If instead 10 percent of the estate had been given to charity, £100,000 in this case, the remaining inheritance would qualify for the tax rate of 36 percent. Colorado is not one of these states, so anyone who dies leaving behind property in colorado will not have to worry about estate taxes at the state level.

Do It Yourself Documents – Free Generic Last Will Testament Will And Testament Last Will And Testament Documents

In kentucky, for instance, inheritance tax must be paid on any property in the state, even if the heir lives elsewhere.

Inheritance tax rate colorado. As a matter of fact, you may have to file one or more of these returns: A state inheritance tax was enacted in colorado in 1927. The exemption amount will rise to $5.1 million in 2020, $7.1 million in 2021, $9.1 million in 2022, and is scheduled to match the federal amount in 2023.

The tax is usually assessed progressively. No estate tax or inheritance tax connecticut: The good news is that since 1980 in colorado there is no inheritance tax, and there is no us inheritance tax, but there are other taxes that can reduce inheritance.

Kentucky class c inheritance tax rate. It’s only charged on the part of your estate that’s above the threshold. But that there are still complicated tax matters you must handle once an individual passes away.

Ad an inheritance tax expert will answer you now! Inheritance tax is a tax paid by a beneficiary after receiving inheritance. Kentucky class b inheritance tax rate.

There is no inheritance tax or estate tax in colorado. How much tax do you pay on inheritance? The maximum rate of estate tax is 40 percent.

The top estate tax rate is 12 percent and is capped at $15 million (exemption threshold: That means the federal government gets to collect $1.32 million in taxes, leaving a total of $13.68 million for your heirs. The table below details historical estate tax rates.

Maryland is the only state to impose both. There is also no colorado inheritance tax or gift tax imposed under state law. Until 2005, a tax credit was allowed for federal estate taxes, called the “state death tax credit.” 2 the colorado estate tax is equal to this credit.

If the total estate asset (property, cash, etc.) is over $5,430,000, it is subject to the federal estate tax (form 706). Does colorado have an inheritance tax or estate tax? Inheritance tax and inheritance tax rates are often misunderstood.

The current state income tax rate in colorado is a flat rate of 4.63 percent. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels, as. A state inheritance tax was enacted in colorado in 1927.

Ad an inheritance tax expert will answer you now! Inheritance tax is calculated based on a tax rate applied to the amount that exceeds an exemption amount. The exemption amount will rise to $5.1 million in 2020, $7.1 million in 2021, $9.1 million.

In 2013, rate will increase to 40 percent. Colorado form 105, colorado fiduciary income tax return, is the colorado form for estate income taxes. In more simplistic terms, only 2 out of 1,000 estates will owe federal estate tax.

The maximum estate tax rate peaked at 77 percent between 1941 and 1976. Inheritance taxes when a person dies and leaves behind property, that property will typically be transferred to family member inheritors. That means the federal government gets to collect $1.32 million in taxes, leaving a total of $13.68 million for your heirs.

The standard inheritance tax rate for anything over the £325,000 threshold is 40%. What is the inheritance tax rate in colorado. This means that the tax rate gets higher as the amount exceeds the threshold.

The 2.9% state sales tax rate only applies to medical marijuana. In 1980, the state legislature replaced the inheritance tax 1 with an estate tax. Colorado also has no gift tax.

So if you’re leaving £325,000 or less, you won’t be paying an inheritance tax rate. An inheritance tax was implemented in 1927 and replaced with an estate tax in 1980. Estate tax was first levied by the federal government in 1916.

Impose estate taxes and six impose inheritance taxes. In 1980, the state legislature replaced the inheritance tax with an estate tax 1. Colorado inheritance tax and gift tax.

Who pays state inheritance tax there is no inheritance tax or estate tax in colorado. That means, regardless of what tax bracket you’re in, you’ll pay the same rate. In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

Some states might charge an inheritance tax if the decedent dies in the state even if the heir lives elsewhere. The current rate is lower than the 4.75 percent rate set in 1999, and the 5 percent rate that preceded it, according to the taxation division of colorado’s revenue department. Does colorado have an inheritance tax or estate tax?

There are no colorado inheritance tax. What is the inheritance tax rate in colorado. In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

The standard inheritance tax rate is 40%. Until 2005, a tax credit was allowed for federal estate taxes, called the “state death tax credit.” 2 the colorado estate tax is based on this credit. This really depends on the individual circumstances.

If the inheritance tax rate is 10%, and you inherit $100, you pay $10 in inheritance tax. All inheritance are exempt in the state of colorado. Between 1977 and 2012, rate declined to 35 percent.

How is inheritance tax calculated? The federal estate tax only affects.02% of estates. Twelve states and washington, d.c.

Estate tax is a tax on assets typically valued at the. There are only 6 states in the country that actually impose an inheritance tax. There is no inheritance tax in colorado.

An inheritance tax was implemented in 1927 and replaced with an estate tax in 1980.

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Compare Insurance Rates Online Life Insurance Infographic Infographicality Life Insurance Facts Life Insurance Quotes Variable Life Insurance

States With Highest And Lowest Sales Tax Rates

How To Plan Around Estate Tax Uncertainties Charles Schwab In 2021 Estate Tax Capital Gains Tax Tax

Individual Income Tax Colorado General Assembly

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Estate Tax Tax

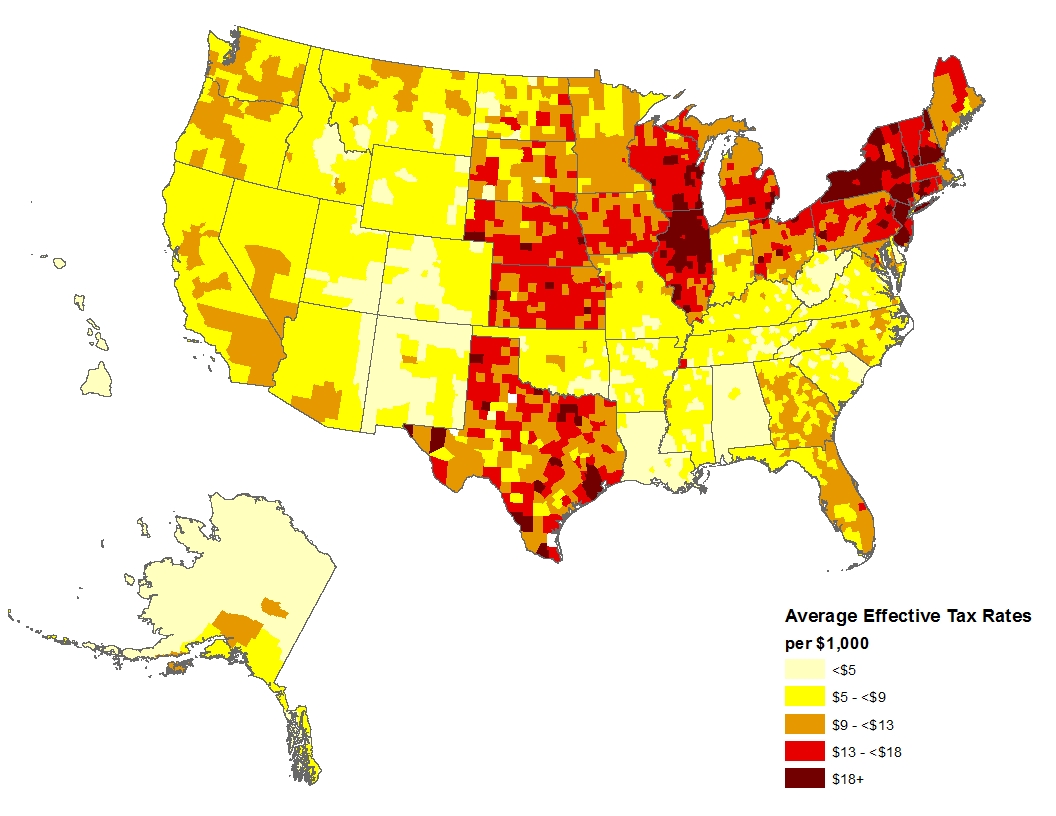

How Property Tax Rates Vary Across And Within Counties Eye On Housing

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Wyoming Tax Benefits – Jackson Hole Real Estate – Ken Gangwer

State Corporate Income Tax Rates And Brackets Tax Foundation

A New Era In Death And Estate Taxes

The States With The Highest Capital Gains Tax Rates The Motley Fool

25 Percent Corporate Income Tax Rate Details Analysis

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Property Taxes By State 2019 Eye On Housing

Car Finance Including Insurance No Deposit Ten Things You Most Likely Didnt Know About Car Finance Including Insuranc Car Finance Finance Cheap Car Insurance

Ranking State And Local Sales Taxes Tax Foundation

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute