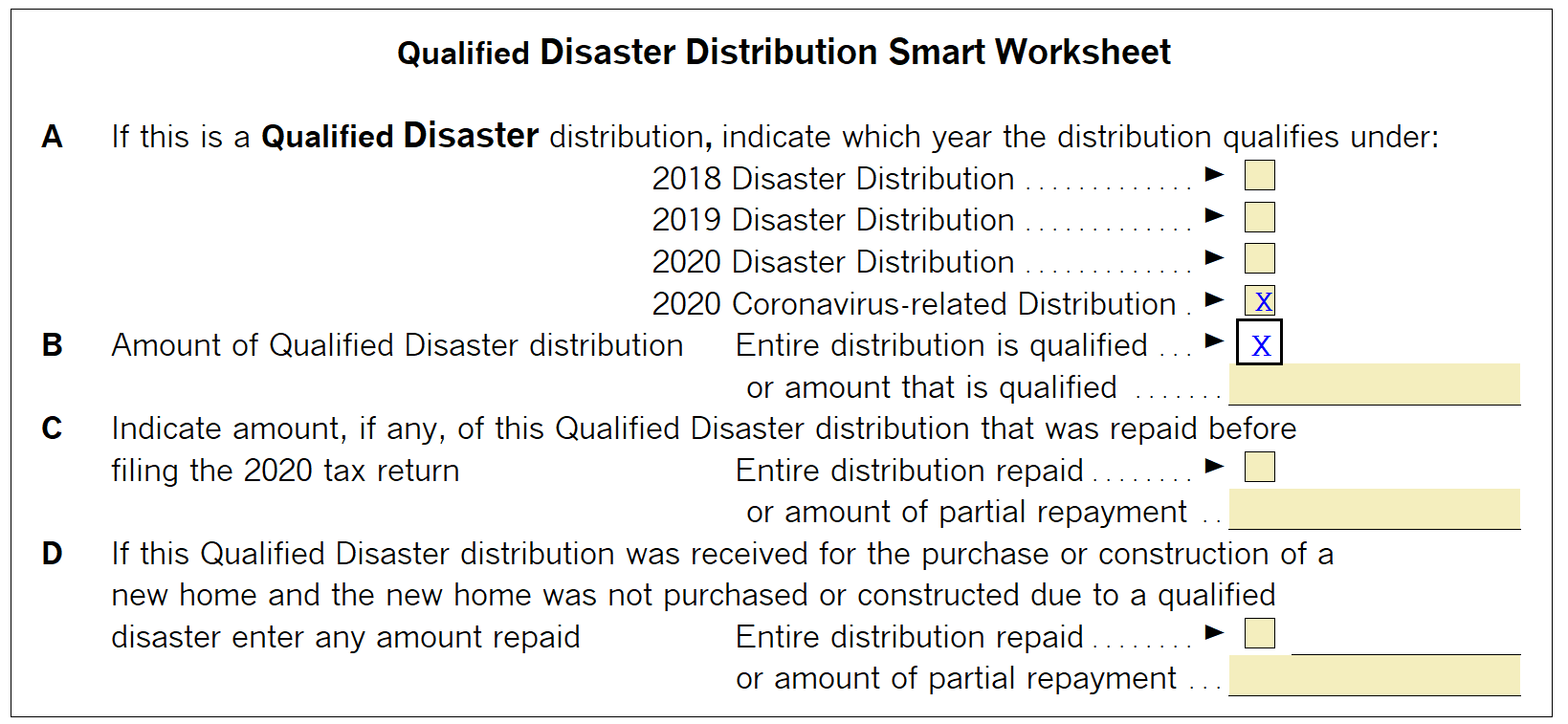

*if do not want to spread the distribution over a 3 year period, you will need to check the box next to elect not to spread the taxable amount over 3 years. please note: For instructions and the latest information. Release dates vary by state.

That qualifies for favorable tax treatment. form eligibility and data entry varies depending on the year of drake.

National Association Of Tax Professionals Blog

Re When Will Form 8915-e 2020 Be Available In Tur – Page 19

Re When Will Form 8915-e 2020 Be Available In Tur – Page 19

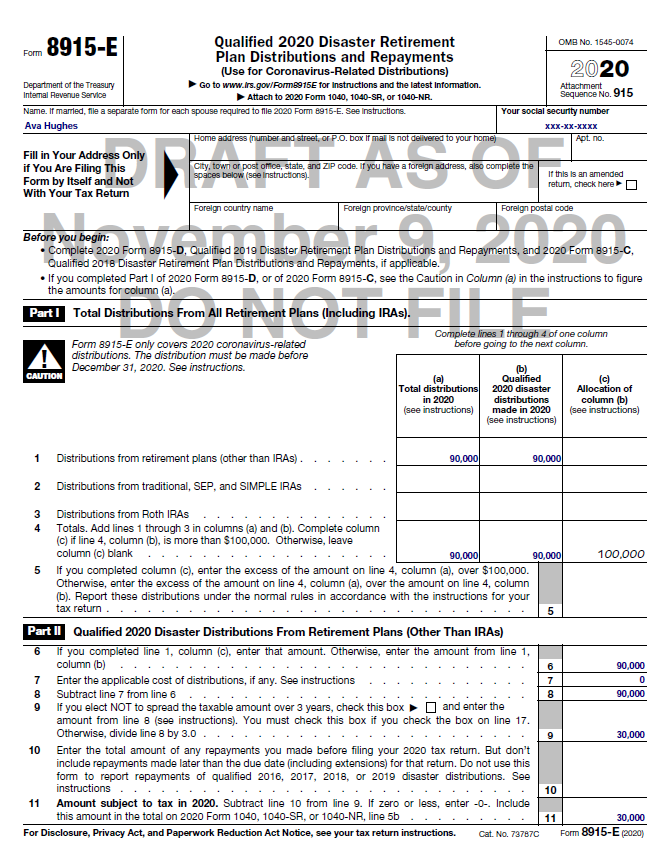

Use Form 8915-e To Report Repay Covid-related Retirement Account Distributions – Dont Mess With Taxes

Form 8915-e – Basics Beyond

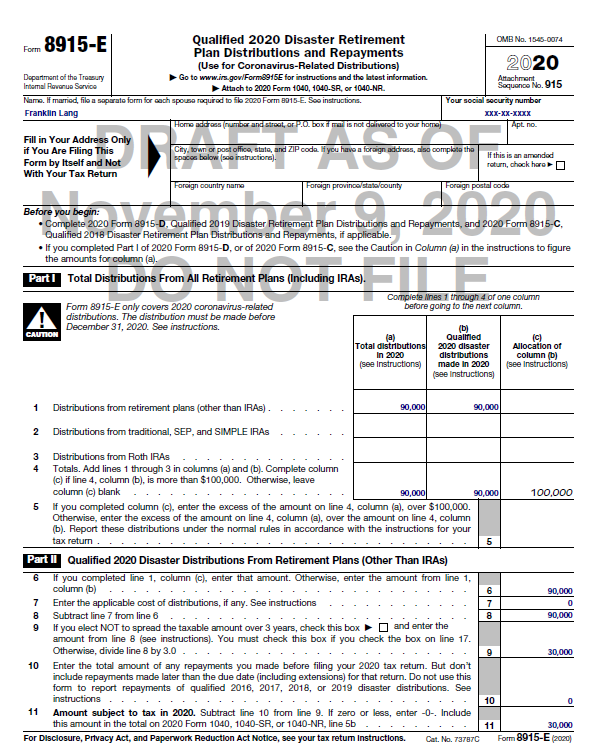

Generating Form 8915-e In Proseries – Intuit Accountants Community

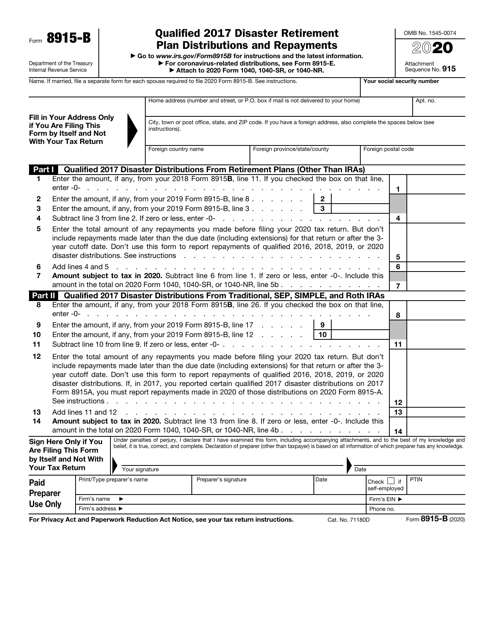

Irs Form 8915-b Download Fillable Pdf Or Fill Online Qualified 2017 Disaster Retirement Plan Distributions And Repayments – 2020 Templateroller

Publication 4492-a 72008 Information For Taxpayers Affected By The May 4 2007 Kansas Storms And Tornadoes Internal Revenue Service

Publication 4492-a 72008 Information For Taxpayers Affected By The May 4 2007 Kansas Storms And Tornadoes Internal Revenue Service

Solved Irs Form 8915 E – Page 2 – Intuit Accountants Community

8915 E Form – Fill Online Printable Fillable Blank Pdffiller

Use Form 8915-e To Report Repay Covid-related Retirement Account Distributions – Dont Mess With Taxes

8915 E – Fill Online Printable Fillable Blank Pdffiller

National Association Of Tax Professionals Blog

Publication 4492-a 72008 Information For Taxpayers Affected By The May 4 2007 Kansas Storms And Tornadoes Internal Revenue Service

National Association Of Tax Professionals Blog

Form 8915-e For Retirement Plans Hr Block

2

Publication 4492-a 72008 Information For Taxpayers Affected By The May 4 2007 Kansas Storms And Tornadoes Internal Revenue Service