The 8.5% sales tax rate in san francisco consists of 6% california state sales tax, 0.25% san francisco county sales tax and 2.25% special tax. The california constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law.

Richard Wurman Understanding Usa 1999 Tech Company Logos Understanding Company Logo

If you make purchases in the city by the bay, you should be aware of the sales tax in san francisco.

San francisco sales tax rate history. 1% lower than the maximum sales tax in ca. Tax rate for entire value or consideration is. Average sales tax (with local):

This is the total of state, county and city sales tax rates. The december 2020 total local. San francisco, ca sales tax rate.

Datasf's mission is to empower use of data. Please ensure the address information you input is the address you intended. We believe use of data and evidence can improve our operations and the services we provide.

$1,000,000 or more but less than $5,000,000. The tax rate given here will reflect the current rate of tax for the address that you enter. There are a total of 513 local tax jurisdictions across the state, collecting an average local tax of 2.492%.

$2.50 for each $500 or portion thereof. The tax is calculated as a percentage of total payroll expense, based on the tax rate for the year. Until 2018, all businesses with a taxable san francisco payroll expense greater than $150,000 must file a payroll expense tax statement for their business annually by the last day of february for the prior calendar year (jan.

More than $100 but less than or equal to $250,000. See detailed property tax report for 324 3 ave, san francisco county, ca. This was the state tax rate through june 30, 2011, when the increase expired and the sales tax of 7.25 percent resumed.

San francisco 776,733 14.00% emeryville 12.00% long beach 461,522 12.00% oakland 11.00% fresno 427,652 12.00% hayward 10.50% sacramento 407,018 12.00% concord 10.00% oakland 399,484 11.00% palo alto 10.00% san diego 1,223,400 10.50% san jose 10.00% san jose 894,943 10.00% san leandro 10.00% santa ana 337,977 9.00% fremont 8.00% More than $250,000 but less than $1,000,000. The sales tax jurisdiction name is san francisco tourism improvement district (zone 2), which may refer to a local government.

5 digit zip code is required. The rates display in the files below represents total sales and use tax rates (state, local, county, and district where applicable). Historical tax rates in california cities & counties.

Secured property tax bills are mailed in october. As of march 2013, the sales tax rate in the city was 8.75 percent, which is slightly higher than the overall california sales tax. The county sales tax rate is %.

California has state sales tax of 6% , and allows local governments to collect a local option sales tax of up to 3.5%. There is no applicable city tax. As of april 1, 2017, 176 cities and 32 counties have approved local sales tax increases.

The san francisco sales tax rate is %. This ultimately leads to increased quality of life and work for san francisco residents, employers, employees and visitors. Sb 566 also increased the maximum combined local sales tax rate (local sales tax rate cap) that can be levied by local governments from 1.50% to the current 2.00%.

We seek to transform the way the city works through the use of data. Proposition 13, enacted in 1978, forms the basis for the current property tax laws. To view a history of the statewide sales and use tax rate, please go to the history of statewide sales & use tax rates page.

The current total local sales tax rate in san francisco, ca is 8.625%. The california sales tax rate is currently %. $3.40 for each $500 or portion thereof.

What is the sales tax rate in san francisco, california? San juan plaza (san juan capistrano) 7.750%: On january 1, 2013, the state sales tax increased by 0.25 percent to the rate of 7.5 percent.

Type an address above and click search to find the sales and use tax rate for that location. The minimum combined 2021 sales tax rate for san francisco, california is.

How High Are Capital Gains Taxes In Your State Tax Foundation

Sales Tax On Saas A Checklist State-by-state Guide For Startups

Californias Sales Tax Rate Has Grown Over Time Econtax Blog

Cal Facts 1996–state Revenue

Why Not 10 Reasons Not To Move To California State Bliss

Understanding Californias Property Taxes

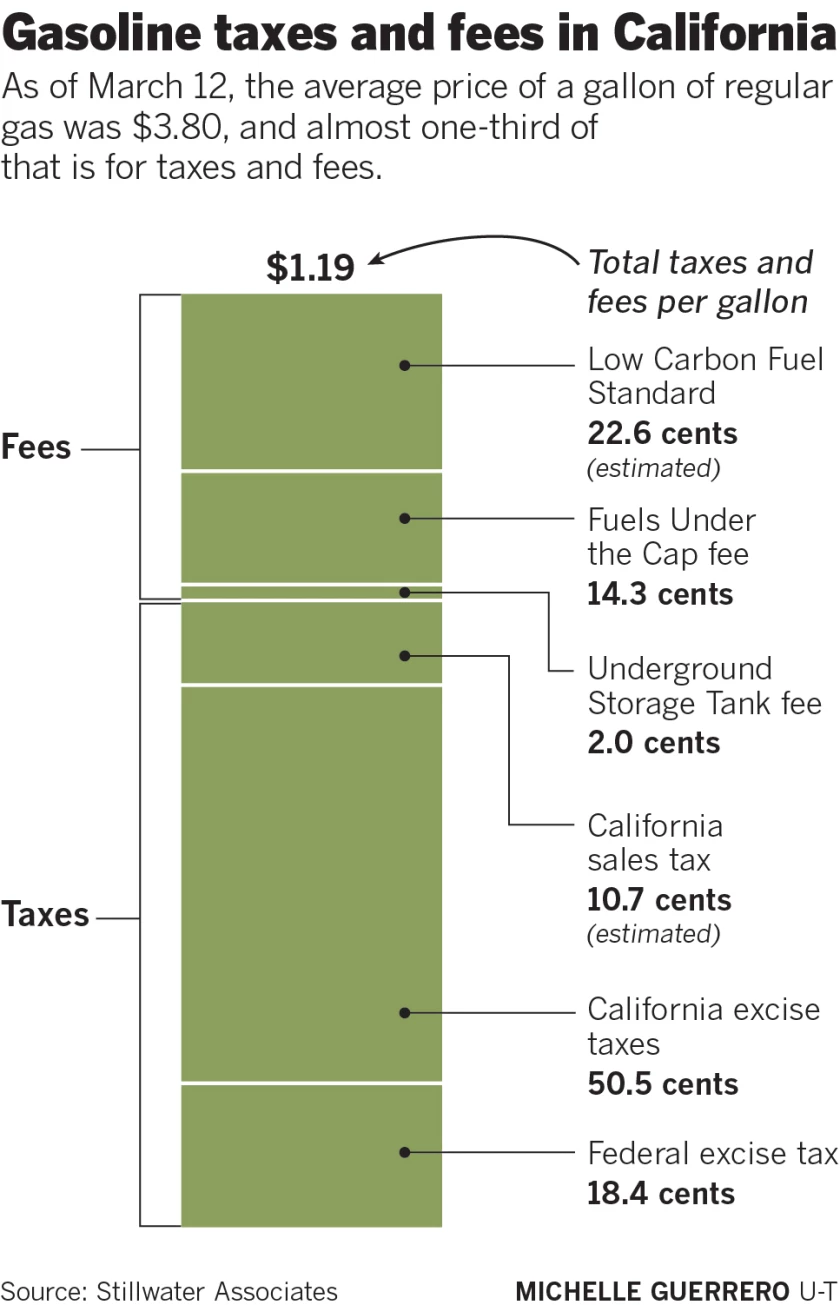

How Much Are You Paying In Taxes And Fees For Gasoline In California – The San Diego Union-tribune

Understanding Californias Property Taxes

948 Lombard St San Francisco Ca – 1 Bath San San Francisco Francisco

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeographycom

Understanding Californias Property Taxes

Tax Pyramiding What Is Tax Pyramiding Taxedu

California Sales Tax Rates By City County 2021

Sales Tax Collections City Performance Scorecards

Understanding Californias Property Taxes

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeographycom

States With Highest And Lowest Sales Tax Rates

How High Are Cell Phone Taxes In Your State Tax Foundation

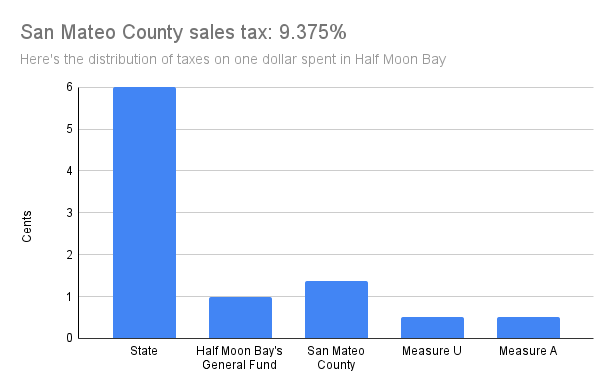

County Begins Collecting Higher Sales Tax Local News Stories Hmbreviewcom