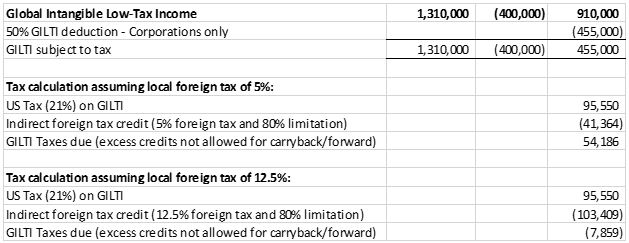

Shareholder of a cfc subject to a 15% foreign tax rate on gilti,. The above example uses a 5 percent tax rate which results in a balance due of $54,186 from gilti in addition to tax the us parent corporation owes from their us operations.

Gilti Detailed Calculation Example

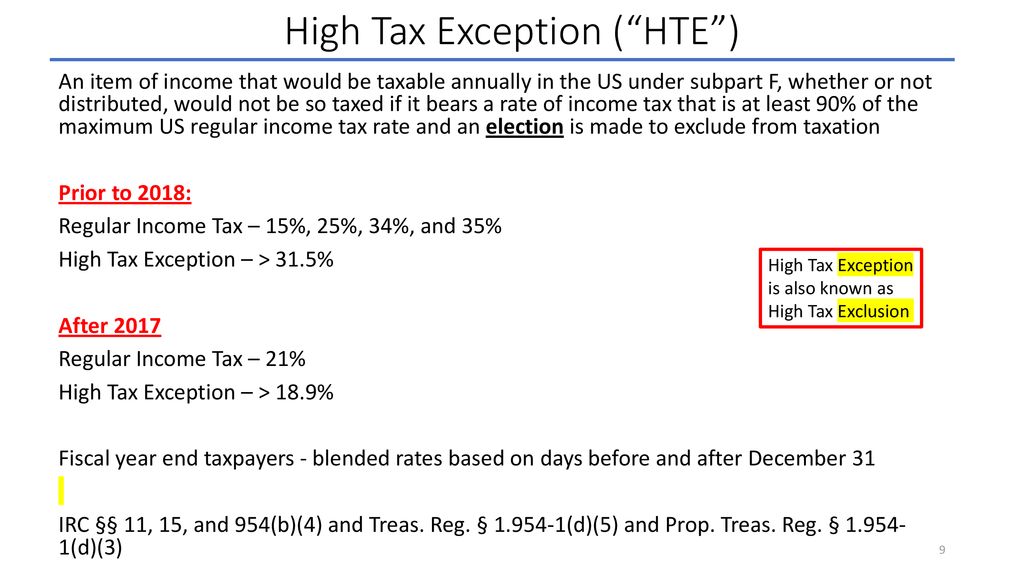

This threshold is unchanged from the proposed regulations.

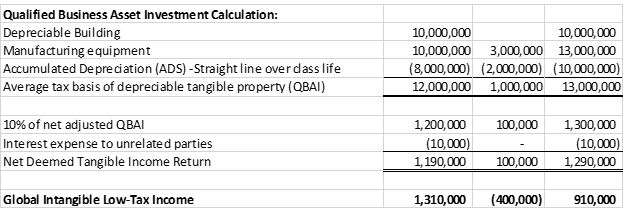

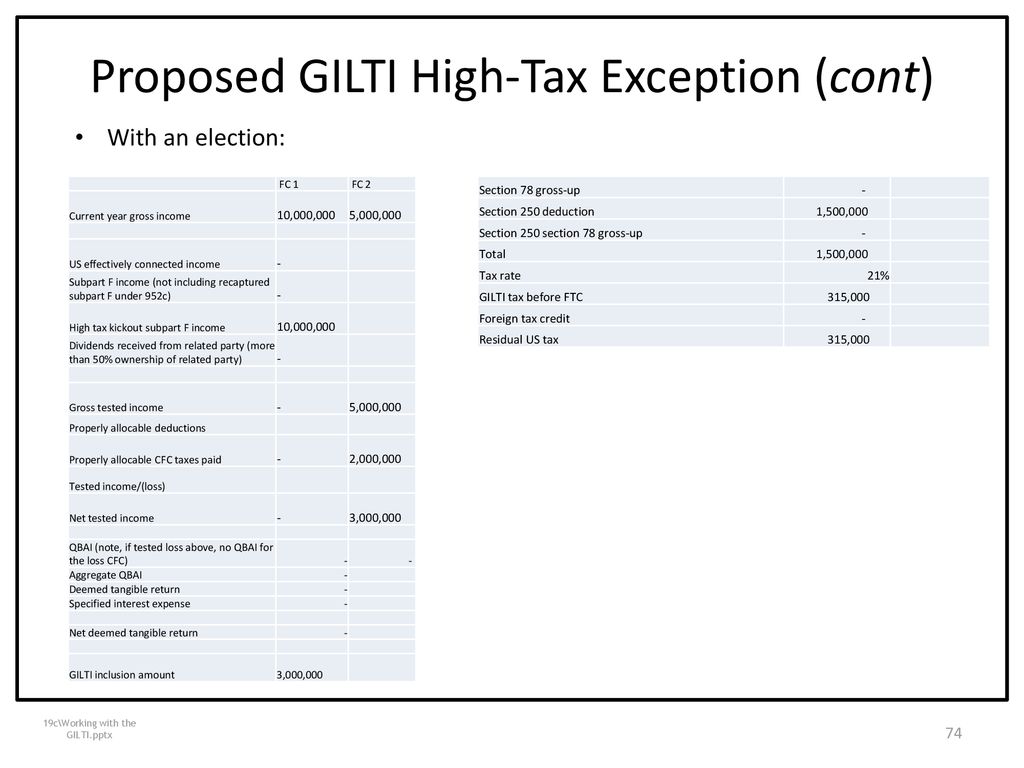

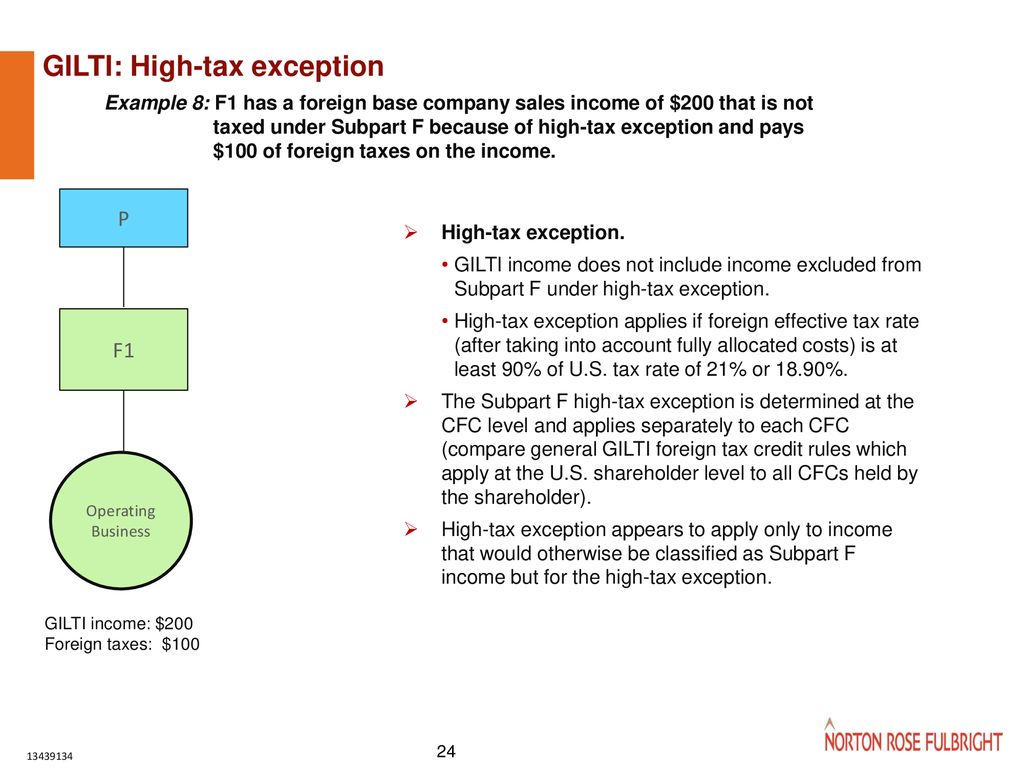

Gilti high tax exception example. 954(b)(4) regardless if the income would otherwise be subpart f income. For example, the high tax election: Cfc owns assets with us tax basis of $2,000.

If the local tax rate of the cfc were higher (i.e. This example illustrates the potential blending of foreign taxes that could cause an item of foreign base company income that was otherwise subject to a low. The gilti high foreign tax exception allows a complete exclusion of gilti tested income from the federal taxable income of a u.s.

Categories in their treatment of gilti: To be eligible for the exclusion, the cfc’s earnings must be subject to an effective foreign corporate income tax rate that is greater than 90% of the current u.s. Affects the amount of qualified business asset investment (qbai) the taxpayer can use to reduce their gilti inclusions;

[1] the final regulations provide that a tested unit includes a cfc. For taxpayers with more complex ownership structures, or with cfcs with multiple unrelated owners, there. The article presented a basic example where the u.s.

Corporate tax rate, which is 21%). Shareholder that owns a cfc. Can impact foreign tax credits, as gilti gross income is excluded from gross income

Similar to a subpart f inclusion, “u.s. As discussed in the tax notes article, congress’s intent that gilti not apply above a minimum foreign tax rate of 13.125% does not take into account the interaction of § 951a with existing parts of the code, particularly the expense allocation rules of treas. 12.5 percent) then the result would be much different as the total foreign tax credit of $103,409 would be higher than the total us tax on gilti.

States that include gross or net gilti income in state taxabl e income but allow a dividends received deduction (drd) or other subtraction of less than 100. The gilti high tax exception can be a useful planning tool, but there are disadvantages in certain situations. Shareholders” of cfcs include gilti in income on an annual basis.

Federal corporate income tax rate.

Global Intangible Low-tax Income – Working Example Executive Summary – Mksh

Harvard Yale Princeton Club – Ppt Download

International Aspects Of Tax Cuts And Jobs Act

The Tax Times Final Regs Provide That Gilti High-tax Exception Is Retroactive

Btcpanet

Us Cross-border Tax Reform And The Cautionary Tale Of Gilti

Lwcom

Harvard Yale Princeton Club – Ppt Download

Global Intangible Low-tax Income – Working Example Executive Summary – Mksh

Gilti Detailed Calculation Example

Gilti Detailed Calculation Example

Gilti High-tax Exclusion How Us Shareholders Can Avoid The Negative Impact Sch Group

Lwcom

Lwcom

Final Gilti Hte Regs Provide Flexibility Grant Thornton

International Aspects Of Tax Cuts And Jobs Act 2017 – Ppt Download

The High-tax Exception To Gilti Under The New Regulations – Youtube

Hard Hit On Global Supply Chain Structures – Ppt Download

Lwcom