The latest sales tax rates for cities in massachusetts (ma) state. Counties and cities are not allowed to collect local sales taxes.

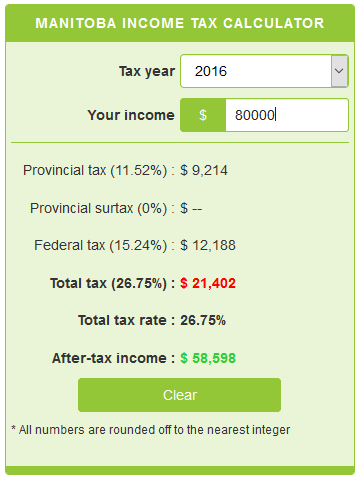

Manitoba Income Tax Calculator – Calculatorscanadaca

The massachusetts (ma) state sales tax rate is currently 6.25%.

Massachusetts meal tax calculator. Massachusetts local sales tax on meals. First enacted in the united states in 1921, sales tax dates back to ancient egyptian times where paintings depict. While massachusetts' sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to sales taxes.

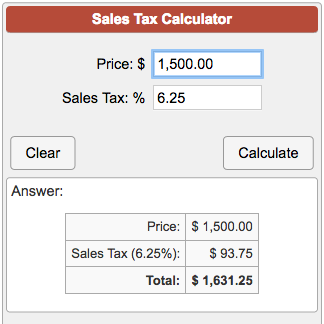

The massachusetts state sales tax rate is 6.25%, and the average ma sales tax after local surtaxes is 6.25%. Exact tax amount may vary for different items. Our sales tax calculator will calculate the amount of tax due on a transaction.

This sales tax calculator estimates the final price or the before tax price of an item for any of the us states by adding or excluding the sales tax rate. Last updated november 27, 2020 There is in depth information on this subject below the web form.

In the u.s., a tip of 15% of the before tax meal price is typically expected. The massachusetts tax calculator is designed to provide a simple illlustration of the state income tax due in massachusetts, to view a comprehensive tax illustration which includes federal tax, medicare, state tax, standard/itemised deductions (and more), please use the main 2021/22 tax reform calculator. We strive to make the calculator perfectly accurate.

Massachusetts has a 6.25% statewide sales tax rate , and does not allow local. The tip calculator calculates tip amount for various percentages of the cost of the service, and also provides a total amount that includes the tip. Designed for mobile and desktop clients.

Massachusetts cities and/or municipalities don't have a city sales tax. For state, use and local taxes use state and local sales tax calculator. The state general sales tax rate of massachusetts is 6.25%.

This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs. Calculate the sales tax amounts and the total revenue based on the entered tax percentages for state, use and local taxes. Net price is the tag price or list price before any sales taxes are applied.

Rates include state, county and city taxes. The most significant taxes in massachusetts are the sales and income taxes, both of which consist of a flat rate paid by residents statewide. Massachusetts meals tax vendors are responsible for:

How 2021 sales taxes are calculated in massachusetts. After a few seconds, you will be provided with a full breakdown of the tax you are paying. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

To use our massachusetts salary tax calculator, all you have to do is enter the necessary details and click on the calculate button. Anyone who sells meals that are subject to sales tax in massachusetts is a meals tax vendor. if a liquor license holder operates a restaurant where meals are served, the holder of the license is presumed to be the meals tax vendor, whether the meals are served by the license holder or a concessionaire. 2020 rates included for use while preparing your income tax deduction.

A calculator to quickly and easily determine the tip, sales tax, and other details for a bill. 2021 massachusetts state sales tax. In massachusetts, your employer will withhold money from your paychecks to put toward your state income taxes.

The massachusetts income tax rate is 5.00%. Massachusetts sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache. A use tax is generally assessed on purchases made by a resident in a state that does charge a sales tax when the purchase is made from a state that does not charge a sales tax.

Use this app to split bills when dining with friends, or to verify costs of an individual purchase. More than 40 percent of all massachusetts cities and towns now assess the 0.75% local tax on meals. Local tax rates in massachusetts range from 6.25%, making the sales tax range in massachusetts 6.25%.

Find your massachusetts combined state and local tax rate. There is no county sale tax for massachusetts. This page describes the taxability of food and meals in massachusetts, including catering and grocery food.

Registering with the dor to collect the sales tax on meals. Collecting a 6.25% sales tax (and, where applicable, a.75% local option meals excise) on all taxable sales of meals. Paying the full amount of tax due with the appropriate massachusetts meals tax return on time, and.

Total price is the final amount paid including sales tax. The meals tax rate is 6.25%. The statewide sales tax rate of 6.25% is among the 20 lowest in the country (when including the local taxes collected in many other states).

Sales tax is a tax paid to a governing body (state or local) for the sale of certain goods and services. The calculator can also find the amount of tax included in a gross purchase amount. Every 2021 combined rates mentioned above are the results of massachusetts state rate (6.25%).

Calculate a simple single sales tax and a total based on the entered tax percentage. Groceries and prescription drugs are exempt from the massachusetts sales tax. The provided information does not constitute financial, tax, or legal advice.

In the united states sales tax is assessed by most but not all states. You can use our massachusetts sales tax calculator to look up sales tax rates in massachusetts by address / zip code. That’s why we came up with this handy.

The state sales tax rate in massachusetts is 6.25%, but you can customize this table as.

Pin On My Ebay Store

Want To Calculate Compound Interest On An Investment User Our Free Compoun Interest Calculator Investing Compound Interest

Massachusetts Income Tax Calculator Smartassetcom Income Tax Income Tax

Doordash Tax Calculator 2021 What Will I Owe How Bad Will It Hurt

Llc Tax Calculator – Definitive Small Business Tax Estimator

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

675 Sales Tax Calculator Template Tax Printables Sales Tax Calculator

Ibm Tdsp Calculator Calculator Ibm How To Plan

Need To Convert Inches To Centimeters Use This Free Calculator To Convert Inches Or In To Centimeters Cm And Vice Ve Converter Calculator Centimeters

Pin On Calculators

Investing – Rental Property Calculator James Baldi Somerset Powerhouse- Re Real Estate Investing Rental Property Real Estate Rentals Rental Property Investment

Pin Op Calculators

Massachusetts Sales Tax Calculator Reverse Sales Dremployee

56 Sales Tax Calculator Template Sales Tax Calculator Tax

Sales Tax Calculator

5 Tipp A Szoevetsegi Szolgaltatasi Csoporttol A Koevetelebehajtasok Kezeleserol Httpscstuio068ad1 Tax Services Accounting Firms Certified Public Accountant

Tax Words Written On Table Words Writing Business Tax

Avalara Salestax Free Sales Tax Calculator Rate Lookups Sales Tax Tax Map

Quarterly Tax Calculator – Calculate Estimated Taxes