One advantage offered by the new jersey plan is that individuals may be eligible for a scholarship of up to $1,500 if they enroll in a new jersey college or university. In new mexico, families can deduct 100% of their contributions to new mexico’s 529 plan on their state taxes.

A Tax Break For Dream Hoarders What To Do About 529 College Savings Plans

For example, new york residents are eligible for an annual state income tax deduction for 529 plan contributions up to $5,000 ($10,000 if married filing jointly).

Does nj offer 529 tax deduction. A 529 plan is designed to help save for college. New jersey does not offer any state tax benefits for opening a nj 529 plan. New jersey taxpayers, with a gross income of $200,000 or less, may qualify for a state income tax deduction for contributions into an njbest plan of up to $10,000 per taxpayer, per year, beginning with contributions made in tax year 2022.

New jersey no yes beginning with the 2022 tax year, maximum deduction of $10,000 per taxpayer per year for taxpayers with gross incomes of $200,000 or less that contribute to new jersey’s 529 plan (contributions made before 2022 tax year are not deductible) This state offers no tax deduction for 529 plans. Not all states offer a tax deduction for contributions to a 529 college savings plan.

Many other factors beyond the state tax benefit can influence your choice of 529 plan. Managed and distributed by franklin distributors, llc, an affiliate of franklin resources, inc., which operates as franklin templeton. New jersey does not offer a deduction for 529 plan contributions.

If your state has no income tax, the 529 plan tax deduction doesn’t apply. The proposed state budget includes a new state tax deduction for contributions of up to $10,000 into an njbest account for families with incomes below $200,000, state treasury officials said. But it does offer these two key benefits:

New jersey does not provide any tax benefits for 529 contributions. This state offers no tax deduction for 529 plans. (for more information, please see ny 529 plans.)

If your state does, and you want to set up a 529 plan to capture the tax savings, talk to the plan. “as of january 2019 there are no tax deduction benefits when making a contribution to a 529 plan in new jersey, however you do have the ability to take advantage of up to a $1,500 maximum scholarship by investing within the program for over 12 years.” But if you live in new york and pay new york state income taxes you may be able to deduct the contributions on you r new york tax return.

Some states do have income taxes but no 529 plan tax deduction. Thankfully, nj residents can open an account in any other state that lets them. New jersey may become the 35th state to offer an income tax benefit for residents who contribute to a 529 plan.

The new jersey college affordability act allows taxpayers with household adjusted gross income between $0 and. In colorado, new mexico, south carolina and west virginia 529 plan contributions are fully deductible in computing state income tax. This state offers no tax deduction for 529 plans.

New jersey offers tax benefits and deductions when savings are put into your child's 529 savings plan. As of january 2019 there are no tax deduction benefits when making a contribution to a 529 plan in new jersey, however you do have the ability to take advantage of up to a $1,500 maximum. The new jersey college affordability act allows for new jersey taxpayers, with gross income of $200,000 or less, to qualify for a state income tax deduction for contributions into an njbest plan of up to $10,000 per taxpayer, per year, beginning with contributions made in tax year 2022.

36 rows nebraska offers married taxpayers a state tax deduction for 529 plan. If you use the money for qualified educational expenses, the. This state offers no tax deduction for 529 plans.

Not all states offer a tax deduction for contributions to a 529 college savings plan. Njbest new jersey's 529 college savings plan is offered and administered by the new jersey higher education student assistance authority (hesaa); New jersey to offer 529 plan tax deduction.

The 529 plan tax deduction is part of a comprehensive college affordability plan in the state’s fiscal year 2022 budget proposal. Unfortunately new jersey does not offer any tax benefits for socking away funds in a 529 account for your child. If your state does, and you want to set up a 529 plan to capture the tax savings, talk to the plan.

But there are no tax. 1) favorable treatment when you apply for financial aid from the state of new jersey.

A Tax Break For Dream Hoarders What To Do About 529 College Savings Plans

Nj College Affordability Act What You Need To Know Access Wealth

529 Tax Benefits By State Invesco Us

How Much Is Your States 529 Plan Tax Deduction Really Worth

A Tax Break For Dream Hoarders What To Do About 529 College Savings Plans

New Jersey Nj 529 Plans Fees Investment Options Features Smartassetcom

Will Nj Ever Allow Deductions For 529 Plan Contributions – Njcom

Nj Able New Jersey 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Blackrockcom

Tax Deduction Rules For 529 Plans What Families Need To Know – College Finance

Does Your State Offer A 529 Plan Contribution Tax Deduction

New Jersey 529 Plans Learn The Basics Get 30 Free For College

Can I Use A Ny 529 Plan Even Though I Live In Nj – Njcom

529 Accounts In The States The Heritage Foundation

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

Tax Strategies Bernstein

New Jersey 529 Plan And College Savings Options Njbest

Njbest 529 College Savings Plan New Jersey 529 College Savings Plan Ratings Tax Benefits Fees And Performance

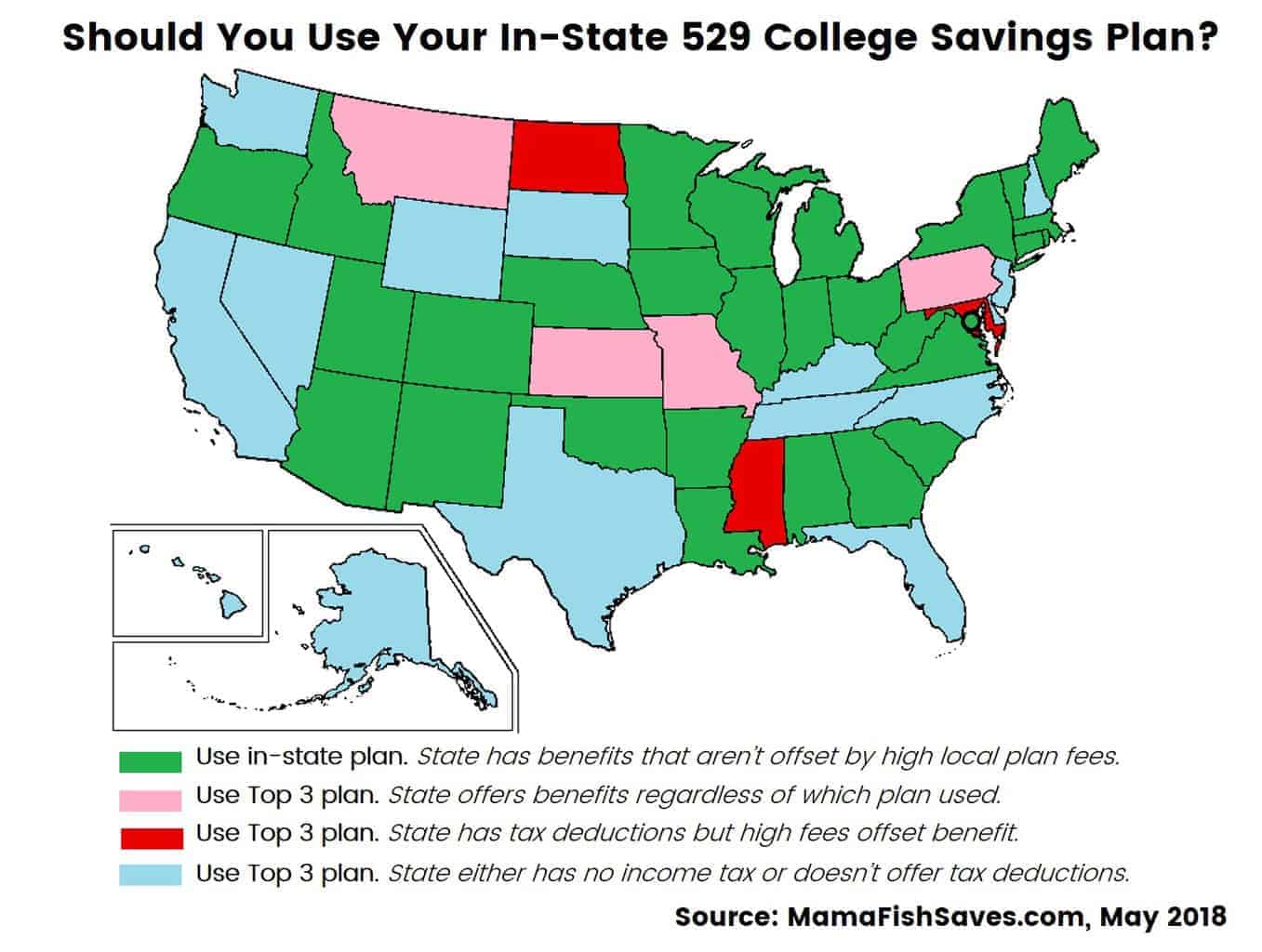

Choosing The Best 529 College Savings Plan For Your Family – Smart Money Mamas