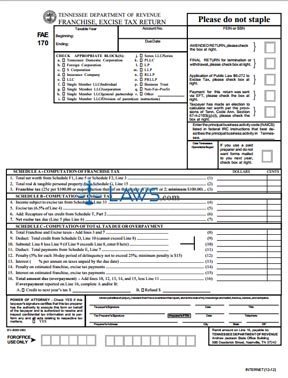

Select yes to “is this a final return for termination or withdrawal?” file your final return for termination or withdrawal. All franchise and excise returns and associated payments must be submitted electronically.

Fillable Online Tn Tennessee Department Of Revenue Application For Extension Of Time To File Franchise Excise Tax Return Fae 173 Taxable Year Account No – Tn Fax Email Print – Pdffiller

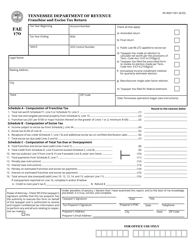

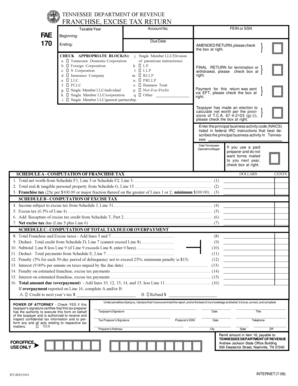

The franchise tax rate is 25 cents per $100, or major fraction thereof, applied to the greater of a taxpayer’s net worth or the book value o f property owned or used in tennessee at the close of the tax year covered by the required return.

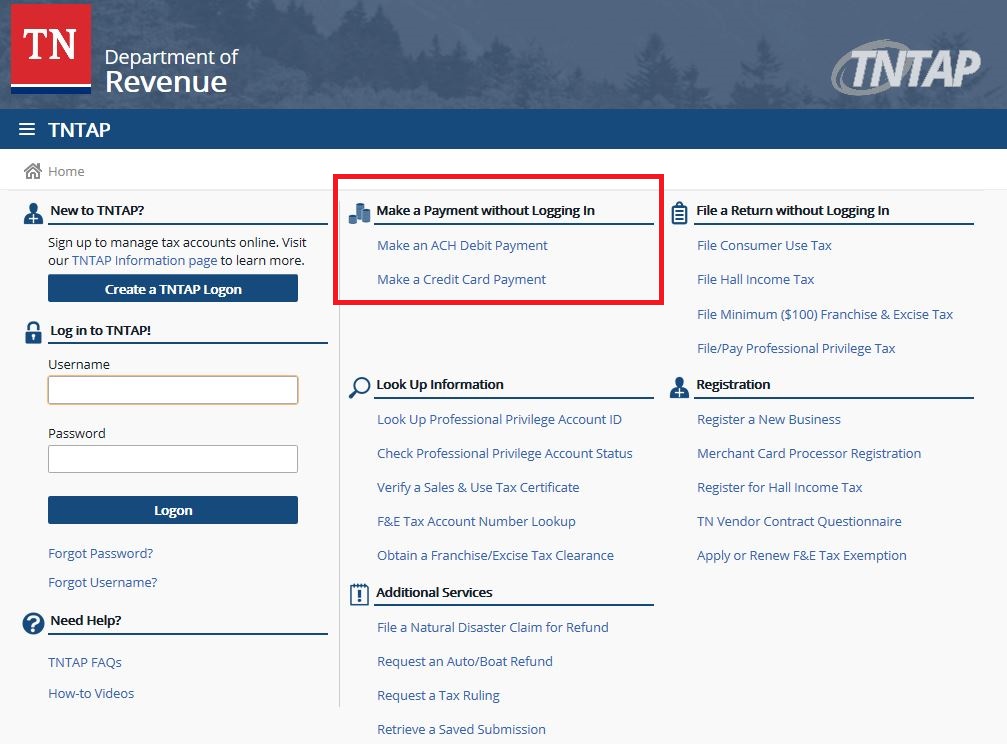

Tn franchise and excise tax return. This can be accomplished by using the tennessee taxpayer access point (tntap). The excise tax is 6.5% of the net earnings of the corporation or llc generated from business transaction in tennessee for each tax year. If a business’ liquidation starts and ends on the same.

To close a franchise and excise tax account: Schedule e (partnership) schedule e (s corporation) schedule e (estate or trust) select the applicable activity name or number. Go to screen 54, taxes.

The tennessee franchise, excise tax return. The excise tax is 6.5% of the net taxable income. Taxpayer services 500 deaderick street nashville, tennessee 37242 phone:

Net taxable income starts with federal taxable income and certain adjustments are applied to arrive at net taxable income for tennessee purposes. Amounts, including irc section 179 and contributions passed through to shareholder partners, shown in the line 5 enter any brownfield property credit available per tenn. When you have completed all of pages on the return, select the “submit” button.

Franchise and excise tax return kit: Franchise and excise tax annual exemption renewal : These entities that are subject to the franchise or excise tax must file their own separate franchise and excise tax return.

The minimum franchise tax of $100 is payable if you are incorporated, domesticated, qualified, or otherwise registered through the secretary of state to do business in tennessee,. General partnerships not seeking llc protection and single member llcs with corporate owners are not required to file separate tennessee tax. The franchise tax on a final return is computed using either the book value of assets or net worth immediately preceding liquidation or the average monthly values of net worth or assets, depending on how the business actually liquidated.

Select tennessee smllc franchise, excise tax return from the left navigation menu. Select the file now link for the current franchise and excise return. The franchise tax is 0.25% of the greater of the corporation’s or llc’s net worth or the value of the real property and tangible personal property owned in tennessee for each tax year.

The minimum tax is $100. The excise tax is based on net earnings or income for the tax year. Quarterly franchise, excise tax declaration:

The franchise tax is based on the greater of the entity’s net worth or the book value of certain fixed assets, plus an imputed value of rented property. Select the applicable form (ctrl+t) from dropdown menu: The franchise tax is a privilege tax imposed on entities for the privilege of doing business in tennessee.

Tennessee department of revenue attention: The minimum franchise tax payable each year is $100. A tntap logon should be created to.

From that starting point adjustments are made to arrive at tennessee taxable income. Schedule e (rental) schedule f/form 4835; If you have questions about franchise and excise tax online, contact.

Franchise Excise Tax Workshop – Youtube

Form Fae170 Rv-r0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Tngov

Form Fae-170 Franchise And Excise Tax Return Kit

Fae170 – Fill Online Printable Fillable Blank Pdffiller

Tngov

Franchise And Excise Guide – Tennessee – Free Download Pdf

Free Form Fae 170 Franchise And Excise Tax Return Kit – Free Legal Forms – Lawscom

Form Fae-170 Franchise And Excise Tax Return Kit

Franchise Excise Tax Workshop – Filing And Paying Requirements – Youtube

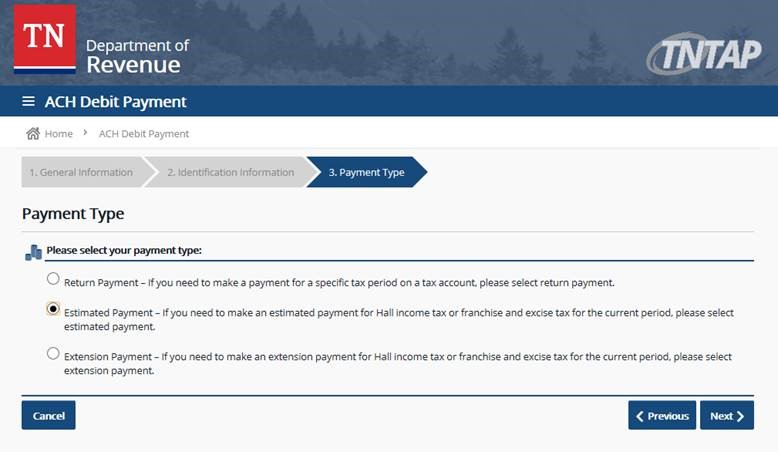

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

State Extends Tax Deadlines For Businesses News Wsmvcom

Fae 170 – Fill Out And Sign Printable Pdf Template Signnow

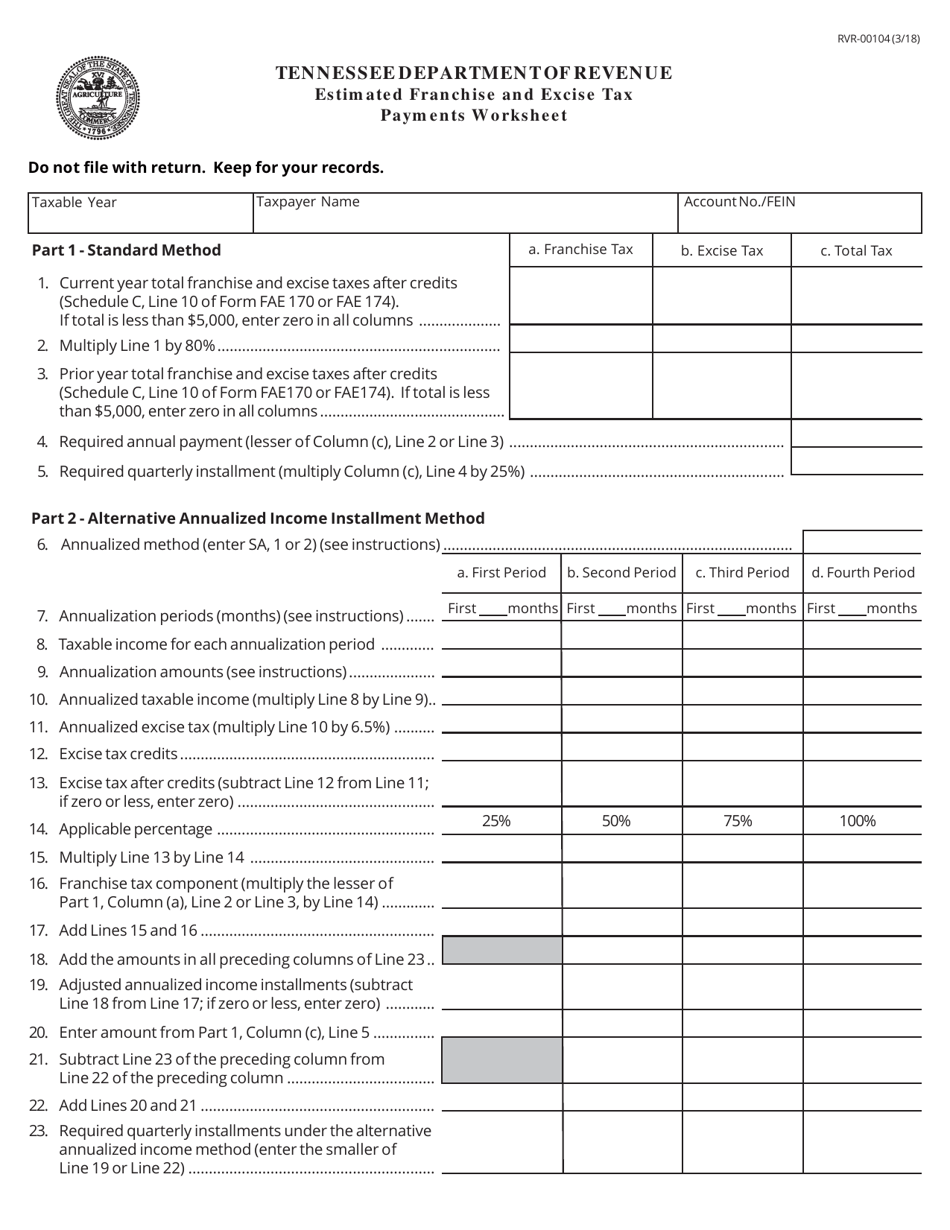

Form Rvr-00104 Download Printable Pdf Or Fill Online Estimated Franchise And Excise Tax Payments Worksheet Tennessee Templateroller

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Tngov

Form Fae170 Rv-r0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Tngov

Tennessee Franchise And Excise Tax Exemption – Fill Online Printable Fillable Blank Pdffiller