Taxes capital gains as income and the rate reaches 5.75%. The idaho income tax has seven tax brackets, with a maximum marginal income tax of 6.92% as of 2021.

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Idaho does have a deduction of up to 60% of the capital gain net income of qualifying idaho property.

Does idaho have capital gains tax. Below, we have highlighted a number of tax rates, ranks, and measures detailing idaho’s income tax, business tax, sales tax, and property tax systems. Tax rates are the same for every. In 2020 the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year.

Since its highest income tax rate is 6.9%, its highest capital gains tax rate is 4.9%. Additional state capital gains tax information for idaho. On the federal level, the capital gains tax rates are as follows:

States also have an additional tax rate between 2.90% and 13.30%. Taxes capital gains as income and the rate reaches 6.6%. However, certain types of capital gains qualify for a deduction.

Idaho axes capital gains as income. For married individuals with earnings between $78,751 and $434,549, the capital gains tax rate is 15%. Another tax you’ll need to be aware of is a real estate transfer tax.

Each state’s tax code is a multifaceted system with many moving parts, and idaho is no exception. (1) if an individual taxpayer reports capital gain net income in determining idaho taxable income, eighty percent (80%) in taxable year 2001 and sixty percent (60%) in taxable years thereafter of the capital gain net income from the sale or exchange of qualified property shall be a deduction in determining idaho taxable income. In addition to paying capital gains tax at the federal levels, a majority of u.s.

The percentage is between 1.6% and 7.8% depending on the actual capital gain. In addition, while some states do charge capital gains tax on real estate, luckily idaho is not one of them. Detailed idaho state income tax rates and brackets are available on.

Capital gains are taxed as regular income in idaho, and subject to the personal income tax rates outlined above. The state of idaho charges a capital gains tax when individuals sell investments that have appreciated in value. The combined rate accounts for federal, state, and local tax rate on capital gains income, the 3.8 percent surtax on capital gains and the marginal effect of pease limitations (which results in a tax rate increase of 1.18 percent).

Capital gains tax is the tax that you pay on those capital gains. If you sold your home for $500,000 you would not pay capital gains taxes on the entire $500,000. Capital gains tax rates on most assets held for less than a year correspond to ordinary.

Taxpayers with adjusted gross incomes above $250,000 (filing jointly) or $200,000 (filing individually) may be subject to an additional 3.8% medicare tax on investment income as a result of. For married individuals with earnings of $78,750 or less, the capital gains tax rate is 0%. However, the state does not charge this capital gains tax on the “sale” of traditional currency, no matter how much it might have inflated.

Capital gains for farms is complicated. Taxes capital gains as income and the rate is a flat rate of 3.23%. “capital gain net income” is the amount left over when you reduce your gains by your losses from selling or exchanging capital.

Al, ar, de, hi, in, ia,. General information use form cg to compute an individual’s idaho capital gains deduction. For tax year 2001 only, the deduction was increased to 80% of.

Many home sellers don’t have to report the sale to the irs. Many real estate investors are unsure if they can use a 1031 exchange when selling property in one state and purchasing another in a different state. How much are real estate transfer taxes in idaho (and who pays them)?

The capital gains rate for idaho is: Idaho does not have a special tax rate for gains and losses on stocks, bonds, or other intangibles. Period requirement for capital gains purposes.

Montana taxes capital gains as income, but it has a 2% capital gains credit. The time in which you owned your idaho house is going to play a role in the type of idaho capital gains tax you could end up being responsible for. 52 rows ak, fl, nv, nh, sd, tn, tx, wa, and wy have no state capital gains tax.

You would only pay the tax on the profit on your home, if it’s above a specific amount. Because this is a farm, it is impossible forme to figure the actual exact tax rate for this sale. Fortunately, for all the investors out there, moving markets is not an issue when it comes to 1031 exchanges.

The first step towards understanding idaho’s tax code is knowing the basics. The deduction is 60% of the capital gain net income included in federal taxable income from the sale of idaho property. Rsaveeal property that is held for at least one year is eligible for a deduction of 60% of the net capital income (that is the net gain after expenses).

Taxes capital gains as income and the rate is a flat rate of 4.95%. Idaho does have a deduction of up to 60% of the capital gain net income of qualifying idaho property.

Jvzoo Marketplace Motivation Entrepreneur Melbourne

Capital Gains Tax Idaho Can You Avoid It Selling A Home

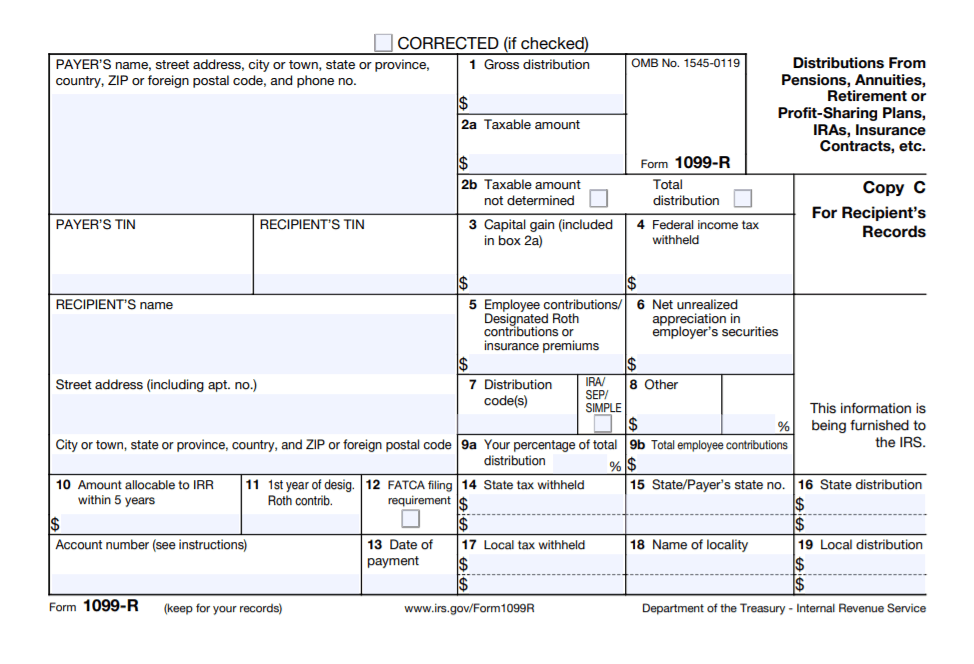

Taxes 1099-r Public Employee Retirement System Of Idaho

Would You Like To Know What Your Business Is Worth The Rural Alberta Business Centre In Hanna Can Help Together Business Valuation Business Advisor Business

Types Of Accounts Accounting Notes Accounting Golden Rule

Idaho Property Taxes Everything You Need To Know

Idaho Tax Forms And Instructions For 2020 Form 40

The Ultimate Guide To Idaho Real Estate Taxes

Sold In Heron River Residential Real Estate Selling House Real Estate

Capital Gains Tax Idaho Can You Avoid It Selling A Home

What Are Capital Gains What Is Capital Capital Gain Finance Investing

State Labor Force Changes And The Need For A Flexible Labor Market Labour Market Forced Labor Marketing

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Investing In Real Estate What You Ought To Know Capital Gain Capital Gains Tax Angel Investors

Idaho Retirement Tax Friendliness Retirement Calculator Property Tax Investing

Historical Idaho Tax Policy Information – Ballotpedia

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Idaho Income Tax Calculator – Smartasset

Reasons Why Having Good Credit Is Important For Modern Living Money Life Hacks National Insurance Good Credit