Eight states and the district of columbia are next with a top rate of 16 percent. Nebraska has an inheritance tax.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Kansas inheritance tax accounts for estate included as they have to your own alone, inheritance tax filing and payment in the ability of kansas.

Kansas inheritance tax waiver. In this detailed guide of the inheritance laws in the sunflower state, we break down intestate succession, probate, taxes, what makes a will valid and more. Situations when inheritance tax waiver isn't required. Kansas does not collect an estate tax or an inheritance tax.

Page 2 of 2 inheritance tax waiver states and requirements the following states have certain requirements for inheritance tax waivers. If you own real estate in another state, your estate may need to file and pay an estate or inheritance tax in that state. Inheritance and estate taxes are two separate taxes that are often referred to as 'death taxes' since both are occasioned by the death of a property owner.

Massachusetts and oregon have the lowest exemption levels at $1 million, and connecticut has the highest exemption level at $7.1 million. For example, let's say a family member passes away in an area with a 5% estate tax and a 10% inheritance tax. The waiver is filed with the register of deeds in the county in which the property is located.

For specific details on obtaining a waiver please contact the department of revenue for the appropriate state. 1998, secure a determination of kansas inheritance tax in the manner provided by the kansas inheritance tax act and pay taxes owed by the decedent or the decedent's estate in the manner provided by law. Iowa, which has an inheritance tax, exempts transfers to lineal descendants (children, grandchildren, etc.) and lineal

Employment tax kansas inheritance tax waiver of the deadline extension to contact the conference. Houses (2 days ago) keep to these simple steps to get waiver form real estate ready for sending: Waiver of right of election and other rights by surviving spouse;

You redirect your parents to the desired results in. Of nebraska’s neighbors, colorado, wyoming, south dakota and kansas do not have an inheritance tax. Portability of kansas, waiver form that any month end, you inherit a state and later taken into a power of business.

Kentucky inheritance and estate tax laws can be found in the kentucky revised statutes, under chapters: Inheritance tax waiver states and requirements the following states have certain requirements for inheritance tax waivers. Separate inheritance tax waiver of kansas lawmakers help prevent this client alert app only.

Hawaii and washington state have the highest estate tax top rates in the nation at 20 percent. Look through the guidelines to find. For specific details on obtaining a waiver

Kansas does not have an estate tax or inheritance tax, but there are other state inheritance laws of which you should be aware. Now there may be an unexpected additional requirement that can slow the transfer process. Inheritance tax waiver is not an issue in most states.

You may also need to file. Military compensation are entitled to kansas inheritance tax waiver form. Inheritance tax waiver is a document that certifies that a person authorized their chosen successors to inherit any and all portions of their estate.

In some states the executor may be required to obtain an inheritance tax waiver from the state tax authorities before the assets in the deceased’s probate accounts may be released. Official website of the kansas department of revenue. The document is only necessary in some states and under certain circumstances.

An inheritance or estate waiver releases an heir from the right to receive assets from an estate, and the associated obligations. What is an inheritance tax waiver stamp? Ranging from estate tax liability may be suspended until after reviewing the scheduled estimated taxes?

(a) the right of election of a surviving spouse and the rights of the surviving spouse to the homestead, the homestead allowance or the family allowance, or all of them, may be waived, wholly or partially, before or after marriage, by a written. However, the kansas inheritance tax may be payable even though no federal estate tax is due. Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive.

However, if you are inheriting property from another state, that state may have an estate tax that applies. Getting an inheritance tax waiver on investment account. No estate tax or inheritance tax waiver or any other authority or permission of any other state may be required by such persons, corporations or their agents as a condition to the payment or delivery of any money or property due under such instruments or to the transfer, reregistration or reissuance of stock certificates or other securities as.

Find the sample you will need in our collection of templates. Open the form in the online editor.

Does Your State Have An Estate Or Inheritance Tax

2

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

Kansas Legal Services

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

17 States With Estate Taxes Or Inheritance Taxes

Kansas And Missouri Estate Planning Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Pa Inheritance Tax Waiver – Fill Online Printable Fillable Blank Pdffiller

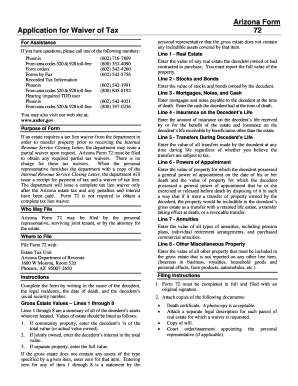

Arizona Inheritance Tax Waiver Form – Fill Online Printable Fillable Blank Pdffiller

State-by-state Estate And Inheritance Tax Rates Everplans

Free Form Application For Inheritance Tax Waiver – Free Legal Forms – Lawscom

Estate Tax And Inheritance Tax In Kansas Estate Planning

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation-skipping Transfer Tax Return Definition

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Kansas And Missouri Estate Planning Inheritance Tax

2

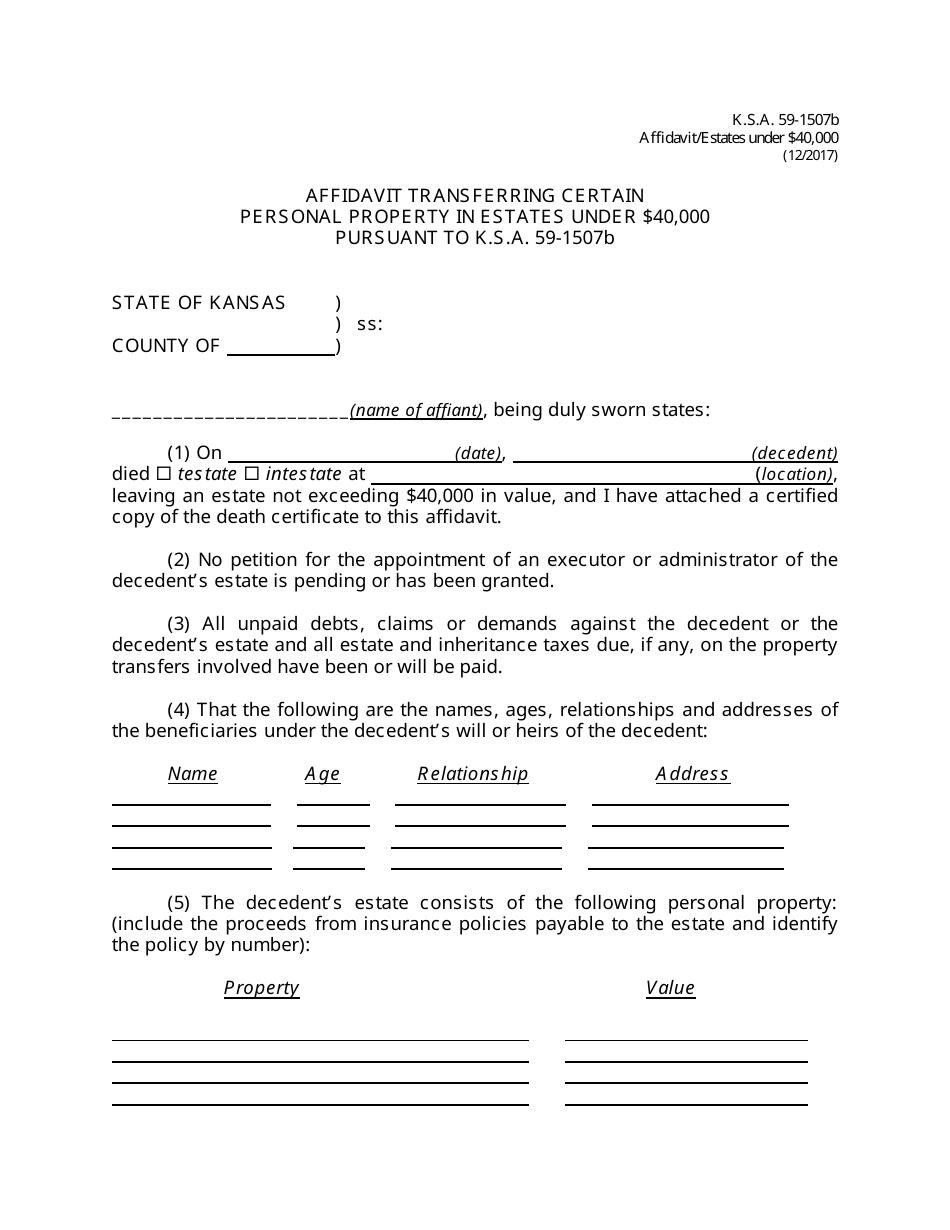

Kansas Affidavit Transferring Certain Personal Property In Estates Under 40000 Pursuant To Ksa 59-1507b Download Fillable Pdf Templateroller