32 rows foreign social security tax rate: Employees working in germany are generally subject to german social security payments.

Pin On Aiken High School German

Excepting this rule from the saving clause means that the united states may not apply the code rules to tax its citizens.

Us germany tax treaty social security. Tax treaties with the above mentioned countries, us social security benefits are only taxable in the expat’s country. (5) paragraph 2 of article 19 provides for the taxation of social security benefits only in the state of residence of the beneficiary. If you are assigned, by a us company, to work in germany for five years or less, you will pay into us social security.

This means that if you are still living in germany when you qualify for social security benefits, you will not pay any u.s. Canada, egypt, germany, ireland, israel, italy (you must also be a citizen of italy for the exemption to apply), romania or the united kingdom. Residents of the following countries are exempt from us tax on their us social security benefits:

5, sentence 1 of the german income tax act (§ 49, sec. The treaty provides that the distributions are taxed only in your country of residence. Www.irs.gov (just put “tax treaties” in the search box.) fyi, us citizens who are residents of canada, egypt, germany, ireland, israel, italy (you must also be a citizen of italy for the exemption to apply), romania or the united kingdom are exempt from us tax on their benefits.

Social security benefits received by us citizens and green card holders residing in germany are exempt from tax in the united states and are taxable only in germany. The exemption was effective for benefits paid after december 31, 1989 for areas which were formerly in west germany. If the assignment is for more than five years, you pay into german social security.

Social security benefits paid under the social security legislation of a contracting state and other. Contracting state shall be taxable only in that other contracting state. To establish your exemption from coverage under the u.s.

Social security system, your employer in germany must request a certificate of coverage (form d/usa 101) from the local german sickness fund that collects your german social security taxes. The united states has tax treaties with germany and canada whereby social security benefits paid by those countries to u.s. Ad a tax advisor will answer you now!

Yes, if you did not pay tax on this income in germany, then this would be excluded from the income that was taxed by your foreign country of residence. You can review the text of us bilateral income tax treaties at: It was effective for benefits paid after december 31, 1990 for areas which were formerly in.

Where any greater relief from tax would have been afforded to a person entitled to the benefits of the convention between the united states of america and the federal republic of germany for the avoidance of double taxation with respect to taxes on income and to certain other taxes, signed on 22 july, 1954, as amended by the protocol signed on 17 september, 1965 (the 1954. Residents are regarded for u.s. Questions answered every 9 seconds.

Extended business travelers from other eu or eea member states or switzerland will typically be exempted from contributing to the german social security. In august 1991, a tax treaty was finalized which exempted residents of germany from the nonresident alien tax withholding. As of 2009, certain retirement income drawn from germany within the meaning of § 22, no.

10 of the german income tax act) is also subject to limited income tax liability. Questions answered every 9 seconds. In the federal republic of germany this will include

The convention further provides both states with the flexibility to deal with hybrid financial instruments that have both debt and equity features. Germany imposes a value added tax (“vat”) on. Public pensions (not dealt with in paragraph 1) paid by a contracting state to a resident of the other.

We're living in germany so us social security wages are nontaxable (treaty article19.2). Tax purposes as if they were paid under. Social security taxes are used to finance social insurance programs.

In addition, the convention will provide for exemption of german residents from united states tax on united states social security benefits. Ad a tax advisor will answer you now! German state pension german state pension and other payments received under the german public retirement system legislation by us citizens and green card holders residing in germany are taxable in both.

Should they be excluded when calculating the gross income for form 1116?

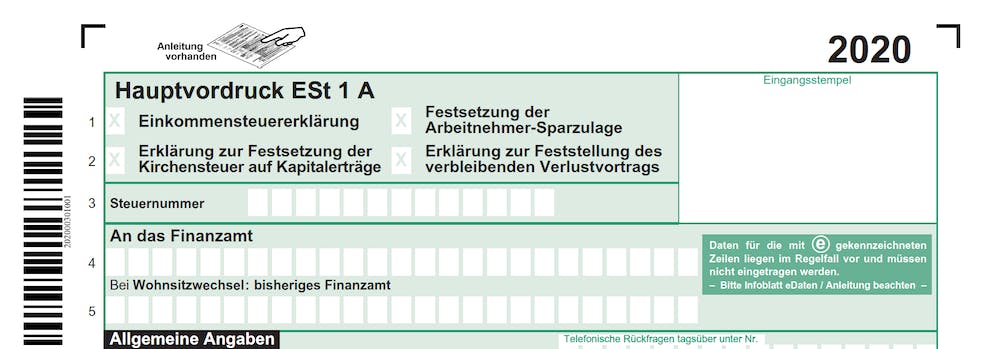

Us Expat Taxes For Americans Living In Germany Brighttax

Your Bullsht-free Guide To Taxes In Germany

Bitcoin Has Been Recognized For Legal And Tax Purposes In Germany Making It The First Country To Take An Official Stance On The Status Of Using The On Fotoshoot

Germany Cryptocurrency Tax Guide 2022 Koinly

War And Uneasy Neutrality – Reading Worksheet Student Handouts Social Studies Worksheets Reading Worksheets High School American History

Salary Taxes Social Security

Rd Tax Incentive In Germany

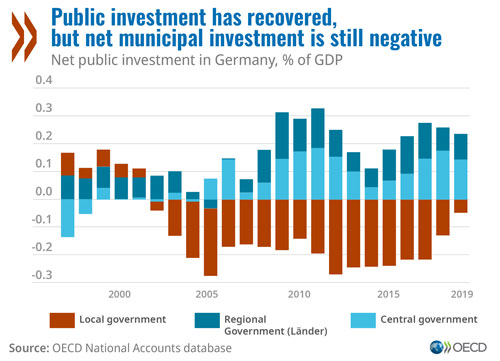

Germany Invest More In Infrastructure Digital Economy And Energy Transition For A Strong And Greener Recovery From Covid-19 Crisis – Oecd

Germany Cryptocurrency Tax Guide 2022 Koinly

How To Germany – American Expats And The Irs In Germany College Fun Top 10 Colleges Starting A Business

German Government Moves To End Solidarity Tax For Eastern Germany News Dw 11082019

Income Tax In Germany For Expat Employees Expatica

16 Free Receipt Templates – Download For Microsoft Word Excel And Google Sheets Free Receipt Template Receipt Template Business Plan Template Word

Germany Taxesgermany Income Taxgermany Tax Ratesgermany Economygermany Business For Enterpenures

Taxes In Germany What American Expats Should Know

Us Expat Taxes For Americans Living In Germany Brighttax

Gqkr2vremjvblm

Pin On Historical Maps

Visualizing Chinas Trading Partners China Trade Trading China