A mill levy is equal to $1 of taxes for every $1,000 in assessed value. Kansas sales and use tax rate locator.

Advisor Tool Survivor Income And Cash Needs Analysis Worksheet Life Insurance Calculator Life Insurance Companies Life

The sales tax rate is always 8.5%.

Kansas vehicle sales tax estimator. Anytime you are shopping around for a new vehicle and are beginning to make a budget, it's important to factor in state taxes, titling and registration fees, vehicle inspection/smog test costs, and car insurance into your total cost. (the sales tax in sedgwick county is 7.5 percent) Car tags cost $39 or $49, while trucks weighing under 12,000 pounds cost $49 to register.

Dealership employees are more in tune to tax rates than most government officials. This is an estimate only, based on the information you have entered. You can find these fees further down on the page.

A sales tax receipt is required if you have purchased the vehicle from a kansas motor vehicle dealer. If you are unsure, call any local car dealership and ask for the tax rate. The cherokee's tax rate may change depending of the type of purchase.

Kansas collects a 7.3% to 8.775% state sales tax rate on the purchase of all vehicles. Once you have the tax. The state general sales tax rate of kansas is 6.5%.

The property tax can run from a minimum of $24 for a full year to several hundred dollars for a new vehicle. 12001 and over = $44.00 There is no special rate for cherokee.

You will need to have the year,. Moped tags cost $20, and motorcycle tags cost $25. Motor vehicle taxes & registration;

Kansas has a statewide assessment percentage of 11.5%. Every 2021 combined rates mentioned above are the results of kansas state rate (6.5%), the county rate (1%), the kansas cities rate (1%). In addition to taxes, car purchases in kansas may be subject to other fees like registration, title, and plate fees.

Please contact either treasurer's office to determine where you will need to pay your sale's tax. For your convenience we have a property tax estimator you may use to calculate the property taxes. For best results, use complete and accurate address information when submitting your query.

Application for a certificate of title and registration must be made through the local county treasurer’s office where the vehicle is garaged. This site provides information on local taxing jurisdictions and tax rates for all addresses in the state of kansas. Motor vehicle titling and registration.

Cities and/or municipalities of kansas are allowed to collect their own rate that can get up to 3% in city sales tax. This means that assessed value, which is the value on which you pay taxes, is equal to 11.5% of your home’s appraised value. Moped tags cost $20, and motorcycle tags cost $25.

It's fairly simple to calculate, provided you know your region's sales tax. Car tags cost $39 or $49, while trucks weighing less than 12,000 pounds cost $49 to register. Kansas’ 105 county treasurers handled vehicle, registration, tags and renewals.

For additional information click on the links below: This means that, depending on your location within kansas, the total tax you pay can be significantly higher than the 6.5% state sales tax. There are also local taxes up to 1%, which will vary depending on region.

Use this online tool from the kansas department of revenue to help calculate the amount of property tax you will owe on your vehicle. This is a combined weight of your trailer, fully loaded. This calculator can help you estimate the taxes required when purchasing a new or used vehicle.

Choose one of the following options: Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction. Kansas has a 6.5% statewide sales tax rate, but also has 376 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 1.555% on top of the state tax.

The property tax can run from a minimum of $24 for a full year to several hundred dollars for a new vehicle. There may be additional sales tax based on the city of purchase or residence. Please refer to the kansas website for more sales taxes information.

Kansas sales tax calculator by county. A $5.00 fee will be applied to each transaction handled at any of the tag offices. The treasurers also process vehicle titles and can register vehicles including personalized license plates.

Add the fees and taxes together to get your estimate. For your convenience we have a property tax estimator you may use to calculate the property taxes. Vehicle tax or sales tax, is based on the vehicle's net purchase price.

Vehicle property tax and fee estimator. You will need to have the. The rate in sedgwick county is 7.5 percent.

Effective july 1, 2002, if the vehicle is purchased in a taxing jurisdiction that has a lower sales tax rate than the jurisdiction where the person lives, the additional sales tax will be collected at the riley county treasurer’s office. Kansas tax rates are described in terms of mill levies. Subtract these values, if any, from the sale.

Every 2021 combined rates mentioned above are the results of kansas state rate (6.5%), the county rate (0% to 2.25%), the kansas cities rate (0% to 3%), and in some case, special rate (0% to 1.375%). Home » motor vehicle » sales tax calculator.

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

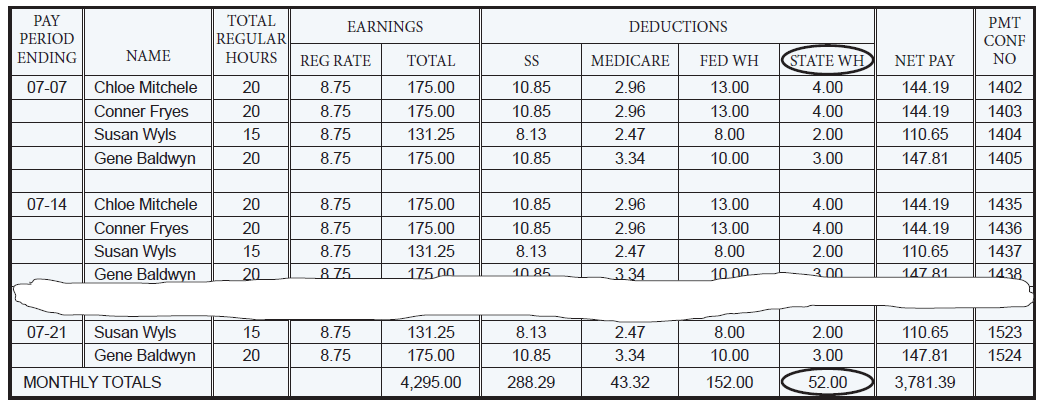

7 Easy Payroll Remittance Form Sample In 2021 Payroll Payroll Taxes Form

Kansas Car Registration Everything You Need To Know

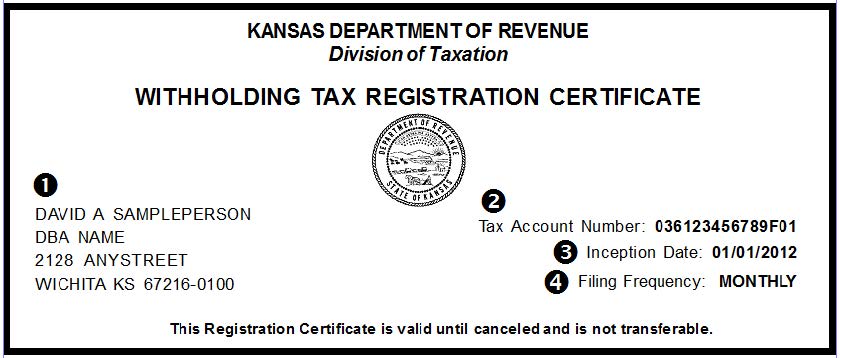

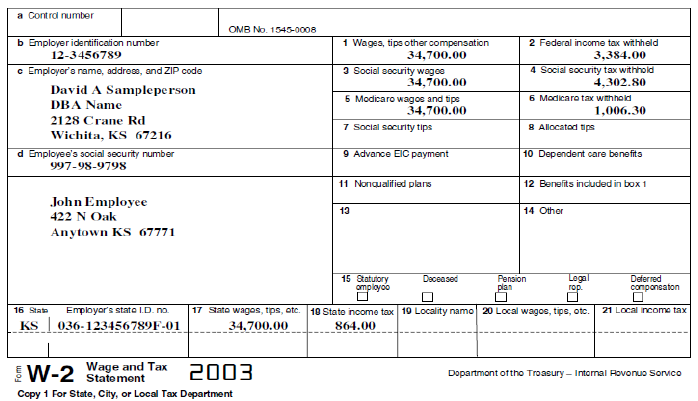

Kansas Department Of Revenue – Kw-100 Kansas Withholding Tax Guide

How New Kansas Laws Affect What You Pay In Property Taxes

Sales Tax On Cars And Vehicles In Kansas

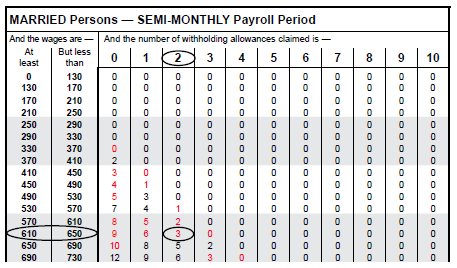

Kansas Department Of Revenue – Kw-100 Kansas Withholding Tax Guide

Kansas Department Of Revenue – Kw-100 Kansas Withholding Tax Guide

How New Kansas Laws Affect What You Pay In Property Taxes

What Is The Combined State And Local Sales Tax Rate In Each Us State – Answers Map Water Crisis Kansas Missouri

Car Tax By State Usa Manual Car Sales Tax Calculator

2

Kansas Sales Tax – Taxjar

Need A Deductions Working Sheet – Paper Size A3 Heres A Free Template Create Ready-to-use Forms At Formsbankcom Paper Size Deduction Sheet

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

Kansas Department Of Revenue – Kw-100 Kansas Withholding Tax Guide

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Kansas Sales Use Tax Guide – Avalara

2