Payments can also be made via credit card (master card, visa or. Income tax guest payment service allows taxpayers to schedule and remit payments for individual and school district income tax via electronic check or credit/debit card without creating an online services account.

Estimated Payments Department Of Taxation

Recurring payments are available and must be setup through the income tax division by calling or visiting the office.

Pay ohio estimated taxes online. Last four digits of the social security number of the primary person listed on the income tax account; City of kettering income tax division. Is a leading provider of digital payment solutions for the irs, as well as states,.

This paymentmethod charges your credit card. According to the ohio department of taxation, you can pay taxes a number of ways: Login to myaccount 24/7 to make estimated tax payments.

The state of ohio changed the due dates for estimated payments beginning tax year 2018. Make payments on time, every time. Payments made online may not immediately reflect on your online services dashboard.

When using this method, you will get a confirmation number. The following items are required to make a payment using the online bill pay service. If you file your taxes through myaccount, the estimate will automatically be.

There is a processing fee to use this service. Regular gasoline is taxed at a rate of 38.50 cents per gallon in ohio. If you are a first time ohio filer, you are not eligible to make a payment through our guest payment service.

They accept electronic checks, visa, mastercard and discover card. You can pay your estimated taxes each quarter through the irs website by going to irs.gov/payments. Payment can now be made by electronic checking/savings withdraw without a fee.

You can pay through irs direct pay by entering your bank account information, or you can pay via. Several options are available for paying your ohio and/or school district income tax. That's a lot of bills!

Also, you have the ability to view payments made within the past 61 months. Taxes on diesel gas are 47.00 cents per gallon. A question is answered every 9 sec.

We accept online payments for individual income taxes, employer withholding and business taxes. Online services is a free, secure electronic portal where you can file and pay your ohio individual and school district income taxes. If you are remitting for both ohio and school district income taxes, you must remit each payment as a separate transaction.

Ad a tax advisor will answer you now! Allows you to electronically make ohio individual income and school district income tax payments. For additional information, refer to publication 505, tax withholding and estimated tax.

Using a debit or credit card online by visiting official payments. Click here to begin bill payment. Ad a tax advisor will answer you now!

Register forgot my user id / password. Taxpayers with existing city tax accounts can make online payments through payment portal or easy file applications. This includes extension and estimated payments, original and amended return payments, billing and assessment payments.

You can also review notices and information about those taxes from the department. Paymentus processes online payments for the newark tax office. For the estates of persons who died prior to that date, however, the prior tax may still be due.

Taxes, tuition, utilities, rent, insurance. Pay via guest payment service register & pay via online services. Pay them simply, quickly and securely with aci payments, inc.

As of january 1, 2013, there has been no estate tax in ohio. Use the estimated payment option of the online tax tool to make your payments and avoid late payment penalties. The new due dates are april 15, june 15, september 15, and january 15.

Click here to access easy file. Employers can pay their newark withholding tax payments through the state of ohio's ohio business gateway. August 11, 2021) on 2.

City of kettering income tax division. Ohio treasurer of state • include the tax year and the last four digits of. Payments by electronic check or credit/debit card.

A question is answered every 9 sec. Visit irs.gov/payments to view all the options. 3600 shroyer rd., north building.

May 04, 2020 | tax. Free to file easy to use faster refund log in to secure zone: It is available 24 hours a day, 7 days a week except for scheduled maintenance.

Pin By Joanne Sweet On Budget Budgeting Worksheets Nevada

![]()

Estimated Payments Department Of Taxation

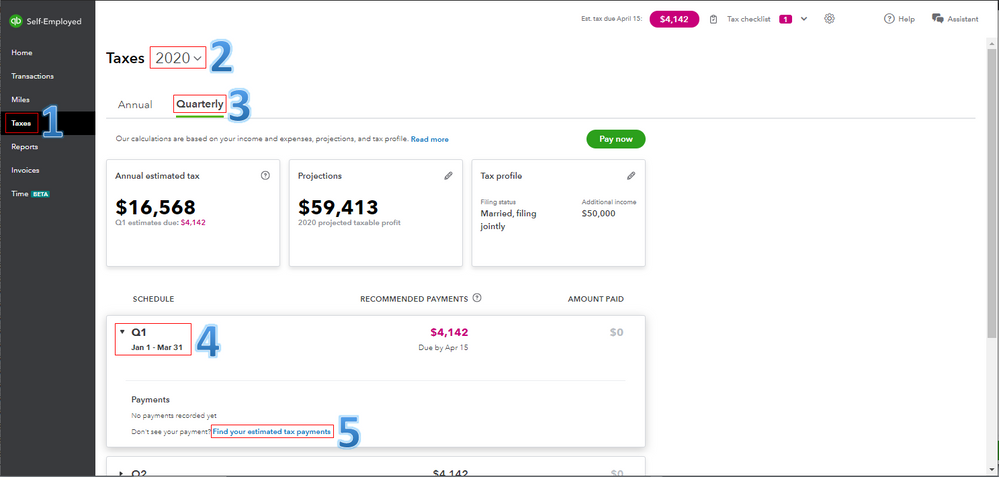

How To Record Paid Estimated Tax Payment

Quarterly Tax Guide For Freelancers And The Self-employed Tax Guide Quarterly Taxes Small Business Tax Deductions

Pin On Bobbie Burgers

Pass-through-entities Fiduciaries – Estimated Payments The 2210 Interest Penalty Department Of Taxation

Pin On Shiny Objects Of Desire

The Daily Iran Said To Announce Crypto-rial This Week Italy Closer To Crypto Regulation Httpsthebitcoinnewscomthe-daily-iran-said-to- Italy Bitcoin Iran

Ghana Revenue Authority In Bed With Tax Defaulters Ghana Online Registration Tin Number

Business Taxes Annual V Quarterly Filing For Small Businesses – Synovus

How To Calculate Quarterly Estimated Taxes In 2021 1-800accountant

Quarterly Tax Calculator – Calculate Estimated Taxes

Estimated Payments Department Of Taxation

Quarterly Tax Calculator – Calculate Estimated Taxes

Estimated Payments Department Of Taxation

You Have Until Monday To Get These 2 Things Done — The Motley Fool The Motley Fool Tax Deductions Tax Brackets Estimated Tax Payments

Pass-through-entities Fiduciaries – Estimated Payments The 2210 Interest Penalty Department Of Taxation

Aspire Auctions Contemporary Ceramics Ceramic Pottery Clay Vase

Pin By Americans For Tax Reform On Infographics Internet Business Infographic It Hurts