The revenue raised from a carbon tax could be used to subsidise alternatives such as green electricity or the revenue raised could be used to repair the damage caused by environmental pollution. A carbon tax increases energy costs in proportion to the carbon content of the source of energy.

18 Advantages And Disadvantages Of The Carbon Tax Futureofworkingcom

Carbon offsetting has benefits at both ends of the process:

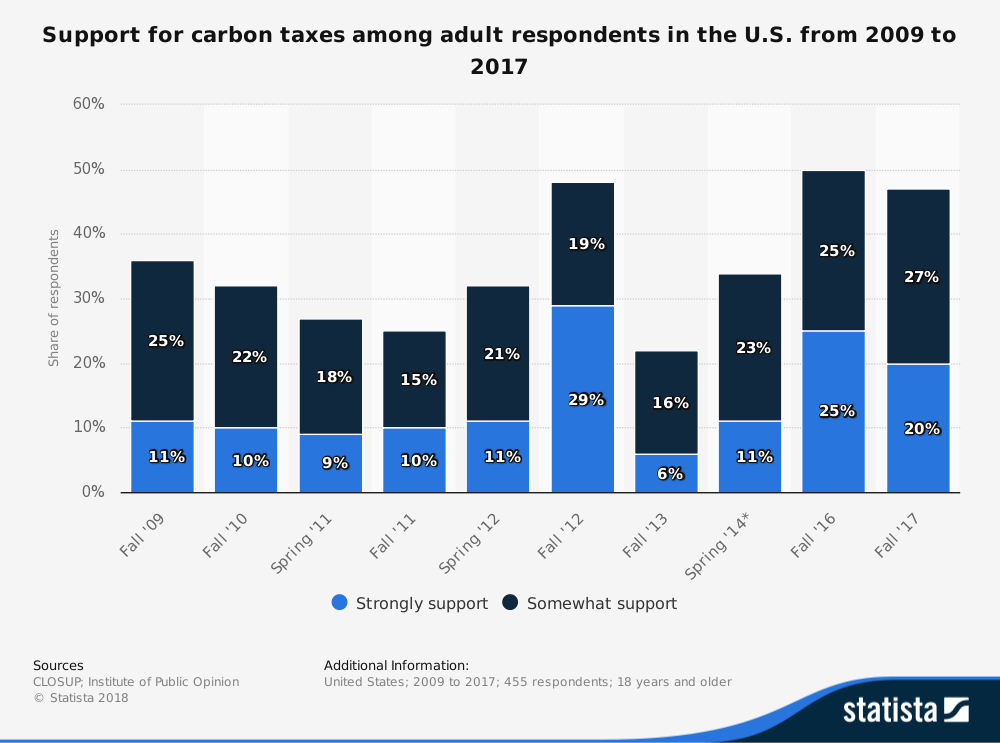

Carbon tax benefits and disadvantages. Incentive to avoid fossil fuels: Many companies can’t reduce their emissions as much as they’d like to. It makes people pay the social cost and.

One of the advantages of using carbon tax is that it represents a quantifiable source of revenue generation that can be controlled by government, along with providing an incentive to avoid the tax by reducing emissions. It is generally agreed upon by economists that carbon taxes are an effective and efficient way to lower carbon emissions because it allows the market to determine the most efficient way to reduce emissions and gives renewable energy sources a more competitive edge. Pressure for faster energy transition process:

Indeed, within twenty years a modest carbon tax can reduce annual emissions by 12 percent from baseline levels, generate enough revenue to. Without accounting for how the revenues from a carbon tax would be used, such a tax would have a negative effect on the economy. Alternatively, a higher carbon tax could be used to reduce other taxes, such as vat.

Higher carbon tax rates cause larger changes in energy prices. More jobs, better educational opportunities, a stronger infrastructure, and more availability for public goods are all possible when the benefits of a carbon tax start working together. Companies may go out of business:

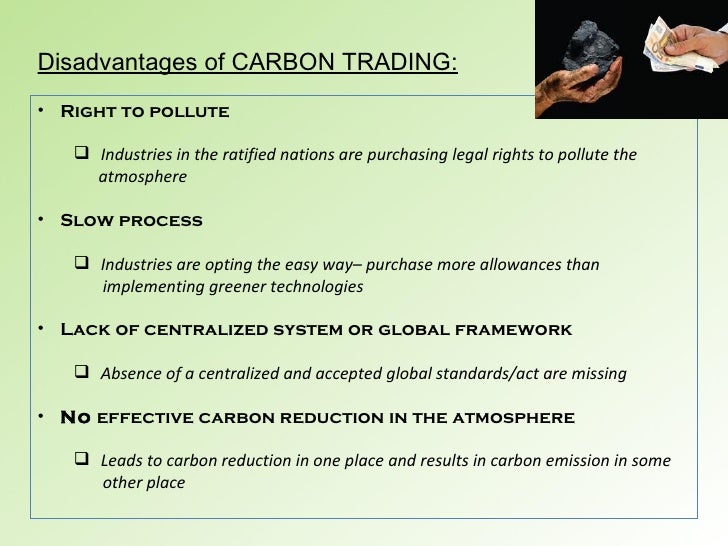

However, there is a view that industrial units may shift to countries with lower or no carbon taxes. The pros of carbon offsetting. Carbon tax pros and cons.

These are the costs that don’t get paid during consumption. There are two types of tradable carbon credits, renewable energy certificates (recs or green tags) and credits on the chicago climate exchange (ccx). The carbon tax can be really expensive, considering that the government would need a substantial amount of money for its implementation.

Carbon taxes are a direct step in saving the planet. Companies may switch to green energies: It helps environmental projects that can’t secure funding on their own, and it gives businesses increased opportunity to reduce their carbon footprint.

It imposes expensive administration costs. Carbon tax pros carbon tax cons; “there could be huge benefits in having a carbon tax,” says economist kortum.

Leads to a socially efficient outcome. One advantage of a carbon tax would be higher emission reductions than from other policies at the same price. If a country were to implement a carbon tax, policymakers would need to take on the role of setting, monitoring, and enforcing the caps on greenhouse gas emissions, and to ensure.

Companies may relocate to other countries: “it's really an issue of whether you should leave it on the extraction sector, the energy sector, or. A carbon tax is a specific tax on the consumption of goods which cause carbon dioxide emissions.

What’s worse, if sufficient funds were not available at. Firms earn these credits by reducing their carbon emissions beyond established goals. The advantages and disadvantages of the carbon tax are built on the economic principle of negative externalities.

About the costs and benefits of reducing emissions. Discuss the concept of carbon tax and assess the advantages and disadvantages that india is likely to face with the imposition of this tax. Firms that do not meet their carbon reduction goals can meet their obligations by purchasing credits.

While doing so we should. Effectiveness depends on tax design: C02 emissions have been identified as a major source of global warming and therefore, governments have.

List of the disadvantages of a carbon tax List of disadvantages of carbon tax 1.

Solar Energy Matter Solarenergy Solar Energy Solar Energy Facts Solar Energy Diy

Carbon Tax – Pros And Cons – Economics Help

14 Advantages And Disadvantages Of Carbon Tax Vittanaorg

Carbon Tax What Are The Pros And Cons – Climateaction

14 Advantages And Disadvantages Of Carbon Tax Vittanaorg

The Benefits And Disadvantages Of A New Tax Carbondigital

27 Main Pros Cons Of Carbon Taxes – Ec

:max_bytes(150000):strip_icc()/nuclear-power-how-it-works-pros-cons-impact-3306336_FINAL-14a12892b0894b6a815182e752d3698a.png)

Carbon Trading Pros And Cons Unbrickid

Cheap Or Free Solar Panels Are They Worth It Moneysavingexpert Solar Energy Solutions Solar Energy System Free Solar Panels

How To Reduce Your Carbon Footprint At Home Carbon Footprint Footprint Carbon

The Benefits And Disadvantages Of A New Tax Carbondigital

Pin On New Innovations In Trading And Finance

Carbon Tax – Pros And Cons – Economics Help

Carbon Tax- Advantages And Disadvantages – Economics Help

Carbon Tax – Pros And Cons – Economics Help

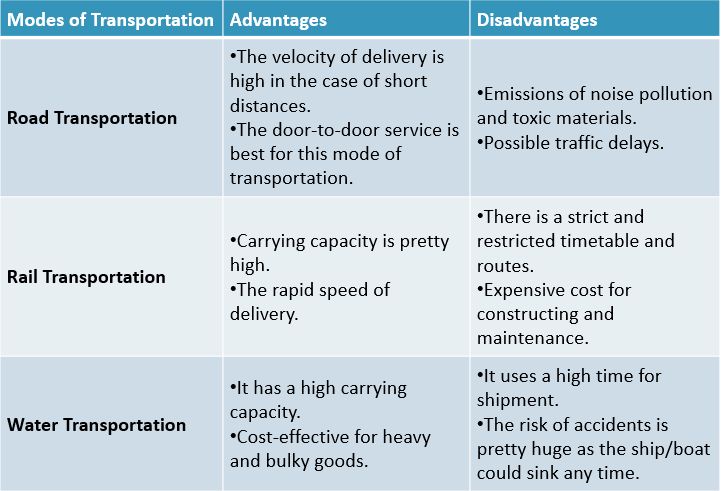

5 Modes Of Transportation And Their Advantages And Disadvantages – A Plus Topper In 2021 Transportation Noise Pollution Advantage

What Are The Pros And Cons Of Banning Plastic Bags Recycling Facts Plastic Free Life Plastic Bag

Advantages And Disadvantages Of Plastic Important Pros And Cons On Plastic – A Plus Topper In 2021 What Is Plastic Nonrenewable Resources Thermal Expansion

Carbon Trading Pros And Cons Unbrickid