2017 income tax withholding instructions and tables. Withholding formula >(district of columbia effective 2018)<.

Understanding The Budget Revenues

Free federal and district of columbia paycheck withholding calculator.

Dc income tax withholding calculator. Below are your washington dc salary paycheck results. Nonresidents who work in dc are not subject to withholding. To use our district of columbia salary tax calculator, all you have to do is enter the necessary details and click on the calculate button.

Therefore, if your annual tax liability is not fully covered by withholding, or if you have no withholding, you must make. Withholding formula >(district of columbia effective 2019)<. The district of columbia (dc) requires employers to withhold income taxes from employee paychecks in addition to employer paid unemployment taxes.

Dc residents must pay estimated taxes on any wages they earn outside the district, unless their employer pays dc withholding taxes. The amount of district of columbia tax withholding should be: The district of columbia does have.

An employee is a dc resident for income tax purposes if certain criteria are met. In other words, these taxes won’t be withheld from your employees’ paychecks. For those working more than one job at a time (including families in which both spouses work) it is important to adjust your withholding to avoid having too little withheld as this subjects the taxpayer to penalties.

Income tax brackets are the same regardless of filing status. This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs. After a few seconds, you will be provided with a full breakdown of the tax you are paying.

Which you are responsible for as an employer, but not as an employee. 2016 income tax withholding instructions and tables. Washington dc salary paycheck calculator.

Use the washington dc paycheck calculators to. These include a district income tax, with rates ranging from 4% to 8.95%, a 6% sales tax and property taxes on real estate. You can find district of columbia’s tax rates here.

Taxes are due as income is earned. Washington dc bonus tax aggregate calculator change state this washington dc bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments, such as bonuses. The district has an average effective property tax rate of 0.56%.

Overview of district of columbia taxes. Over $0 but not over $10,000. District of columbia (dc) employers must withhold dc income taxes on wage payments made to dc residents who work in dc.

2018 income tax withholding instructions and tables. See withholding on residents, nonresidents and expatriates. For example, an individual who earns a significant amount of income in a given year must, by both federal and dc law, pay tax on that income as it is earned, rather than waiting until the next year, when the return is filed on april 15.

Fr900q ( employer / payor withholding tax quarterly return): This booklet and other dc tax forms may be obtained from the tax forms and publications page or by calling otr customer. Subtract the biweekly thrift savings plan contribution from the gross biweekly wages.

2015 income tax withholding instructions and tables. If you have a salary, an hourly job, or collect a pension, the tax withholding estimator is for you. Subtract the biweekly thrift savings plan contribution from the gross biweekly wages.

Income tax withholding is now based on the worker’s filing status and expected tax deductions and tax credits for the year. This page has the latest district of columbia brackets and tax rates, plus a district of columbia income tax calculator. In addition to federal income taxes, taxpayers in the nation’s capital pay local taxes to the district of columbia.

Capital has a progressive income tax rate with six tax brackets ranging from 4.00% to 8.95%. You, on the other hand, are responsible for paying 6% of the first $7,000 of each employee’s taxable income to futa taxes. District of columbia's 2021 income tax ranges from 4% to 8.95%.

This return is a good source of information to use to balance dc income tax withheld from wages, tips, and other compensation for prior quarters. Free district of columbia payroll tax calculator and dc tax rates. Employees fill out d4 employee withholding allowance certificate, to be used when calculating withholdings.

Your average tax rate is 22.2% and your marginal tax rate is 36.1%. $0.00 plus 4.00% of excess over $0. Individual and fiduciary income taxes the taxable income of an individual who is domiciled in the district at any time during the tax year (or who maintains an abode in the district for 183 or more days during the year) or of a dc estate or trust is subject to tax at the following rates:

Has relatively high income tax rates on a nationwide scale. The tax rates for tax years beginning after 12/31/2015 are: Income tax tables and other tax information is sourced from the.

This marginal tax rate means that your immediate additional income will be taxed at this rate. If the amount of taxable income is: Apply the taxable income computed in step 5 to the table below to determine the district of columbia tax withholding.

2014 income tax withholding instructions and tables. Switch to washington dc hourly calculator. The nation's capital has a progressive income tax system where the income taxes are some of the highest in the united states.

Over $10,000 but not over $40,000. The results are broken up into three sections: For instance, an increase of $100 in your salary will be taxed $36.13, hence, your net pay will only increase by $63.87.

Turbotax Taxcaster Free Tax Calculator Free Tax Refund Estimator Turbotax Tax Refund Finance Apps

Irs Tool Helps Small Businesses Calculate Income Tax Withholding Income Tax Small Business Trends Online Business Marketing

Taxes Congressional Budget Office

What Are Marriage Penalties And Bonuses Tax Policy Center

Pin On Misc

Ask Eli Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Arlnowcom

2

Pin On Flies Dead

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

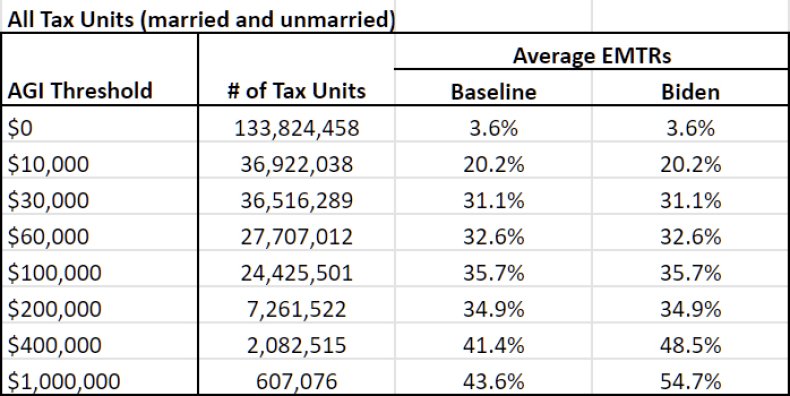

Joe Biden Tax Calculatorhow Democrat Candidates Plan Will Affect You

Washington Dc Payroll Tools Tax Rates And Resources Paycheckcity

Pin On Financial Planning

7 Tips To Make Tax Season Easier Kelsey Smythe Tax Season Tax Tips

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans The White House

Taxation Of Social Security Benefits – Mn House Research

2

Kalkulator Pajak Penghasilan Pasal 21 – Ddtc News

Debt Free Journey Two Teachers Paid Off Over 100k – Inspired Budget Debt Free Debt Debt Payoff

Who Bears The Burden Of Federal Excise Taxes Tax Policy Center