Our certified tax profesionals also offer accounting and bookkeeping services to assist our community and other businesses to grow. Taxation and revenue new mexico;

10-15w Jlh1969 Class A Amplifier Amp Board Left Channel Pcb Assembled Mot2n3055 Amplifier Amp Audio Amplifier

New mexico (nm) sales tax rates by city.

Service tax new mexico. Generally, a business will pass that tax on to the consumer so that it resembles a sales tax. Taxation and revenue new mexico; New mexico has a gross receipts tax that is imposed on persons engaged in business in new mexico.

Taxpayer access point (tap) tap is the department’s electronic filing system. New mexico taxpayer access point (tap). Welcome to the taxation and revenue department’s online services page.

Rose tax & financial works to maximize your tax savings with professional tax preparation services. Depending on local municipalities, the total tax rate can be as high as 9.0625%. T he legal services bureau ( lsb) is the general counsel to the department.

Unlike many other states, the sale and performance of most services in new mexico are taxable in new mexico. (1) one or both legs at or above the ankle or (2) one or both arms at or above the wrist. We offer all types of business and personal accounting, tax, and bookkeeping services for the southern colorado and northern new mexico area.

Taxation and revenue new mexico; Effective july 1, 2021, the compensating tax rate for services will jump to 5.125 percent to match the rate for property. New mexico has recent rate changes (wed jan 01 2020).

While new mexico's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to sales taxes. Midwest finance corporation is a highly reputable finance company that is known for excellent customer service and professionalism. The taxation and revenue department encourages.

Under new mexico law, receipts from selling tangible personal property to a government agency may be deducted from gross receipts, but the portion of those receipts attributable to the performance of a service for a government agency are not deductible. If you're looking for an installment loan or tax preparation service in texas or new mexico, look no further. Printable pdf new mexico sales tax datasheet.

Tax fraud investigation division (tfid); Give us a chance to show you how a relationship with rose tax & financial will make your life better! P must report and pay gross receipts tax on the fee for the service.

Taxation and revenue new mexico; Select the new mexico city from the list of popular cities below to see its current sales tax rate. Freedom tax services located in albuquerque, new mexico caters to both individuals and small business owners in all tax preparation services and tax related guidance.

File your taxes and manage your account online. Taxation and revenue new mexico; 7 to review agency bill proposals for the 2021 regular legislative session and ongoing rule development by the department and the new mexico tax research.

Currently, the state rate is 5.125 percent for property and 5 percent for services, and there are no municipal or county compensating taxes. 1 receipts for health care services provided by physicians employed by §501(c)(3)s (under applicable federal rules), and health maintenance organizations (subject to the premium tax) are exempt from gross receipts tax. We provide legal advice, analysis and review on a broad range of issues including tax and motor vehicle matters, personnel,.

With local taxes, the total sales tax rate is between 5.1250% and 9.2500%. The taxation and revenue department’s tax practitioner advisory committee will meet on thursday, jan. We work with all 50 states, preparing individual, sole proprietor, llc, corporate and partnership returns.

The new mexico taxation and revenue department is comprised of: New mexico has a statewide gross receipts tax rate of 5.125%, which has been in place since 1933. Charge the tax rate of the buyer’s address, as that’s the destination of your product or service.

It also administers driver’s licensing and motor vehicle registration laws. The new mexico (nm) state sales tax rate is currently 5.125%. The office of the secretary;

Fill, print & go : This tax alert summarizes some of the guidance on sourcing sales of services. Taxation and revenue new mexico;

Taxation and revenue new mexico; There are additional levels of sales tax at local jurisdictions, too. Personal and business income taxes, gross receipts tax, weight distance tax and more.

The state sales tax rate in new mexico is 5.1250%. This page describes the taxability of services in new mexico, including janitorial services and transportation services.

Why We Pay Taxes – History

Home Taxation And Revenue New Mexico

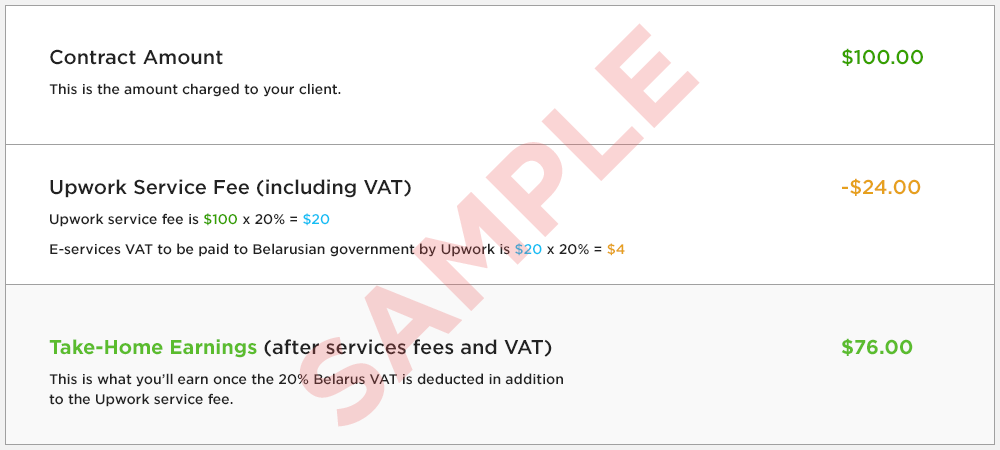

Value Added Tax Vat On Freelancer Fees Upwork Customer Service Support Upwork Help

Taxes In Usa- New Mexico Wdt New Mexico Mexico Usa News

Is The Us The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Online Services Taxation And Revenue New Mexico

What Is Gross Receipts Tax Overview States With Grt More

Applying For Benefits

Michigan Sales Tax – Small Business Guide Truic

Greenback Expat Tax Services The Tax Experts

Welcome To The Barbados Revenue Authority Website

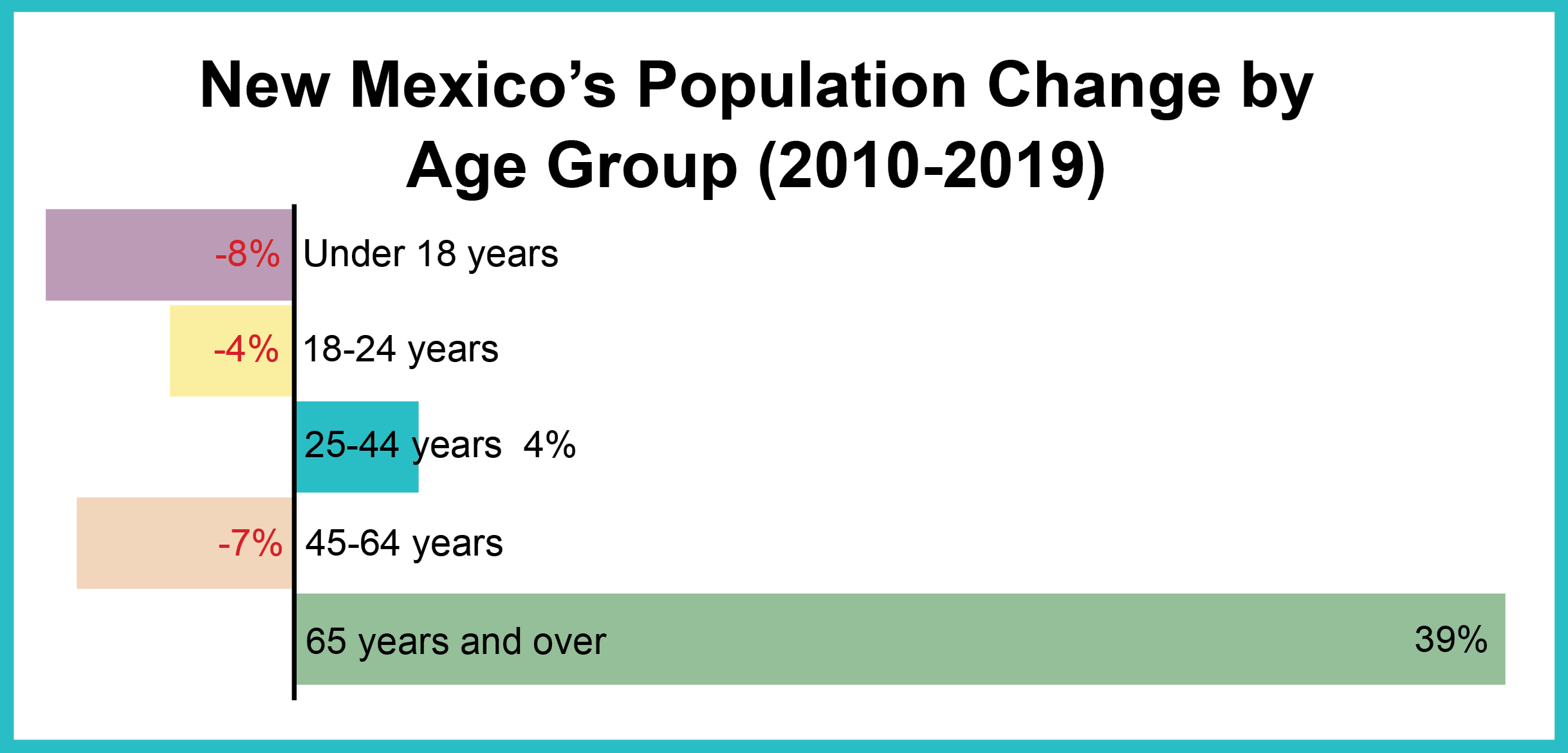

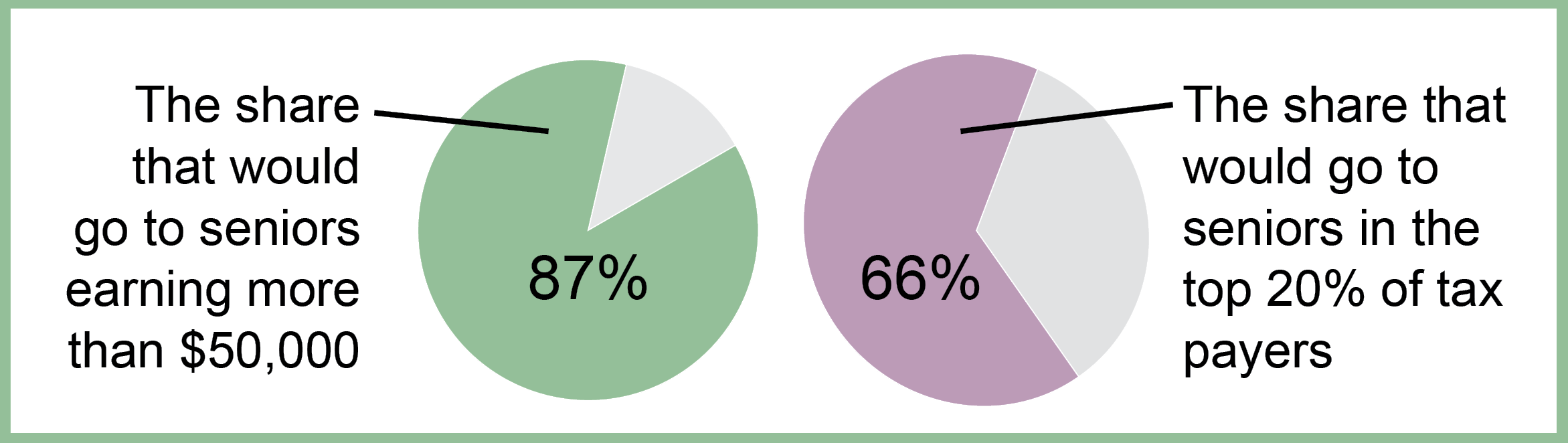

Exempting Social Security Income From Taxation Not Targeted Not Necessary Not Cheap New Mexico Voices For Children

Online Services Taxation And Revenue New Mexico

State W-4 Form Detailed Withholding Forms By State Chart

Disabled Veterans Property Tax Exemptions By State

Xpc9kuks2cth7m

States With Highest And Lowest Sales Tax Rates

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Pin On State Tax N Rev