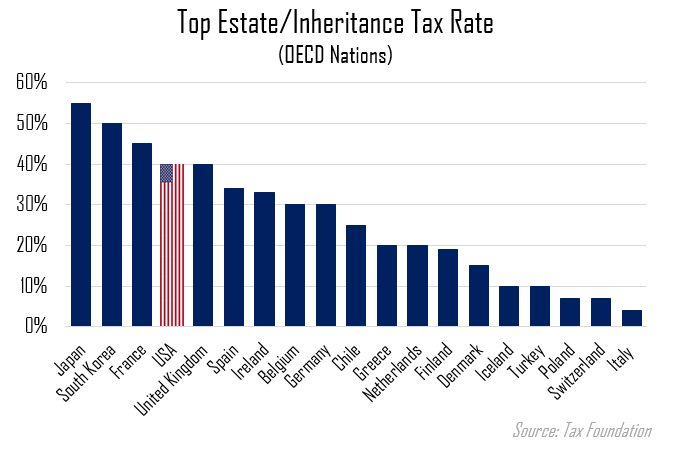

A tax is hereby imposed upon every generation skipping transfer, where the original transferor is a resident of the commonwealth of virginia at the date of original transfer, in an amount equal to the amount allowable as credit for state legacy taxes under § 2604 of the internal revenue code, to the extent such credit exceeds the aggregate amount of all taxes on the same transfer actually paid. The top estate tax rate is 16 percent (exemption threshold:

What Is Estate Tax – Quora

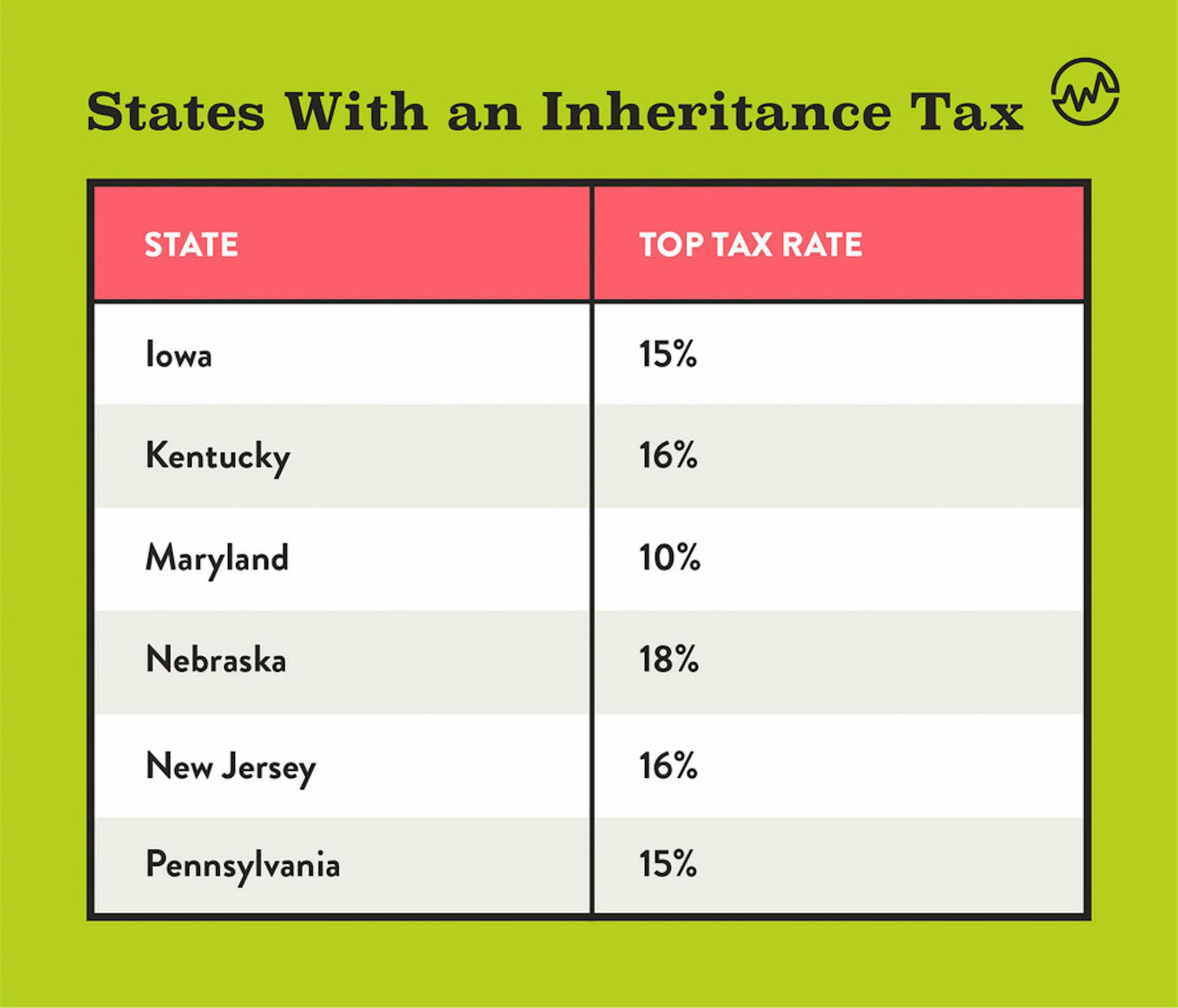

Only 11 states do have one in place.

What is the inheritance tax rate in virginia. For example, indiana once had an inheritance tax, but it was removed from state law in 2013. If you were born on january 1,. No estate tax or inheritance tax.

Rates and tax laws can change from one year to the next. Prior to july 1, 2007, virginia had an estate tax that was equal to the federal credit for state death taxes. Here’s a breakdown of each state’s inheritance tax rate ranges:

West virginia does not have an inheritance or an estate tax. 2021 tax rate tax form due date; Last day of ninth month after death:

With the elimination of the federal credit, the virginia estate tax was effectively repealed. The median property tax in virginia is $1,862.00 per year for a home worth the median value of $252,600.00. No federal inheritance and estate taxes.

Tax rates for decedents who died before july 1, 1999: No estate tax or inheritance tax washington: The remainder passes tax free.

Inheritance tax rates depend on the beneficiary's relationship to the decedent. Virginia collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets. However, certain remainder interests are still subject to the inheritance tax.

In 2020, rates started at 10 percent, while the lowest rate in 2021 is 10.8 percent. No estate tax or inheritance tax Most often, this is a $1 state tax and $0.33 local tax for every $1,000 within the estate.

As with all other tax brackets the government only taxes the amount which exceeds this minimum threshold, meaning that if your estate is worth $11,700,001, the government will levy taxes on $1. It is still a good idea to consult a probate attorney to minimize federal taxes. Virginia currently does not levy an inheritance tax.

Virginia's maximum marginal income tax rate is the 1st highest in the united states, ranking directly below virginia's %. Virginia estate and inheritance taxes prior to january 1, 1980, virginia imposed an inheritance tax on property that beneficiaries received from decedents. However, very few states impose an inheritance tax.

Unlike the federal income tax, virginia's state income tax does not provide couples filing jointly with expanded income tax brackets. However, as the exemption increases, the minimum tax rate also increases. If you inherit property of any kind from a decedent who was a resident of another state, you might receive an inheritance tax bill from the state where the decedent lived.

Another state’s inheritance tax may apply to you if the person leaving you money lived in a state that levies inheritance tax. An inheritance or estate tax is a tax levied on the assets of an individual at the time of his death, with a higher tax rate typically charged on. Virginia inheritance and gift tax.

Connecticut’s estate tax will have a flat rate of 12 percent by 2023. The federal gift tax kicks in for gifts of $14,000 for 2017 and $15,000 for 2018. The fiscal year (july 1st to june 30th) real estate tax is billed in two parts by the office of the city treasurer.

10% on property passing to siblings or other individuals. 1% tax on the clear value of property passing to a child or other lineal descendant, spouse, parent or grandparent. There’s also no gift tax in virginia.

Most purchases in virginia are subject to this 5.3% sales tax while some localities in northern virginia and hampton roads charge 6% due to the 0.7% additional tax imposed in those areas. Virginia offers qualifying individuals ages 65 and older a subtraction that reduces the amount of their income subject to virginia income tax: Virginia’s general sales and use tax rate is 4.3% with a 1% additional local sales tax.

Virginia inheritance laws uniquely include a probate tax in the probate process that is based off the value of the estate in question. The top estate tax rate is 20 percent (exemption threshold: Virginia does not have an inheritance tax.

Although there is no wv inheritance tax, that does not mean that you might not be subject to an inheritance tax from another state. Some food items are subject to sales tax but at a reduced base rate. No estate tax or inheritance tax.

**the rate threshold is the point at which the marginal estate tax rate kicks in. Form 92a200, 92a202, or 92a205: $2.193 million) washington dc (district of columbia):

Today, virginia no longer has an estate tax* or inheritance tax. Pennsylvania has an inheritance tax ranging from 4.5% to 15%.

Virginia Estate Tax Everything You Need To Know – Smartasset

States With An Inheritance Tax Recently Updated For 2020

Avail Arlington Va Tax Service At Most Competitive Prices In Virginia Tax Services Inheritance Tax Tax Deductions

The Death Tax Taxes On Death – American Legislative Exchange Council

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax How Much Will Your Children Get Your Estate Tax – Wealthfit

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

State Estate And Inheritance Taxes Itep

Inheritance Tax How Much Will Your Children Get Your Estate Tax – Wealthfit

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Recent Changes To Estate Tax Law Whats New For 2019

Inheritance Tax How Much Will Your Children Get Your Estate Tax – Wealthfit

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Virginia Estate Tax Everything You Need To Know – Smartasset

Should The Estate Tax Be Increased Or Abolished Seeking Alpha

States With An Inheritance Tax Recently Updated For 2020

Inheritance Tax How Much Will Your Children Get Your Estate Tax – Wealthfit