The calculator will estimate potential capital gains taxes. The amount withheld can be 2, 3, even 10 times more than justified.

You May Be Feeling A Little Antsy Right Now And Converting Your Garage Into A Home Gym Rec Room Or Man Cave Mig Rec Room Hawaii Real Estate Home Improvement

How much these gains are taxed depends a lot on how long you held the asset before selling.

Hawaii capital gains tax calculator. Our calculator has been specially developed in order to provide the users of the calculator with not only how. Interest payment exemption and capital gains oecd (2010), tax policy reform and economic growth, oecd publishing, paris. House members take their oaths of.

The capital gains tax calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Calculate the capital gains tax on a sale of real estate property, equipment, stock, mutual fund, or bonds. If you have owned the investment for 12.

Hawaii's maximum marginal income tax rate is the 1st highest in the united states, ranking directly. Investors must pay capital gains taxes on the income they make as a profit from selling investments or assets. That means you pay the same tax rates you pay on federal income tax.

This capital gains calculator estimates the tax impact of selling your.show more instructions. Ad a tax expert will answer you now! The current top capital gains tax rate is 7.25%, which critics point out is a lower tax rate than many hawaii residents pay on their wages and salaries.

Aka harpta, hawaii real property tax act is a state taxation law for property. Additional state capital gains tax information for hawaii. In 2020 the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year.

You will receive 25% of the sales price. Use this tool to estimate capital gains taxes you may owe after selling an investment property. Long term capital gains tax brackets (for 2021) it should also be noted that taxpayers whose adjusted gross income is in excess of $200,000 (single filers or heads of household) or $250,000 (joint filers) may be subject to an additional 3.8% tax as a net investment income tax.

Capital gains tax calculator & real estate 1031 exchange. You pay £127 at 10% tax rate for the next £1,270 of your capital gains. Like the federal income tax, hawaii's income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

Use this calculator to estimate your income tax liability along with average and marginal tax rates. Our capital gains tax calculator determines the total tax that you will have to pay on the profit or capital gain you earned from selling an asset. In order to insure collection of this tax (and any other taxes you owe may owe the state).

Capital gains tax (cgt) breakdown. Please enter your figures in the fields provided (enter your numbers with no commas or dollar signs, for example: A 25% commission, not 7%, must be paid on the sale price.

You are able to use our hawaii state tax calculator to calculate your total tax costs in the tax year 2021/22. You pay £1,286 at 20% tax rate on the remaining £6,430 of your capital gains These calculations show the approximate capital gain taxes deferred by performing an irc section 1031.

745 fort street, suite 1614. 2021 capital gains tax calculator. Get unlimited capital gain and loss questions answered

Under hawaii state law, seven percent is withheld. Use this calculator to estimate your capital gains tax. Property taxes in hawaii hawaii is one of the 14 states in the united states where property taxes are not

Referring to the table showing capital gains tax rates for 2020, if you are a single filer, you won’t be liable to pay any capital gains tax if your total taxable income is $40,000 or below. In your case where capital gains from shares were £20,000 and your total annual earnings were £69,000: Hawaii taxes capital gains at a maximum rate of 7.25%.

Since 2018, the rate is 7.5% (up from 5%). You pay no cgt on the first £12,300 that you make. Hawaii collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets.

The realized gains amounted to 25%. 300000) and click on the calculate button in each area to perform the calculations. Our calculator has recently been updated to include both the latest federal tax rates, along with the latest state tax rates.

Capital Gains Tax Calculator 2021 Casaplorer

Essential House Hunting Tips Home Buying Tips Real Estate Humor House Hunting

Silver Bar 50 Grams Silver Coins For Sale Gold Bar Buy Gold And Silver

13 Million Homes In Virginia Wisconsin And Oklahoma In 2021 Prairie Style Houses Colonial Revival House Real Estate

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

Img 3624 Departemen Teknik Mesin

A Refined Modern Estate Luxury Mansions For Sale Luxury Real Estate Agent Luxury Real Estate

California Capital Gains Tax Rate 2021 – Capital Gains Tax Rate 2021

States With Highest And Lowest Sales Tax Rates

The States With The Highest Capital Gains Tax Rates The Motley Fool

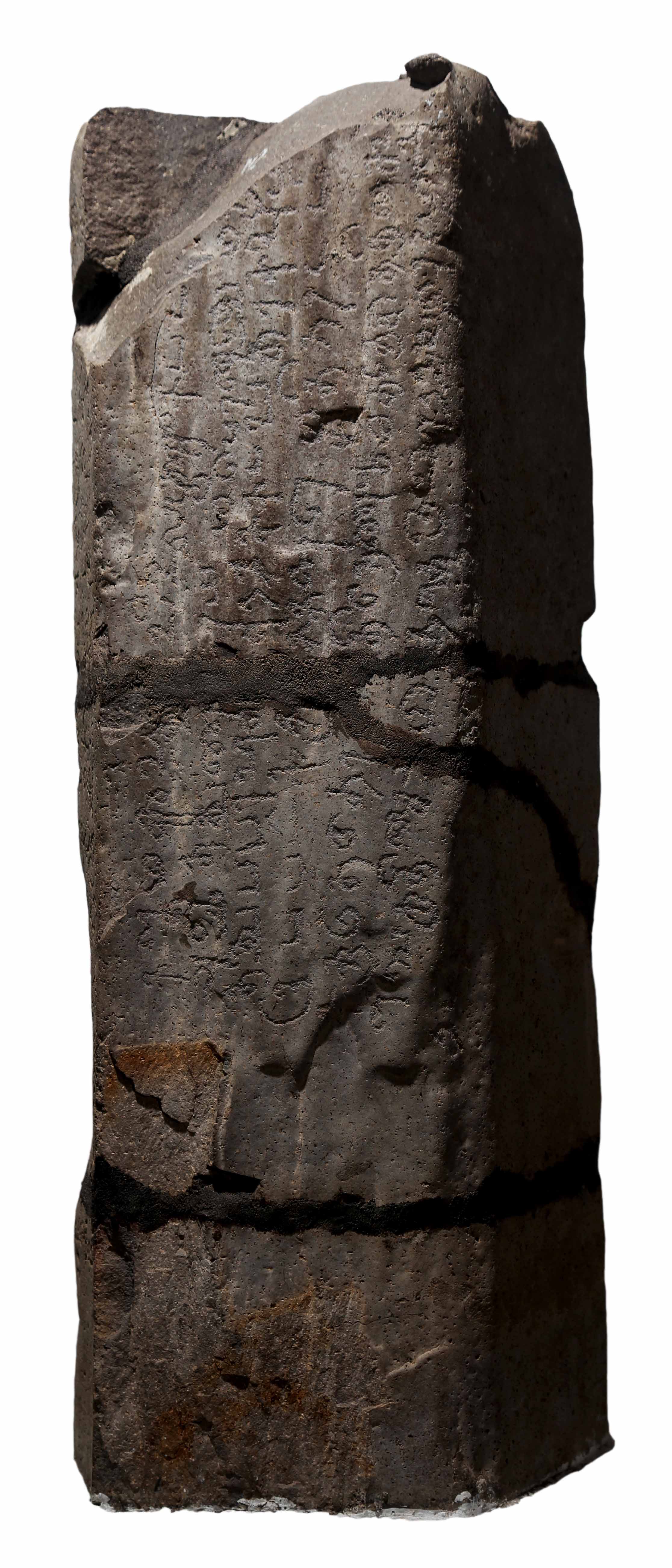

Prasasti Lobu Tua – Museum Nasional Lobu Tuo Tamil

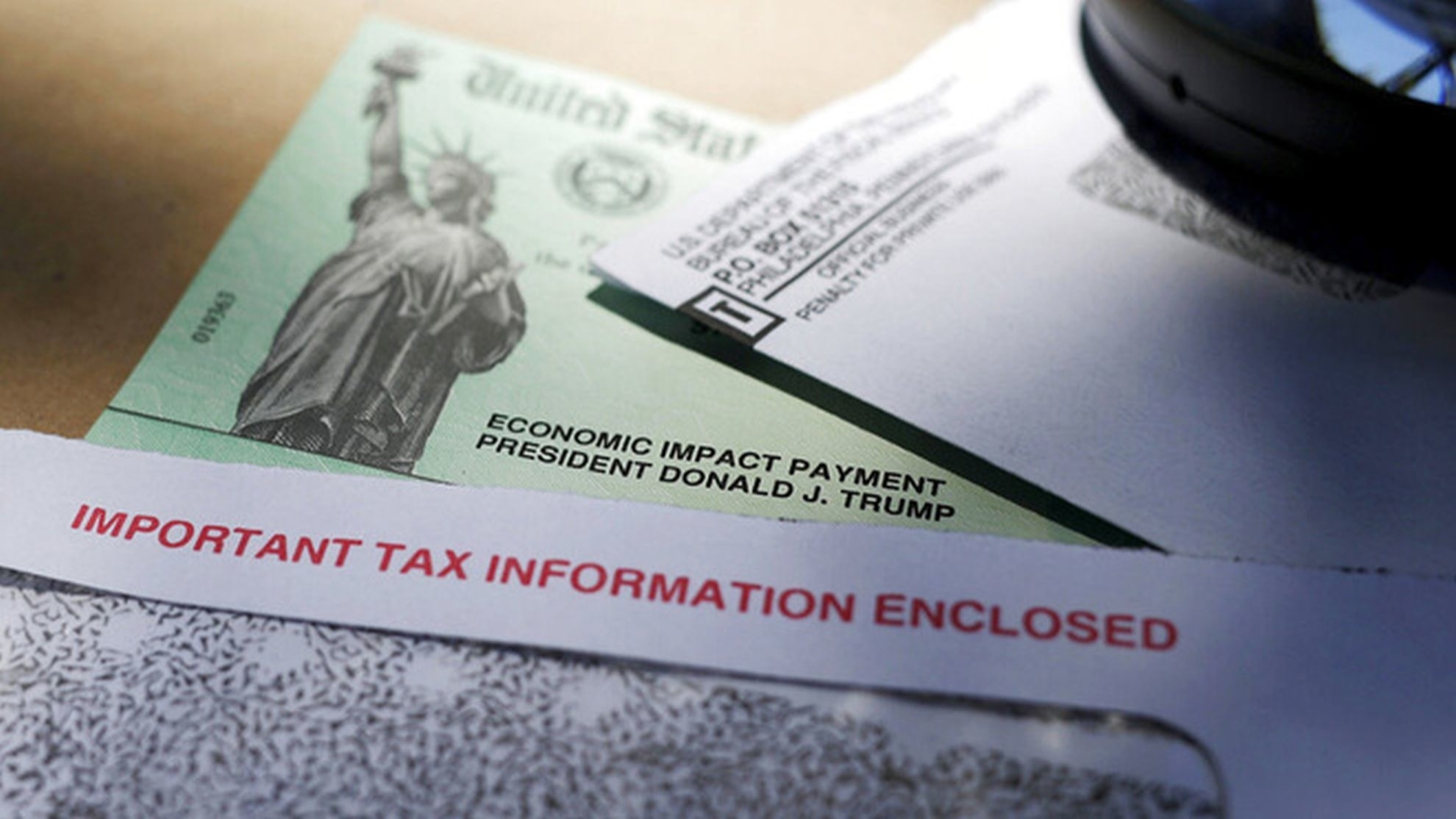

Capital Gains Tax Estimator Hawaii Financial Advisors Inc

Keindahan Air Terjun Kalipedati Bikin Pengunjung Serasa Di Alam Lain Portal Bromo

Arca Nandi – Museum Nasional

Venezuela Supplies 100000 Barrels Of Petroleum To Cuba Each Day On Preferential Terms Cuba Has Paid For This By Sending Cuban Perso Cuban Economy Crude

Its Time For A New Backpack Emt Blog Pets Emt Medical Symbols

The 10 Best States For Retirees When It Comes To Taxes Retirement Locations Retirement Retirement Advice