Find out about the rates & rebates in bc. Bc sales tax (gst & pst) calculator.

Bc Sales Tax Gst Pst Calculator 2021 Wowaca

Trusted by thousands of businesses, paymentevolution is canada's largest and most loved cloud payroll and payments service.

Reverse tax calculator bc. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. Current provincial sales tax (pst) rates are: Enter gst/pst inclusive price and calculate reverse gst and pst values and gst/pst exclusive price current (2021) gst rate in canada is 5% and pst rate in british columbia is 7%.

Check home page if you need sales tax calculator for other. Quebec sales tax (gst & qst) calculator. One of the things that you probably noticed in our reverse gst calculator is that you have the option to choose between determining the reverse gst inclusive as well as the reverse gst exclusive.

You can use the calculator to compare your salaries between 2017, 2018, 2019 and 2020. Here is how the total is calculated before sales tax: Nova scotia income tax calculator;

How to calculate reverse charge under gst? This free calculator is handy for determining sales taxes in canada. Northwest territories, nunavut and yukon have no territorial sales tax at all.

That means that your net pay will be $41,196 per year, or $3,433 per month. The calculator is updated with the tax rates of all canadian provinces and territories. Alberta sales tax (gst) calculator.

Provincial, federal and harmonized taxes are automatically calculated for the province selected. The tool then asks you to enter the employee’s province of residence, and pay frequency (weekly, biweekly, monthly, etc.). It ranges from 13% in ontario to 15% in other provinces and is composed of a provincial tax and a federal tax.

Easy income tax calculator for an accurate british columbia tax return estimate. Amount without sales tax * gst rate = gst amount. If you want a reverse gst pst calculator bc only, just set the calculator above for british columbia, and it will back out the 12% combined tax rate for the amount you enter in.

When a price inclusive the tax is mentioned, in such cases reverse tax is applied. The harmonized sales tax, or hst, is a sales tax that is applied to most goods and services in a number of canadian provinces: The amount can be hourly, daily, weekly, monthly or even annual earnings.

Enter that total price into “price including hst” input box at the bottom of calculator and you will get excluding hst value and hst value. Ontario sales tax (hst) calculator. Amount with sales tax / (1+ (gst and qst rate combined/100)) or 1.14975 = amount without sales tax.

Calculatrice de la taxe de vente du québec (tps & tvq) This simple pst calculator will help to calculate pst or reverse pst: Purchase price before gst gst amount to be paid at time of purchase :

Gst rebate claimed at time of purchase this calculator was created by conrad warkentin, a real estate lawyer at rosborough & co. So, we believe that it makes perfect sense to tell you a bit more about the gst inclusive and the gst exclusive. New brunswick, newfoundland and labrador, nova scotia, ontario, and prince edward island.

The calculator is for entertainment purposes only, and is not to be relied upon for making. Accountants, bookkeepers and financial institutions in canada rely on us for payroll expertise and payroll services for their clientele. You have a total price with hst included and want to find out a price without harmonized sales tax ?

Your average tax rate is 20.8% and your marginal tax rate is 33.8%. Amount with sales tax / (1+ ( (gst and pst rate combined)/100)) = amount without sales tax amount with sales taxes x (gst rate/100) = amount of gst in bc. Newfoundland and labrador income tax calculator;

Formula for calculating reverse gst and pst in bc. Following is the reverse sales tax formula on how to calculate reverse tax. Reverse calculator purchase price including net gst :

It is very easy to use it. Usage of the payroll calculator. All harmonized sales tax calculators on this site can be used as well as reverse hst calculator.

Calculate the gst (5%) & pst (7%) amounts in bc by putting either the after tax or before tax amount. If you make $52,000 a year living in the region of british columbia, canada, you will be taxed $10,804. Hst reverse sales tax calculation or the harmonized reverse sales tax calculator of 2021 for the entire canada, ontario, british columbia, nova scotia, newfoundland and labrador and many more canadian provinces

New brunswick income tax calculator; Your 2020 british columbia income tax refund could be even bigger this year. Scroll down to use it online or watch the video demonstration.

Income tax calculators by province. Saskatchewan sales tax (gst & pst) calculator. The provincial sales tax (pst) applies only to three provinces in canada.

Enter your annual income, taxes paid & rrsp contribution into our calculator to estimate your return. Gst calculator is one of the steps to simply hassle for the taxpayers, so in this article, let us understand how gst calculator helps us to calculate the gst reverse charge. Amount without sales taxes x (pst rate/100) = amount of pst in bc.

Pin On Pics And Quotes

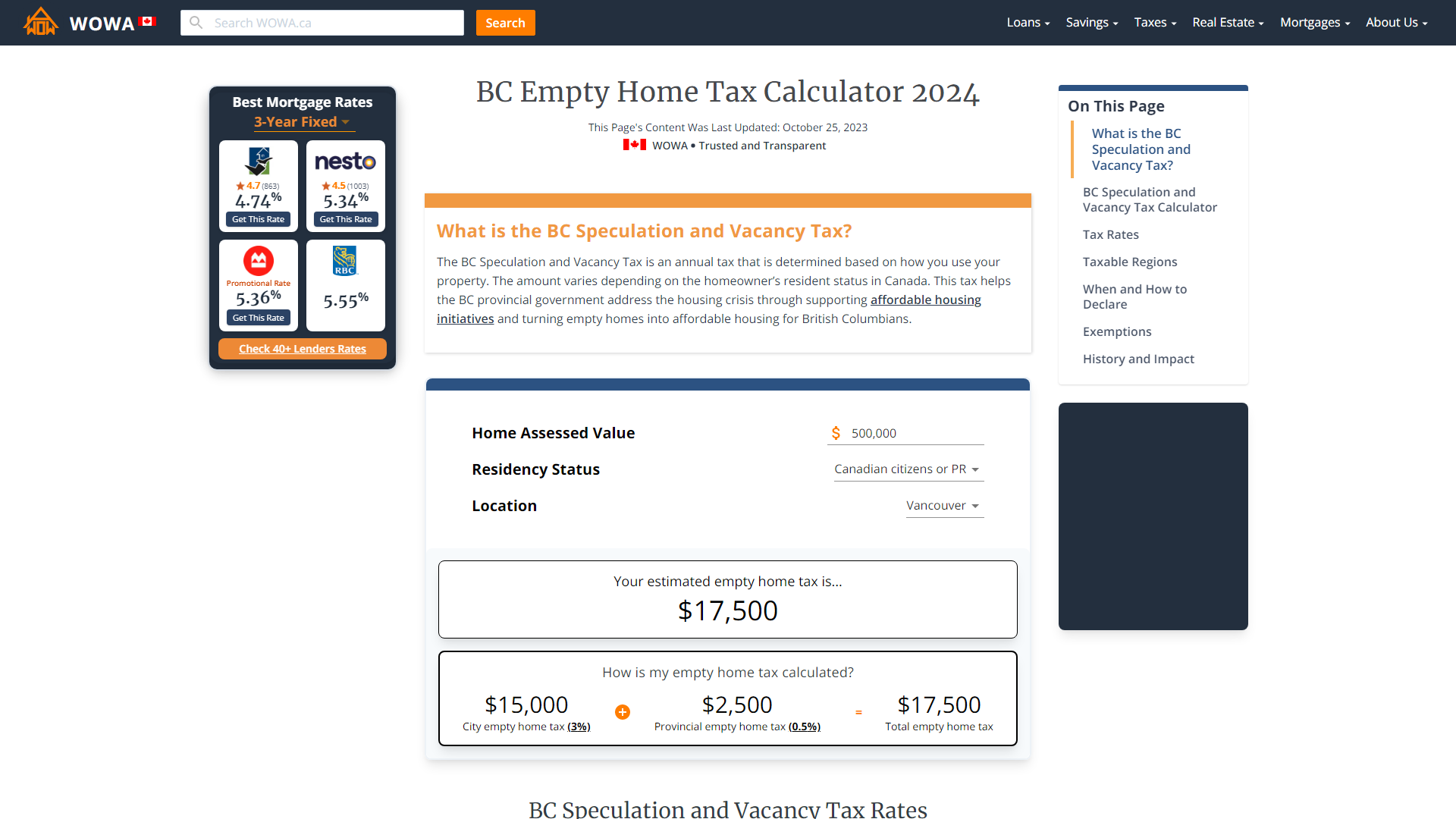

British Columbia Empty Home Tax Calculator 2021 Wowaca

Trusha Desai Innovation Management Inc Bookkeeping Consulting Innovation Management Science Jokes Money Blogging

Real Estate Broker In Thane West In 2020 Homeowners Insurance Fha Mortgage Reverse Mortgage

Sales Tax Decalculator – Formula To Get Pre-tax Price From Total Price

Home Security System Reverse Mortgage Mortgage Marketing Home Security Systems

Canada Federal And Provincial Income Tax Calculator Wowaca

Pin On Lego

Bc Income Tax Calculator Wowaca

Have You Refinanced Refinance Mortgage Mortgage Loans Refinance Loans

Pst Calculator – Calculatorscanadaca

4 Common Mortgage Killersand How To Survive Them Paying Off Mortgage Faster Refinance Mortgage Payday Loans

Ten Rupees 800000 Serial Number Note Xf Condition For Sale Price Rs 300 In 2020 Refinancing Mortgage Debt Reverse Mortgage

Percent Off Calculator Budget Calculator Interest Calculator Cash Budget

British Columbia Gst Calculator – Gstcalculatorca

Kroemer Mortgages Comox Valley Bc On Vancouver Island Cmhc Housing Forecast Weaker Mortgage Info Mortgage Tax Deductions

The Reverse Mortgage Advantage The Tax-free House Rich Way To Retire Wealthy – 1st Edition Ebook In 2021 Reverse Mortgage Tax Free Mortgage

The Ca Taxation Softwares Podcast Tax Software Income Tax Return Income Tax

New Reverse Mortgage Calculator Assess Your Suitability For This Loan Reverse Mortgage Mortgage Loan Calculator Mortgage Calculator