In this video, i have clearly explained how you can calculate your crypto taxes in india. Thus, you should be aware that your income is taxed as you do daily crypto trading and earn income.

Excel Income Tax Calculator Fy 20-21 Fy21-22 – Only 30 Second

Currently, it is worth mentioning that despite the upcoming event, india has a whole set of legal frameworks that govern cryptocurrencies.

Cryptocurrency tax calculator india. Surely, if cryptos were banned, a lot of people would be in a lot of problems. They calculate your gains or losses and. Choose the holding period as less than three years or more than three years.

Enter the sale price of the asset. Their unregulated status may confuse people, but the standard income tax laws apply to them as the income tax act says all incomes are taxable. Catax supports exchange, wallet and blockchain accounts from more than 60+ service providers in 4 countries.

I have also presented necessary tools that can come in really handy. It means income from any source whether legal or illegal is taxable. Buy crypto with just rs.100 purchasing & holding them with inr before transferring them via an exchange

The global crypto market cap as per coinmarketcap as on thursday (november 25, 2021) stands at $2.68 trillion, a 4.35% increase over the previous day. You can also choose between different accounting methods like fifo, lifo, or minimization.our minimization method works to defer tax lots to long term gains where possible where it produces the lowest tax liability via your tax rates. It takes only 60 seconds to get started with catax.

India’s first crypto accounting and tax tool which has been vetted by a chartered accountant. How to use a crypto tax calculator to calculate your crypto taxes. Therefore, for any crypto asset sold within 36 months (<=36) of buying/ receiving it, the gains shall be taxed as.

We can see the gain/loss on each transaction clearly. The government may also levy 18% goods and services tax on transactions on foreign cryptocurrency exchanges. Accordingly, users also purchase cryptos to hold for investment purposes, and such gains are valid for taxation in line with the tax on capital gains.

Cryptocurrency ban in india will lead to more unlawful usage, complete tax evasion, says bacc “the bitcoin scams i monitored received $8.2 million in. You must select the nature of the acquisition. So, when dealing with cryptocurrency, remember that you have to pay tax on all the income you earn.

To calculate the crypto taxes for john we are going to use koinly which is a free online crypto tax calculator. The cryptocurrency tax shows the capital gains tax on cryptocurrency depending on the holding period. Let’s look at the possible tax implications depending on you have obtained the cryptocurrency through crypto tax calculator india.

India has also considered a 2% equalisation levy. Same as like you need data for calculating other capital gain tax. After entering the 3 transactions into koinly manually, this is the output:

You must know the purchase price and the sale price of the cryptocurrency along with the holding period. Cryptocurrency tax software calculates whether the crypto you are selling was held long or short term. Tailored as per the indian tax laws, the algorithm provides an accurate report of your crypto gains/losses for a financial year.

Create your free account now! Profits from cryptocurrencies are taxable in india. Crypto tax calculators work by aggregating your data and then automatically linking your cost bases to your sales, using accounting methods like fifo or lifo.

Revenue secretary tarun bajaj said that in terms of income tax, some people are already paying capital gains tax on the income from cryptocurrency, and in. If you take a look at some approximations, you will see that the amount of money sum caused by these transactions is almost $1 trillion. Without any doubt, this was great news for indian traders.

Cryptocurrency How To Buy Sell And Trade In India – Creditmantri

Tax Rules On Cryptocurrencies In India All You Need To Know- Kuberverse

![]()

Top 10 Crypto Tax Return Software For Australia – Crypto News Au

The Ultimate Crypto Tax Guide 2020 Cryptotradertax In 2021 Cryptocurrency Trading Tax Guide Cryptocurrency

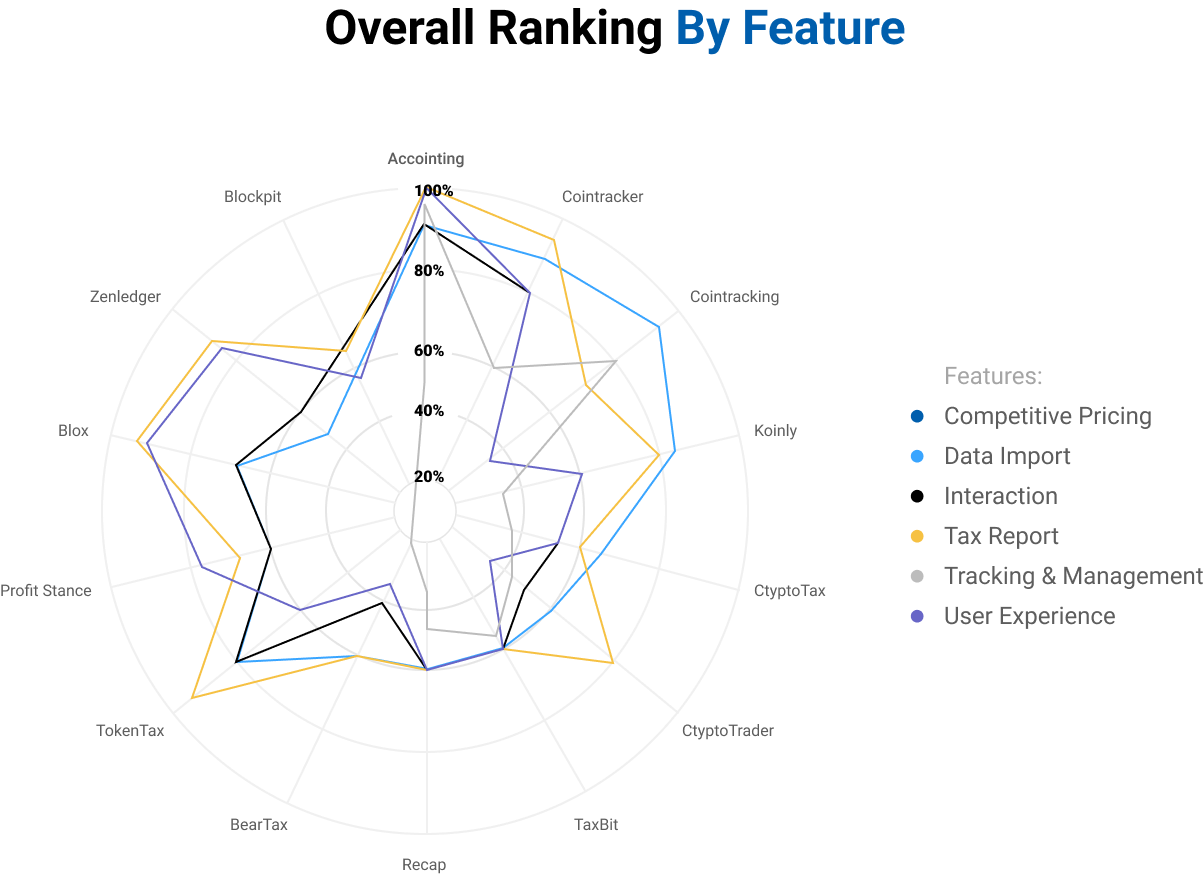

Best Crypto Tax Software In 2021 Coinmonks

Made Gains From Cryptocurrencies Know The Income Tax Implications

Bitcoin Tax Calculator Calculate Your Tax On Bitcoin

Taxes On Cryptocurrency – Blog By Quicko

Free Bitcoin Tax Calculator Crypto Tax Calculator Taxact Blog

.jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2021 Cryptotradertax

Impact Of Cryptocurrency On Stock Market

Cryptoreports – Google Workspace Marketplace

Income-tax Github Topics Github

Income Tax Calculator 2020-21 Calculate Taxes For Fy 2020-21 Income Tax Slabs 2020-21

Best Crypto Tax Software In 2021 Coinmonks

Income Tax Calculator 2020-21 Calculate Taxes For Fy 2020-21 Income Tax Slabs 2020-21

Ey Blockchain Analyzer Tax Calculator Ey – Global

Tax Rules On Cryptocurrencies In India All You Need To Know- Kuberverse

Government Says Crypto-trading Gains And Exchange Services Are Taxable