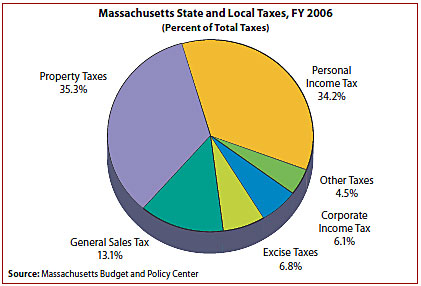

Massachusetts meals tax vendors are responsible for: Local tax rates in massachusetts range from 6.25%, making the sales tax range in massachusetts 6.25%.

Junk Food Tax Boston Mayoral Candidate John Barros Says Yes – Newbostonpost Newbostonpost

That statewide tax is currently 6.25% (which is also massachusetts’ statewide sales tax rate).

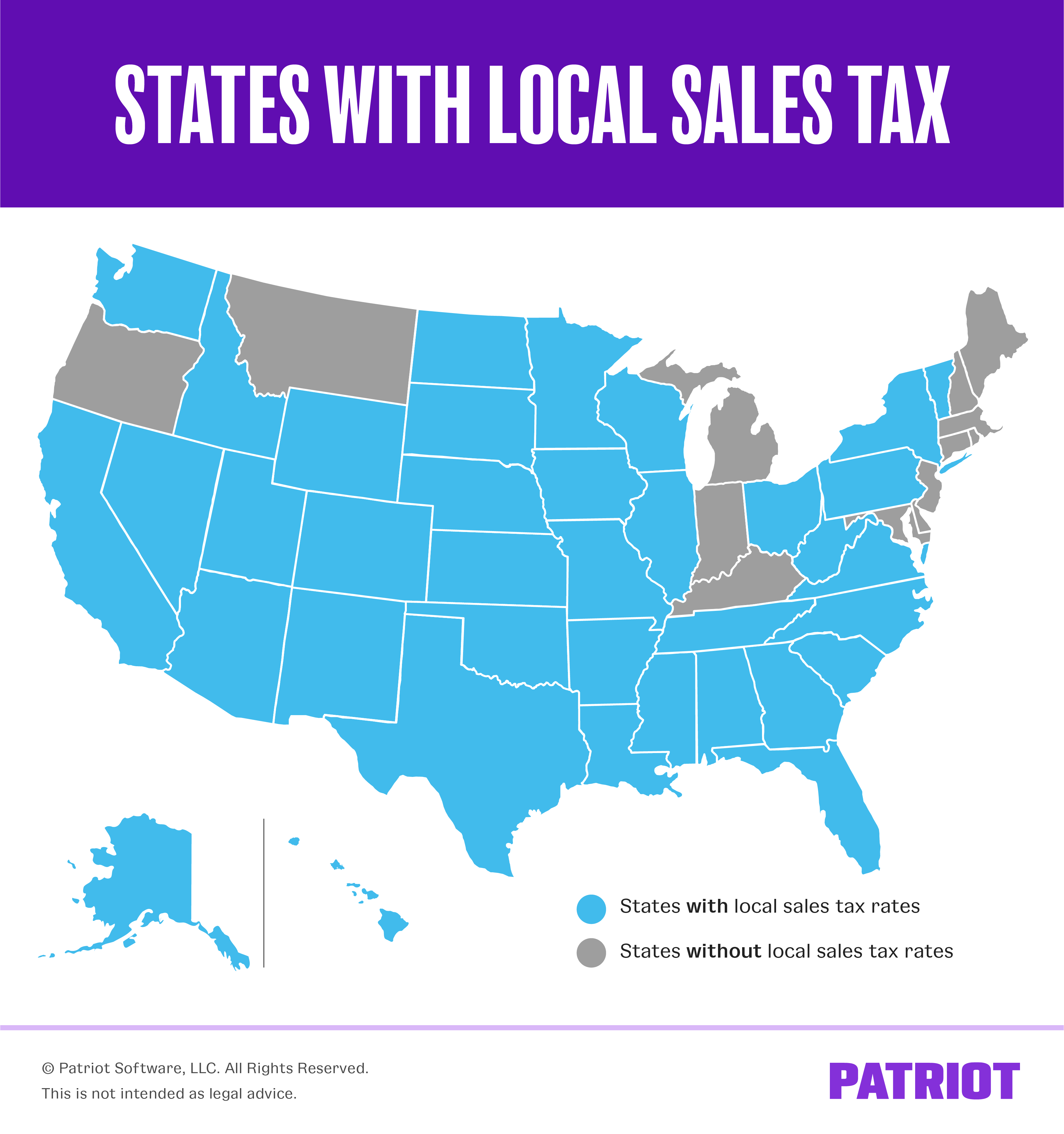

Food tax in massachusetts. Massachusetts department of revenue daigo fujiwara, tom giratikanon/globe staff Massachusetts doesn’t have local tax rates, only a statewide tax rate of 6.25%. Massachusetts has a separate “meals tax” for prepared food.

Some of the massachusetts tax type are: Local areas in massachusetts can also choose to add an additional “local option” sales tax. Request a motor vehicle sales or use tax abatement.

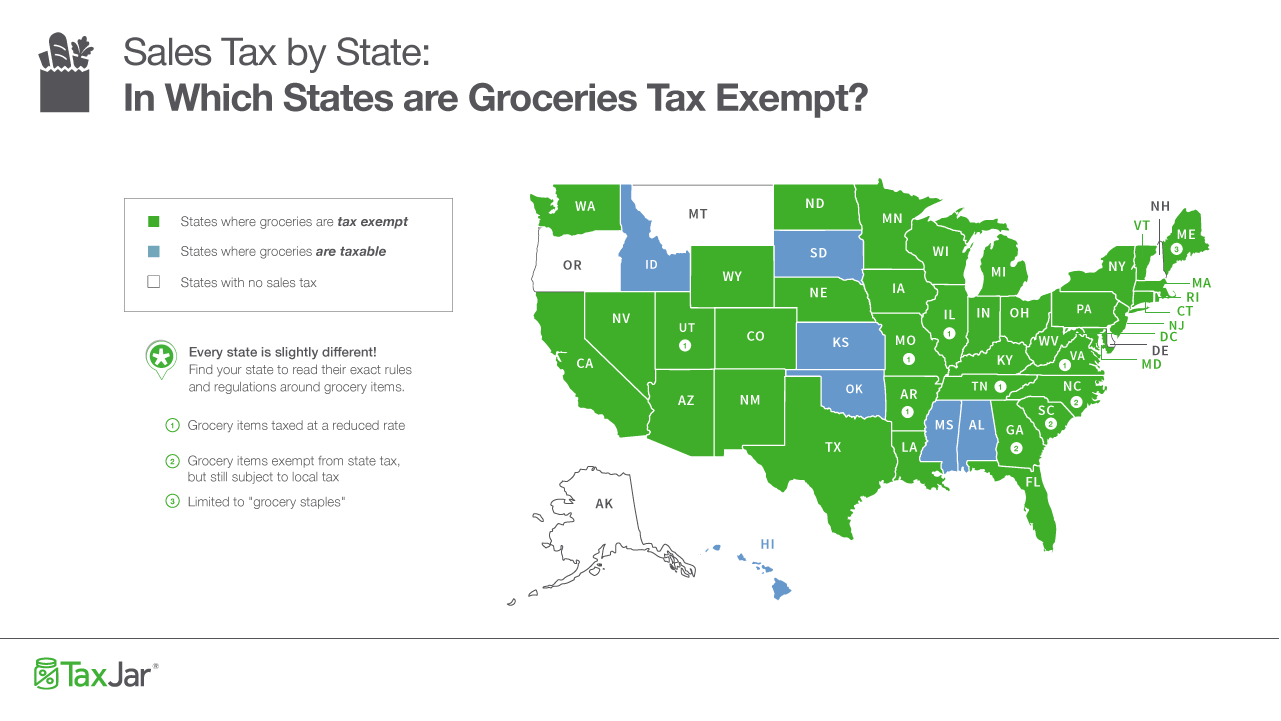

Sales tax treatment of groceries, candy & soda, as of july january 1, 2019 (a) alaska, delaware, montana, new hampshire, and oregon do not levy taxes on groceries, candy, or soda. More than 40 percent of all massachusetts cities and towns now assess the 0.75% local tax on meals. Massachusetts state rate(s) for 2021.

To use our massachusetts salary tax calculator, all you have to do is enter the necessary details and click on the calculate button. California (1%), utah (1.25%), and virginia (1%). 6.25% is the smallest possible.

The massachusetts income tax rate is 5.00%. Massachusetts sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache. The massachusetts state sales tax rate is 6.25%, and the average ma sales tax after local surtaxes is 6.25%.

The massachusetts tax on meals sold by restaurants is 6.25%, this is true for all cities and counties in ma, including boston. The statewide sales tax rate of 6.25% is among the 20 lowest in the country (when including the local taxes collected in many other states). (10) (a) a vignette, graphic, or pictorial representation of a product on a pet food label shall not misrepresent the contents of that package.

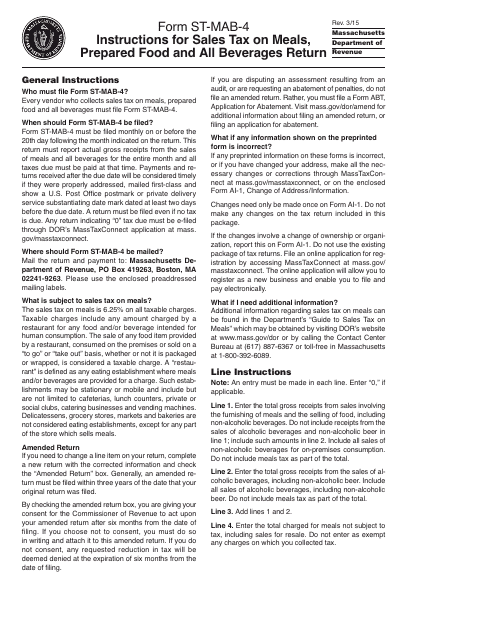

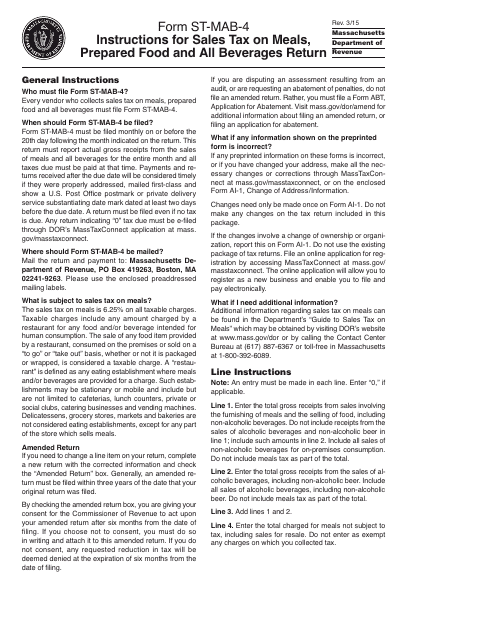

Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by massachusetts law to be a restaurant. Sales tax is a tax paid to a governing body (state or local) for the sale of certain goods and services. The meals tax rate is 6.25%.

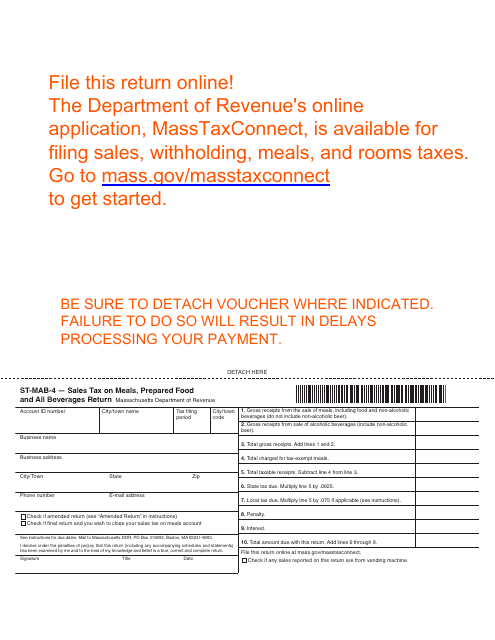

Find your massachusetts combined state and local tax rate. This page describes the taxability of food and meals in massachusetts, including catering and grocery food. Collecting a 6.25% sales tax (and, where applicable, a.75% local option meals excise) on all taxable sales of meals;

This is true whether you are based in massachusetts or whether you are based in another state and have sales tax nexus in massachusetts. Pet food section 13.03 labeling, the label for any pet food distributed within commonwealth, must comply with the following: That’s why we came up with this handy.

Anyone who sells meals that are subject to sales tax in massachusetts is a meals tax vendor. This must be collected from the purchaser and separately stated and charged on the bill. The massachusetts (ma) state sales tax rate is currently 6.25%.

Learn what is and isn't subject to sales and use tax in massachusetts. Sales & use tax for individuals. There is no special rate for massachusetts.

Please refer to the massachusetts website for more sales taxes information. First enacted in the united states in 1921, sales tax dates back to ancient egyptian times where paintings depict the collection of tax on commodities. Registering with the dor to collect the sales tax on meals;

Learn more about sales & use tax for individuals. We include these in their state sales tax. Consumers use, rental tax, sales tax, sellers use, lodgings tax and more.

(photo by wei zeng/unsplash) by emma kopelowicz. While massachusetts' sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to sales taxes. So you would simply charge 6.25% sales tax to buyers in massachusetts.

Paying the full amount of tax due with the appropriate massachusetts meals tax return on time, and The most significant taxes in massachusetts are the sales and income taxes, both of which consist of a flat rate paid by residents statewide. The massachusetts use tax is 6.25% of the sales price or rental charge on tangible personal property (including phone and mail order items or items purchased over the internet, and electronically transferred software) or certain telecommunications services:

Using our massachusetts salary tax calculator. This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs. After a few seconds, you will be provided with a full breakdown of the tax you are paying.

These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items. Groceries and prescription drugs are exempt from the massachusetts sales tax counties and cities are not allowed to collect local sales taxes The massachusetts's tax rate may change depending of the type of purchase.

Would a junk food tax help or harm bostonians? In some boston neighborhoods, it can be next to impossible to find grocery stores that offer affordable healthy options.

How Are Groceries Candy And Soda Taxed In Your State

Massachusetts Sales Tax – Small Business Guide Truic

Save Our Heritage

Meals Tax Helps Budget Gaps In Massachusetts Cities And Towns – Masslivecom

Sales Tax On Grocery Items – Taxjar

Beer Excise Sales And Meals Tax 101 Massachusetts Brewers Guild

States With Highest And Lowest Sales Tax Rates

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

5 Sales Tax Questions Developers Should Ask Woocommerce Clients

Massachusetts Sales Tax Guide

Is Food Taxable In Massachusetts – Taxjar

Sales Taxes In The United States – Wikipedia

Form St-mab-4 Download Printable Pdf Or Fill Online Sales Tax On Meals Prepared Food And All Beverages Return Massachusetts Templateroller

Sales Taxes In The United States – Wikipedia

Often Asked What Is The Sales Tax In Boston Ma

The Great Tax Debate Of 2009 Facts And Figures That Help – News Events – Massachusetts Nurses Association

Download Instructions For Form St-mab-4 Sales Tax On Meals Prepared Food And All Beverages Return Pdf Templateroller

Exemptions From The Massachusetts Sales Tax

Sales Tax Laws By State Ultimate Guide For Business Owners