Due to an emergency clause in this legislation, sales of admissions and tangible property sales at fundraising events by all nonprofit groups and governmental organizations are now exempt from sales tax for transactions on or after march 26, 2019. Nonprofits are also exempt from paying sales tax and property tax.

Free Cash Flow Statement Templates Smartsheet Cash Flow Statement Spreadsheet Template Cash Flow

While there is no general sales tax exclusion for nonprofit organizations, certain types of organizations are eligible for specific tax exemptions and exclusions.

Do nonprofits pay taxes on utilities. These nonprofit, governmental, and civic organizations will no longer charge sales tax on these types of transactions as specified in sections. It is important to contact each utility in A nonprofit organization that has not received tax exempt status from the internal revenue service usually will have to pay property tax.

But there is no similar broad exemption from sales and use tax in places like california. However, some states allow certain types of nonprofit organizations a special exemption from sales tax. Do not have to pay occupational tax (if 80% or more of the organization’s applicable income is derived from charitable activities) but they may be required to register for a business occupational tax certificate (in some cases also known as a business license) with the local jurisdiction and may be required to pay an application fee.

Exempt organizations liable for excise taxes on utilities in illinois. Under current law, 501 (c) (3) nonprofits pay sales tax when they purchase goods and services in north carolina. Once a nonprofit organization has applied for and received tax exempt status from the irs, it then can apply for property tax exemptions to the state, county and/or municipality that collects property tax.

Employment taxes on wages paid to employees, and; This results in significant savings on monthly utility bills. The research to determine whether or not sales tax is due lies with the nonprofit.

Many nonprofit and religious organizations are exempt from federal and state income tax. Nonprofit organizations that receive an exemption identification number (e number) from the department are exempt from state sales and use tax when purchasing. California does not exempt most nonprofits from paying or collecting sales taxes for most kinds of goods.

While the income of a nonprofit organization may not be subject to federal taxes, nonprofit organizations do. Generally, these nonprofits are eligible to apply to the n.c. Susan combs, texas comptroller of public accounts.

Although many nonprofit and religious organizations are exempt from federal and state income tax, there is no similar broad exemption from california sales and use tax. The basic requirements for tax and wage reporting compliance, including. 501(c)(3)s do not have to pay federal and state income tax.

Federal and texas government entities are automatically exempt from applicable taxes. Electronic filing and payment options are available to exempt organizations for the employment tax and information returns required if they pay workers. But they do have to pay:

Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. The most common categories of nonprofit organizations that can qualify for exemption from paying texas taxes on their purchases are the. Received a letter of exemption from sales tax don’t have to pay sales and use tax when they buy, lease or rent taxable items that are necessary to the organization’s exempt function.

Organizations that have applied for and. A 501(c)(3) operating in illinois may not have to pay illinois sales tax and it may exempt from real estate taxes on property it owns. Taxes on money received from an unrelated business activity.

For more information, see does your nonprofit need a business. Generally, a nonprofit’s sales and purchases are taxable. A system of sales tax exemption would save nonprofits time and.

The exemption is generally limited to the purchase of items used in their exempt purpose. But determining what are an organization’s exempt purposes is not always as clear as one might think, and distinguishing between related and. However, this corporate status does not automatically grant exemption from federal income tax.

To be tax exempt, most organizations must apply for recognition of exemption from the internal revenue service to obtain a ruling or determination letter recognizing tax. Although sales tax can be passed on to customers who buy goods, an organization is responsible for paying it unless it fits within one of the state’s specific exceptions. Tax generally applies regardless of whether the items you sell or purchase are new, used, donated, or homemade.

The illinois department of revenue has issued guidance to a taxpayer regarding exemptions for nonprofit organizations. In most states, 501 (c) (3) entities must pay sales tax on their purchases and charge sales tax on the items they sell. An eo generally must deposit employment taxes and certain excise taxes before it files its return.

According to the michigan tax code at the time of publication, churches, schools, charities, eligible hospitals, and other nonprofit organizations are exempt from state sales tax on regulated electric, natural gas, and telecommunication bills.

Rmipolicy Rmipolicy Twitter

Creating Financial Projections For A New Restaurant – Projectionhub Blog Saving Money Budget Budgeting Money Financial

Actual Utilities Are Far From Being Equalized Meaning That Team Members Download Table

Electric Utilities Sector Supplement – Global Reporting Initiative

How I Organize My Grant Writing Process Boss On A Budget – Build A Strong Nonprofit Turn Your Passion Int In 2020 Nonprofit Startup Grant Writing How To Raise Money

Cash Flow Statement Printable Pdf Letter A4 A5 Etsy Cash Flow Statement Small Business Bookkeeping Small Business Accounting

Actual Utilities Are Far From Being Equalized Meaning That Team Members Download Table

Pdf Run Profit And Loss Statement Profit And Loss Statement Statement Template Profit

Actual Utilities Are Far From Being Equalized Meaning That Team Members Download Table

New York City Taxes A Quick Primer For Businesses

Houston Utility Assistance Find Help To Pay Your Light Bill

Taxes Fees In Lakewood – City Of Lakewood

Free Cash Flow Forecast Templates Smartsheet Cash Flow Personal Finance Budget Flow

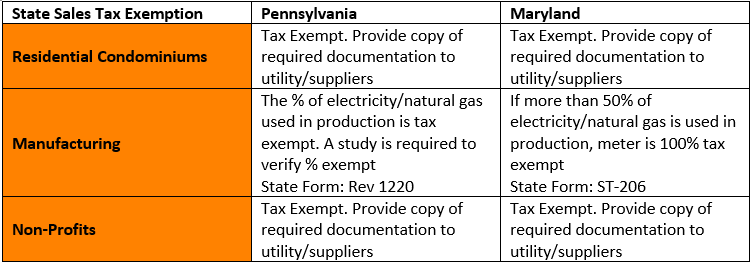

Tax Exemptions For Energy – Nania

Solar Incentives In Utah – Utah Energy Hub

Xls Xlsformat Xlstemplates Xlstemplate Check More At Httpsmavensocialcofree-househ Budget Spreadsheet Template Budgeting Worksheets Budget Spreadsheet

National Workshop Resource Presentation Title Saving Taxes For

Nonprofit Project Budget Template Seven Doubts About Nonprofit Project Budget Template You S Budget Template Budgeting Budgeting Worksheets

Tax Exemptions For Energy – Nania