Income tax deducted if you receive employment income or any other type of income, your employer or payer will deduct income tax at source from the amount paid. Your employer or payer will calculate how much income tax to deduct by referring to your total claim amount on form td1 , personal tax credits return and using approved calculation methods.

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

Medicare tax is levied on all of your earnings, with no upper income threshold or limit.

How much tax is deducted from a paycheck in missouri. If you have a salary, an hourly job, or collect a pension, the tax withholding estimator is for you. In 2020, the threshold for federal estate tax is $11.58 million, a slight increase from 2019 when the threshold was $11.4 million. Yes, missouri residents are subject to state personal income tax as well as local income tax in some counties.

The standard deduction dollar amount is $12,550 for single households and $25,100 for married couples filing jointly for the tax year 2021. Fiscal year filers must file no later than the 15th day of the fourth month following the close of their taxable year. Luckily, when you file your taxes, there is a deduction that allows you to deduct the half of the fica taxes that your employer would typically pay.

The due date for the 2020 missouri individual income tax return is extended from april 15, 2021 to may 17, 2021. For employees who more than $200,000 per year, you’ll need to withhold an additional medicare tax of 0.9%, which brings the total employee medicare withholding above $200,000 to 2.35%. Use the tax withholding estimator

There are paycheck calculators to help you determine how much your paycheck will be after deductions and to help you decide how much you should have deducted to cover taxes. The social security tax is 6.2 percent of your total pay until you reach an annual income threshold. The percentage rate for the medicare tax is 1.45 percent, although congress can change it.

Exit and check step 2 box otherwise fill out this form. Yes, missouri has a progressive state personal income tax system as well as local county taxes. Your employer sends the money withheld to the irs and the department.

This notice requirement does not apply if an employee is asked to work fewer hours or changes to a different position with different duties. Taxpayers can choose either itemized deductions or the standard deduction, but usually choose whichever results in a higher deduction, and therefore lower tax payable. Your employer withholds 1.45% of your gross income from your paycheck.

Age is not a factor when determining whether a person has to pay income tax or not. Employers can use the calculator rather than manually looking up withholding tax in. You'll be able to take a credit on your home state.

If you are an employee, tax withholding is the amount of federal income tax that is deducted from your paycheck each pay period. Your employer pays an additional 1.45%, the employer part of the medicare tax. If a teenager receives money from an employed position, income tax will be deducted from their paycheck.

Your home state of mo can tax all your income, regardless of where you earned it. Fica taxes (% of employee gross pay) employee pays: There are no income limits for medicare tax, so all covered wages are subject to medicare tax.

All that matters—from the standpoint of the internal revenue service (irs)—is whether you earn an income. The missouri hourly paycheck calculator will show you the amount of tax that will be withheld from your paycheck. The missouri department of revenue online withholding tax calculator is provided as a service for employees, employers, and tax professionals.

Do missouri residents pay personal income tax? Any company or corporation violating this requirement shall pay each. Does missouri have state and local income tax?

This new threshold was part of the tax cuts and jobs act which went into effect on january 1, 2018. If you have a household with two jobs and both pay about the same click this button and exit. Employers also must match this tax.

Medicare taxes, unlike social security tax, go to pay for expenditures for current medicare beneficiaries. Learn how to fill out a w4 form before you begin a new job, so you can make sure the correct amount of money is deducted from each paycheck. 1.45% 1.45% additional medicare tax 0.9% on gross pay over $200,000:

Census bureau) number of cities that have local income taxes: Social security tax and medicare tax are two federal taxes deducted from your paycheck. The result is that the fica taxes you pay are still only 6.2% for social security and 1.45% for medicare.

Social security tax 12.4% (up to annual maximum) 6.2% 6.2% medicare tax 2.9% up to $200,000: Your income is taxable by both states. Amount taken out of an average biweekly paycheck:

For medicare tax, withhold 1.45% of each employee’s taxable wages until they have earned $200,000 in a given calendar year. Employers also must match this tax. Learn more about the extension.

Median household income $57,409 (u.s. If your household has only one job then just click exit.

How Much Tax Is Taken Out Of My Paycheck Indiana – Tax Walls

Employer Payroll Tax Calculator Gusto

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Payroll Software Solution For Missouri Small Business

Free Missouri Payroll Calculator 2021 Mo Tax Rates Onpay

Payroll Software Solution For Missouri Small Business

Missouri Paycheck Calculator – Smartasset

Payroll Taxes Explained – Cashay

Tax Withholding For Pensions And Social Security Sensible Money

How To Do Payroll In Missouri

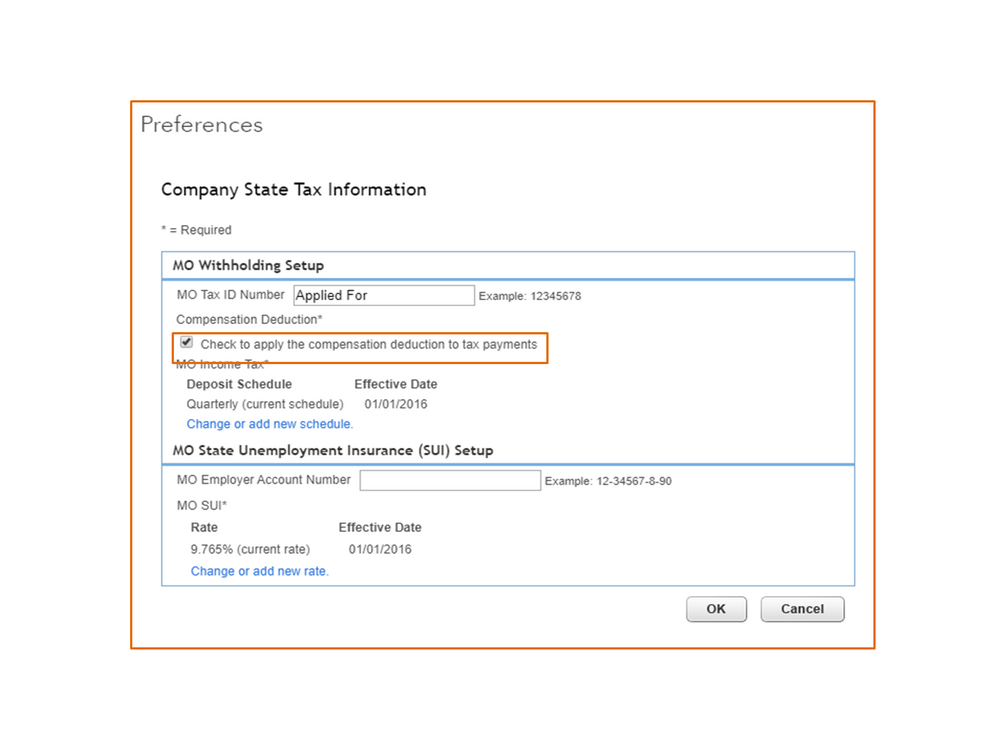

Missouri Withholding Tax Compensation Deduction

An Easier Way To Get The Right Tax Withheld From Your Paycheck This Year

Missouri Withholding Tax Compensation Deduction

Paycheck Calculator – Take Home Pay Calculator

Missouri Paycheck Calculator – Smartasset

Form 4282 Employers Tax Guide – Missouri Department Of Revenue

Payroll Software Solution For Missouri Small Business

Payroll Software Solution For Missouri Small Business

Missouri Income Tax Rate And Brackets Hr Block