An ad valorem tax levied by the board for operating purposes, exclusive. Exemption for surviving spouses of first responders who die in the line of duty.

Free Form Dr-462 Application For Refund Of Ad Valorem Taxes – Free Legal Forms – Lawscom

Disclosure of ad valorem taxes to prospective purchaser.

Ad valorem tax florida statute. The taxable value of the property is determined by the county property appraiser, a constitutional officer. Property purchasing tax disclosure law. (1) “ad valorem tax” means a tax based upon the assessed value of property.

The levy of ad valorem taxes shall be approved by referendum when required by the state constitution. This is the disclosure law in the florida statutes on disclosure of ad valorem taxes to a prospective purchaser. Such tax shall be assessed, levied, and collected in the same manner and same time as county taxes.

These are levied by the county, municipalities, and various taxing authorities in the county. (1) a prospective purchaser of residential property must be presented a disclosure. Taxes are based on the assessed value and the millage of each taxing authority.

The term “property tax” may be used interc hangeably with the term “ad valorem tax.” Tax increment financing (often referred to as tif) is a method to pay for redevelopment of a slum or blighted area through the increased ad valorem tax revenue resulting from that redevelopment. Chapter 197 which apply to general ad valorem assessments (property taxes), including the use of.

Your ad valorem property taxes are determined by multiplying the taxable value of your property by the millage rate for the current tax year. “annually an ad valorem tax of not exceeding 1½ mills may be levied upon all property in the county, which shall be levied and collected as other county taxes are levied and collected. It has been used in many states since the late 1940s and early 1950s to pay for redevelopment projects.

The property tax oversight (pto) program publishes the florida ad valorem valuation and tax data book twice a year. — an elected board may levy and assess ad valorem taxes on all taxable property in the district to construct, operate, and maintain district facilities and services, to pay the principal of, and interest on, general obligation bonds of the district, and to provide for any sinking or other funds established in connection with such bonds. Section 197.3632(8)(a), florida statutes, requires that the.

Such tax shall be assessed, levied, and collected in the same manner and same time as county taxes. Exemption for certain permanently and totally disabled veterans and for surviving spouses of veterans; Authority for ad valorem taxes:

Claims by members of armed forces. Tax increment financing in florida. [2] the statute also authorizes the county to levy ad valorem taxes as provided therein.

Set forth in § 197.3632(3) and (4). Florida statute 689.261 sale of residential property; These are levied by the county, municipalities, and various taxing authorities in the county.

Ad‐valorem property tax exemptions florida statute 193.621 provides that for purposes of assessment for ad‐valorem property taxes, pollution control equipment shall be. If a florida property tax appraiser denies your longstanding ad valorem tax exemption, you may be able to get it back by challenging the denial in front. The ad valorem tax provided for herein shall be in addition to county and all other ad valorem taxes provided for by law.

Ad valorem taxes are based on the assessed value and the millage of each taxing authority. The ad valorem tax provided for herein shall be in addition to county and all other ad valorem taxes provided for by law. (1) in any administrative or judicial action in which a taxpayer challenges an ad valorem tax assessment of value, the property appraiser’s assessment is presumed correct if the appraiser proves by a preponderance of the evidence that the assessment was arrived at by.

Article vii of the florida constitution and chapters 192, 193, 194, 195, 196, 197, 200, and 201 of the florida statutes. Authority for non ad valorem: Section 125.016, florida statutes, is a general grant to counties of the authority to impose an ad valorem tax, and provides, in full:

Additional homestead exemption for persons 65 and older. The levy of ad valorem taxes shall be approved by referendum when required by the state constitution.

Today Is A Shopaholics Dream Come True Floridas Taxfreeweekend Has Arrived This Years Tax Holida Tax Holiday Tax Free Weekend How To Apply

January Is Property Tax Month In Most States Property Tax Florida Real Estate Property

Florida Dept Of Revenue – Property Tax – Taxpayers – Exemptions Property Tax Filing Taxes Revenue

New Tax Laws Have Home Buyers Checking New Places Corporate Law Property Tax Tax Rules

Pin On Feeling Guilty

Fl Dept Rev – Classification Of Workers For Reemployment Tax Employees Vs Independent Contractors Filing Taxes Florida Child Support Laws

9 Best Tax Laws Ranked By State Tax Relief Center State Tax Tax Help Tax Rules

Rental Property Tax Deductions Rental Property Management Being A Landlord House Rental

Form Dr-462 Download Printable Pdf Or Fill Online Application For Refund Of Ad Valorem Taxes Florida Templateroller

9 Tips For Buying A Vacation Home Sarasota Real Estate Vacation Home Real Estate Tips

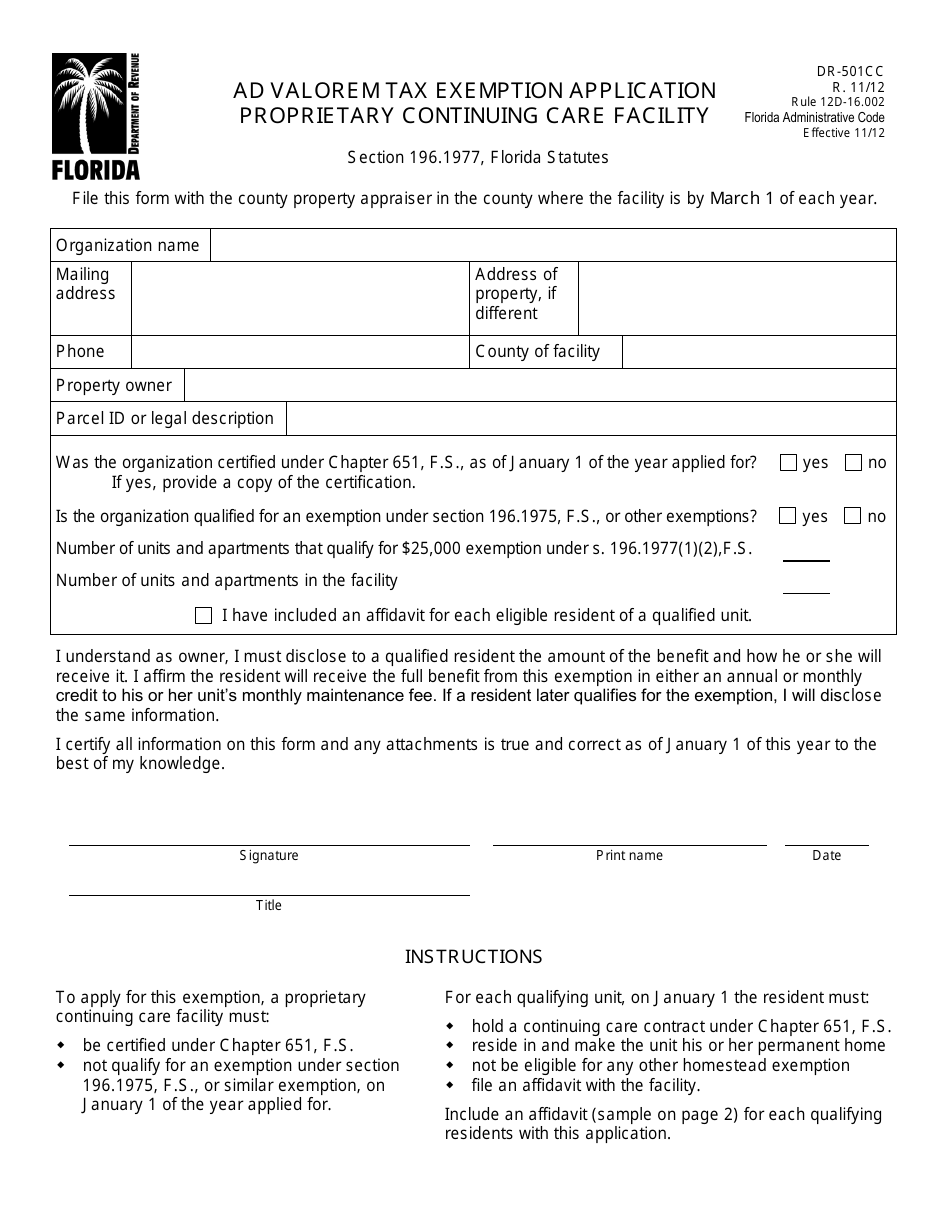

Form Dr-501cc Download Printable Pdf Or Fill Online Ad Valorem Tax Exemption Application Proprietary Continuing Care Facility Florida Templateroller

Sales Tax Collection Tips Ten Quick Tax Rules To Help With The Murkiness Of State Taxes If You Need More Help Visit Our Sales Tax Tax Rules Tax Preparation

Dormyfloridacom Filing Taxes Child Support Laws Revenue

Florida Estate Tax – Rules On Estate Inheritance Taxes

Floridas Ad Valorem Tax Exemption Dean Mead

Fl Veterans Property Tax Exemptions — You Need To Read This Dormyfloridacom Dor Property Brochures Pt109pdf Property Brochures Brochure Property Tax

Ecommerce Businesses Can Integrate Shopping Carts Automatically From Walmart Amazon Shopify And Ebay Sales Tax Filing Taxes Revenue

Pin On Florida Legal

Bfp Affidavit – Entity Real Words Property