The city of bethlehem imposes an amusement tax on all events with a capacity of 200 or more attendees which charge more than $10.00 per ticket/admission. If i pay this late is there a penalty applied?

List Of Pennsylvania Counties By Per Capita Income – Wikipedia

A flat rate and/or proportional tax levied on the occupation of persons residing within the taxing district.

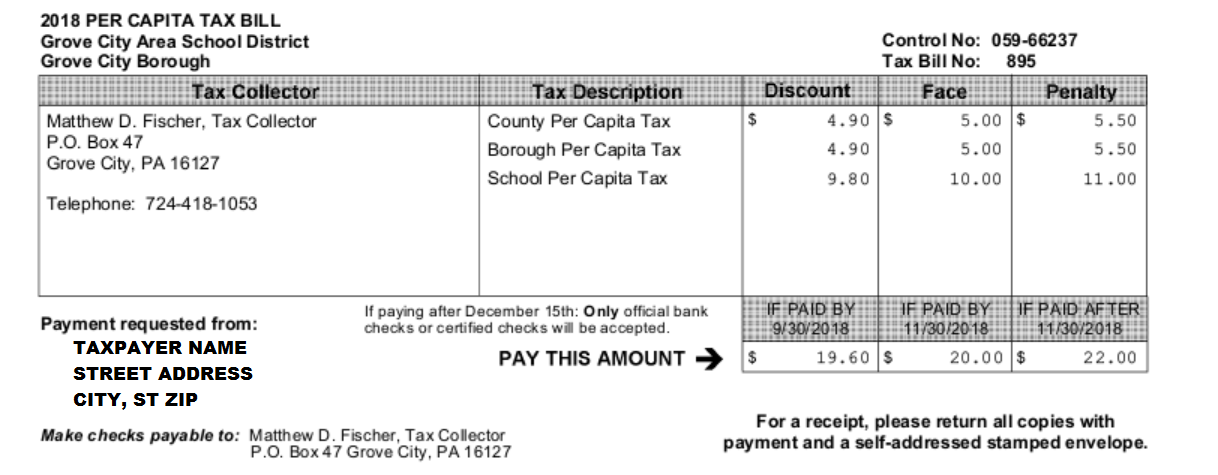

Per capita tax bethlehem pa. In addition amusement event holders must obtain a permit to hold events. A $5 per capita fee dedicated to ems/fire protection would generate $186,205. Northampton area school district per capita & real estate taxes are collected by:

Ad a tax advisor will answer you now! A full time student as of july 1 of the tax year. A flat rate tax levied on each adult resident within the taxing district.

Box 519 irwin, pa 15642 irwin, pa 15642 all tax bills and payments must be postmarked on or before the dates shown above. The borough tax collector is responsible for the collection of real estate and per capita taxes. A $10 fee would generate $372,470.

The application form may be used by a pa taxpayer whose community has adopted one or more tax exemptions. (02) bethlehem area school district municipality: School district real estate tax.

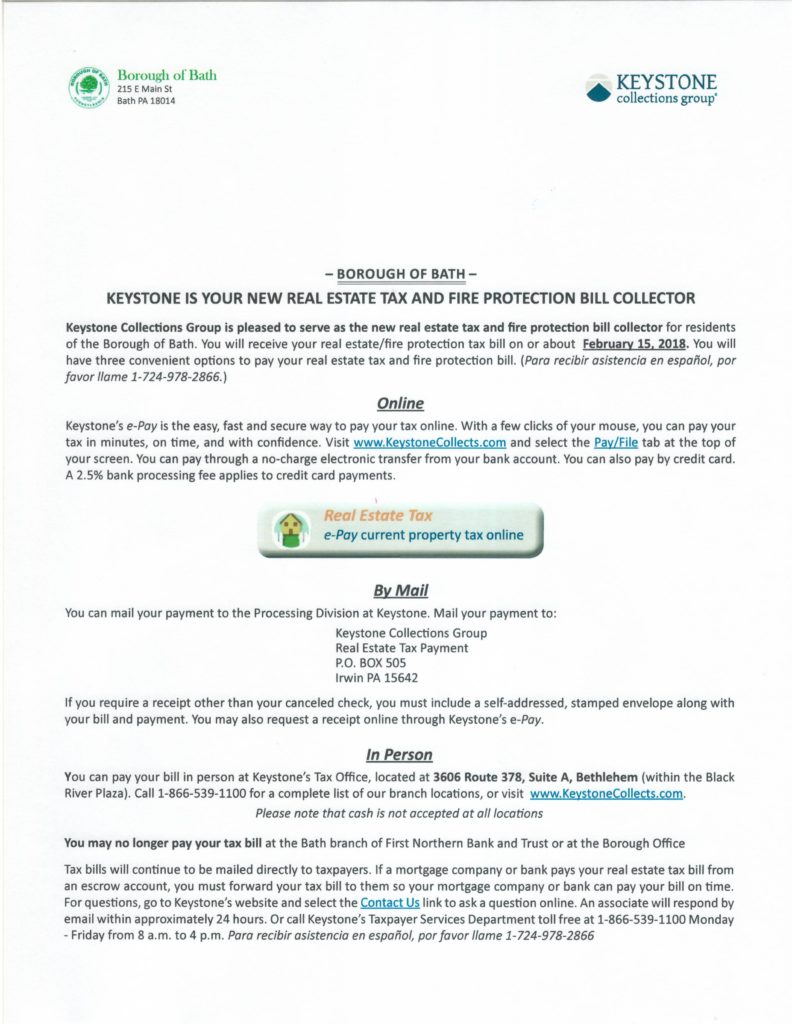

Ad a tax advisor will answer you now! Keystone collections group black river plaza 3606 route 378, suite a The per capita tax is $10 per resident, regardless of whether someone owns a home or not.

Bethlehem area school district bethlehem, pennsylvania application for exoneration of per capita tax in order to be considered for a temporary exonerationan individual must complete an application on a yearly basis and meet one of the requirements listed below: Funding just one station would require a $12 countywide per capita tax. (a) taxpayers making payment of property taxes on or before the discounted tax date in any taxable year shall pay the base tax, minus a discount of two percent (2%).

Suite a, bethlehem, pa 18015. (b) taxpayers making payment of property taxes after the discounted tax date, but no later than two. A proportional tax levied on the transfer price of real property within the taxing district.

Exoneration from tax is applicable to the current tax year only. Questions answered every 9 seconds. Combined income from wages, salary, fees, pensions,

Seigworth mentioned the annual budget for a single ambulance station can run at least $450,000. The per capita tax exemption form should be. Questions answered every 9 seconds.

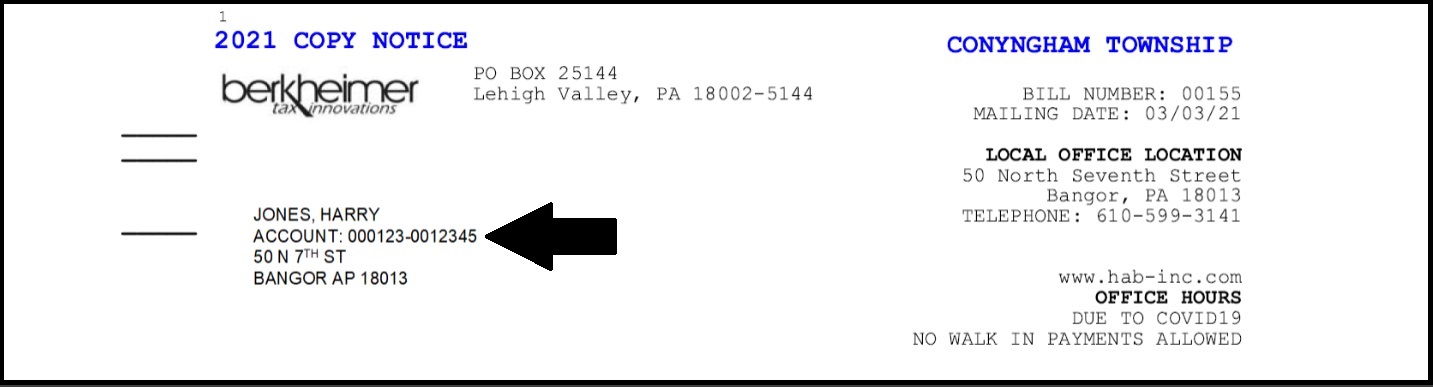

You must file exemption application each year you receive a tax bill. If a payment is received without the tax bill form which was mailed to you, we will need to prepare a duplicate bill. Real estate tax payment per capita tax payment p.o.

To insure uniformity, all payments must be accompanied by a tax bill in the standard format. It is collected annually and the cost to collect it has increased over the years while the tax has remained flat, which is one reason board directors concluded that its value as a. Clarion county's population, according to the 2020 census, is 37,241.

Bethlehem Pennsylvania Pa Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Saucon Valley School Board Eliminates Districts Per Capita Tax Saucon Source

List Of Pennsylvania Counties By Per Capita Income – Wikipedia

How Much Does Your State Collect In Sales Taxes Per Capita

2

Finance Taxes – Lehigh Township Pennsylvania

2

Calling It A Nuisance Saucon Valley May End Per Capita Tax – The Morning Call

Hab-inccom

2

Grove City Tax Office

Tax Collection Borough Of Bath

Calling It A Nuisance Saucon Valley May End Per Capita Tax – The Morning Call

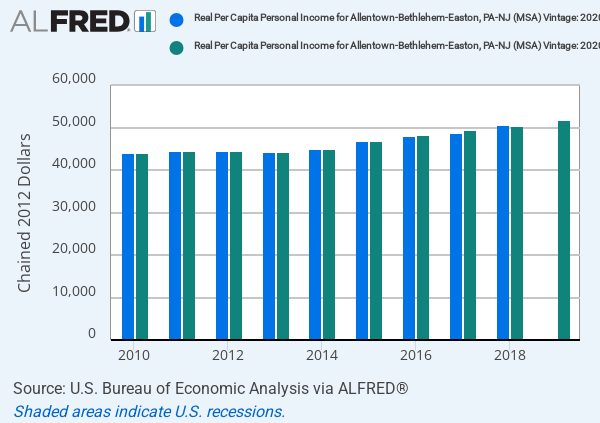

Real Per Capita Personal Income For Allentown-bethlehem-easton Pa-nj Msa Rpipc10900 Fred St Louis Fed

2

Business Office Tax Office

Bethlehem Pennsylvania Pa Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Online Payments Berkheimer

2