You cannot claim political deductions on your tax return for your business. In most cases, political contributions are not considered a viable business expense and therefore are nondeductible.

Chapter 5 Taxable Income From Business Operations Mcgraw-hillirwin – Ppt Download

Again, the contributions made by donors are not tax deductible, but the entity itself pays no income taxes.

Are political contributions tax deductible for a business. No, donations to political websites are not tax deductable! You may think, are political contributions tax deductible for your business? Such donations or contributions include monetary aid granted for any political party, candidate, campaign teams, political advertising, or political action committees.

More specifically, you cannot claim any amount paid in connection with. Your business can’t deduct political contributions, donations, or payments on your tax return. Federal political contributions are donations that were made to a registered federal political party.

Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and vote in federal, state and local elections and to contribute to the campaign funds of the candidate or party of their choice are deductible by the taxpayer (under section 162(a) of the internal revenue code of 1954) provided such expenditure (classified as. While charitable donations are generally The disallowance applies to individuals for personal tax return on form 1040 and other business entities who claim business deductions on forms 1120 or 1165.

The same goes for campaign contributions. Therefore, it is wise to partner with a financial advisor or tax professional. While writing checks to a political party may not help your tax bill, there are ways to financially support a cause you believe in and still take a tax benefit in the process.

A business tax deduction is valid only for charitable donations. Political contributions are tax deductible like charitable donations, right? Political contributions are not tax deductible, though;

This contribution is eligible for deduction while computing the total income of. Even so, they are not exempted from taxes on. Your business can't deduct political contributions, donations, or payments on your tax return.

In any case, you have to pay taxes on your political donations. You can receive up to 75 percent of your first $400 of donation as credit, followed by 50 percent of any amount between $400 and $750 and 33.5 percent of amounts over $750. Most of the time, donors have big money, and they qualify to be in a millionaire group, at least.

“no corporation, domestic or foreign, shall give donations in aid of any political party or candidate or for purposes of partisan political activity.” The simple answer to whether or not political donations are tax deductible is “no.” however, there are still ways to donate, and plenty of people have been taking advantage of them over the. The maximum amount of the credit is capped

Political organizations (such as pacs) might fall under 501c(4) or under 527. Indian companies and other persons are allowed to give donations but not in cash. Individuals cannot deduct contributions made to political campaigns on their federal tax returns, regardless of whether they itemize or claim the standard deduction.

Your business can’t deduct political contributions, donations, or payments on your tax return. Supporting political leaders that back your industry can be very beneficial to your business, but you won’t be able to use your donation as a tax deduction. Moreover, under chapter 6a of the income tax act, tax deductions for political parties are allowed for salary income, business income, rental income and interest income.

However, the world of taxes can be complicated. If you’re wondering if campaign contributions are tax deductible for your business, the same rules apply. Political contributions are made to cover the expenses made by the political party mainly for election campaigns.

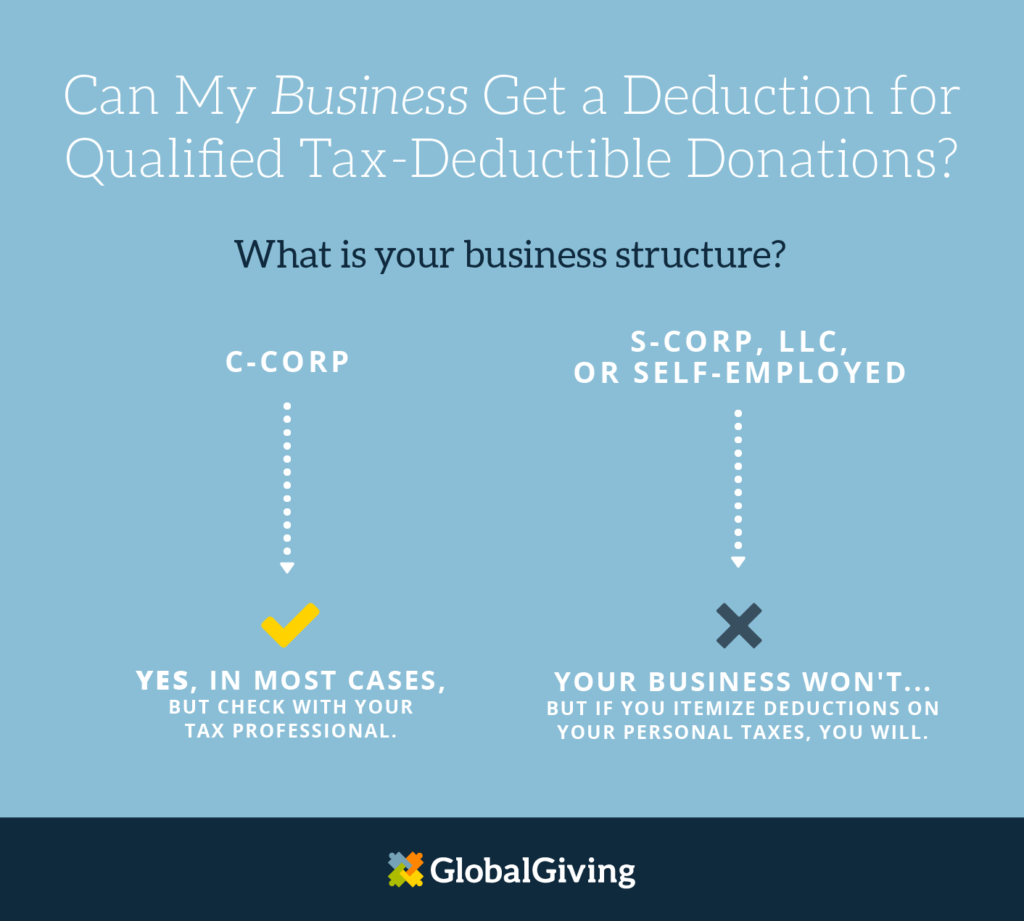

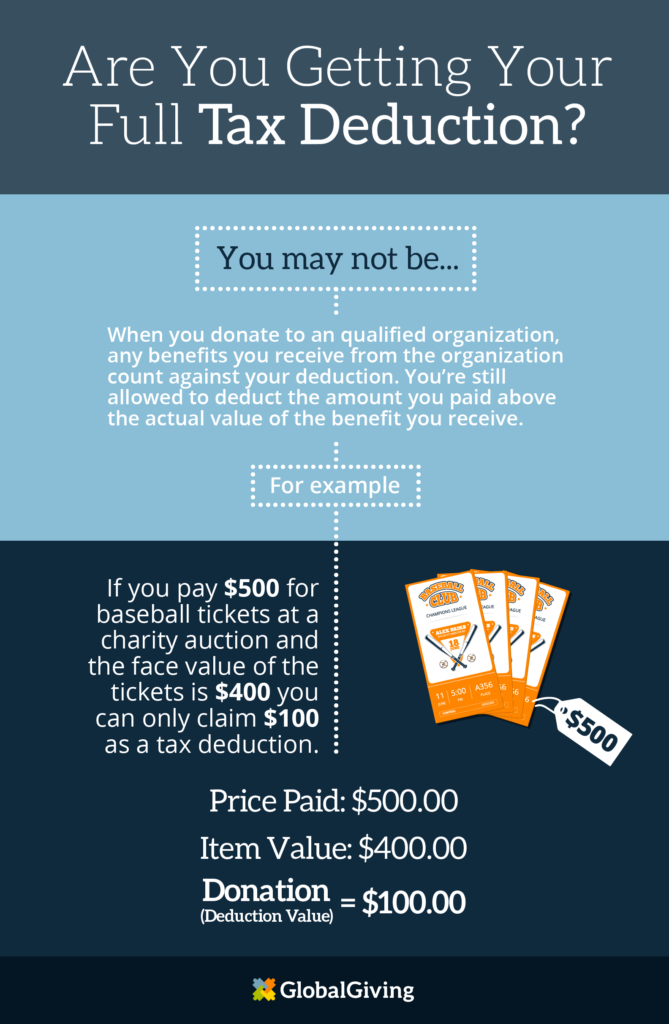

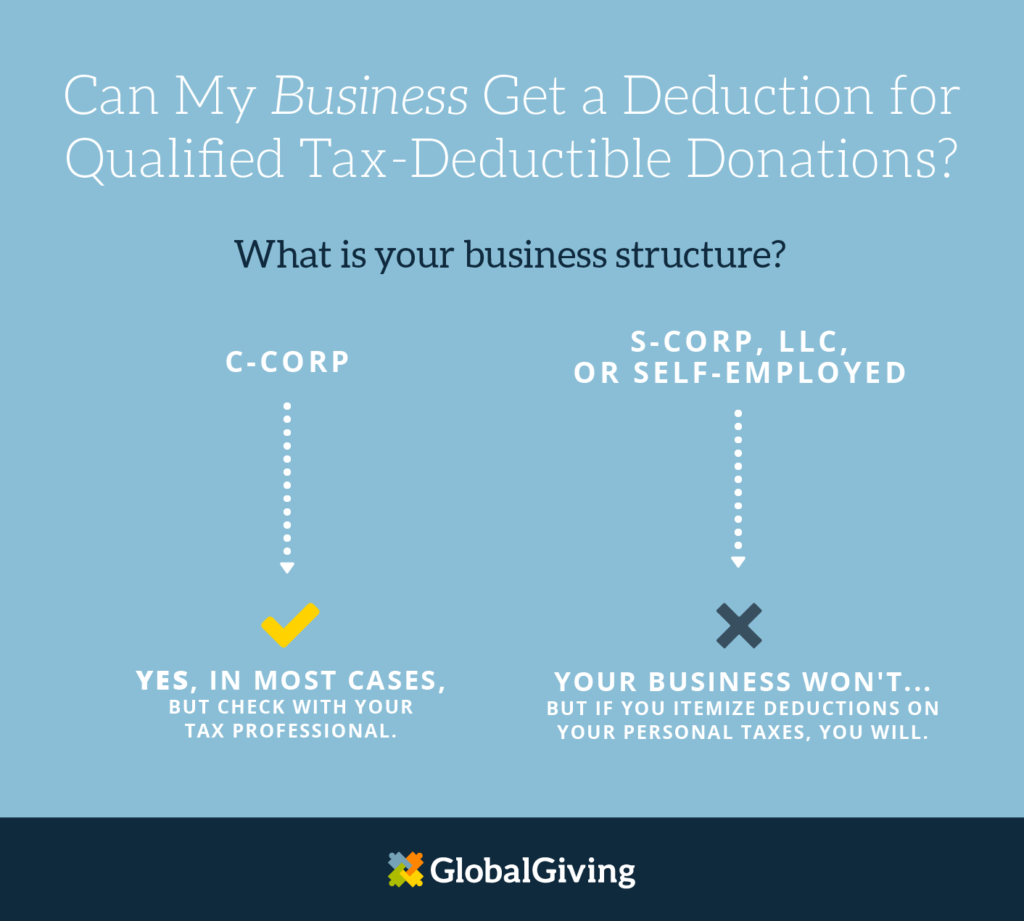

Everything You Need To Know About Your Tax-deductible Donation – Learn – Globalgiving

Can You Deduct Facebook Donations From Your Taxes Taxact Blog

Are Political Contributions Tax Deductible – Turbotax Tax Tips Videos

Deductible Or Not A Tax Guide A 1040com A File Your Taxes Online Business Tax Tax Write Offs Business Bookeeping

Pin On Email For President 2016

Are Campaign Contributions Tax Deductible

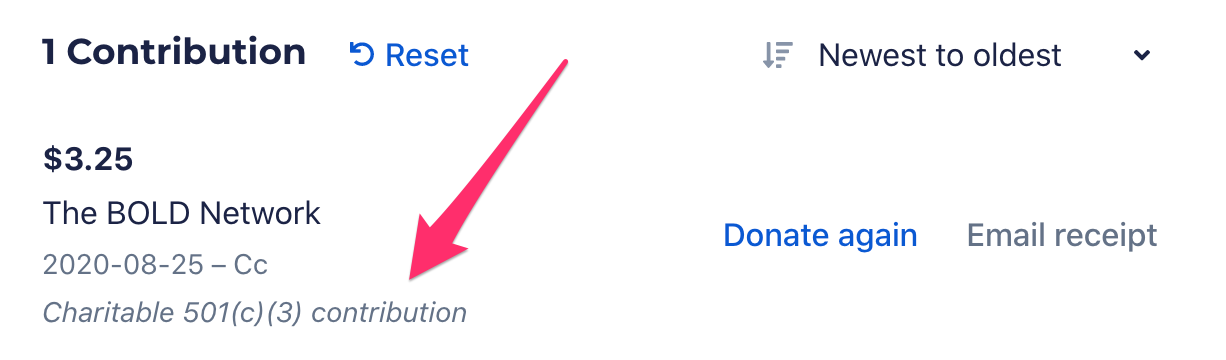

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible Anedot

Canadian Personal Tax Organizer In 2021 Tax Organization Tax Checklist Tax Return

Are Political Contributions Tax Deductible Anedot

Are Political Contributions Tax Deductible Hr Block

Everything You Need To Know About Your Tax-deductible Donation – Learn – Globalgiving

Are Political Donations Tax Deductible Credit Karma Tax

Are Your Political Contributions Tax Deductible Taxact Blog

Are Political Contributions Tax-deductible Personal Capital

Federal And California Political Donation Limitations – Seiler Llp

Limits And Tax Treatment Of Political Contributions – Spencer Law Firm

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible Hr Block