Deadline approaches for maryland student to apply for state debt relief. Increasing from $5,000 to $100,000 the amount of the student loan debt relief tax credit that certain individuals with a certain amount of student loan debt may claim against the state income tax;

Tas Tax Tips American Rescue Plan Act Of 2021 Individual Tax Changes Summary By Year – Taxpayer Advocate Service

File 2021 maryland state income taxes.

Maryland student loan tax credit application 2021. And applying the act to taxable. Applications must be submitted by september 15. (1) the qualified taxpayer's full legal name, date of birth, gender, residency address, email address, phone.

Complete the student loan debt relief tax credit application. 1, 2021 through the end of 2025. Then go to the “licenses and permit” section and scroll downward.

From july 1, 2021 through september 15, 2021. Increasing from $9,000,000 to $100,000,000 the total amount of tax credits that the maryland higher education commission may approve in a taxable year; More than 9,494 marylanders were eligible for student loan debt relief in 2018 as the state awarded more than $9 million in tax credits, the governor's office announced friday.

Student loan debt relief tax credit for tax year 2021. The student loan debt relief tax credit can be applied from their website by following these steps: This application and the related instructions are for maryland residents who wish to claim the student loan debt relief tax credit.

Mhec will prioritize tax credit recipients and dollar amounts based on applicants. View details open from jun 30, 2021 at 11:59 pm edt to. But it's temporary, applying to debt cancellations from jan.

To be eligible, you must claim maryland residency for the 2021 tax year, file 2021 maryland state income taxes, have incurred at least $20,000 in undergraduate and/or graduate student loan debt, and have at least $5,000 in outstanding student loan debt upon applying for the tax credit. The student loan debt relief tax credit program deadline of september 15 is just under two weeks away, and comptroller peter franchot and maryland college officials are urging students to take. The loan assistance repayment programs (larp) can assist maryland residents in certain careers with student loan debt repayment.

The student loan debt relief tax credit application shall require a qualified taxpayer to submit, in a form prescribed by the secretary, information required by the secretary to determine the taxpayer's eligibility for certification, including but not limited to: Maryland’s student loan debt relief tax credit can help save you money, but you need to act fast because the deadline to apply is sept. 6 student loan debt or both when submitting an application under subsection (c) of this 7 section.

Brooks, a law professor at georgetown university who has studied tax law and student debt, says that limited time period. Have incurred at least $20,000 in undergraduate and/or graduate student loan debt. Have at least $5,000 in outstanding student loan debt remaining when.

The student loan debt relief tax credit is a program,. 8 (b) subject to the limitations of this section, a qualified taxpayer may claim a 9 credit against the state income tax for the taxable year in which the commission certifies 10 a. Maryland taxpayers who have incurred at least $20,000 in undergraduate and/or graduate student loan debt, and have at least $5,000 in outstanding student loan debt at the time of applying for the tax credit.

The student loan debt reli ef tax credit provides maryland income tax credits to eligible recipients to apply against student loan balances that were used to pay for undergraduate and graduate postsecondary education. Marylanders to apply for tax credit applications for student loan debt relief due september 15 annapolis, md. At the bottom of the page, you will find a heading called “apply or.

Can The Student Loan Statute Of Limitations Get Rid Of My Private Loans Student Loan Hero

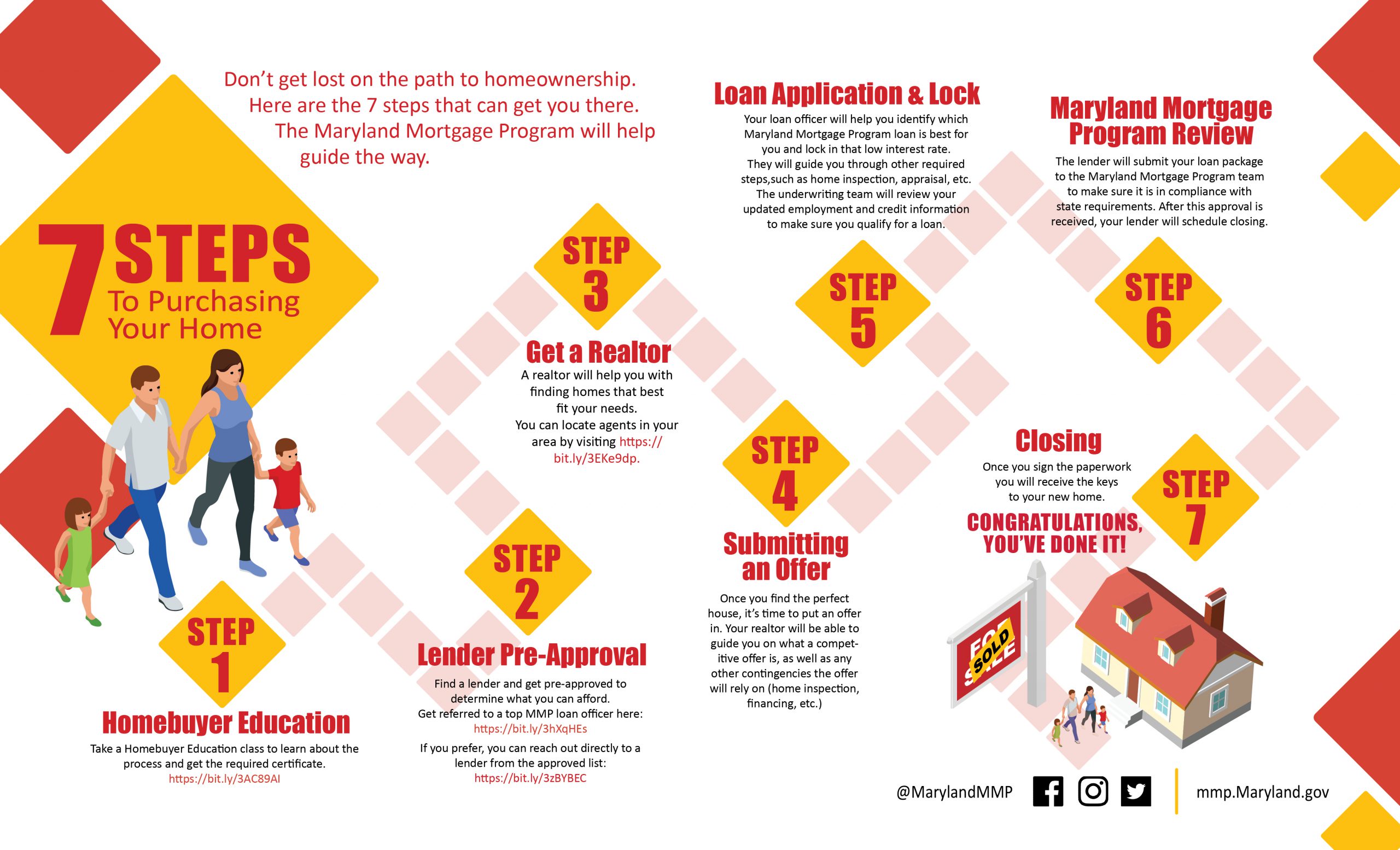

Skip To Main Content Menu Marylandgovstate Directorystate Agenciesonline Services Translate Marylandgov Home Department Of Housing And Community Development Search Facebook Twitter Md Social Media Directory Home Homeownership

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Learn How The Student Loan Interest Deduction Works

Learn How The Student Loan Interest Deduction Works

Maryland Student Loan Forgiveness Programs

Amy Frieder Facebook

Skip To Main Content Menu Marylandgovstate Directorystate Agenciesonline Services Translate Marylandgov Home Department Of Housing And Community Development Search Facebook Twitter Md Social Media Directory Home Homeownership

Interest-free Loans For Students Why They Help And How To Find Them Student Loan Hero

Irs Child Tax Credit Payments Start July 15

Student Loans May Qualify For Federal Forgiveness

How To Stop Pbcm If They Have Your Student Loans

How To Get Student Loans For Grad School Even With Bad Credit Student Loan Hero

Learn How The Student Loan Interest Deduction Works

Student Loan Debt Statistics In 2021 A Record 17 Trillion

Irs Now Adjusting Tax Returns For 10200 Unemployment Tax Break Forbes Advisor

6 Best Student Loans Of 2021 Money

How To Apply For College Loans A Beginners Guide – Student Loan Hero

Interest-free Loans For Students Why They Help And How To Find Them Student Loan Hero