Contra costa county sales tax: Contra costa county 8.75% city of antioch 9.75%.

Job Opportunities Sorted By Job Title Ascending Employment Opportunities Contra Costa Superior Court

Proposition 13, enacted in 1978, forms the basis for.

Contra costa county sales tax history. California department of tax and fee administration. The assessed market value for the current tax year is $527,104. It is used by municipalities nationwide to retrieve and manage documents.

Contra costa county, california, measure x, sales tax (november 2020) contra costa county measure x was on the ballot as a referral in contra costa county on november 3, 2020. Assessor parcel books which are annotated with additional map references. Free contra costa county property records search.

We've collated all the information you need regarding contra costa taxes. Public works records currently available via weblink include: California city and county sales and use tax rates rates effective 10/01/2018 through 03/31/2019 city rate county acampo 7.750% san joaquin.

The tax amount paid for 131 davisco drive, oakley is $6,019. 2 the city increased its existing tax of 0.50 percent (gzgt) to 1.00 percent (gztu) and extended the expiration date to. The last sale price for 131 davisco drive, oakley was $522,000.

The california constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law. Sales and use tax rates. Click here to find other recent sales tax rate changes in puerto rico.

This tax is levied in contra costa county at a rate of 10% for accommodations at facilities in the unincorporated areas of the county. A “yes” vote supported authorizing an additional sales tax of 0.5% for 20 years generating an estimated $81 million per year for essential services. To assist in the issuance and administration of the tax and revenue anticipation notes and other bond programs.

This system allows for citizen access to various public records. 1 the city increased its existing tax of 0.50 percent (cncd) to 1.00 percent (cntu) in addition to the contra costa countywide increase of 0.50 percent listed in the countywide table. County 7.25% city of williams 7.75%.

The contra costa county sales tax rate is %. This is the total of state and county sales tax rates. Proponents argued that money from the sales tax was vital to expanding public transportation and luring people out of their cars.

See detailed property tax report for 1632 zinfandel dr, contra costa county, ca. Its stated goal was to. Peruse rates information, view relief programs, make a payment, or contact one of our offices.

The 9.75% sales tax rate in richmond consists of 6% california state sales tax, 0.25% contra costa county sales tax, 1% richmond tax and 2.5% special tax. The minimum combined 2021 sales tax rate for contra costa county, california is. The california state sales tax rate is currently %.

Contra costa county sales tax: What is the assessed value of 131 davisco drive, oakley? More about contra costa county property taxes assessment history for 1150 hensley street, richmond here's the assessment & property tax history for 1150 hensley street, richmond, including the evolution of the total tax rate and corresponding property tax.

California city and county sales and use tax rates rates effective 10/01/2020 through 03/31/2021. Find contra costa county residential property records including property owners, sales & transfer history, deeds & titles, property taxes, valuations, land, zoning records & more. 1788 rows contra costa:

The contra costa county sales tax has been changed within the last year. Albany* 9.750% alameda alberhill (lake elsinore*) 7.750% : Antioch* 8.750% contra costa anza 7.750% riverside apple valley* 7.750% san bernardino applegate 7.250% placer aptos 8.500% santa cruz.

It was raised 0.5% from 8.25% to 8.75% in april 2021. To build the countywide tax roll and allocate and account for property tax apportionments and assessments for all jurisdictions in the county. You can print a 9.75% sales tax table here.

Albion 7.875% mendocino alderpoint : How much was 131 davisco drive, oakley sold for? California sales and use tax rates by county and city * operative october 1,.

The purpose of the property tax division is: For tax rates in other cities, see california sales taxes by city and county. What is the sales tax rate in contra costa county?

News Flash Contra Costa County Ca Civicengage

Contra Costa County District Attorneys Office – Home Facebook

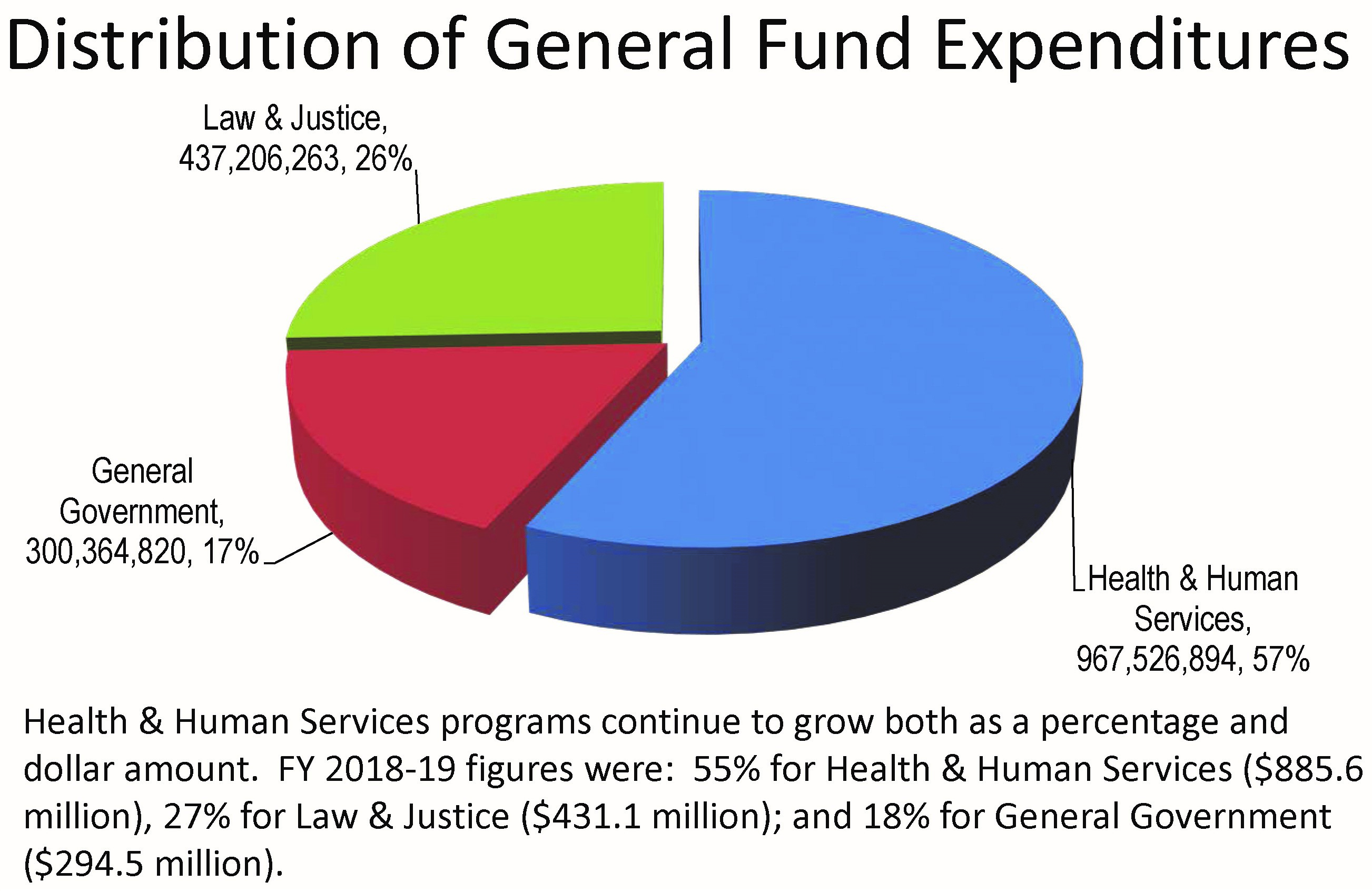

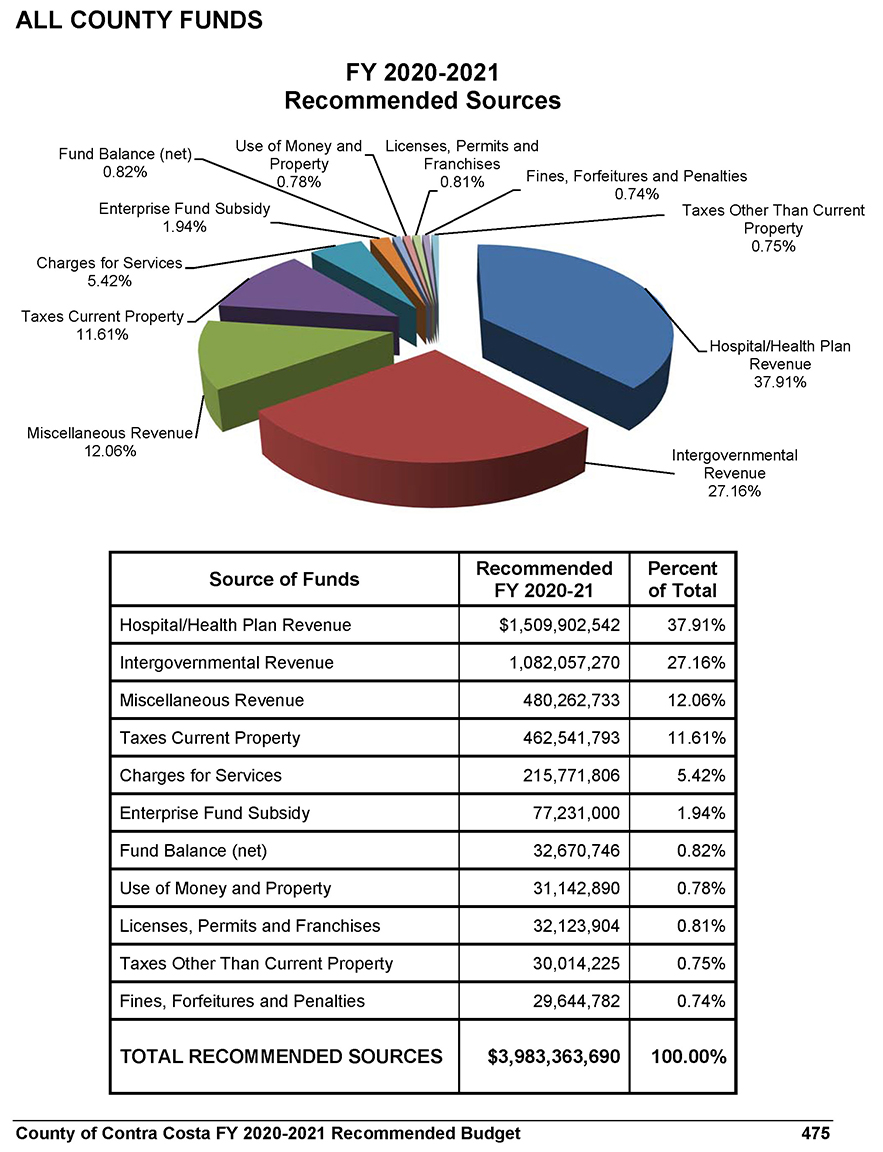

Supervisors Review Proposed 37 Billion Budget Discuss Potential New Tax Source

Contra Costa County Ca Property Data Reports And Statistics

8eissajp4xeqsm

2

2

Supervisors Review Proposed 37 Billion Budget Discuss Potential New Tax Source

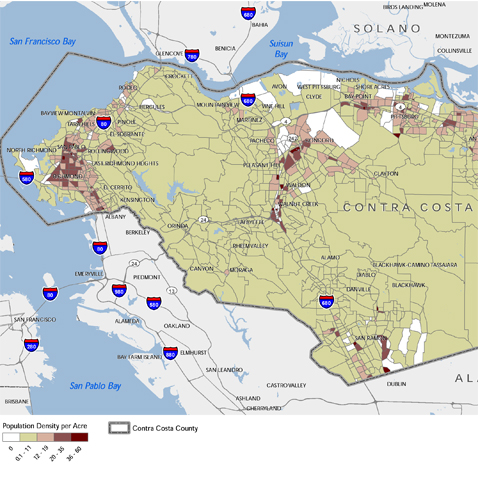

Contra Costa County Ca Dyett Bhatia

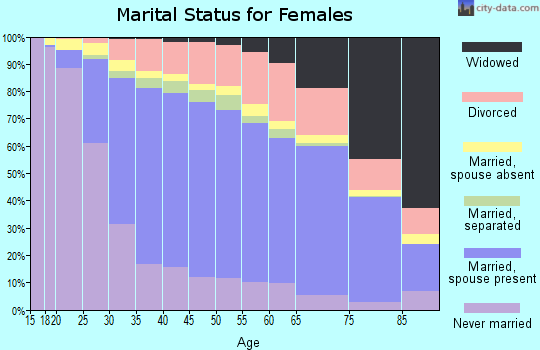

Contra Costa County California Detailed Profile – Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Contra Costa County California Detailed Profile – Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Contra Costa County Policy Protection Map – Greenbelt Alliance

2

Election Costs Rise As Contra Costa Supervisors Ok 36 Billion 2020-2021 Budget

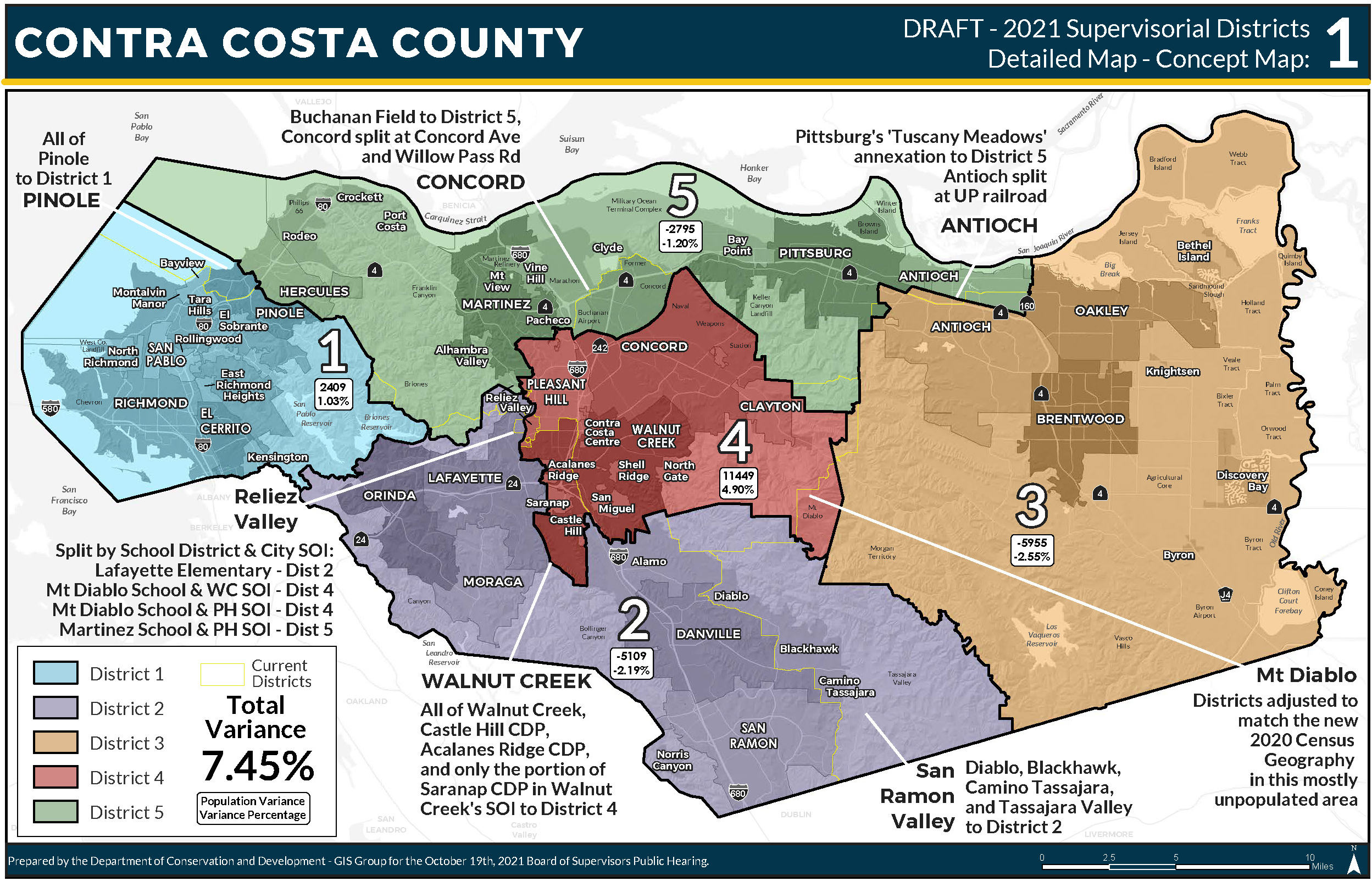

Supervisors Contra Costa Herald

Pay Property Taxes Contra Costa County – Property Walls

Supervisors Contra Costa Herald

Contra Costa County California Detailed Profile – Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Contra Costa County California Detailed Profile – Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More