The municipal homestead exempt tax, mhe tax; Daily october 1, 2018 through november 2, 2018 at the tax collector's office.

Frequently Asked Questions – Calhoun County Commissioner Of Licenses

Search for property using a filter below and click the 'search' button.

Calhoun county alabama delinquent property taxes. Delinquent taxes are for inquiry purposes only. (1) a tax rate (millage) increase, or (2) an increase in the appraised value of the property. For fire tax distribution purposes only.

Name search by name through property and tax records. Once your price quote is processed it will be emailed to you. Refunds will only be provided for overpayments.

Parcel number search by parcel number through property and tax records. Will my taxes go up every year? Without the tax revenue generated from real estate located in piedmont alabama,.

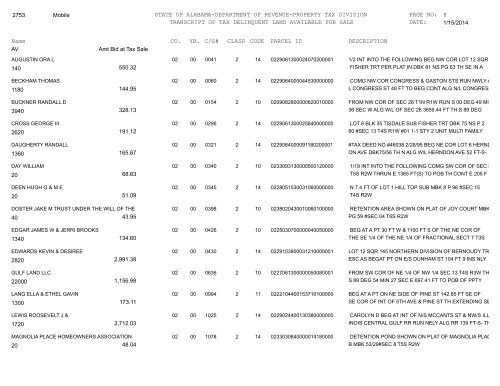

Click here for search tips. You may search for transcripts of properties currently available by county, cs number, parcel number, or by the person’s name in which the property was assessed when it sold to the state. The format of sale has officially changed to tax lien auction and sale effective with the 2018 tax

Within 45 days of delinquency the tax collector is required to advertise in the local newspaper all unpaid personal property taxes for one week. Tax delinquent properties for sale search. Having trouble searching or not finding the results you expect?

Notice of tax lien auction for 2019 delinquent taxes. The median property tax in calhoun county, alabama is $399 per year for a home worth the median value of $98,200. All unpaid tangible personal property becomes delinquent on april 1 each year, with a 1.5% penalty added each month.

Calhoun county alabama tax lien certificates are sold at the calhoun county tax sale which is held annually during april or may. They issue yearly tax bills to all property owners in calhoun county, and work with the sheriff's office to foreclose on properties with delinquent taxes. The buyer of the tax lien has the right to collect the lien, plus interest based on the official.

If the taxes remain unpaid, a warrant will be issued. Below is the pdf link to the notice of tax lien auction list for 2018 delinquent taxes: How does a tax lien sale work?

T is the same as tax district 11 b is the same as tax district 21: A property (tax) that has been delinquent for one (1) year is considered forfeited. You are given ten calendar days.

Calhoun county collects, on average, 0.41% of a property's assessed fair market value as property tax. How to read the transcript of tax delinquent property the second line of each record contains the state tax exempted due to the property being the homestead of the person assessed to, she tax; Tax liens in calhoun county, al buy tax liens and tax lien certificates in calhoun county, al, with help from foreclosure.com.

T is the same as tax district 11 b is the same as tax district 21 Top o anniston inc or john smith. The certificate is then auctioned off in calhoun county, al.

The county homestead exempt tax, che tax; The calhoun county tax collector is responsible for collecting property tax from property owners. The name of the owner or business.

No refunds may be issued through this site. You may request a price quote for state held tax delinquent property by submitting an electronic application. At this time, the interest rate goes from 1% per month to 1.5% per month back to.

There will be no registering the day of the sale. Search for property using a filter below and click the 'search' button. Delinquent taxes cannot be paid online.

Property taxes are due october 1, and are delinquent after december 31. Tax delinquent property and land sales about. In accordance with title 40, chapter 10, code of ala.

A pdf reader is required to view the tax lien auction data. There are two reasons for your property taxes to increase: Address search by address through property and tax records.

If calhoun county alabama is unable to collect property taxes, they are also unable to fund important government services like police protection, public schooling, and emergency medical services. The delinquent tax office will be closed november 5, 2018 and will not accept 2017 property tax payments. Calhoun county has one of the lowest median property tax rates in the country, with only two thousand five hundred eighty five of the 3143 counties.

Delinquency notices are mailed january 1. Once you have found a property for which you want to apply, select the cs number link to generate an online application. In calhoun county alabama, real estate property taxes are due on october 1 and are considered delinquent after december 31st of each year.

Registration will be available from 9:00a.m.

Delinquent Property Tax List – St Clair County 2016 Newsaegiscom

Calhoun County Al Tax Liens

Alabama Property Tax Calculator – Smartasset

Calhoun County Alabama

Alabamataxofficialscom

2021 Jefferson County List Of Delinquent Residential Business Property Taxes – Alcom

How To Find Tax Delinquent Properties In Your Area Rethority

Alabamataxofficialscom

2018 Lee County Delinquent Tax List – 1st Run By Opelikaobserver – Issuu

Alabamataxofficialscom

Alabamataxofficialscom

Revenuealabamagov

02state Of Alabama-department Of Revenue-property Tax Division

Payyourpropertytaxcom – Calhoun County Property Tax

02state Of Alabama-department Of Revenue-property Tax Division

Unpaid Tax Sales System To Change County Says Calhoun County Annistonstarcom

More Than 1 Million In Delinquent County Property Taxes Owed News Annistonstarcom

Alabamataxofficialscom

Alabama Tax Sales Tax Liens Tax Deeds – A Goldmine For Real Estate Investors – Youtube