By staff writer last updated april 5, 2020. Counties in north carolina collect an average of 0.78% of a property's assesed fair market value as property tax per year.north carolina has one of the lowest median property tax rates in the united states, with

Pin On Home

The district of columbia moved in the.

North carolina estate tax 2020. Vermont also continued phasing in an estate exemption increase, raising the exemption to $5 million on january 1, compared to $4.5 million in 2020. Printable north carolina state tax forms for the 2020 tax year will be based on income earned between january 1, 2020 through december 31, 2020. Complete this version using your computer to enter the required information;

Prescription drugs are exempt from the north carolina sales tax; Description estates and trusts tax credit summary. North carolina estate tax 2020.

On july 23, 2013, the governor signed hb 998 which repealed the north carolina estate tax retroactively to january 1, 2013. Then print and file the form. This act reduces the current estate tax exemption from $5,762,400 to $4 million dollars in 2021.

Even though north carolina has neither an estate tax or nor an inheritance tax, the federal estate tax still applies to north carolinians, depending on the value of their estate. However, now that north carolina has eliminated its estate tax, most wealthy north carolina residents will owe estate taxes only to the federal government. The exemption is portable for spouses, meaning that with the right legal steps a couple can protect up to $22.36 million upon the death of both spouses.

9 hours ago north carolina property taxes by county 2021. $1,209.00 3 hours ago the median property tax in north carolina is $1,209.00 per year for a home worth the median value of $155,500.00. Nc capital gains tax on real estate.

North carolina does not collect an inheritance tax or an estate tax. Read on for information on how the north carolina estate tax was applied to the estates of those who died prior to 2013. Compare your take home after tax and estimate your tax return online, great for single filers, married filing jointly, head of household and widower

The inheritance tax rate in north carolina is 16 percent at the most, according to nolo. Tax amount varies by county. If there are creditors or others who contest the will and cause disagreements, your heirs could end up paying much more to hire other attorneys to fight for their inheritance.

If you live or work in nc when you die, your estate may be subject to these taxes. After aunt ruth’s estate deducts the exemption, she would only owe gift and estate taxes on the remaining $1.55 million, taxed at. However, as the exemption increases, the minimum tax rate also increases.

The median property tax in north carolina is $1,209.00 per year for a home worth the median value of $155,500.00. If you live or work in nc when you die, your estate may be subject to these taxes. Description beneficiary's share of north carolina income, adjustments, and credits.

The federal estate tax exemption increased to $11.18 million for 2018, when the 2017 tax law took effect. According to investopedia, “probate can easily cost from 3% to 7% or more of the total estate value.”. The federal estate tax exemption is $11.58 million in 2020, so only estates larger than that amount will owe federal estate taxes.

However, state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than $11.18 million. In 2020, rates started at 10 percent, while the lowest rate in 2021 is 10.8 percent. 2020 north carolina tax tables with 2022 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator.

Under the new law, the district of columbia will use a graduated tax rate of up to 16% for estates worth more than $10 million. North carolina estate tax 2020. North carolina law requires local tax collectors to annually advertise current year unpaid taxes levied on real estate.

Connecticut’s estate tax will have a flat rate of 12 percent by 2023. In september, the mayor of the district of columbia signed the “estate tax adjustment amendment act of 2020” into law. Tax is tied to federal state death tax credit.

Prescription drugs are exempt from the north carolina sales tax; The estate tax exclusion is $4,000,000 as of 2021, after the district chose to lower it from $5,762,400 in 2020. Counties in north carolina collect an average of 0.78% of a property's assesed fair market value as property tax per year.

In 2020, rates started at 10 percent, while the lowest rate in 2021 is 10.8 percent. While there isn’t an estate tax in north carolina, the federal estate tax may still apply. Real estate taxes for 2020 became past due on january 6, 2021, and interest began to accrue on that date.

Starting in 2022, the exclusion amount will increase annually based on a cost of. The north carolina income tax rate for tax year 2020 is 5.25%. After aunt ruth’s estate deducts the exemption, she would only owe gift and estate taxes on the remaining $1.55 million, taxed at the rate of 40 percent.

North Carolina Tax Reform North Carolina Tax Competitiveness

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Previsioni Meteo Estate 2020 Caldo Insopportabile Gia Da Maggio Estate Isola Di Calore Buongiorno Bellissimo

75 Owen Lane Gas Fireplace Logs Lake Real Estate Estate Homes

Pin On Cary

Asheville Nc Real Estate Condos In 2020 Nc Real Estate Asheville Nc Real Estate Vacation Rentals By Owner

Pin On Ifttt

15 Things To Know Before Moving To North Carolina – Smartasset

Equestrian Estate On 350 Acres In North Carolina Set To Hit The Auction Block – Mansion Global

Explore Income Tax Information For States From New York To Wyoming As Well As Other Tax Burden Information Like Property Taxes Wyoming Estate Tax Income Tax

Tax Comparison – North Carolina Verses South Carolina

Find Raleigh North Carolina Homes For Sale Raleigh Nc Real We Buy Houses House For Sell Home Buying

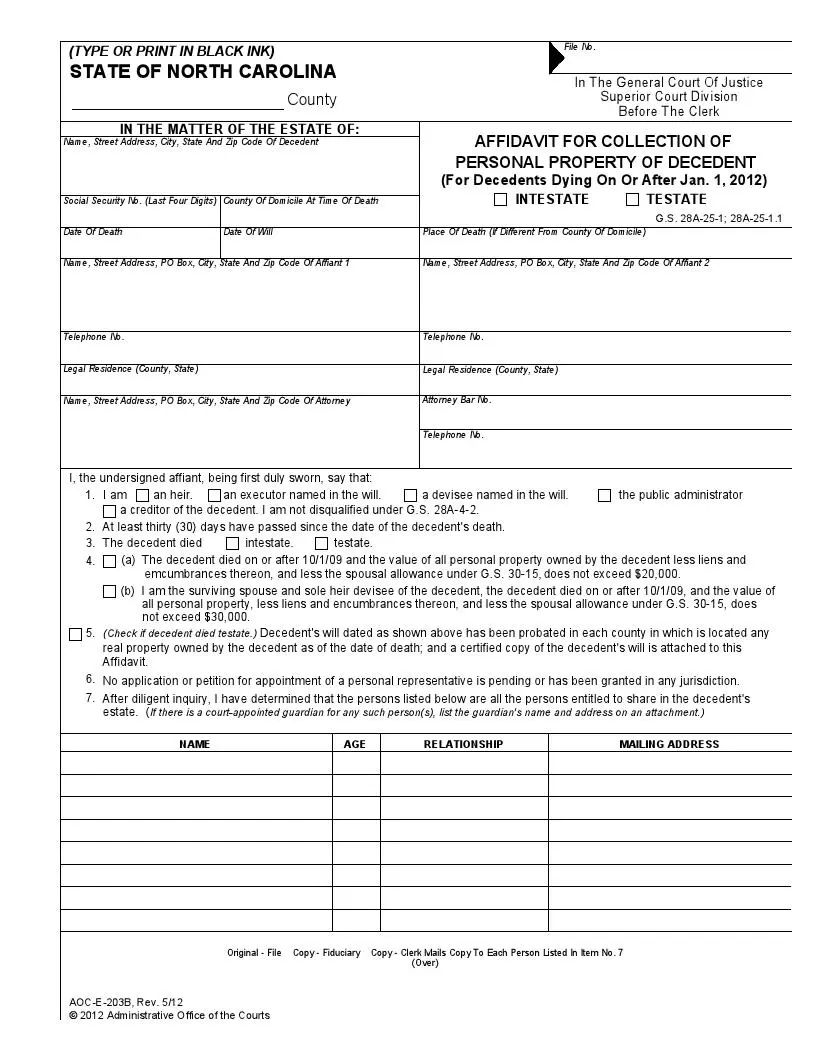

Free North Carolina Small Estate Affidavit Form Pdf Formspal

Priciest Home Sales In Locust Valley In 2020 Locust Valley Sale House Valley

Shopping For A Cause In 2020

South Carolina Vs North Carolina – Which Is The Better State Of The Carolinas

Guide To Nc Inheritance And Estate Tax Laws – Hopler Wilms Hanna

Lexisnexis Practice Guide North Carolina Estate Planning Lexisnexis Store

Does An Executor Get Paid In North Carolina How Much Carolina Family Estate Planning