Paying your tax liabilities in full; Here are the four ways you can pay your edd audit penalty:

Sample Commercial Rental Agreement Rental Agreement Templates Lease Agreement Commercial

Instead, they’re due once per year, with a rolling due date based on your month of enrollment.

Can you pay california state taxes in installments. This is a formal request for a payment arrangement with the california ftb. Questions answered every 9 seconds. Unlike secured property taxes, unsecured property taxes are not charged in installment payments.

Wage garnishment (earnings withholding order) bank levy (order to withhold) You’ve filed all your income tax returns for the past 5 years; Individuals can complete form 9465, installment agreement request.

You may wish to recognize the gain all in the year of sale, which means that you would pay no tax on principal payments after the first year. Calculating property taxes in california. Overpay your next instalment payment ;

For more information you may write the ftb at: You can pay the amount in 60 months or less. You can pay both installments at once if you so choose.

Ad a tax advisor will answer you now! Be sure to mail the payment to the address listed on the bill and use necessary postage. For more information go to the ftb website at www.ftb.ca.gov/online/installments_bus.shtml.

If your return is more than 60 days late, the minimum penalty you'll have to pay is the lesser of $435 or 100% of the tax owed. Paying your tax liabilities in installments; 100% of the preceeding year's tax.

Current installment agreement with us; This means that you could end up paying more income tax next year, unless you continue to pay your second property tax installment early. The average effective (after exemptions) property tax rate in california is 0.79%, compared with a national average of 1.19%.

(1) you can elect “out” of the installment tax treatment. This will allow you to earn instalment credit interest. You've filed all your income tax returns for the past 5 years.

You may qualify to pay your tax in monthly installments when you owe less than $25,000 and agree to pay your balance within 60 months (five years). California’s overall property taxes are below the national average. You can reduce or eliminate interest and penalties if you do one of the following:

Questions answered every 9 seconds. You pay these instalments during the year while you are earning the income, similar to how an employer deducts tax directly from each pay period. That rate increases to 1% if the tax remains unpaid 10 days after the irs.

How to pay online to make your payment online. You can’t apply online if you have a: If you are ineligible for a payment plan through the online payment agreement tool, you may still be able to pay in installments.

Amount due is less than $25,000. Tax instalments are payments you make throughout the year to cover the taxes you normally pay in one lump sum on april 30 of the following year. Say you sell in a year when you have massive taxable losses in your business, or you have massive otherwise unusable capital loss carryovers.

Using an offer of compromise to pay the debts Mail your forms to us You may be eligible for an installment agreement if:

For example, if you buy unsecured property on january 1st, your taxes will become due on august 31. John's instalment penalty would be $750. Paid too little (you owe taxes) if you expect to owe over a certain amount, you must make estimated tax payments throughout the year.

California property tax rates typically fall between 1.1 percent to 1.6 percent of its assessed value. You can pay the amount in 60 months or less; But high income taxpayers must meet some different standards as listed below:

You may be eligible for an installment agreement if: Pay your next instalment early; You can only deduct the taxes allocable to the part of the year that you were the owner of the property.

If you owe $10,000 or less, you must agree to pay your balance within 36 months. The liabilities must not exceed $25,000. However, in order for a taxpayer to be eligible for an installment agreement all of the following must be true:

In the year of purchase or sale of real property there is an allocation of real property taxes paid by the buyer and seller. Amount due is less than $25,000; 90% of the current year's tax or 2.

Generally, taxpayers can avoid paying california penalties for underpayment of estimated taxes by paying the lesser of the following: Businesses owing the ftb may also establish an installment payment agreement over the phone, but it is more complicated and more documents are required. Ad a tax advisor will answer you now!

Reduce your instalment interest and penalty charges. This is often surprising to california taxpayers and business owners because the internal revenue service (irs) generally has only ten years to collect a tax debt. You will have paid three installments in 2011 and only have one payment due in 2012.

To illustrate, the state of california franchise tax board will accept installment agreements for up to 60 months. Now you divide the $1,500 by 2.

Column State Lacks New Money For School-funding Program That Grants Property Tax Relief – Chicago Tribune

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

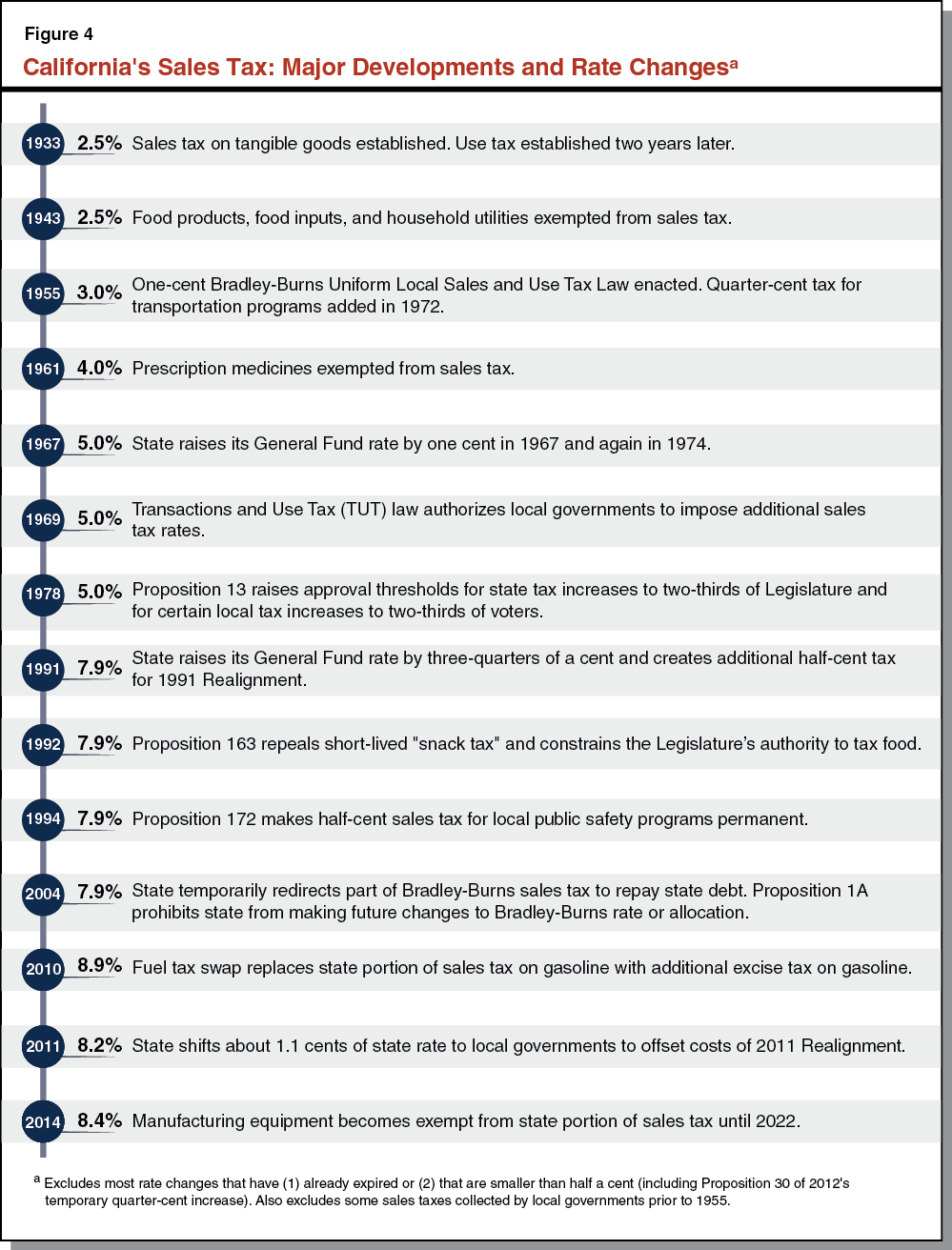

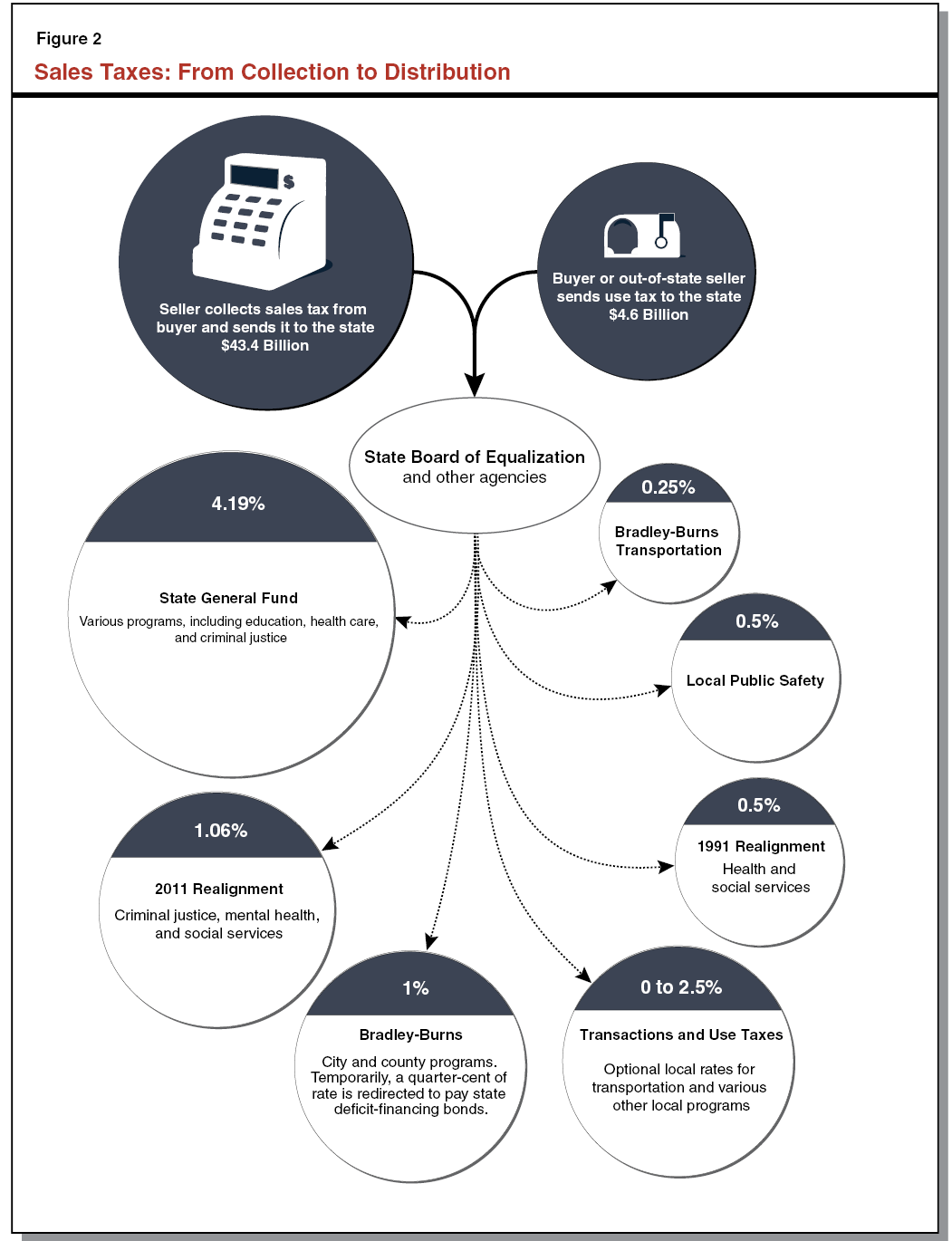

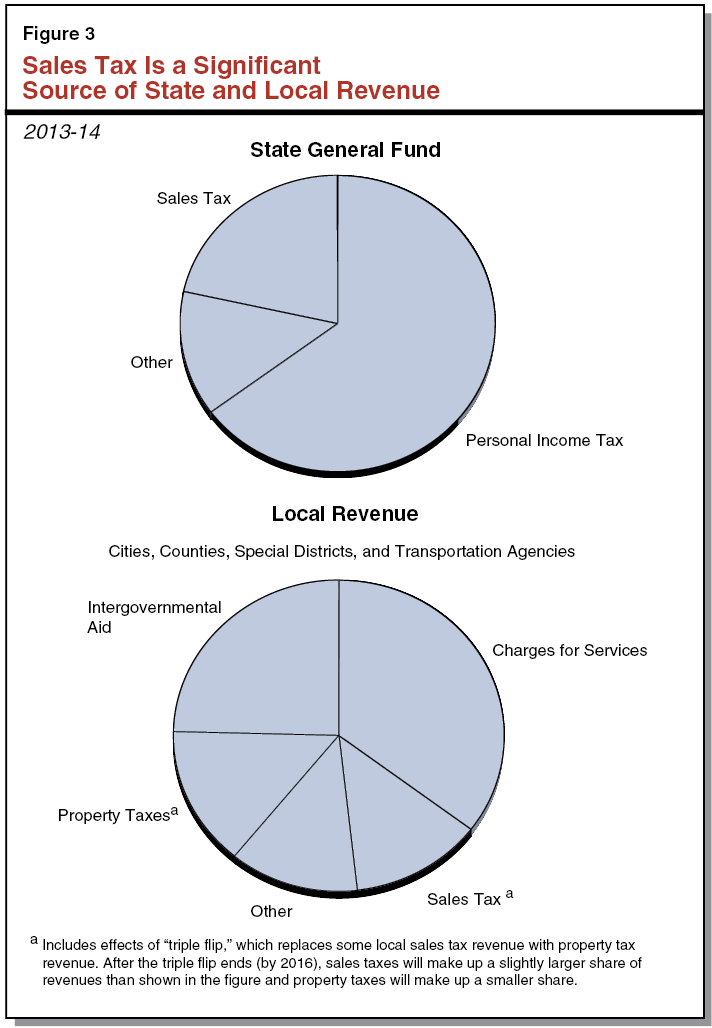

Understanding Californias Sales Tax

Property Tax Comparison By State For Cross-state Businesses

/9465-700bb91065234917b8d2866f2306afe9.jpg)

Form 9465 Installment Agreement Request Definition

Understanding Californias Sales Tax

Why Should I Pay Federal Or State Taxes – Quora

Key Issues Tax Expenditures Types Of Taxes Infographic Tax

Understanding Californias Sales Tax

Moving Out Of State Dont Forget About The Source Tax – Mullin Barens Sanford Financial And Insurance Services Llc

I Owe California Ca State Taxes And Cant Pay What Do I Do

Offer In Compromise Acceptance Letter Offer In Compromise Debt Relief Programs Tax Debt

Understanding Californias Sales Tax

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

Understanding Californias Sales Tax

Understanding Californias Property Taxes

Understanding Californias Property Taxes

Tax Relief What You Need To Know Community Tax

Sample Commercial Rental Agreement Rental Agreement Templates Lease Agreement Commercial