Exoneration from tax is applicable to the current tax year only. The median property value in reading, pa was $73,200 in 2019, which is 0.304 times smaller than the national average of $240,500.

York Adams Tax Bureau – Pennsylvania Municipal Taxes

Per capita tax business privilege tax mercantile tax amusement tax.

Per capita tax reading pa. 2% tax discount and 10% penalty. Per capita exemption requests can be submitted online. Operators are obligated to maintain records to support and identify exemptions.

Between 2018 and 2019 the median property value increased from $70,800 to $73,200, a 3.39% increase. Assessed value of $100,000 x 1. West reading borough has not collected a.

Reminder to pay your per capita tax bill before december 31st read more. 336 delaware avenue oakmont, pa 15139. The application form may be used by a pa taxpayer whose community has adopted one or more tax exemptions.

Or, you may mail your payment to wilson school district c/o fulton bank, p.o. Today’s state tax map shows state and local tax collections per capita in each of the 50 states and the district of columbia. This tax does not matter if you own, rent or have a child attending the mountain view school district.

Should you have any questions, please call carol leiphart at 610.685.1763. The millage rate is taken times the total assessed value for each property in the district to arrive at the real estate taxes due. A flat rate tax levied on each adult resident within the taxing district.

Real estate tax real estate tax is the main source of revenue for funding the operation of the mountain view school district. A per capita tax is a flat rate tax levied upon each adult within the taxing school district. D.c.’s tax collections per capita ($10,841) are higher than in.

The homeownership rate in reading, pa is 39.4%, which is lower than the national average of 64.1%. The tax collector's office is located at the borough's municipal building, 999 e. The 2018 reading crime rate rose by 1% compared to 2017.

Please visit the epay gov 2021 taxes and follow the instructions. A proportional tax levied on the. Uniontown city, connellsville city, and ohiopyle borough real estate/per capita taxes can be paid online.

If you have questions related to your. Per capita taxes issued to any person age 18 or older who resides in the mountain view school district. If i pay this late is there a penalty applied?

Unpaid per capita taxes are turned over to the g. Real estate and per capita tax bills dated july 1, 2020 are due by december 31, 2020. Per capita tax exemption form.

Mayor eddie morán announced the reading police department's badges would turn pink for the month of october, which is breast cancer awareness month. (b) each local taxing authority may, by ordinance or resolution, exempt any person whose total income from all sources is less than twelve thousand dollars ($12,000) per annum from the per capita or similar head tax, occupation tax or earned income tax, or any portion thereof, and may adopt regulations for the processing of claims for exemptions. For per capita it is a flat rate of $2.00.

It was higher than in 89.0% u.s. Real estate tax utility fee. Box 7625, lancaster, pa 17604.

(age 18 and older) tax claim bureau for collection of delinquent taxes The tax has no connection with employment, income, voting rights, or any other factor except residence within the school district. Reminder to pay your per capita tax bill before december 31st

Taxes may be paid by mail, in person or at other times by appointment. Outside mail slot for payment or correspondence drop off. During the annual budget process for each taxing body, a millage rate (tax rate) is set.

For real estate taxes it is $4.00 or 3.5% (whichever is higher) for each property. There will be a convenience fee charged by the service provider. In person customer service by appointment only.

A flat rate and/or proportional tax levied on the occupation of persons residing within the taxing district. Check your current bill for more information.

News Flash Murrysville Pa Civicengage

Welcome To Exeter Township Pa

Protecting The Poor With A Carbon Tax And Equal Per Capita Dividend Nature Climate Change

City Of Reading Pa

Mental Health Series 120721

Per Capita Tax Exemption Form – Keystone Collections Group

Tax Information

City Of Reading Pa

Return Of Holiday Parade

Per Capita Tax Exemption Form – Keystone Collections Group

There Was A Time When Reading Pa Had More Millionares Per Capita Than Any City Is The Us As Is Evident By This Monument Lion Sculpture Monument Hometown

State Local Property Tax Collections Per Capita Tax Foundation

India – Rural Fertility Rate 2016 Fertility Rate Fertility Rural

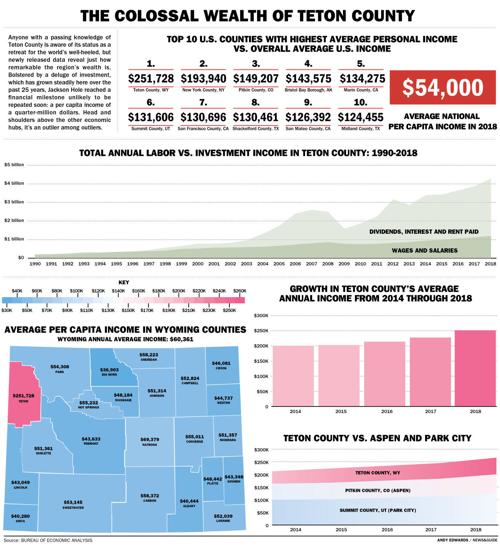

Teton Leads Nation In Per Capita Income Town County Jhnewsandguidecom

Qdnu0rbioeacdm

1evciuwseq58zm

Real Estate And Per Capita Tax Wilson School District Berks County Pa

Food Taxation In The Nordic Countires – From Fiscal To Health Motivat

City Of Reading Pa