This time in the form of annual taxes on unrealized investment gains. This weekend, his treasury secretary, janet yellen, went on cnn and said they want to tax ‘unrealized gains’ from the top 1 percent to pay for the bill.

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

Billionaires, and their growing piles of untaxed investment gains.

Tax on unrealized gains bill. In reality it is a tax on wealth. What this means is that someone who owns stock or property that increases in value does not pay tax on that. President biden said friday he supports a democratic proposal to tax billionaires annually on their unrealized investment gains.

The largest part of the tax bill will be upfront. A tax on unrealized capital gains would be a direct tax because it’s a tax on personal property paid by someone who cannot—quoting the pollock decision—“shift the. There's what we call the nominal rate of taxation, which is whatever it says, it's 15%.

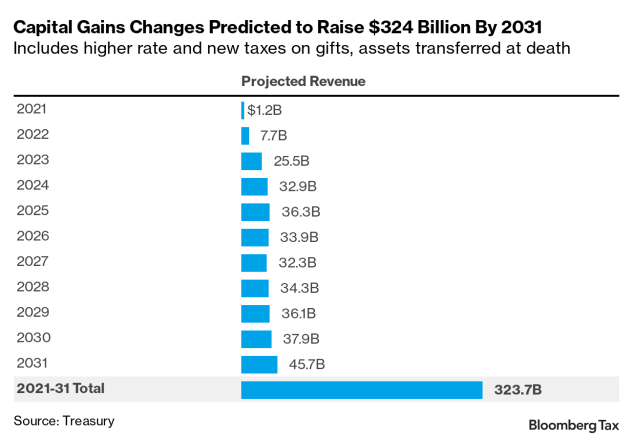

Senate finance chairman ron wyden, d. That is not really what we tax capital gains at. At the current top capital gains tax rate of 23.8 percent, the tax bill on a $3 billion gain would be $714 million, spread over five years.

The plan stakes out new territory by putting levies on unrealized gains in the value of billionaires’ liquid assets, such as stocks, bonds and cash. This suggests that the bill costs way more than zero dollars. Washington—a new annual tax on billionaires’ unrealized capital gains is likely to be included.

Currently, the tax code stipulates that unrealized capital gains aren't taxable income. 24, 2021 1:26 pm et. While it was claimed that the new $3.5t spending bill wouldn’t cost us anything, now it appears the government feels it needs another new tax to pay for it.

Biden administration proposes taxing billionaires’ ‘theoretical income’ to pay for spending bill The tax policy center says that the plan raises many practical problems and won't work and is ripe for abuse.on nov. With their latest tax proposal, democrats are going after an elusive target:

The bill also extends an expanded tax. The treasury secretary janet yellen also told cnn that the proposal was “being reviewed by senate finance committee chairman ron wyden” and “would impose an annual tax on unrealized capital gains on liquid assets held by billionaires.”. It would impose significant tax liability when first implemented as taxpayers would be required to pay taxes on assets they first acquired years or.

The democrats’ proposal to tax unrealized capital gains for about 700 of the. The measure would put taxes on unrealized capital gains, but would start at an extremely high threshold. The impacted assets include stocks, bonds, real estate, and art.

The real rate of taxation is way, way lower. Normally of course you don’t pay taxes on gains until you sell assets and establish a profit. Such a tax is really a tax on wealth.

To meet the threshold, an individual would need to. 21, 2019 tax policy center senior fellow howard gleckman wrote: “it's not a wealth tax, but a tax on unrealized capital gains of exceptionally wealthy individuals.

Tax on unrealized gains would highlight complexities of valuing munis. The new unrealized capital gains tax would levy annual taxes on assets while they still have not been sold. More than $5 trillion is.

The tax would apply to people who make more than us$ 100 million a year for three years in a row or if one makes us$ 1 billion in annual income. Payments could be spread out over five years. A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income.

In other words, they want to tax wealth that hasn’t even been created yet. Is that because we don't tax capital gains until you show up at the cashier and turn it into cash. House speaker nancy pelosi took issue with plans by fellow democrats to levy a tax on unrealized capital gains to help pay for president biden's $1.75 trillion social spending bill.

Not only do americans overwhelmingly oppose the concept of taxing unrealized gains, the nation's top progressive tax policy group says the idea pushed by dem senator ron wyden won't work.. A tax on unrealized gains would punish taxpayers for past decision making by taxing paper gains from the original date that asset was acquired.

Democrats Proposed Tax On Unrealized Capital Gains Likely Unconstitutional The Heritage Foundation

Here It Is Wydens Unrealized Capital Gains Tax On Wealthy Americans – Swfi

Bidens Tax On Unrealized Gains Will Impact Everyone

Analyzing Bidens New American Families Plan Tax Proposal

What The Wyden Proposed Tax On Unrealized Capital Gains May Mean For You

Proposed Tax On Billionaires Raises Question Whats Income – The New York Times

Top Democrat Proposes Annual Tax On Unrealized Capital Gains – Wsj

Biden Capital Gains Tax Plan Could Raise 113 Billion If Step Up Is Killed

Dems Plan Billionaires Unrealized Gains Tax To Help Fund 2t Bill

Proposed Tax On Billionaires Raises Question Whats Income – The New York Times

Epic Games Tim Sweeney Says Democrats Unrealized Capital Gains Tax On Billionaires Would Crush Entrepreneurs Fox Business

Dems Plan Billionaires Unrealized Gains Tax To Help Fund 2t Bill

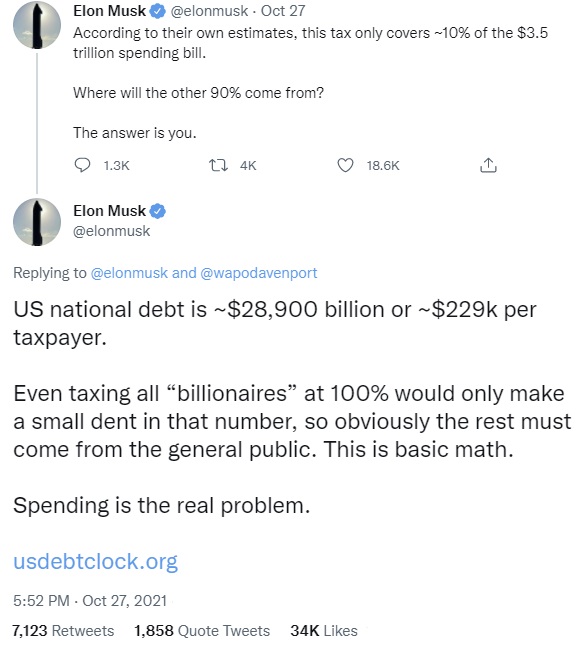

Elon Musks Warning About Government Spending And Unrealized Gains Tax Proposal Highlights Benefits Of Bitcoin Economics Bitcoin News

Tax On Billionaires Unrealized Gains Will Likely Be In Budget Package Democrats Say – Wsj

Biden Estate Tax A 61 Tax On Wealth Tax Foundation

How Elon Musk Could Pay For A Tax On Unrealized Capital Gains Barrons

Yellen Describes How Proposed Billionaire Tax Would Work Barrons

Tax Pros Perplexed By Scope Of Bidens Capital Gains Overhaul

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains – The New York Times