Learn about pennsylvania tax rates, rankings and more. Elk county was approached by statewide tax recovery, inc.

Grove City Tax Office

Beginning in 2020, these two taxes will be included on one bill which will be mailed to each.

Per capita tax in pa. The york adams tax bureau (yatb) has been chosen by adams county to collect both the earned income tax and local services tax from residents for both. $14.70 if paid in august or september; Is this tax withheld by my employer?

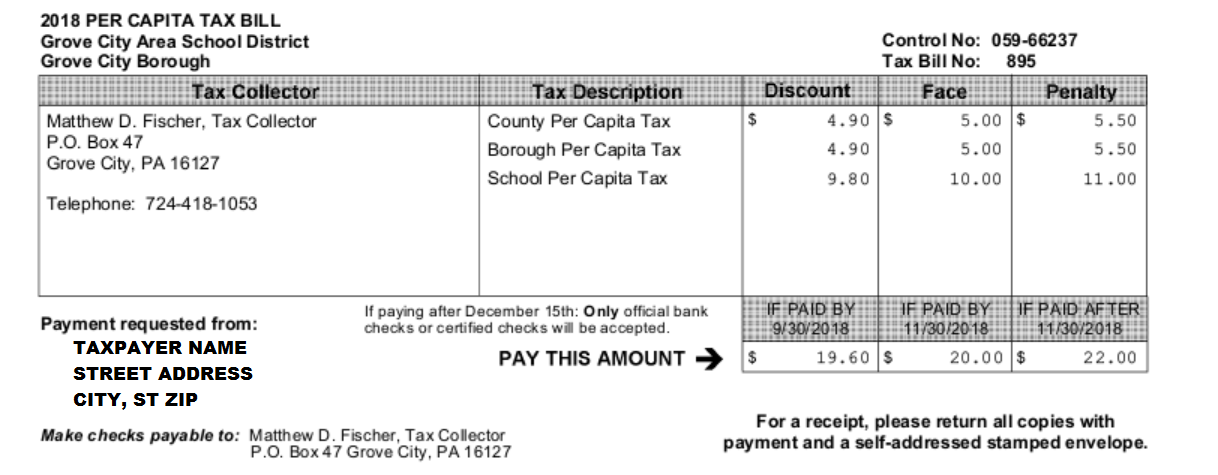

County per capita taxes are based on a calendar year from january 1 thru december 31 of the current year. If you pay your bill on or before the discount date in september, you receive a 3% discount. This tax has no connection with employment, income, voting rights or any other factor except residence with arnold city limits.

The school district as well as the township or borough in which you reside may levy a. Ordinance is to continue said per capita tax of $5.00 for the year 1978 and thereafter to broaden the scope of said tax effective with the year 1979 so as to include all residents or inhabitants of the borough over the age of eighteen (18) Seigworth said some of the ideas kicked around at the meeting included a dedicated municipal tax millage or even per capita fees.

Explore data on pennsylvania's income tax, sales tax, gas tax, property tax, and business taxes. “per capita” means “by head,” so this tax is commonly called a head tax. A $10 fee would generate $372,470.

Normally, the per capita tax is not withheld by your employer. Per capita is a tax collected for each adult individual 18 years and older within arnold's taxing district. A proportional tax levied on the transfer price of real property within the taxing district.

$15.00 if paid in october or november; Exoneration from tax is applicable to the current tax year only. What is the per capita tax?

Wage tax forms should be mailed to: Per capita tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. Information about per capita taxes.

Do i pay this tax if i rent? It is not dependent upon employment. What is a per capita tax:

Per capita tax exemption form. The application form may be used by a pa taxpayer whose community has adopted one or more tax exemptions. A $5 per capita fee dedicated to ems/fire protection would generate $186,205.

A flat rate and/or proportional tax levied on the occupation of persons residing within the taxing district. Today’s state tax map shows state and local tax collections per capita in each of the 50 states and the district of columbia. Per capita tax is a tax levied by a taxing authority to everyone 18 years of age and older residing in their jurisdiction.

The municipal tax is $5.00 and the school tax is $10.00 these taxes are due on an annual basis. A flat rate tax levied on each adult resident within the taxing district. A per capita tax is a flat rate tax equally levied on all adult residents within a taxing district.

If you pay after the face amount due date in november, a 10% penalty is. If i pay this late is there a penalty applied? In 2017 to form a contractual.

Clarion county's population, according to the 2020 census, is 37,241. Per capita tax we collect for: Whether you rent or own, if you reside within a taxing district, you are liable to pay this tax to the district.

Is five dollars per individual, while per capita tax for greater latrobe school district is ten dollars per individual. Per capita bills are mailed on march 1 st of every year to all individuals, over 18 years of age, in the county and are able to be paid to the tax collector up until december 31 st of the year in which they were billed. Forms can be picked up at the city of corry or the corry area school district and must be submitted by september 1st to the corry area school district administration office attn:

In the past, delinquent per capita taxes were difficult to collect as people move, etc. Per capita tax for unity twp. Per capita tax roll pa state law requires counties to maintain a personal/per capita tax roll that lists all individuals by their job title, occupation, and assessment.

Per capita exemption requests can be submitted online. “per capita” means “by head,” so this tax is commonly called a head tax. The list must also include persons who are retired, unemployed or persons not currently working.

The wilson borough per capita tax is mailed the beginning of each new year. A combined per capita tax is billed on august 1 of each year. Per capita means by the head so it is a tax commonly called a head tax.

Real estate or per capita tax questions should be directed to: The arnold per capita tax is $20 with.

Indonesia Average Monthly Expenditure Per Capita Economic Indicators Ceic

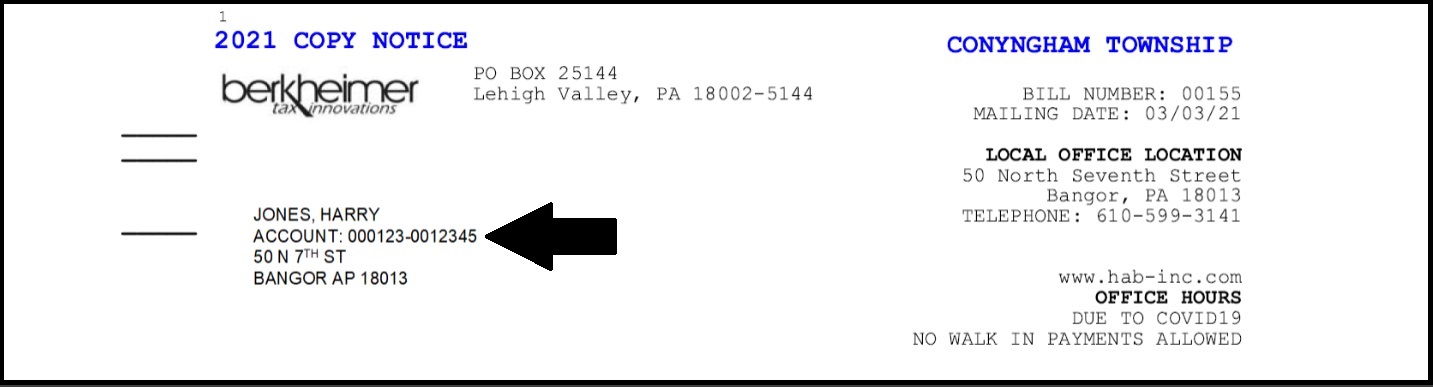

Online Payments Berkheimer

Indonesia Average Monthly Expenditure Per Capita Clothing Footwear And Headgear Ready Made Clothes For Woman Economic Indicators Ceic

Argentina Gdp Per Capita 1962 2021 Ceic Data

The Poorest Countries In The World Emit Around 01 Tonnes Of Co₂ Per Person In One Year France Emits 5 Greenhouse Gases Greenhouse Gas Emissions Emissions

Azerbaijan Gdp Per Capita 1990 2021 Ceic Data

Real Estate And Per Capita Tax Wilson School District Berks County Pa

Taxes Amity Township

Per Capita Tax Exemption Form – Keystone Collections Group

Information About Per Capita Taxes – York Adams Tax Bureau

Pennsylvania – Per Capita Personal Income 2020 Statista

State Local Property Tax Collections Per Capita Tax Foundation

Per Capita Tax Exemption Form – Keystone Collections Group

Sweden Gdp Per Capita 1957 2021 Ceic Data

Hungary Gdp Per Capita 1991 2021 Ceic Data

Maptitude Mapping Software Map Infographic Of Turkeys Raised By State Map Mapping Software Infographic

Singapore Gdp Per Capita 1960 2021 Ceic Data

14 Monetary Fiscal Policies N N N N

There Was A Time When Reading Pa Had More Millionares Per Capita Than Any City Is The Us As Is Evident By This Monument Lion Sculpture Monument Hometown